Property tax deduction upon sale. What are the tax deductions for selling real estate? When selling real estate with certain shares

Property tax deduction when selling an apartment is one of the types of tax deductions. It represents the right to reduce the tax levied on the state budget when selling real estate. The benefit can be used by individuals and legal entities. The maximum refund amount is reflected in the current legislation. Citizens often encounter problems when determining the amount of deduction. To know in advance how to act in each specific situation, experts recommend familiarizing yourself with the rules for calculating benefits. Additionally, it is worth studying when a refund is provided and who is entitled to a tax deduction. We’ll talk about the specifics of calculating the amount, as well as the nuances of receiving benefits below.

The benefit can be used by individuals who have the status of residents of the Russian Federation. To do this, you must reside in the state for more than 183 days. Individual entrepreneurs who have not used the sold real estate in commercial activities have a similar right. In order for a tax deduction on the sale of an apartment to be granted, certain conditions must be met.

The list of which includes:

- real estate is not used for profit;

- the housing was owned by the citizen for a specified period;

- profit from the sale of the premises is at least 1 million rubles.

Online tax deduction calculator

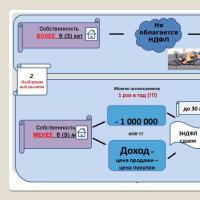

Period of ownership of property to receive a tax deduction

When figuring out who has the right to receive a deduction, a person will find out that the property must be owned for more than 3 years. This period was valid until 2016. However, subsequent amendments were made to the legislation regarding the provision of tax deductions. Now the period has been increased to 5 years.

However, the three-year period still applies if a person has sold real estate that:

- was registered before 2016;

- passed to the owner by inheritance;

- was given to the current owner by a relative;

- was privatized;

- transferred to the owner of the premises on the basis of a life-long annuity agreement.

In accordance with current legislation, the right of ownership arises in a citizen from the moment of state registration and ends with the transfer of property to a third party. The fact of the transaction must be confirmed by relevant documentation within the prescribed period.

If the property was received by inheritance, the date of commencement of ownership is considered to be the date of opening of the inheritance.

Disputes often arise in a situation where a person wants to sell a share in real estate. Let’s say that initially a citizen owned 1/3 of the apartment. Then, subsequently, he received the remaining 2/3. In this situation, not everyone knows what moment is considered the beginning of the period of ownership. The Ministry of Finance provides clarifications regarding the problem.

Until 2014, it was reported that the period of ownership of the entire apartment should be calculated from the moment when the initial share was registered. However, in 2014, the position of the Ministry of Finance changed. Today, on a share that has been owned for a period not exceeding 3 years, upon sale you must pay tax and receive a property deduction.

Amount of tax benefit

The maximum benefit amount is fixed by law. The tax base can be reduced by up to 1 million rubles from the total expenses that were associated with the purchase of real estate. However, they have to be documented. The costs include not only the price of the property, but also interest on the loan if the property is purchased with bank money, as well as the costs of realtor services and other expenses.

You can use a benefit in a fixed amount when a citizen cannot document the expenses incurred, or their amount is less than 1,000,000 rubles. In another situation, it makes sense to reduce the amount of taxable income by the amount that was actually spent on the purchase.

Calculation of income tax if a benefit is used

Before you receive a tax deduction when selling an apartment in 2019 and return part of the funds, you will need to make a number of calculations. In particular, experts recommend independently determining the amount of income tax when using the benefit.

If the refund is provided in a fixed amount, the calculation will be carried out using the following formula:

Personal income tax = (Amount received upon sale of an apartment - 1,000,000 rubles) * 13%

If expenses that a citizen had to bear are taken into account, the calculation scheme changes. It will look like this:

Personal income tax = (Income - number of confirmed expenses) * 13%

Thanks to the changes that came into force in 2016, possible speculation in real estate was stopped. Now, if the agreement includes an amount of at least 1 million rubles, this does not allow a person to evade paying tax. If the income from the sale of real estate that was purchased in 2016 is less than the cadastral value multiplied by a factor of 0.7, the tax calculation scheme will also change. To determine how much money will be given to the state, the following calculations must be made:

Personal income tax = (Cadastral value of the premises * 0.7) * 13%

It should be taken into account that the constituent entities of the Russian Federation have the right to independently set the period of ownership of real estate and the coefficient.

It’s easier to understand how tax deductions are calculated when selling real estate using a ready-made example.

Let’s say a citizen sold an apartment in 2015. The property was purchased a year earlier. The premises were sold for RUB 3,955,700. In order not to pay tax, the citizen indicated in the contract the price of the property as 950,000 rubles, and the rest of the amount was executed by receipt. The cadastral value of the premises was 3,100,000 rubles. Despite an attempt to evade paying contributions to the state, the citizen will be required to pay 282,100 rubles in tax. The amount was obtained by the following calculations: (3,100,000*0.7)*13%=282,100 rubles.

If common property is sold

The property may be jointly owned. This will also affect the features of obtaining a deduction. Its amount is distributed between the spouses. The action is carried out on the basis of the application. If the document has not been drawn up, the distribution of the due deduction by default is carried out in equal shares.

If there was a sale of property that is in shared ownership, the deduction will be provided in accordance with the size of the share of each owner.

The benefit for selling an apartment can be used at least every year. This feature is fundamentally different from the tax deduction when purchasing an apartment, which is available for use only once in a lifetime. However, there are a number of restrictions. If a person sold several objects at once during the year, a refund will be provided for only one of them.

The process of obtaining a tax deduction

To receive a property deduction when selling an apartment, a citizen will have to follow a procedure.

In particular, the person must:

- Submit a declaration. The document is drawn up in the form 3-NDFL. The paper must be sent to the Tax Inspectorate at the place of registration or stay. The latter is possible only in cases specified by law. The declaration must be submitted by April 30 of the year following the period of sale of the property.

- Prepare an application for a deduction. It must be issued in accordance with the rules.

- Take documents confirming the fact of sale of the apartment and its acquisition, if the return is stated in the amount of expenses that were incurred during the purchase process.

- Pay tax in accordance with the approved benefit entitlement.

Having studied the size and features of receiving a deduction when selling an apartment, a person will find out that the benefit is multi-use in nature. The law allows you to use it every year. Non-residents of the Russian Federation are not eligible to receive a refund. An application to reduce the tax base when selling an apartment will also be rejected if the person has had ownership of the property for less than 5 years. The law allows you to reduce the income received from the sale by the amount of expenses that had to be incurred when purchasing an apartment, or by 1 million rubles if there is no documentary evidence of the expense.

Almost any monetary receipts of Russians are subject to income tax. Upon the alienation of real estate, personal income tax must be calculated, which is then included in the budget. Under certain conditions, you can avoid paying tax at all or reduce it significantly by studying the nuances governing tax deductions when selling an apartment.

Tax benefit for the disposal of an apartment and other real estate (house) - what is it? Today this means:

- The amount of income received is reduced by the amount of the benefit - this is the most correct understanding from the point of view of the Tax Code (Tax Code of the Russian Federation).

- The procedure for obtaining tax benefits, including issues of prescription of ownership and reduction of personal income tax, is the most common point of view.

In everyday life, the concept of “tax deduction” includes a certain procedure, the ultimate goal of which is to pay less tax to the budget, or not pay it at all. The procedure, taking into account current legislation, answers the questions:

- How many consecutive years of home ownership does it take to not pay at all?

- If the statute of limitations does not apply, then how to legally and effectively reduce the tax if you have already sold the apartment?

Before preparing the living space for sale, you need to look at how long it was in the seller’s possession. Then, if due to the statute of limitations it is not possible to be exempt from payment, you need to reduce personal income tax using a direct tax deduction.

Who is eligible for the tax benefit?

Tax preference belongs to the seller provided:

- he is a resident of Russia;

- the property is geographically located in the country.

A person is considered a resident in the eyes of the law if he stays within the country's borders for at least 183 days during a calendar year. Therefore, if a Russian citizen spent more time per year outside the Russian Federation, he is not entitled to tax preferences.

Individual entrepreneurs also have the right to take advantage of a tax deduction, provided that the housing was not used in their trade or production activities.

How long does it take to avoid paying taxes?

The well-known rule “3 years have passed - you don’t have to pay” has undergone some innovations not in favor of citizens. The tenure period was increased at the beginning of 2016, adding a list of conditions. Now, first, you need to carefully look at the extract from the real estate register, namely, the date of state registration of the seller’s property rights. Next, there are two possible options.

- If the date you are looking for is earlier than 01/01/2016 (that is, until 12/31/2015 inclusive), then the usual three-year period applies - you do not need to pay tax on the sale of an apartment when it has been owned for three years in a row or more.

Example . Bykova L.N. bought a home on September 14, 2015, state registration date was September 21, 2015. A citizen will be able to sell an apartment without tax starting from September 22, 2018.

- If the registration date is January 1, 2016 or later, then the new rules apply. It matters on what basis the seller acquired the property.

The three-year period must be counted when she:

- privatized;

- inherited;

- gifted by a close relative;

- received under an annuity transaction.

The management period for inherited property is counted from the day when the previous owner died. In other cases - from the date of making an entry in the Unified State Register of Ownership of the seller.

Example. Relative of Ivanov A.B. died on January 26, 2017. According to the will, the apartment was completely transferred into the ownership of Ivanov. It was possible to register the transfer of rights in the Unified State Register of Real Estate after inheritance procedures only on July 1, 2017, but the ownership period began on January 26, 2017, and Ivanov will be able to sell the apartment without paying tax starting on January 27, 2020.

Otherwise, an extended five-year period applies. For example, when the living space:

- purchased;

- donated from other relatives, as well as friends and acquaintances;

- exchanged;

From the date of registration of the property, sixty months of continuous management must be counted, after which it can be sold without tax. So, if the living space was purchased in 2016, then it will be possible to sell it without personal income tax only in 2021.

Important. Prescription of ownership exempts both from tax and 3-personal income tax. There is no need to fill out a declaration after such a transaction.

If the transaction takes place before the expiration of the minimum holding period, the taxpayer is entitled to apply a tax benefit.

Amount of deduction

The Code provides two options for property deduction when selling an apartment in 2019:

- fixed deduction of one million rubles (1,000,000 rubles);

- expenses - the amount of money spent on the purchase and renovation of an apartment.

Which one is better to use depends on the desire of the seller. For example, if the income from a transaction does not exceed a million rubles, or if documents on expenses have not been preserved, it is better to settle on a fixed amount. It does not need to be further confirmed by papers or statements.

If the transaction is more than one million, you need to see what documents about the costs of acquisition and repairs have been preserved. Only the actual expenses incurred are what matters, not any expenses at all. If, for example, a repair contract was concluded for the amount of 450,000 rubles, but in fact the repair cost 320,000 rubles, then exactly 320,000 rubles are accepted as a benefit.

The following will help confirm actual expenses:

- Contract between the seller and the previous owner;

- DDU with the developer;

- agreements on repair and finishing works and development of design and estimate documentation;

- any documents confirming payment for the above-mentioned agreements: receipts, checks, receipt orders, bank statements;

- receipts for the purchase of building materials.

For example, if the living space was purchased by the seller for 1,700,000 rubles, during the renovation, 320,000 rubles were invested in it (purchase of materials, finishing work), and it was sold for 2,400,000 rubles, then you can declare the amount of purchase and repairs, that is 1,700,000 + 320,000 = 2,020,000 rubles.

The choice is reflected in the 3-NDFL tax return. If you choose a fixed deduction, you do not need to confirm it with anything - it is provided by force of law. If the expense option is used, supporting documents are attached to the declaration.

Calculation of income tax when receiving benefits

When calculating income tax, you need to answer three questions in sequence:

- How long has the seller continuously owned the home?

- What income was received from the transaction?

- Which tax deduction is more profitable?

The amount obtained after answering these questions must be multiplied by 13% (or by 0.13 - this is arithmetically correct). The result will be the amount of tax payable.

Question 1: How long has the seller continuously owned the home?

When answering this question, you need to calculate the minimum tenure limit according to the rules outlined above. If the deadline is met, that is, the seller of the securities was the owner for more than 3 (5) years, then there is no need to pay tax on the sale, regardless of the amount.

There is no need to submit a 3-NDFL tax return.

If the seller is the owner for less than the established period: less than three (deductions for apartments less than 3 years and less than 5 years); Tax incentives will help reduce the amount of tax.

Question 2. What income was received from the transaction?

Income is traditionally considered to be the amount specified in the contract, regardless of the cadastral value. It is to this that tax deductions and the personal income tax rate should be applied. This approach is permissible only if the housing is registered to the seller until December 31, 2015 inclusive.

If the property was registered after January 1, 2016, it is necessary to check the sale amount with the cadastral value of the property, multiplied by 0.7 (reducing factor). Which of these figures will be greater must be taken into account when calculating personal income tax.

The verification algorithm is simple:

- The first step is to order Rosreestr a certificate of cadastral value as of January 1 of the year in which the sale occurred.

- In the finished certificate, find the line “Cadastral value”.

- Multiply the indicated figure by 70%.

- Compare the obtained result with the contract price.

The largest of these amounts will be recognized as income from the sale.

After determining income taking into account the above rules, you can proceed to subtracting the tax benefit from it.

Question 3. Which tax deduction is more profitable?

You can choose one of two provided by law: fixed or expendable. The bottom line is this: you just need to subtract the deduction amount from the amount of income. The result is the amount of taxable income, which must be multiplied by 13%.

The sales price must be taken taking into account the rules for determining the amount of income set out above (cadastral value multiplied by 0.7, or the contract price).

It is better to decide on the benefit option before selling your home. Calculating an apartment using a personal income tax calculator will help you decide which benefit is more profitable in a particular case.

Tax calculation formula

The universal calculation formula is as follows:

(D – NV) * 13% = tax amount, where

D – income (from the contract or from the cadastral value);

NV – tax deduction (fixed or expense).

Tax calculation using an example

Initial data: living space was purchased in February 2016 at a price of 1,250,000 rubles. During the period of ownership, major repairs were carried out at a cost of 285,000 rubles. There are documents for repairs. The taxpayer decided to apply for a deduction for housing after selling it in June 2018 for 1,600,000 rubles. The cadastral price of real estate as of January 1, 2018 was 1,640,000 rubles.

- How long has the seller owned the home? From the date of registration to the sale transaction, 29 months passed (from February 2016 to June 2018) - this is less than the five years (or 60 months) required by law. The seller is not able to avoid tax on this basis.

- How much money was received? After calculating the cadastral price, the seller received: 1,640 thousand * 0.7 = 1,148 thousand rubles. The result is less than the price established by the contract, therefore 1,600,000 rubles will be accepted as income from the transaction (as in the contract).

- Which tax deduction is more profitable? The seller has evidence of expenses totaling 1,535 thousand rubles (1,250 thousand for purchase and 285 thousand for repairs). A deduction in this amount is clearly more profitable than a fixed amount of 1 million rubles, so the seller will declare an expense model.

(1,600,000 – 1,535,000) * 13% = 8,450 rubles.

Total: the amount of personal income tax payable to the budget will be 8,450 rubles.

Important. When the deduction is greater than or equal to the amount of income, the calculation results in a negative tax amount. In this case, you do not need to pay anything to the budget, but you still must submit a declaration.

Features of shared ownership

If an apartment that is in shared ownership is sold, the tax on its sale is divided among everyone. Accordingly, the tax deduction is also divided - in accordance with the shares. At the same time, parts of the property being sold are determined in official documents - a certificate of ownership or an extract from the Unified State Register of Real Estate.

This means that owners who own 1/3 each have the right to receive a benefit in the amount of 1/3 of the total amount each. If one owner owns 3/4, and the second – 1/4, then the deduction will be distributed between them in the same proportions.

As for common joint property (spouse), tax deductions for the sale of a share in an apartment are divided equally between husband and wife.

Features of the sale of inherited housing

Inherited property gives its owner a grace period of ownership, which is necessary in order not to pay tax at all. The tenure period will be 3 years in any case, regardless of whether the apartment was registered before 2016 or after.

The nuance also lies in the order in which the starting point of the period is determined. In the case of inheritance, it shifts - the beginning is counted from the date of death of the testator, and not from the date of state registration in the Unified State Register of Real Estate.

It does not matter when the property was registered to the new owner - six months, a year or more. The day of death of the previous owner determines the required period. It also does not matter whether the housing was received by law or by will, from a relative or not.

Example. An acquaintance of Karbysheva A.N. died on March 11, 2015. According to the will left, the three-room apartment was transferred to A.N. Karbysheva, and the relatives of the deceased did not receive any rights to housing. After lengthy legal proceedings, on September 17, 2017, the apartment was finally registered to A.N. Karbysheva. In this case, despite all the difficulties, the period of ownership will be calculated from March 11, 2015, and the property can be sold tax-free starting from March 12, 2018.

Features of benefits for pensioners

Any benefits for pensioners related to paying taxes when selling an apartment are not provided for by current legislation. A pensioner's income from the sale of housing is subject to personal income tax according to the same scheme as the income of other categories of the population.

Features when selling an apartment to a relative

When selling an apartment to a relative, the seller does not have any benefits or additional obligations to the budget. In this case, personal income tax is calculated on general terms.

It must be remembered that transactions between relatives are quite often imaginary in nature and can be challenged by interested parties (especially in bankruptcy) through the court. In addition, in no case should you use the purchase and sale of an apartment within the family circle for the purpose of cashing out maternity capital funds. This is a criminal offense.

Important. In this case, the buyer does not receive a deduction for the purchase (purchase between relatives).

Receipt procedure

The main question upon receipt is whether it is possible to get a deduction if the apartment is sold? There is no need to confuse the buyer's deduction and the seller's deduction. The buyer returns the personal income tax paid to the budget, and the seller reduces the amount of tax before payment.

This means that the tax office does not return anything - it is the taxpayer who will end up paying less on his part.

To apply for a benefit you must:

- Wait until the end of the year in which the apartment was sold.

- Fill out the declaration (Z-NDFL) yourself or with the help of a specialist, attach supporting documents to it.

- Submit the package to the department by April 30.

- Pay the tax calculated in the declaration by July 15.

The papers must be submitted to the Federal Tax Service (not the Federal Tax Service) at the seller’s residence address. After settlements with the budget, you can request a reconciliation and make sure that no tax debts have arisen.

List of required documents

For registration you will need:

- The most important thing is the completed 3-NDFL declaration.

- Evidence of the completion and execution of the transaction (DCP, transfer deed, payment documents).

- If the expense option is used - evidence of expenses (agreements for the purchase of an apartment, for repairs, finishing, production of the project, checks and receipts for the purchase of building materials).

Important changes for 2019

The tax deduction for the sale of an apartment in 2019 has not changed. However, it is necessary to take into account the innovations of 2016, namely:

- the minimum ownership period after which there is no need to pay tax has changed - from 3 to 5 years;

- added grounds for acquisition on which the tenure period depends;

- The procedure for calculating sales income has changed - now the contract price must be compared with the cadastral value multiplied by 0.7.

All of these features can be seen in more detail above.

Conclusion

The tax deduction allows you to significantly save on tax when selling an apartment in 2019, and in some cases even exempts you from it. At first glance, the rules for applying deductions are complex, but understanding them is not difficult.

When applying for a benefit, it is necessary to understand how long the apartment was owned, what income was received from its sale, and which tax deduction is more effective in a particular situation. Otherwise, arithmetic calculations and paperwork do not take much time - therefore, the answer to the question of how to get a tax deduction from the sale of an apartment comes down to analyzing the individual situation and finding the most profitable tax options.

Also, do not forget about the loan that you are entitled to if the apartment was purchased with a mortgage.

You can find out more about this at a free consultation with a lawyer. Sign up on our website through a consultant.

We are waiting for your questions and will be grateful for your like and repost.

According to the law currently in force in Russia, when an individual sells any property that has been his property for less than 3 years, such person generates income. And this income is subject to a special tax, which is called “on the income of individuals.” Therefore, when selling property that belongs to him, a law-abiding taxpayer immediately has the obligation to fill out a 3-NDFL declaration and submit it to the tax office at his place of residence. And this must be done no later than April 30 of the year that follows the calendar year of property sale.

Also, according to existing tax legislation, an individual who has sold his property has the right to reduce the income received from the sale if he provides the Federal Tax Service with documents confirming the actual expenses incurred directly related to the acquisition of this property. And quite often, doing this is much more profitable than claiming the due property deduction.

Calculation of property deduction

Today, the maximum amount of deduction that reduces income from the sale of housing (for example, private houses, apartments or rooms), land plots, dachas or garden houses, as well as shares in the ownership of all of the above, is 1,000,000 rubles. And by another 250,000, the taxpayer can reduce the corresponding income from the sale of non-residential premises, cars, garages, as well as other items included in the established legal list.

Today, the maximum amount of deduction that reduces income from the sale of housing (for example, private houses, apartments or rooms), land plots, dachas or garden houses, as well as shares in the ownership of all of the above, is 1,000,000 rubles. And by another 250,000, the taxpayer can reduce the corresponding income from the sale of non-residential premises, cars, garages, as well as other items included in the established legal list.

In cases where the property being sold was in joint or shared ownership for less than 3 years, but was sold as a single object of law with the conclusion of the same purchase and sale agreement, 1 million rubles of property tax deduction will be distributed among the former owners of such property, according to their shares, or according to an existing agreement (this is when realized joint ownership is meant).

But if shares of jointly owned property are sold each under their own separate purchase and sale agreement, then each of the owners of such shares will have the right to claim a property tax deduction of 1 million rubles.

Important: If during a calendar year the taxpayer sells more than one property item, the specified limit on property deduction is applied to all property items together, in the aggregate.

It happens (and often) that the income received by a particular citizen as a result of the sale of property does not exceed the monetary limits established by law, then the obligation to file a declaration remains with such a taxpayer, but the obligation to pay the corresponding tax simply does not arise and that’s all.

An example of calculating a tax deduction from the sale of an apartment

Let's say someone Pupkin sold his own apartment this year, say, for 3,000,000 rubles. This apartment was purchased by Pupkin two years ago, for example, for 2,500,000 rubles.

It is obvious that the above-mentioned citizen owned the property for less than 3 years specified in the law, which means he must submit the appropriate personal income tax return for the income received to the tax office at his place of residence.

Let's consider 2 options:

- Suppose Pupkin does not declare a property deduction in his declaration. In this case, he will have to pay tax on 2 million rubles. According to this calculation:

3,000,000 (amount of income received) - 1,000,000 (tax-free limit) = 2,000,000 rubles x 13% (current personal income tax rate) = 260,000 rubles.

This money will have to be contributed by Mr. Pupkin to the state treasury in the form of an appropriate tax. - If the taxpayer makes an application for a property deduction in the submitted declaration (in the amount of expenses incurred by him, confirmed by documents), the taxable income will be only 500,000 rubles. Accordingly, personal income tax will not exceed the amount of 65,000. The calculation is as follows:

3,000,000 (the amount of income received from the sale of an apartment) - 2,500,000 (documented amount of expenses for the purchase of the same apartment less than 3 years ago) = 500,000 rubles (taxable) x 13% = 65,000 rubles in personal income tax.

The difference is more than significant!

How to get a deduction when selling an apartment?

For the sale of their own property, taxpayers can receive a property deduction as many times as they wish, in contrast to the property deduction, which is provided one-time in connection with the purchase of housing.

And in order to take advantage of its own right to a property deduction upon sale, the state obliges the taxpayer to:

Important: Only copies of the necessary documents are submitted to the Federal Tax Service along with the declaration. However, the taxpayer must also have the originals with him in case a meticulous tax inspector wants to check them himself.

Selling an apartment can cost the owner a pretty penny due to taxes. However, the legislature has established a rule according to which you can receive a tax deduction when selling an apartment that has been owned for less than 3 years.

It will help you save on taxes through income tax refunds. Since 2016, the period after which you can sell an apartment without paying profit tax has been increased to five years.

Changing apartments often is not very profitable, based on the regulations of the Russian Federation. If, after not having lived for even five years, you have to sell your home, and it is not the only one the owner has (this point is important in this case), the law obliges you to pay 13% of the price when selling the property.

And if you live in an apartment for five years and only then sell it, you won’t have to pay sales tax. This is enshrined in various legal regulations.

When is it enough to own an apartment for 36 months in order not to pay dividends to the state when making a purchase and sale transaction?

The owner can live in the apartment for thirty-six months and sell it, while he is exempt from paying dividends if:

- The apartment was inherited and was donated.

- Municipal housing began to be privatized.

- The property was taken over under a rental agreement.

- The apartment was purchased before 2016 and the owner has owned it for more than 36 months.

In all other cases, when selling an apartment that has been owned for less than five years, you will have to pay income tax.

It is important! The period of ownership of real estate is counted from the date of registration of the certificate of ownership.

Thus, if the owner of a real estate property wants to avoid unnecessary expenses when selling a home, he must live in it for at least 60 months before the sale.

Ways to avoid paying taxes when selling an apartment

There are two ways to avoid paying taxes by selling real estate:

- You must live in the apartment for at least 5 years.

- Housing should cost no more than 1 million rubles.

You need to know this! The amount of 1 million rubles is fixed by law as a property deduction when selling real estate: an apartment, a room or a residential building, a summer house, etc.

The law exempts from paying tax on the sale of housing worth up to 1 million rubles. You can live in such housing for any amount of time. In this case, dividends do not need to be paid for legal reasons.

The only thing that an owner who sells an apartment worth 1 million rubles, in which he has lived for less than three or five years, will have to do is submit a tax return to the fiscal authority, that is, to the tax office.

In this case, the tax amount will be zero, as will the tax base, due to the use of property deductions upon sale. That is, you will not have to pay taxes.

Note! Filing a declaration when selling an apartment, even if the tax is zero, is required.

For violation of the rule, a fine of 1000 rubles is provided. The fine will be greater if the tax payment is not zero.

You need to know this! If the owner sells his only home, no matter how many years it has been owned, the proceeds from its sale are not subject to tax.

When selling an apartment, you need to submit a declaration to the Federal Tax Service (or simply to the tax office) within the year in which the transaction was completed.

This is interesting! The Tax Code, Article 220, assigns to the owner the right to receive a tax deduction and the seller’s obligation to pay income tax when selling an apartment.

Calculation of the deduction amount when selling property

If the owner of a home, having lived in it for less than three years, sells it for 5 million rubles, what tax deduction can he receive?

You can take advantage of this legislative right and reduce the tax base. In the example given, the owner must pay a tax in the amount of 520 thousand rubles. Here's how the tax amount was calculated:

(5,000,000 - 1,000,000) x 13% = 520,000 Russian banknotes

1 million is a tax deduction for the sale of an apartment owned for less than 36 periods of 30 (31) days. In the above example, the tax is ultimately paid not on five, but on four million rubles. banknotes

You can also document how much the apartment was previously purchased for and deduct this amount from the income received from the sale. For example, if it was purchased for three million banknotes and sold for five million rubles, the following amount is subject to tax:

5,000,000 - 3,000,000 = 2,000,000 banknotes. It is on this amount that you will have to pay a tax of thirteen percent. That is, 260,000 rubles will go to the budget as dividends. Accordingly, the tax burden will be halved.

You need to know this! If documents on the cost of purchasing an apartment from the current seller have not been preserved, then the profit, which is subject to taxes, is recognized as the entire cost for which the housing was sold.

The law does not prohibit receiving tax benefits when selling housing as many times as the owner will make purchase and sale transactions. That is, there are no restrictions on the amount of use of dividends upon sale. But it will not be possible to use several deductions in one calendar year, since this is prohibited by regulations.

This is interesting! Residents of the Russian Federation pay tax on income received in the amount of 13%. Foreign citizens - 30% (almost one third) of the income.

The owner of real estate after 2016, having sold it, is exempt from paying income tax if:

- The apartment cost less than 1 million rubles.

- The period of ownership of real estate is more than 60 months.

If the real estate seller indicates in the documents the price of the sold residential premises is less than the cadastral price in order to reduce the amount of tax, according to the law, the tax base will be increased. Correction factor - 0.7. This is due to innovations that became law in 2016.

Attention! An apartment purchased before January 1, 2016 can be sold without paying taxes after 36 months from the date of purchase. And real estate acquired after this date is subject to tax-free sale only after five years, that is, not earlier than January 1 (for example) 2021.

From this video you can learn about new changes and the procedure for completing documents at the tax office:

Distribution of deductions between owners

When selling real estate owned by several persons who are citizens of the Russian Federation and residents of the country, the property deduction - 1 million Russian banknotes - is divided between them in proportion to the size of the part of the property owned by each. If one of the owners sells his part of the property, he receives the entire benefit.

Based on the above, the following conclusions can be drawn. If the owner sells his apartment, by law he must pay tax on the value. In this case, by selling, he makes a profit, and the profit is subject to taxation.

However, the legislator has established a rule according to which a tax deduction is taken when selling an apartment that has been owned for less than three years. Two years after 2014 (then the procedure for providing compensation for the purchase of property that was awarded to real estate changed), the period after which you can sell an apartment without paying profit tax was increased to five years.

As a general rule, if property was owned by a citizen for more than three years (for property acquired from January 1, 2016, this period was increased to five years), then income from its sale is not subject to taxation (). Otherwise, paying taxes cannot be avoided. But the tax amount can be reduced by using the right to a property tax deduction. The Tax Code of the Russian Federation provides for two options for their use - to deduct expenses incurred when purchasing property, or to apply a deduction in a fixed amount (). Let's look at both options and see in which cases it is more profitable to use one or the other deduction.

Property tenure

At the end of last year, the President of the Russian Federation Vladimir Putin a law was signed establishing new rules for taxation of income from the sale of property by individuals in terms of the period of ownership (Federal Law No. 382-FZ of November 29, 2014, hereinafter referred to as Law No. 382-FZ). The innovations will only apply to property acquired after January 1, 2016. ().

As a general rule, personal income tax will not be assessed on income from the sale of property that was owned by a citizen for more than five years at the time of sale (Clause 4 of Article 217.1 of the Tax Code of the Russian Federation). However, in the territory of a particular region, this period can be reduced down to zero if a constituent entity of the Russian Federation passes a corresponding law.

There are exceptions to this rule - the minimum three-year period of ownership of property, as today, will apply if at least one of the following conditions is met:

- if the property right was received by inheritance or under a gift agreement from a family member and (or) a close relative of the taxpayer;

- if ownership was obtained as a result of privatization;

- if the right of ownership was acquired by the rent payer as a result of the transfer of property under a lifelong maintenance agreement with dependents (clause 4 of Article 217.1 of the Tax Code of the Russian Federation).

OUR HELP

Close relatives are considered to be relatives in a direct ascending and descending line - spouses, parents and children, grandparents and grandchildren, full and half (having a common father or mother) brothers and sisters ().

Now let's figure out how to calculate the period of ownership of property. As a general rule, ownership of property arises from the date of state registration and the corresponding entry is made in the Unified State Register (USR). As the 1st class adviser to the state civil service of the Russian Federation of the department of tax and customs tariff policy of the Ministry of Finance of Russia explained to the GARANT.RU portal Nikolay Stelmakh, it is this date that is the basis (counting date) for calculating the period of ownership of the property (for example, an apartment) when providing a deduction. This means that if, for example, an apartment was purchased on May 15, 2011, then the three-year period of ownership should be considered to have expired on May 15, 2014.

But there are a number of cases when the date of state registration of property rights does not matter. So, for example, when receiving an inheritance, the right of ownership arises from the date of opening of the inheritance (that is, from the date of death of the testator), regardless of the date of its actual acceptance or registration of ownership (). And when receiving an apartment in a cooperative, the owner takes over his rights from the date of payment of the last share (). There is also a situation when the apartment was privatized before the Federal Law of July 21, 1997 No. 122-FZ came into force (it came into force on January 29, 1998), and the certificate of ownership was received later than that day. In this case, the date of receipt of the certificate of state registration of property does not matter - the apartment is considered to belong to the citizen from the moment of privatization ().

Let us give several examples of calculating personal income tax when selling property, and we will proceed from the current minimum property ownership period of three years. So, if the property has been owned by the taxpayer for less than three years, then tax must be paid on the income from its sale. In this case, the tax amount can be reduced by using a tax deduction.

- property tax deduction in a fixed amount (1 million rubles for the sale of residential houses, apartments, rooms, dachas, garden houses, land plots, as well as shares in them and 250 thousand rubles for the sale of other property - cars, non-residential premises, garages etc.);

- deduction for the amount of actually incurred and documented expenses associated with the acquisition of property.

The taxpayer can use any of these deductions, but first you need to calculate which deduction is more profitable in a given situation.

EXAMPLE

EXAMPLE 1

A.I. Solntsev purchased an apartment for 7 million rubles. in 2013, and in 2014 he sold it for 8.2 million rubles. On the income received (1.2 million rubles), he must pay tax at a rate of 13%, but can reduce it by the amount of tax deductions. Let's see which deduction will be more profitable for the taxpayer to use.

This deduction is provided in the amount of 1 million rubles. from the income received from the sale of the apartment. This means that the tax amount should be calculated as follows:

(8,200,000 rub. – 1,000,000 rub.) x 0.13 = 936,000 rub.

Situation 2. Tax deduction in the amount of expenses incurred for the purchase of an apartment.

An owner who chooses this type of tax deduction can reduce the income received from the sale of an apartment by the amount of expenses incurred when purchasing it. Let's calculate the amount of personal income tax payable:

(8,200,000 rub. – 7,000,000 rub.) x 0.13 = 156,000 rub.

Thus, if the cost of the property being sold slightly exceeds the expenses incurred during its acquisition, then it would be most profitable to apply a deduction in the amount of expenses incurred.

EXAMPLE 2

A.V. Tuchkin purchased a garage for 100 thousand rubles. in 2012, and sold it in 2014 for 260 thousand rubles.

Situation 1. Fixed tax deduction.

When selling a garage that has been owned for less than three years, the owner can take advantage of a deduction in the amount of 250 thousand rubles. Thus, the amount of tax payable will be:

(260,000 rub. – 250,000 rub.) x 0.13 = 1,300 rub.

Situation 2. Tax deduction in the amount of expenses incurred when purchasing a garage.

Since the acquisition costs amounted to 100 thousand rubles, then by applying this deduction, the owner will be required to pay tax in the following amount:

(260,000 rub. – 100,000 rub.) x 0.13 = 20,800 rub.

In this case, it is more profitable for the owner to take advantage of a tax deduction in a fixed amount.

A fixed tax deduction is applied to the owner, and not to the property, which means that if the owner sold several types of property during the year, then the maximum deduction applies to all objects in the aggregate, and not to each individually ().

Similar rules apply to property that was in shared ownership, but sold as a single object (that is, all shares were sold by their owners under one sales contract). Then the deduction amount is distributed in proportion to the shares in the ownership of the property ().

As for the deduction in the amount of expenses incurred, in order to use it, you need to collect all the documents confirming the expenses for purchasing an apartment, for example, a sales contract and an act of acceptance and transfer of property (). At the same time, the Tax Code of the Russian Federation does not provide any explanations regarding what types of expenses can be claimed for deduction. The only requirement is that they must be documented and directed towards the purchase of an apartment.

As the Russian Ministry of Finance explained, such expenses may directly include the cost of purchasing an apartment, realtor services and interest on a mortgage loan. And the costs of paying the tariff for maintaining a loan account under a loan agreement, insurance of the apartment, as well as expenses for the purchase and installation of a metal door are not included in the tax deduction (). To confirm expenses, the following documents are provided: cash receipt orders, sales and cash receipts, bank statements, payment orders, receipts from the seller for receipt of funds and others.

If the apartment was purchased under an exchange agreement, then the deduction is provided in the amount of the market value of the apartment established on the date of signing the agreement. In order to find out this value, you can use the services of an independent appraiser. His assessment report will be a document confirming the expenses incurred by the owner ().

It often happens that the apartment was purchased using maternal capital. As officials explained, the amount of such one-time assistance can be included in the tax deduction and reduce the amount of income received from the sale of the apartment. The same applies to the amount of one-time subsidies for the purchase of housing - for example, as part of a program to provide housing for military personnel, police officers, etc. ().

How to pay tax

Documents confirming the fact of sale of property, for example, a purchase and sale agreement and an acceptance certificate, as well as documents giving the right to apply one or another deduction (agreement for the purchase of an apartment, an agreement for the provision of realtor services, etc.) must be attached to the completed tax form. declarations in form 3-NDFL and submit them to the tax office at your place of residence. This must be done no later than April 30 of the year following the year of sale of the property (). If the declaration is filed later than this deadline, the tax office will charge a fine of 5% of the unpaid tax for each full or partial month of delay, but not more than 30% of the tax amount and not less than 1 thousand rubles. ().

Please note that you do not need to fill out and submit a tax return only if you have owned the property for more than three years (). If the period of ownership of the property is less than three years, you will still have to fill out and submit a declaration to the tax authority - even if the income from the sale does not exceed the amount of the tax deduction.

Construction company LEGENDA Intelligent Development Residential complex on Institutsky Avenue 16

Construction company LEGENDA Intelligent Development Residential complex on Institutsky Avenue 16 What are the tax deductions for selling real estate?

What are the tax deductions for selling real estate? Georgy Sidorov - the radiance of the highest gods and the rocks

Georgy Sidorov - the radiance of the highest gods and the rocks What does human health depend on?

What does human health depend on? Parable about school class hour on the topic

Parable about school class hour on the topic The best parables about the meaning of life, life problems and life goals Famous parables of the world

The best parables about the meaning of life, life problems and life goals Famous parables of the world Basic Sign Language Courses

Basic Sign Language Courses