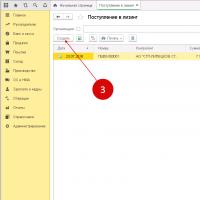

1c management of a trading enterprise. Document "Invoice for payment to supplier"

"1C: Trade Management 8" is a modern tool for increasing the business efficiency of a trading enterprise.

"1C: Trade Management 8" allows you to comprehensively automate the tasks of operational and management accounting, analysis and planning of trade operations, thereby ensuring the effective management of a modern trading enterprise.

The subject area automated using "1C: Trade Management 8" can be represented in the form of the following diagram.

"1C: Trade Management 8" automates the following areas of business activity:

- control and analysis of target performance indicators of the enterprise.

The program can register both already completed and planned business transactions. "1C: Trade Management 8" automates the preparation of almost all primary trade and warehouse accounting documents, as well as cash flow documents.

"1C: Trade Management 8" is designed for any type of trading operations. Accounting functions have been implemented - from maintaining directories and entering primary documents to receiving various analytical reports.

The solution allows you to maintain management accounting for the trading enterprise as a whole. For an enterprise with a holding structure, documents can be drawn up on behalf of several organizations included in the holding.

The application solution supports the following taxation systems:

- The general taxation system is OSNO (registration of entrepreneurs operating under an individual scheme (IP) is not supported).

- Simplified taxation system - simplified taxation system.

- Single tax on imputed income - UTII.

The functionality of the solution can be flexibly adapted by enabling/disabling various functional options. For example, in this way the program can be significantly simplified for a small organization by disabling many features necessary only for large companies (the disabled functionality is hidden from the interface and does not interfere with the work of users). The following will be a description of the functionality of the solution including all options.

"1C: Trade Management 8" provides automatic selection of data necessary for accounting and transfer of this data to .

Using the Trade Management program together with other programs allows you to comprehensively automate wholesale and retail enterprises. The Trade Management program can be used as a management system for the solution.

New functionality of the software product ed. 1.1: description of new functions, analytics and accounting mechanisms, service processing, reports, etc.

Additional information on issues related to the acquisition process USP programs Trade Enterprise Management:

Contents "Description of new functionality of USP rev. 1.1":

Especially for our clients - a simple, convenient CRM as a SaaS service!

Main advantages:

- In payment documents in the tabular section “Payment Decoding” in addition to the agreement and transaction (order), you can indicate information about the payment document (shipment document, receipt) for which payment should be recorded.

- In all documents that affect mutual settlements (“Sales of goods and services”, “Receipt of goods and services”, etc.) a tabular part “Advance payment” (“Documents of settlements with counterparties”) is added, on which you can specify information about the payment document , with which the payment was made, the amount of mutual settlements and the amount in the currency of regulated accounting.

- Clicking the “Fill” button provides a service for automatically filling out the list of payment documents in the documents for shipment and receipt of goods.

- The list of payment documents is filled out according to the FIFO principle, that is, the first outstanding payment document is selected to pay for this payment document.

- If the settlement option “By orders” is set, then payment documents are selected within the framework of the order specified in the shipment (receipt) document;

- If the shipment (receipt) document provides for the indication of orders in the tabular part of the document and the agreement establishes the maintenance of mutual settlements "By orders", then an additional column "Order" is added on the "Advance payment" tab ("Documents of settlements with counterparties"). Thus, when shipping (receiving) goods for several orders, you can immediately record payment for each shipment (receipt) document within several orders.

- New ability to check the compliance of sales documents (receipts) with actually shipped (received) goods by scanning product barcodes

- Executing division - a division of the enterprise responsible for fulfilling the order;

Executor is an employee of the enterprise appointed responsible for fulfilling the order. To adjust the internal order, the document "Adjustment of the internal order" has been added. At the same time, a standard set of functions is supported:

entering a document based on an internal order;

- filling out the table section by clicking the "Fill" button;

- auto-filling of reserves using the “Fill and Post” button;

- printing an adjustment document;

- printing of an internal order taking into account adjustments.

- enter information about the supplier’s nomenclature (name, code and article number of the supplier’s goods) and delivery prices;

- indicate the storage location for the new product

- register selling prices for item items

- calculate selling prices based on base prices and trade markups

- determine the list of components for kits and kits; calculate prices for kits based on the prices of components.

- enter information about projects or types of distribution for several projects to which this item of the nomenclature belongs

- assign a single discount (document "Setting item discounts");

- assign a markup (discount) depending on the sales conditions (document “Setting markups on the sales conditions”).

- By percentage markup on the base type - prices will be obtained by changing the base price values by a certain markup percentage that must be specified;

- When the base price enters the range, prices will be calculated depending on whether the base price belongs to a certain range. The scale of base price ranges and the corresponding price values are established by the document “Setting base price ranges”.

- Buyer's order;

- Adjustment of the buyer's order;

- Retail sales report;

- Receipt of goods and services;

- Receipt of goods and services into NTT;

- Sales of goods and services;

- Invoice for payment to the buyer;

- Order to supplier;

- Adjustment of the supplier's order;

- Invoice for payment to the supplier;

- Return of goods from the buyer;

- KKM check.

- Formation of a price list only for those items for which prices have changed (exclusion from the price list of goods whose prices have not changed since a certain date).

- Formation of a price list using product properties and categories.

- Changing the names of additional columns displayed in the price list and their location relative to the item position (together with the item name, in a separate column before or after the item name).

- Sorting of goods in the price list;

- Saving all settings made.

- amounts of actual receipts and payments of DS;

- cash flow plans (according to other scenarios, for a different period, etc.);

- actual volumes of sales and purchases;

- sales and purchasing plans;

- amounts of receivables and payables;

- unpaid orders from customers and orders to suppliers;

- wage arrears.

- Do not use;

- For admission documents;

- For implementation documents;

- For receipt and sales documents. The column “Buyer’s order” is added to the tabular parts of the documents “Sales of goods and services” and “Invoice for payment to the buyer”. The visibility of the column in documents depends on the accounting settings settings. In this case, it is possible to select orders, as well as fill out sales and payment documents taking into account orders in the tabular parts. The column “Order to supplier” is added to the tabular parts of the documents “Receipt of goods and services” and “Receipt of goods and services in NTT”. The visibility of the column in documents depends on the accounting settings settings.

- Sales of goods to own organizations

- Purchasing goods from own organizations

- Combine indicators into groups;

- Display negative indicator values in red;

- Manage the need to display overall results;

- Manage the need to display detailed records;

- Display properties and categories of objects along with measurement values;

- Display additional fields taking into account placement and position:

- Placement: with groupings, in separate columns, in a separate column;

- Position: before grouping, instead of grouping, after grouping;

- Set selection based on indicator values;

- Perform sorting by indicator values;

- Design the report using one of the available standard design options;

- Use conditional formatting;

- Open several reports at the same time;

- Store report settings in the infobase.

- Storing settings in the information base;

- Storage and use of general, group and personal user settings;

- Borrowing personal settings of other users.

- in the document "Request-invoice" on the "Cost Accounting" tab;

- in the document “Receipt of goods and services” on the “Services” tab;

- in the document "Other costs". The "Customer's order" grouping has been added to the "Costs" report

- at the planned cost of production,

- by the number of services.

- "At planned production cost." The provision of services is reflected in the documents "Act on the provision of production services", services during the month are accounted for at the planned cost;

- "By revenue." The provision of services is reflected in the documents "Sales of goods and services", services during the month are accounted for at the sales price;

- "According to planned cost and revenue." Different types of services are reflected in different documents. Services reflected in the documents “Act on the provision of production services” are accounted for at planned cost during the month. Services reflected in the documents “Sales of goods and services” are accounted for at the sales price during the month. Services accounted for at planned cost and revenue are recommended to be classified into different product groups.

- in accounting policies of management accounting;

- in accounting policies - for each organization.

- direct costs. The sum of direct production costs for all cost items with the nature of “Production” is used as the distribution base;

- individual items of direct costs. The sum of production costs for items selected by the user is used as the distribution base. Selected cost items are entered into the directory "List of cost items included in the indirect cost distribution base." The list of cost items is an element of the directory. Thus, several lists of cost items can be entered into the directory, which can be used to allocate production overhead costs to various items or departments. In the information registers “Methods for the distribution of indirect costs” and “Methods for the distribution of indirect costs of organizations”, when selecting the distribution base “Individual items of direct costs”, you must specify the directory element “List of cost items included in the distribution base for indirect costs”.

- If the main contract of the counterparty satisfies the conditions, then it is selected as a new value, otherwise the selection continues among other contracts of the counterparties.

- If this counterparty has only one agreement with this organization with the required conditions, then this agreement is selected as the new value of the “Agreement” attribute.

- If a given counterparty has several contracts with a given organization, then the contract attribute is cleared, and the right to select a contract remains with the user.

- how to fill out the text of the letter;

- the format in which the printed form will be placed in attachments;

- adjust the attachment file name.

- Multiple connection options supported

- Direct connection of 2 infobases (COM connection).

- Share files via a shared network folder.

- File exchange via FTP resource. Initial synchronization of objects in 2 infobases (necessary if, before using the exchange, accounting was kept in at least one of the 2 infobases)

- Resolving collisions with recording the history of objects.

- History of all exchange sessions with errors recorded.

- Informing the exchange administrator by email about violations and errors in the operation of the exchange mechanism.

- A special tool "Exchange Monitor" that allows you to see various parameters of the data exchange process.

- Order to supplier - Order from buyer

- Invoice for payment to the buyer - Invoice for payment to the supplier

- Sales of goods and services - Receipt of goods and services

- Return of goods to the supplier - Return of goods from the buyer

- Revaluation of goods submitted for commission - Revaluation of goods accepted for commission

- Report of the commission agent on sales of goods - Report to the committent on sales of goods.

- uploading item data

- uploading item prices, pictures, property values and categories, etc.

- downloading customer orders placed in the online store from the website

- uploading modified customer orders to the WEB site

- uploading data on the status of shipment and payment of the order to the WEB site

- exchange only changed data

- ability to configure separate unloading of goods and exchange of orders

- the ability to set up a schedule for exchange and perform data exchange in the background from the user’s main work

- storing the history of exchanges with error logging

Demo version is available online right now!

Typical configuration. Trade management, edition 1.1, Version 1.1.1

New in version 1.1

MANAGEMENT OF MUTUAL SETTLEMENTS in "Management of trade enterprise"

Conducting mutual settlements using settlement documents

The new ability to conduct mutual settlements with details on settlement documents will allow users to control the payment of each specific invoice in parallel, taking into account the conduct of mutual settlements for orders and for the agreement as a whole. With this method of conducting mutual settlements, all possibilities associated with reserving goods according to customer orders and placing them in suppliers’ orders are fully preserved. When conducting mutual settlements under contracts with the “Maintain mutual settlements according to settlement documents” attribute set, you can indicate a direct connection between documents that affect mutual settlements, for example, between shipment and payment documents:

In management accounting, detailing mutual settlements according to settlement documents is usually used to control the timeliness and completeness of payment; in regulated accounting - for more accurate allocation of advances and determination of the amounts of the 1st event. Therefore, the need for detail is determined within the framework of each contract separately for management and regulated accounting.

In management accounting, detailing of settlement documents is supported for any option for conducting mutual settlements (under the agreement as a whole, by orders, by accounts). To conduct mutual settlements based on settlement documents, a special accumulation register “Mutual settlements with counterparties based on settlement documents” is intended.

Regulated accounting for payment documents is possible only in the case of mutual settlements under the agreement as a whole: if accounting for orders or invoices is kept under the agreement, then this information is sufficient to allocate advances and determine the 1st event. In tax accounting, detailing of settlement documents is carried out for the same agreements as in accounting, provided that complex tax accounting is not maintained for these agreements, i.e. The date and amount of the 1st event are quickly determined.

In accounting, the selection of payment documents is carried out taking into account the account for accounting for settlement of advances. In tax accounting, in addition, VAT rates and tax purposes specified in payment documents and in receipt (sales) documents are taken into account.

When automatically selecting settlement documents in a document reflected in all types of accounting, all additional settlement analytics are taken into account: only documents are selected that have the same agreement, advance payment account, VAT rate and tax purpose. However, a situation is possible when it is necessary to close the debt in different ways in different types of accounting. Therefore, manual selection of prepayment documents is possible. When selecting documents manually, the user must understand that not in all types of accounting they will be compared to the receipt (sales) document.

Credit lines

Within the framework of agreements with mutual settlements in the context of settlement documents, the ability to track mutual settlements in accordance with the credit lines entered for the counterparty has been added. To open a credit line, you need to enter into a new agreement for the counterparty, or enter the parameters of the credit line into an existing agreement with this counterparty. The parameters of the credit line are the amount of eligible debt and the term of the debt. After setting these parameters, posting of shipping documents is blocked if the amount or term of the debt is exceeded. The debt period is controlled taking into account the entered work schedules of the enterprise.

Only a user with a special right can post a document for which the term or loan amount has been exceeded. The new right to disable control of mutual settlements is set in the settings of additional user rights. If the user has such a right, he can disable settlement control in a specific sales document by setting the new flag “Disable settlement control when posting a document” on the “Advanced” tab.

You can find out about the status of your credit lines using the new “Credit Line Report” report. In the report, you can specify a selection by counterparty, counterparty agreement (credit line). In the report, you can set groupings by counterparties, contracts, settlement documents, movement documents (debt repayment documents).

Settlements with accountable persons using bank cards

Added the ability to transfer funds to accountable persons to bank cards. In this case, both personal bank cards of employees and corporate bank cards can be used. The transfer of funds to an employee to a personal bank card is formalized by the document “Outgoing payment order” (or “Payment order for debiting funds”) with the transaction type “Transfer of funds to an accountant”. An employee uses a card to pay for goods and services, and can also withdraw cash. The employee prepares advance reports for expenses incurred (similar to cash payments). To make payments to accountable persons through corporate bank cards, the organization must open a special card account at the bank, obtain from the bank the required number of payment cards “linked” to this account, and issue these cards to employees. An employee, having received a card, can use it to pay for goods and services, as well as withdraw cash.

Unlike a regular bank account, all transactions involving the expenditure of funds from a card account are considered to be issued for reporting to an employee - the holder of a corporate bank card. The transfer of funds to a special card account when using a settlement (debit) corporate card is reflected in the document “Outgoing payment order” with the transaction type “Transfer to another account of the organization.” Crediting of a loan to a special card account is formalized by the document “Payment order for receipt of funds” with the type of operation “Settlements on loans and borrowings”.

To reflect payment for bank services related to the opening and servicing of a special card account (funds are transferred from the organization's current account), the documents "Outgoing payment order" (or "Payment order for debiting funds") with the transaction type "Other debiting non-cash funds" are used. funds." The expenditure of funds by the card holder to pay for goods, work, services or for other purposes is documented in the document “Payment order for debiting funds” with the transaction type “Transfer of funds to the accountable”. The employee prepares expense reports for all expenses made using the card.

New features of the "Counterparties" directory

To speed up the process of entering new counterparties, a new form “New Contractor Registration Assistant” has been added. When entering a new counterparty, the user enters only basic data (name of the counterparty, its address, address of the main contact person), and all other parameters are generated automatically. For example, a counterparty agreement is automatically created indicating those parameters (organization, type of mutual settlements) that are specified in the default user settings. The New Contractor Registration Assistant form can be pre-configured. For example, indicate that information about a new buyer is being entered, the legal address is always used as the address, etc. When entering a new counterparty, you can enable control of duplicate records and the program will warn that a counterparty with one of the entered parameters (TIN, EDRPOU code, full name, short name) has already been entered into the information base. This will reduce the volume of the information base and avoid entering duplicate counterparties by different users of the program.

For the convenience of users, a quick selection of elements has been added to the directory list form, which is carried out using two controls: a selection field and an input field. In the selection field, you must select the type of quick search (selection), i.e. indicate by which directory field the selection will be made: by code, name, INN, EDRPOU code, full name or by all fields visible in the form. And in the input field you need to enter a string of characters, the occurrence of which in the selected field will select elements. After setting the selection, only those counterparties that satisfy the selection condition will be visible in the list. To cancel the selection, you must clear the selection field.

RETAIL TRADE MANAGEMENT in the "Trading Enterprise Management" configuration

New Retail Reports

To control the correct receipt of retail revenue (in ATT and NTT), the report “Statement of cash at retail outlets” has been added. To analyze the movement of goods and value assessment of the balances of goods in ATT at retail prices, the report “Statement of goods in retail” has been added.

Use of bank loans in retail trade

The “Trade Management” configuration now allows you to service retail sales transactions with full or partial payment by bank loans with automatic calculation of the bank commission. To enable this feature, in the accounting settings, you must select the “Use payment with bank loans” checkbox. Information about the provision of a bank loan is indicated in the document "KKM Receipt" when registering a retail sale to the buyer. When posting a document in a check punched on the fiscal registrar, the amounts of cash and non-cash payment (payment by bank loan) are displayed separately. After sending copies of contracts to the bank at the close of the cash register shift, all non-cash payments are collected in the “Retail Sales Report” document on the “Payment by Bank Loans” tab. The amount of the bank commission is calculated automatically from the amount of bank loan payments and the percentage of the bank commission specified in the agreement with the bank providing the loan.

To register the receipt of funds from the bank for granted bank loans, a new type of operation “Payment for bank loans” has been added in the document “Payment order: receipt of funds”.

INVENTORY MANAGEMENT in the program "Trading Enterprise Management"

New opportunities for batch accounting of goods

An optional option for execution on the server has been added to the “Post by batch” processing. In order for processing to be performed on the server, the “Perform on server” flag must be set in the processing form. In this case, messages about the progress of the batch process will not be promptly displayed in the message window. Messages will be displayed after batch posting on the server is completed.

Added the ability to write off batches when posting an expense order. If the sale of goods is processed using an order scheme, then there are now two options for generating movements in batch accounting registers. If the “Write off batches with an issue order” checkbox is selected in the accounting settings, then movements in the batch accounting registers and associated movements in other registers are formed at the time the issue order is posted to the batches. If the “Write off batches with an expense note” checkbox is cleared, then movements in batch accounting registers are generated at the time the document “Sales of goods and services” is posted by batch. At the same time, management accounting records batches with the statuses “Returnable containers, deferred shipment,” “Purchased, deferred shipment.” The final write-off occurs at the time the corresponding expense order is posted.

New opportunities when working with internal orders

To control the execution of an internal order, the following details have been added to the “Internal Order” document on the “Additional” tab:

To remove reserves and close internal orders, the document "Closing internal orders" has been added. When filling out a document, you can use automated document selection based on various selection criteria. For example, select unfulfilled orders whose reserves have expired.

Added the ability to specify several different internal orders for the fulfillment of which goods or returnable containers are moved in the "Movement of Goods" documents. To analyze internal orders, new reports "Internal Orders" and "Analysis of Internal Orders" have been added.

New mechanism for working with serial numbers

Now, to keep track of serial numbers, it is not necessary to use the series directory. The ability to store serial numbers in a separate, specially created directory has been implemented. The configuration has added the ability to indicate serial numbers from the new directory in receipt, sales, and return documents. Maintaining quantitative and total accounting of items by serial numbers is not provided in the configuration.

Maintaining serial numbers is enabled optionally, both for the configuration as a whole (the "Use serial numbers" flag is set in the accounting parameters settings) and for each item item (the "Maintain serial numbers" flag). The list of serial numbers is stored in the "Serial Numbers" directory, subordinate to the "Nomenclature" directory. Information about the serial number is filled in on an additional tab in the document (“Serial numbers”). It is possible to enter serial numbers using a barcode scanner. In documents that use serial numbers, it is possible to print a document indicating the serial numbers of goods shipped or received.

Indication of storage locations for goods

The ability to specify standard storage locations for goods has been implemented. This will reduce the time it takes to search for goods in the warehouse and the time it takes to assemble orders. Also, this opportunity, when registering the receipt of new goods, will allow you to quickly arrange the goods in their storage locations. Information about storage locations is entered into the “Storage Locations” directory, which is subordinate to the “Warehouses” directory. For each item of the nomenclature, information is entered about where this item of the nomenclature should be located. This information is entered into the information register “Item Storage Locations”. For an item item, you can define several storage locations in different warehouses; one of the storage locations will have priority.

To quickly search for goods in warehouses at their designated storage locations, a printed form “Commodity Filling Form” is provided. This form is connected to documents accompanying the shipment and receipt of goods. In the “Commodity Filling Form” form, the goods specified in the tabular part of the documents are grouped and sorted in the order of their location in storage locations identified as the main (priority storage locations) for a given warehouse. For your reference, the form displays information about alternative storage locations and the remaining goods in the warehouse. The “Product Filling Form” form can be customized according to the needs of each specific user working with the program.

New ability to check the compliance of sales documents (receipts) with actually shipped (received) goods by scanning product barcodes

Added the ability, after filling out the tabular part of the document (for example, in the based input mode), to check the list of shipped (received) goods by scanning their barcodes. This feature can be used when pre-assembling goods according to customer orders or when moving goods from warehouse to warehouse. This option can also be used if it is necessary to compare the correct composition of incoming goods with the provided printed form of the incoming document.

When checking goods, various types of retail equipment can be used: barcode scanners, data collection terminals, RFID tag reader. Barcode verification is carried out in a separate dialog form, which is opened by clicking the "Check" button in the documents accompanying the receipt and shipment of goods.

Working with product sets

The program has implemented a new feature: registration of sales of kits without preliminary assembly. This will reduce the time spent on shipping such kits. That is, the kits can be assembled “on the fly” during the process of shipping goods to the buyer. To achieve this, the program's mechanism for working with sets has been changed. Two new types of nomenclature have been introduced - set-set and set-package. Using a set-package is similar to using an item item with the “Set” view in the previous edition of the configuration. A batch set is used to quickly select a list of items into a document.

A kit kit is used for shipping goods that do not require pre-assembly. The kit kit is not stored in the warehouse; the picking process occurs at the time the goods are shipped to the buyer. A set may have prices that differ from the total price of the components included in it. Information about the components included in the kit is specified on the “Components” tab, but can also be changed in the document itself. Information about the kit is entered on the “Products” tab. A separate tabular part of the document (the “Set Contents” button) displays a list of those components that are specified for the kit in the “Nomenclature” directory. If necessary, the composition of the components included in the kit can be changed.

When registering the shipment of goods from a warehouse, the fact of sale is the sale of a set. In this case, those components that are included in the kit are written off. The cost of a kit is calculated as the sum of the costs of the components included in its composition. For kits, it is possible to reserve the components included in the kit in the warehouse and order components from the supplier for a specific customer order.

Item entry assistant

To speed up the entry of information about new item items, an item entry assistant has been added to the configuration. The input assistant is used as an item form when entering new items. Using the input assistant, you can customize the list of available and required fields in the item item form for each specific user. In this case, you can configure both the display of individual pages (form bookmarks), as well as the visibility and mandatory indication of individual details. For example, a sales manager should not have access to information about the supplier who supplies this product, but indicating the full name and article when entering a new product should be mandatory. A check is performed for required details when recording, and if the details are not filled in, a corresponding message is displayed. For some details, you can set a uniqueness check, then when you record an element, a uniqueness check will be performed for them using the “Search and replace duplicate directory elements” processing. Using the input assistant when entering new item items, you can:

When registering a new position, new documents are automatically created that register prices (“Setting item prices”, “Setting prices for counterparties’ items”), as well as new entries in the corresponding registers (“Item storage locations”, “Supplier items”, “Component items” and etc.). Thus, the process of entering a new product item is simplified; the user does not need to enter additional documents; they will be generated automatically when entering a new record about the product.

Displaying balances and prices in the list forms of the “Nomenclature” directory

A new ability to quickly view balances, prices and the location of a specific product in accordance with storage locations has been added to the “Nomenclature” directory. Using this feature will help the sales manager quickly answer the client’s question about the availability of goods in the warehouse and the price of the goods. This feature is enabled in the list forms of the “Nomenclature” directory in the “Actions” - “Remaining goods in warehouses” menu. A separate table field of the form displays information about balances for the current item list position in the item directory in the context of the characteristics of this item and warehouses. Moreover, information is displayed not only about free stock of goods, but also about the quantity of reserved goods and the quantity of expected goods according to suppliers’ orders. In the same dialog box, you can display information about the current selling prices set for goods. If storage locations in warehouses are defined for an item in the information register "Item storage locations", then the address of the main storage location in the warehouse will be shown.

Quick selection in the "Nomenclature" directory

To make it easier for users to work with the list of items, a quick selection of elements has been added to the directory list form, which is carried out using two controls: a selection field and an input field. In the selection field, you must select the type of quick search (selection), i.e. indicate by which directory field the selection will be performed: by name, article, full name, or by all fields visible in the form. And in the input field you need to enter a string of characters, the occurrence of which in the selected field will select elements.

After setting selection, only those item items that satisfy the selection condition will be visible in the list. To cancel the selection, you must clear the selection field.

Changes in the documents "Adjustment of quality of goods" and "Adjustment of series and characteristics"

For goods that are reserved for customer orders, it is prohibited to change the quality parameters, series and characteristics of goods. When posting documents, a check has been added to check for the presence of lines in the document that do not change the quality, series or characteristics of goods. If such lines are present in a document, then such a document will not be posted and a corresponding warning will be issued.

New indicator in the report "Analysis of the availability of goods in warehouses"

The "Ordered from suppliers" indicator has been added to the "Analysis of goods availability in warehouses" report. Using this indicator, you can control information about the quantity of expected goods, that is, it shows the number of goods that have been ordered from suppliers, but have not yet been received as of the date the report is generated.

PRICING in "Trade Management"

A separate document journal “Journal of Pricing Documents” has been created for pricing documents.

Price groups

To make it easier for the user to work with the “Pricing” subsystem, another option for classifying goods has been added - price groups. The list of price groups is stored in the directory of the same name. For all products belonging to the same price group you can:

For each client of a retail enterprise, you can assign different types of sales prices for each price group of goods (document “Setting price types by product groups for customers”). After assigning a new product to a price group, this product will be subject to all the conditions that are set for products of this price group, without entering additional pricing documents. Price groups can also be used to group and sort item items in a price list. Each product item can be assigned to one price group. For this purpose, the “Price group” attribute has been added to the “Nomenclature” directory.

New way to calculate prices

A new method of calculating prices has been added to the configuration: based on the entry of the base price into the range. Thus, in the configuration there are now two calculation methods possible:

The calculation method is specified in the document “Setting item prices”. For each product item, you can specify your own price calculation method. By default, the calculation method that is specified for the price type in the “Item Price Types” directory is used.

In the document “Setting item prices” and in the “Nomenclature” directory, the ability to automatically calculate selling prices based on the base price and trade markup (“Calculate at base prices”) has been added. An additional option has been added to the "Nomenclature" reference book for calculating the price of a set based on the prices of components ("Calculate the price of a set").

Formation of prices based on base price ranges

Added the ability to set the sales price discretely by intervals of the base price, for example: if the base price is from 2 c.u. up to 2.5 USD - sale at a price of 50 UAH, if the base price is from 2.5 USD. up to 3 USD - sale at a price of 60 UAH.

The scale of base price ranges and the corresponding price values are established by the document “Setting base price ranges”. This data is used when calculating prices in the document "Setting item prices" for those lines that indicate the calculation method "By entry of the base price into the range." The sales price is calculated in the item price setting document in accordance with the specified calculation method; in goods release documents, the already set price is used.

Setting price types by item groups for customers

Added the ability for each buyer (for all his contracts) to set a price type that is different from the price type in the contract for certain price or nomenclature groups of goods. For example, by default, under an agreement with the buyer, all goods are sold to him in the 3rd column of the price list, but for the "Multimedia" price group it is assigned that goods should be sold in the 4th column. Assignment of special price types for price or item groups is made by the document “Setting price types by item groups for buyers.”

Setting markups according to sales conditions

Added the ability to set a markup (discount) on the selling/purchasing prices of goods, depending on the sales conditions, when preparing documents for the receipt/sale of goods. Information about the terms of sale under which the markup (discount) is established is stored in the “Terms of Sales” directory. For example, the conditions of sale may include: a markup when selling for non-cash payment, a markup for setting up equipment, etc. The markups (discounts) that will be established in accordance with the terms of sale are assigned by the document “Setting markups according to the terms of sale.” Markups are assigned for price or item groups, which is determined by the type of document transaction. If the markup percentage is specified as a positive number, then a markup will be set; if it is negative, a discount will be applied.

In the documents, the management of setting a markup (discount) for sales conditions is carried out in a form that opens by clicking the “Prices and Currency” button. The value of the sales condition according to which the markup (discount) will be set is specified in the "Sales condition" field. If the sales condition is specified in the agreement under which the document is drawn up or is set in the user settings, then this sales condition will be used in the document by default. In this case, the sales condition from the contract takes precedence over the sales condition in the user settings.

Working with this mechanism is possible in the following documents:

Natural (bonus) discounts

Added the ability to assign natural (bonus) discounts when selling goods. In-kind (bonus) discounts are assigned if, when purchasing a certain list of goods, one of the goods is given to the client as a gift, that is, for free. For example: “When you buy 2 pairs of shoes, the cream is free,” “When you buy a refrigerator and a TV, you get a free coffee maker.” An item that is given away for free is called a “bonus”.

Natural (bonus) discounts are entered in the document “Setting item discounts” with the operation type set to “In-kind discounts”. On the "Bonuses" tab, you need to specify the necessary sets for which the bonus is given, and match them with the bonus (gift). In sales documents, before posting the document, a check is made to ensure that bonus sets are compiled from the selected product range. If the selected products can be used to create sets for which a bonus is given, then a question is asked about opening a form for selecting bonus sets. If the answer is yes, then a window opens in which you must select the required bonus and indicate the amount of this bonus. The form also shows what the bonus is for, and what bonuses are provided. The selected bonus set replaces the list of items for which the bonus is given. And the bonus set includes positions for which bonuses are given and the bonuses themselves. You can refuse to select a bonus set - in this case, the user returns to editing the document.

The bonus can be provided not only when purchasing a certain number of products, but also when purchasing several products. For example, a “Coffee Maker” bonus is given for the “TV and Refrigerator” set. When registering a sales document and selecting the “TV” item, the program will warn that if the buyer also buys a “Refrigerator”, he will be offered a “Coffee Maker” as a gift. Use of incomplete specs. offers (bonuses) can be disabled in the program. Prices for sets with a bonus are set in a standard way in the document “Setting item prices”. In-kind discounts can be canceled ahead of schedule using the document “Cancellation of item discounts”.

New options for printing price lists

New features have been added to the “Print price list” processing:

Assigning automatic discounts when selling services

You can now set automatic discounts on services in sales documents. Automatic discounts on services are assigned by the document “Setting item discounts”. In wholesale sales documents (“Buyer’s order”, “Adjustment of customer’s order”, “Invoice for payment to buyer”, “Sales of goods and services”) on the “Services” tab, details for working with automatic discounts have been added to the tabular section. When filling out the tabular part with services, if the condition for providing a discount is met, then an automatic discount will be calculated for the services. In the retail trade documents "KKM Receipt" and "Retail Sales Report" you can also work with automatic discounts on services.

Analysis of discounts provided

To analyze the discounts provided, a new report "Provided discounts" has been added. The "Sales" report now has the ability to receive information about the amount of sales without a discount, the amount of the discount and the percentage of the discount.

New opportunities when setting discounts on discount cards

Now it is possible to assign discounts not only for one specific discount card, but also for several discount cards of the same type. The purpose of discounts is now documented - the document “Setting item discounts”. That is, now discounts can be assigned for certain price groups, for specific products, taking into account the validity period. For example, you can assign a discount on a discount card for goods of a certain price group only during the daytime. Added the ability to use cumulative discounts on discount cards. When using this opportunity, data on the amount of discounts on discount cards is summed up, and if the amount of purchases reaches a certain value, then the percentage of the discount on the discount card increases or the discount card is replaced for its owner. To control the provision of discounts on discount cards, a new report "Sales on discount cards" has been added.

Group printing of price tags and labels

Added the ability to group print price tags and product labels. Group printing of price tags and labels is now available in goods receipt documents (“Receipt of goods and services” and “Receipt of goods in NTT”) and in the “Nomenclature” directory. When printing price tags and labels, you can select by item, product characteristics, and product availability in the warehouse. At the same time, it is possible to print several copies of price tags or labels for one product, and the ability to indicate the price on the product label

CASH MANAGEMENT in the "Trading Enterprise Management" configuration

Cash flow plan

A mechanism has been developed for cash flow planning. The DDS plan gives a fairly clear picture of the cash flows of the planning period and does not require significant experience and significant resources.

Planning is carried out using the document "Cash Flow Plan". The document is generated for a department according to a scenario for a period of a certain frequency (from a day to a year). Separate documents formulate plans for the movement of non-cash and cash funds. In addition, planning is carried out in the context of DDS articles and projects.

The plan can be filled out automatically using actual data and data from other planning subsystems. Possible planning sources:

Applications for the expenditure of DS and planned receipts of DS are not used as planning sources. The DDS plan is usually formed for a period longer than the payment calendar and contains more general information.

Summary information about the results of planning, for example, about the DDS plan for all divisions of the enterprise, can be obtained from the “Cash Flow Plan” report.

To monitor the implementation of the plan, the “Comparative analysis of cash flow” report is intended. The same report can be used to compare DDS plans under different scenarios or for different periods.

Payment from buyers by payment cards

The “Trade Management” configuration now allows you to service retail and wholesale transactions with full or partial payment by payment card. To enable this feature, in the accounting settings, you must select the “Use payment by payment cards” checkbox. When working with payment cards, acquiring agreements concluded with the bank are used, which indicate the types of payment cards serviced and the percentage of trade concessions.

Payment by payment card in retail trade is recorded by the document “KKM Receipt”. After closing a cash register shift, information about all payments by payment cards for the shift is collected in the “Retail Sales Report” document on the “Payment by Payment Cards” tab.

In the event that when paying with a payment card, information about the buyer must be recorded, then such payment is processed using the document “Payment from the buyer by payment card.” The document must specify the type of transaction “Payment from buyer”. In this case, the buyer can be either an individual or a legal entity. The document can be entered based on a shipment document, an invoice for payment to the buyer, or an order to the buyer. When making settlements with the bank, a document “Payment order: receipt of funds” is drawn up with the transaction type “Receipt of payment by payment cards”. The document indicates the amount of the trade concession and the cost item to which this amount will be allocated.

New fields to fill in payment documents

In the directory "Counterparty Agreements" the attribute "Main item of cash flow" has been added (on the "Additional" tab). The value specified in this detail will be substituted by default in payment and cash documents when selecting this agreement.

ORDER MANAGEMENT in the software solution "Trade Management"

New opportunities for working with supplier orders

To quickly place an order to a supplier when using the “work to order” scheme, the ability to enter the “Order to Supplier” document based on the “Buyer’s Order” document has been added.

To automatically generate orders based on the needs for returnable packaging, on the “Containers” tab, methods have been added to automatically fill out the tabular part (using the “Fill” button) “Fill with needs” and “Add requirements”.

Indication of orders in the tabular parts of receipt and sales documents

Added the ability to indicate orders in the document's tabular sections in documents for the receipt and sale of goods, which allows you to draw up one sales document for several orders from the buyer and one document for receipt for several orders to the supplier.

The operation of this mechanism is controlled in the accounting settings. To configure "Indicating orders in the tabular part of documents" you can select one of the options:

New options for setting up auto-reservation and auto-placement of orders

Added the ability to configure an auto-reservation strategy for orders. In the accounting settings settings on the "Orders" tab, you can specify the strategy that will be used by default in documents during auto-reservation: "First in orders to suppliers, then in warehouses" or "First in warehouses, then in orders to suppliers." If necessary, you can choose a different strategy in the documents. In the previous version of the configuration, auto-reservation and auto-placement of orders were managed using the "Auto-reservation" and "Auto-placement" flags in the form of documents "Buyer's order", "Customer's order adjustment", "Goods reservation", "Internal order". Now the management of auto-reservation and auto-placement in these documents, as well as in the new document “Adjustment of an internal order”, is carried out in a special form, which opens by clicking the “Fill and Post” button. When opened, the form is filled in with the default settings for auto-reservation, which are specified in the accounting settings and user settings.

New reports for monitoring the reservation and placement of goods

To control and manage reserves and placement of goods in supplier orders, new reports “Goods in reserve in warehouses” and “Order placement” have been added.

The report "Items in reserve in warehouses" shows the balance of goods reserved in customer orders, internal orders and goods reserved under the document "Receipt order for goods" (with the "Without the right to sell" flag set). Using this report, you can see which documents the item is reserved for and, if necessary, remove the item from reservation and transfer the reserve to another customer order.

The "Order Placement" report is intended to obtain information about the placement of supplier orders in customer orders. Using this report, you can obtain information about which orders to the supplier placed a specific product ordered by the buyer and the date of delivery of goods by suppliers.

SALES MANAGEMENT in "Trading Enterprise Management"

Intercompany sales

The process of issuing transfer documents between own organizations based on negative balances of goods in some organizations and positive balances in other organizations has been automated.

Sales to own organizations are carried out as sales to own contractors, information about which is stored in the information register “Own contractors”.

The preparation of documents for intercompany sales is carried out using the "Batch entry of documents" processing, and for the organization on behalf of which the documents are prepared, this can be done in one of two ways:

"Quick sale" mechanism

To reduce the time it takes to complete documents for the buyer, the “Quick Sale” mechanism has been added to the “Buyer’s Order” and “Sales of Goods and Services” documents, which batch inputs documents based on the completed “Sales of Goods and Services” document.

The form for setting up the "Quick Sale" mechanism opens in the "Buyer's Order" document by clicking the "Execute Sales" button, and in the "Sales of Goods and Services" document by clicking the "Execute Documents" button. In the form, you can specify a list of documents that need to be prepared ("Tax invoice", "Cash receipt order", "Sale of goods and services"). For documents, you can select a printing form, set the document printing mode (with preview or directly to print), and the number of printed copies of documents. Making a cash payment when batch inputting documents from the “Buyer’s Order” document is possible only if the cash desk to which the funds should be received is selected in the “Bank account (cash)” field.

The settings set by the user in the quick sale settings form are saved and can be used in the next session. If you clear the “Show the settings form when generating documents” flag in the settings form, the form will not open when you call the mechanism, but actions will be performed immediately according to the settings. You can restore the display of the form from the menu "Actions" - "Open the form for setting up the design of a package of documents."

New processing capabilities "Sales manager's workplace"

Now the sales manager can use the sales workplace not only to issue customer orders and invoices for payment, but also to issue the “Sales of goods and services” document.

New reports on product sales analysis

To analyze sales of goods by supplier, a new report "Sales by supplier" has been added.

Added the "Gross Profit by Supplier" report, which shows gross profit by supplier. The synchronized operation of the "Gross Profit" and "Gross Profit by Supplier" reports has been ensured. An additional indicator "Efficiency" has been added to reports. The "Efficiency" indicator is calculated as the ratio of gross profit to the cost of goods, expressed as a percentage.

The "XYZ Sales Analysis" report has been renamed to "XYZ/ABC Sales Analysis". Now, one report combines the ability to classify objects by stability classes (XYZ analysis) and by importance classes (ABC analysis) of the selected parameter from the point of view of the sale of goods and services of a trading enterprise according to management accounting data.

PLANNING SALES AND PURCHASES in the "Trade Management" configuration

To reduce the number of planning documents, the ability to detail the composition of the plan by subperiods of the main plan period has been added. This makes it possible to draw up one enlarged plan (for example, for a year) and in it indicate detail by sub-periods (for example, a month) without drawing up additional planning documents for each month. Moreover, each position of the plan can be assigned to a specific sub-period. One of the periodicities can be used as a sub-period: year, half-year, quarter, month, decade, week, day. The distribution of goods by subperiods can be done taking into account distribution profiles (sales seasonality).

The program now allows you to create more detailed plans for contractors, contracts and customer orders. This will allow you to more clearly plan customer sales volumes and monitor the implementation of sales plans in the context of customer orders using plan-fact analysis. When planning purchases, you can create orders for suppliers based on information about customer orders presented as part of the purchase plan.

New service options in the planning assistant

Now, when planning to analyze data, you can use data for several periods at once (a combination of several strategies of the same type) as demand sources. In this case, the addition and merging of sources can be done with or without taking into account orders, departments, projects, counterparties, and contracts. This will allow, for example, to choose the following planning strategy: create a purchasing plan based on an analysis of sales of the wholesale sales division for the month of November of the previous two years. In this case, select the sales volume that is the maximum as the source.

All settings made in the planning assistant (strategies for calculating quantities and amounts, selecting data for planning, order of working with sources of needs) are now saved in the information base for each specific user. Moreover, these settings can be available for use by all other users. Thus, the head of the marketing department can develop strategies for calculating planned data, approve them with the management of the enterprise, and then distribute them to all other employees to apply these strategies in their current work.

Planning by order point

In the document "Setting order point values" the ability to specify the unit of measure for the order point value and the minimum safety stock value has been added. Specifying a unit of measurement makes sense only for a fixed method of determination, since only in this case the values of the order point and the minimum safety stock are specified directly in the document. Other methods of determination involve the calculated values of the indicated indicators. When posting a document, the values of the indicated indicators are converted to units of storage of balances.

In the "Order point analysis" report, a new indicator "Recommended purchase volume" has been added, which is calculated as the difference between the stock balance and the order point value on the date the report is generated. You can generate orders to suppliers directly from the report form. Orders to suppliers are formed for those goods for which the recommended purchase volume is greater than zero. Before placing orders, a preliminary table is displayed in which you can clarify the composition of the goods for which orders need to be generated for suppliers. The supplier specified as the supplier is the one that is defined for the product as the main supplier.

MANAGING RELATIONSHIPS WITH BUYERS AND SUPPLIERS in the "Trade Management" configuration

Tasks with alerts

Added the ability to create tasks with alerts. A notification task is used to fix a specific task by the program user (initiator) and transfer it for execution to another program user (executor). The task indicates the expected completion date of the task and provides its description. Having received a notification about a task, the performing user must complete the assigned task and mark its completion.

Monitoring the execution of tasks is carried out in the list of tasks (menu item "Tools" - "Tasks with alerts" - "View list").

A new task with an alert can be entered based on the documents: “Event”, “Buyer’s order”, “Order to supplier”, “Invoice for payment to buyer”, “Invoice for payment to supplier”, “Internal order”. Entering a new task is done by clicking the button with the image of an alarm clock in the top command panel of documents or through the menu item "Tools" - "Tasks with alerts" - "Set a task". A new task can be assigned to a counterparty or contact person. The notification task is also used to remind the birthday of a counterparty or contact person.

Important. The notification task mechanism replaces the previously existing reminder mechanism.

Mechanism "Contact Manager"

The Contact Manager processing provides the user with a single tool for working with events, the user's calendar, and internal email. Processing is called from the menu "Tools" - "Contact Manager".

Important. The previously existing separate processing “Mail” and “User Calendar” have been removed from the system.

REPORTS in "Trade Management"

"Universal Report" report

A new universal report has been added to the configuration, which combines the capabilities of the “Balances and Turnovers” and “List / Cross-Table” reports. A universal report allows you to:

Working with report settings

For reports created on the basis of a universal report, new options for working with report settings have been added:

Report "Accounts receivable by debt maturity"

Added the "Accounts receivable by debt maturity" report. The report allows you to obtain information about the amounts of receivables (debt of counterparties to the trading enterprise) as of the report date, and how long ago this debt arose. The timing of debt occurrence is grouped by intervals.

ACCOUNTING FOR PROJECTS in the software solution "Trade Enterprise Management"

The program provides for keeping records of shipments, receipts of goods, as well as receipts and expenditures of funds by project. The new edition of the configuration adds the ability to automatically distribute product items among projects. This distribution is made in accordance with the distribution types specified for product items. The project can be specified both for the entire document and for individual item items. When goods are shipped (received), distribution can be made among projects in accordance with specified projects (or types of distribution across several projects) for an item item. This will allow for a more detailed analysis by project. The “Main project” attribute has been added to the counterparty agreement. In documents in which you can specify a project, when selecting a counterparty agreement, the value of the project from the agreement will be substituted (in the header of the document).

ACCOUNTING in the configuration "Trade Management"

Register of information "Item Accounting Accounts"

Item accounting accounts in version 1.1 can be specified for each type of item. You can also set up accounting accounts for a specific group in the "Item" directory and a specific type of item.

Document "Inventory of mutual settlements with counterparties"

The document "Inventory of mutual settlements with counterparties" (menu Documents - "Purchase" ("Sale") - "Inventory of settlements with counterparties") is intended for conducting an inventory of receivables and payables of an accounting organization. Using the document data, you can print the standard form INV-17 “Act of Inventory of Settlements with Buyers, Suppliers and Other Debtors and Creditors.”

Product report

It is possible to generate a product report (menu "Sales" - "Product report (retail)") for retail warehouses and NTT warehouses with total accounting according to accounting data. The commodity report shows the balances at the beginning of the period, the amount of goods receipts in the context of receipt documents, the amount of goods consumption in the context of expenditure documents, and the balances of goods at the end of the period.

Entering initial balances for closed mutual settlements (unreceived tax invoices)

The document "Adjustment of debt", type of operation "Entering initial balances", now allows you to enter balances for unreceived tax invoices in the case when mutual settlements with counterparties are closed at the time of entering balances. To carry out this operation, you must select the “No Taxpayer” and “Mutual settlements closed” checkboxes in the tabular part of the document.

PRODUCTION AND COST ACCOUNTING in the solution "Trade Management"

Changes to cost accounting dimensions

Accounting for sales costs is now possible based on customer orders. The cost order can be specified:

ATTENTION! Accounting by order is carried out only for sales costs. There is no custom accounting in production.

Since the distribution of overhead costs is made for the department as a whole, without breakdown by item groups, now the item group cannot be indicated in documents recording overhead costs.

Document "Requirement-invoice"

The document "Request-invoice" indicates the same cost analytics for all written-off materials. On the "Materials" tab, for each material the cost item and additional cost analytics (item group, construction object) are no longer indicated.

Cost analytics in management and accounting is indicated on the “Cost Accounting” tab. First, the management accounting cost analytics are indicated: a cost item and additional analytics, the composition of which depends on the nature of the costs. Accounting analytics are filled in automatically and coincide with management accounting analytics. Accounting analytics can be changed by the user.

Note. The information database contains documents entered before the update. Management accounting cost analytics for them has been moved from the “Materials” tab to the “Cost Accounting” tab. If different cost analytics were specified for different materials, this analytics is saved on the “Materials” tab. To see it, you need to set the visibility of the columns “Cost Item”, “Item Group” and “Construction Object”. Setting the visibility of columns is done in the special “List Settings” window, called up from the context menu of the tabular section.

Documents registering the release of finished products (provision of services, performance of work)

When posting the document "Production Report for a Shift", raw materials and materials necessary for the production of products can be written off. To do this, you need to set the “Write off materials” flag in the document and fill out the tabular part on the “Materials” tab. The tabular part can be filled in automatically by clicking the "Fill" button if specifications are indicated on the "Products" and "Services" tabs.

In the documents “Production Report for a Shift” and “Certificate of Provision of Production Services”, the production product group is now indicated for each product (service). The “Nomenclature group” attribute has been moved from the document header to the “Products” and “Services” tabular sections. The item group is entered automatically if the “Item group” attribute is filled in for the selected item.

In the documents “Act on the provision of production services” the details Division, Organizational Division and Cost Account have been moved from the “Cost Account” tab to the document header.

Cost Allocation

Allocation of costs of main and auxiliary production: internal services

Internal services can be accounted for:

The default accounting meter is determined in the accounting parameters settings on the "Production and Costs" tab. The accounting meter is specified in each document "Production report for the shift" on the "Services" tab. Thus, accounting for services belonging to different nomenclature groups can be carried out in different meters. For the services of one document “Production Report for a Shift”, management and accounting records are maintained in the same meter.

When calculating the actual cost at the close of the month, the costs of the main and auxiliary production are distributed between types of services in proportion to their planned cost or quantity, depending on the meter in which the services were taken into account during the month.

Allocation of costs of main and auxiliary production: services provided to third parties

During the month, services can be accounted for:

The method of accounting for services provided to third parties is indicated:

When calculating the actual cost at the close of the month, the costs of the main and auxiliary production are distributed between types of services in proportion to their planned cost or sales price, depending on the meter in which the services were taken into account during the month.

Distribution of overhead costs

New distribution bases for overhead costs have been added. The distribution bases are indicated in the information registers “Methods for the distribution of indirect expenses” and “Methods for the distribution of indirect expenses of organizations”. Added databases:

Counter release of products and services

The “Organization” dimension has been added to the information register “Counter output of service products”. It has become possible to set up different procedures for calculating the cost of counterproduction products and services for various enterprise organizations.

For used register entries, the "Taking into account" flag is set. For temporarily unused records, the flag is cleared. To reuse an entry, just fill in the “Taking into account” flag again.

Production reports

The reports "Work in progress", "Costs", "Defects in production" have been transferred to a universal report. During the month, when indirect costs have not yet been distributed and the actual cost has not been determined, it is recommended to select only the indicators of the “Receipt” group when setting up. After closing the month, it is advisable to select all report indicators when setting up.

The “Cost Item” and “Consumed Materials” groupings have been added to the “Work in Process” report. When setting up the report, you should take into account that in the context of cost and materials items, only the write-off of costs to work in progress is taken into account. Accordingly, it is advisable to use the “Cost Item” and “Consumed Materials” groupings only to view the indicators of the “Receipt” group. The indicator "Receipt. Quantity of materials" has been added to the "Work in Process" report.

Default line items

In the accounting settings on the "Production and Costs" tab, you can define a default cost item for commission accounting. This cost item will be automatically inserted into the “Commission Agent Sales Report” documents on the “Cost Accounting (Control)” tab.

In the accounting settings settings on the "Production and Costs" tab, a default cost item can be defined to account for the costs of buying and selling currency. This cost item will be automatically inserted into the “Purchase and sale of currency” documents on the “Costs for management accounting” tab.

MANAGEMENT OF INTANGIBLE ASSETS in "Management of a trading enterprise"

Accounting for intangible assets by location by division and MOL

The accounting of intangible assets in the context of materially responsible persons and departments has been implemented. When accepting intangible assets for accounting, it is necessary to fill in the details of the MOL and the department for management and accounting.

Document "Movement of intangible assets"

A document has been added intended for the movement of intangible assets between departments and materially responsible persons in management and accounting.

Document "Inventory of intangible assets"

A document has been added designed to identify the actual presence of intangible assets and verify the compliance of accounting data on the number of intangible assets with the actual presence of such objects.

Document "Modernization of intangible assets"

The document "Modernization of intangible assets" has been added to reflect the modernization (reconstruction) of intangible assets in accounting. The document writes off the costs at the construction site to the intangible assets being modernized. In accounting, costs for construction projects are accumulated in account 1542 “Production of intangible assets.”

Document "Invoice for payment to supplier"

The ability to draw up the document “Invoice for payment to the supplier” for the acquisition of intangible assets, as well as entering the document “Receipt of intangible assets” based on it, has been implemented.

Document "Acceptance for accounting of intangible assets"

A new type of operation “Construction objects” has been added to the document “Acceptance for accounting of intangible assets” - for acceptance for accounting of intangible assets, the cost of which is formed from the costs allocated to the construction project. In accounting, costs for construction projects are accumulated in account 1542 “Production of intangible assets.”

Implemented the entry of the document “Acceptance for accounting of intangible assets” based on “Receipt of intangible assets”.

RETAIL STORE EQUIPMENT

Changes have been made to processing for working with retail equipment. Processing for fiscal registrars working with drivers from ArtSoft and HelpCo has changed.

ATTENTION! When updating processing for fiscal registrars working with drivers from ArtSoft, you must:

a) Run a report with zeroing on the fiscal registrar (Z-report).

b) Delete the DBF file in the 1C:Enterprise program directory with a name consisting of the Cash Register code.

c) Update processing and continue working with the registrar.

OTHER NEW FEATURES of the "Trade Business Management" program

Processing "Item selection"

In the "Item Selection" processing, the ability to convert balances into a price unit has been added.

In the “By reference book” selection mode, an optional feature has been added to display the remaining product in the list column.

In the “By reference book” selection mode, you can enable the display of balances and prices in a separate table field. The mode is activated by the “Remaining balances and prices of goods” button in the command panel of the list.

The ability to select items based on product quality has been improved.

In the configuration, there are documents that work only with the quality of the item "New" or documents that work with different quality depending on the type of operation and the tabular part from which the selection is opened. If the selection of an item is opened from a document (tabular part) in which there is no columns "Quality" or the choice of quality other than "New" is prohibited for methodological reasons, then the calculation of balances and selection of items is carried out only for goods with the "New" quality.

In the selection processing form, as well as in additional forms with the characteristics of selection processing, the quality column is hidden. Remaining balances are calculated only for goods of “New” quality.

If the selection of an item is opened from a document that works with item items that have different qualities, then the balances are calculated taking into account the quality of the item, with the ability to select a product with a quality different from new in the document.

Types of selections: “By inventory balances and quality” and “By item balances, quality and prices” have been renamed to the following selection types: “By item balances” and “By item balances and prices”, respectively.

Added functionality for setting a filter to display items with the "Service" view in selection processing.

In the configuration there are documents in the tabular parts of which:

You cannot select services. In this case, item selection processing does not display item items with the “Service” type.

It is possible to select only items with the “Service” type. In this case, in item selection processing, only item items with the “Service” type are displayed.

You can select both goods and services. In this case, in item selection processing, all item items are displayed in accordance with the established selection criteria; a filter by item type is not installed.

Processing "Processing the tabular part of the document"

The flag "Transfer only marked positions" has been added to processing. If the flag is set, then only those positions that are marked in the list are transferred to the tabular part of the document, otherwise all positions are transferred.

Setting the value of the “Agreement” attribute in documents when changing the “Organization” and “Counterparty” details

When changing the values of the “Organization” and “Counterparty” details in the document header, the previously selected value of the “Agreement” attribute is analyzed. If the previously selected agreement does not correspond to the organization and counterparty specified in the document, then it is replaced with an agreement with the same organization and with the same counterparty, which will satisfy the conditions required in this document: by type, method of conducting and currency of mutual settlements. The selection of a new contract is carried out according to the principle:

Universal printing form

When generating printed forms for configuration objects, the generated printed document is now opened not as a spreadsheet document, but in a separate form that contains a field of the spreadsheet document.

You can send an email directly from this form, attaching the generated printed form. There is a special button in the command bar of the form for this purpose. By clicking on this button, a form for setting up the printed form to be sent opens, in which you can configure:

INTEGRATION "Trading Enterprise Management"

Data exchange with the configuration "BAS ROZDRIBNA TORGIVLYA"

The ability to exchange data with the "BAS Retail Trade" configuration has been added to the configuration. The "Trade Management" configuration can be installed in the central office, and the "BAS Retail Trade" configuration can be installed in a store that carries out retail sales.

The release of the "BAS Retail Trade" configuration must be no lower than 1.0.2.