Leasing in 1 with 8.3 accounting. Accounting info. How to reflect the monthly lease payment

Leasing is one of the most common types of business lending. With the help of leasing, organizations can acquire ownership of expensive equipment, vehicles, and real estate. Accounting for leasing on the lessee's balance sheet in 1C 8.3 is carried out in several stages. How exactly? Read in this article.

Read in the article:

Property acquired under a leasing agreement can be accounted for in two ways:

- on the lessor's balance sheet;

- on the balance sheet of the lessee.

There is a mandatory condition in the leasing agreement that specifies who has the property on their balance sheet. If the contract specifies the method “on the lessor’s balance sheet,” then the acquired property in 1C 8.3 is reflected in off-balance sheet account 001 “Leased fixed assets.” If the agreement states “on the balance sheet of the lessee,” then use account 08 “Investments in non-current assets.” To organize leasing accounting on the lessee’s balance sheet in 1C 8.3, you need to go through 5 steps.

Step 1. Create the “Receipt for leasing” operation in 1C 8.3

The cost of the leased property is equal to the sum of all lease payments that will be transferred under the lease agreement, taking into account advances. It is this amount that must be reflected in 1C 8.3 when filling out the “Receipt for leasing” form. To do this, go to the “Fixed assets and intangible assets” section (1), click on the link “Access to leasing” (2). The “Receipt for leasing” window will open.

In the window that opens, click on the “Create” button (3). A form will open for filling out data for the “Receipt of leasing” operation.

Step 2. Fill out the “Receipt for leasing” form in 1C 8.3

In the “Receipt for leasing” window, indicate:

- your organization (1);

- lessor (2);

- details of the leasing agreement (3);

- the warehouse where the property was received (4);

- name of property (5);

- price of property (6). It consists of all lease payments.

To reflect in accounting 1C 8.3 records on the receipt of leased property, click the “Post and close” button (7).

Click on “DtKt” (8) to view the accounting entries for accounting for the operation of receiving property under lease.

In the 1C 8.3 posting window, we see that the cost of leased property without VAT (9) is reflected in the debit of account 08.04.1 “Purchase of components of fixed assets” and the credit of account 76.07.1 “Rental obligations”. The amount of VAT (10) is recorded in the debit of account 76.07.9 “VAT on lease obligations” and the credit of account 76.07.1 “Rease obligations”.

Step 3. Create in 1C 8.3 the operation “Acceptance for accounting of fixed assets”

Go to the section “Fixed assets and intangible assets” (1) and click on the link “Acceptance for accounting of fixed assets” (2). A window will open to reflect this operation.

In the window that opens, click on the “Create” button (3). A form will open for filling out the “Acceptance for accounting of fixed assets” operation.

At the top of the form please indicate:

- your organization (1);

- financially responsible person (2);

- subdivision where the property is located (3).

In the “Non-current asset” tab (4), fill in the fields:

- “Method of entry” (5). Select the value “Under a leasing agreement”;

- "Counterparty" (6). Specify the lessor;

- "Treaty" (7). Provide the details of the leasing agreement;

- "Equipment" (8). Select the property received under a leasing agreement;

- "Warehouse" (9). Indicate the warehouse where the property is located.

Step 4. Fill out the “Fixed Assets” tab

In the “Fixed Assets” tab (1) you need to create a new fixed asset in the “Fixed Assets” directory. To do this, click on the “+” button (2). A form for creating a fixed asset in the directory will open.

Fill out the fields in this form:

- “Assets accounting group” (3). Select the value that suits you from the list, for example “Vehicles”;

- “Name” and “Full name” (4). Indicate the name of the fixed asset;

- “Part of the group” (5). Select the appropriate group from the list, for example “Transport”.

After filling in the fields, click on the “Record and close” button (6). There is now a new fixed asset in the Fixed Assets directory.

Indicate this fixed asset in field (7). The tab is full.

Step 5. Complete the Accounting Tab

In the “Acceptance for accounting of fixed assets” form, go to the “Accounting” tab (1). Fill in the fields:

- “Accounting procedure” (2). Select “Depreciation calculation” from the list;

- “Method of calculating depreciation” (3). Specify "linear";

- “Method of reflecting depreciation expenses” (4). Here, indicate in the debit of which account the depreciation will be reflected, for example, “Depreciation (account 20.01)”;

- “Useful life (in months)” (5). In this field, write the depreciation period in months. For example, if the property is planned to be depreciated over 8 years, then the period will be 96 months (8 years x 12 months).

Step 6. Complete the “Tax Accounting” tab

In the “Tax Accounting” tab (1), fill in the fields:

- “The procedure for including costs in expenses” (2). Select “depreciation calculation”;

- "Initial cost" (3). Here, indicate the amount of expenses (excluding VAT) of the lessor for the purchase of property. Information on these costs can be found in the leasing agreement;

- “Method of reflecting expenses on leasing payments” (4). Specify the value “Depreciation (account 20.01)”;

- “Useful life (in months)” (5). In this field, write the depreciation period in months in tax accounting. For example, if the property is planned to be depreciated over 8 years, then set it to 96 months (8 years x 12 months).

To reflect in the accounting records on the acceptance of property for accounting, click “Record” (6) and “Post” (7). The following entries will be made in accounting:

DEBIT 01 CREDIT 08

- fixed assets object is accepted for accounting

To see the postings in 1C 8.3, click on the “DtKt” button (8).

Step 7. Reflect leasing services in 1C 8.3

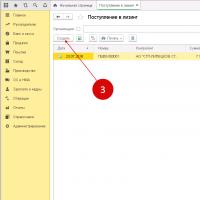

The lessor will issue you a monthly invoice for leasing services. In 1C 8.3 there is a special act to reflect expenses for them. To create it, go to the “Purchases” section (1) and click on the link “Receipts (acts, invoices) (2). A window for creating an act will open.

In the window that opens, click the “Receipt” button (3) and select “Leasing Services” (4). An act for reflecting leasing services “Receipt of leasing services” will open.

Indicate in it:

- number and date of the act received from the lessor (5);

- your organization (6);

- lessor (7);

- details of the leasing agreement (8).

In the “Nomenclature” field (9) indicate “Leasing services”, in the “Amount” field (10) - the amount according to the act (invoice). To generate an invoice, enter its number (11) and date (12), and click the “Register” button (13). The act is completed, click on the “Post and close” button (14). Now in accounting and tax accounting there are entries for expenses for leasing services.

After closing the act, you will again be taken to the “Receipts (acts, invoices)” window. It contains a list of all created acts. To view accounting and tax entries for leasing expenses, click on the act and press the “DtKt” button (15). Postings will open in accounting 1C 8.3.

The entries show that in accounting, leasing payments are not included as expenses, but are recorded as a debit to account 76.07.1 “Lease obligations” (16). It is the credit of this account that reflects the amount of equipment received for leasing. Thus, after all lease payments are paid according to the schedule, account 76.07.1 will be closed.

Leasing expenses are taken into account for tax purposes minus tax depreciation of leased property. 1C 8.3 automatically calculates depreciation of such property and leasing expenses for tax accounting purposes. This is done by the “Month Closing” operation, which we wrote about in detail in this article. In this case, the operation “Recognition of leasing payments in NU” is automatically created.

Please note that for leasing transactions there is a difference between accounting and tax accounting. 1C 8.3 will automatically reflect these differences. To do this, in 1C 8.3 you need to set up an accounting policy, indicating in it that your organization keeps records in accordance with the current edition of PBU 18.

Under a leasing agreement, property can be recorded on the balance sheet of the lessor or lessee. The second option is the most complex and often raises questions among accountants, since accounting and tax accounting data do not coincide and differences arise. In the 1C: Accounting 8 program, edition 3.0, starting with release 3.0.40, basic operations with leased property are automated, which are recorded on the lessee’s balance sheet without taking into account the redemption value.

New accounts in 1C:Accounting 8 (rev. 3.0) to automate leasing accounting

The main regulatory legal acts that must be followed when concluding a leasing agreement are the Federal Law of October 29, 1998 No. 164-FZ “On Financial Lease (Leasing)” and Part Two of the Civil Code of the Russian Federation - in Chapter 34 “Lease” paragraph 6 is devoted to leasing.

Under a leasing agreement, the lessee must accept the property purchased for him by the lessor from the seller, pay the lessor lease payments, the procedure and terms of payment of which are determined by the agreement, and at the end of the lease agreement, return this property or buy it back into his own ownership.

The agreement specifies the amount of lease payments, methods and frequency of their transfer to the lessor.

The tax consequences for the parties to the transaction depend on the terms of the agreement and the structure of the lease payment.

IS 1C:ITS

In the reference book “Agreements: conditions, forms, taxes” in the “Legal support” section, read more about what is important for the lessor and lessee to know when concluding a leasing agreement.

When reflecting leasing transactions in accounting, they are guided by the “Instructions for reflecting transactions under a leasing agreement in accounting,” approved. by order of the Ministry of Finance of Russia dated February 17, 1997 No. 15 (hereinafter referred to as Instructions No. 15).

The lessee, if the leasing object is accounted for on its balance sheet, upon receipt of the fixed asset (FPE), must generate transactions (paragraph 2, clause 8 of Instructions No. 15):

Debit 08 “Investments in non-current assets”

Credit 76 “Settlements with various debtors and creditors” subaccount “Rental obligations”

After accepting the leased property, the following entry is made into the OS:

Debit 01 “Fixed assets” subaccount “Leased property”

Loan 08 “Investments in non-current assets”

If the leased property is accounted for on the lessee’s balance sheet, then the accrual of lease payments to the lessor in the lessee’s accounting records is reflected in the following entries (paragraph 2, clause 9 of Instructions No. 15):

When accounting for the leased asset on the lessee's balance sheet, the property is accounted for as depreciable (clause 9 of Instructions No. 15, paragraph 3 of clause 50 of the Methodological Instructions for Accounting of Fixed Assets, approved by order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n).

The amounts of depreciation charges are reflected in the debit of the accounts for recording production (circulation) costs in correspondence with account 02 “Depreciation of fixed assets,” subaccount “Depreciation of leased property.” In this case, it is allowed to use an accelerated depreciation mechanism by a factor not higher than 3 (paragraph 3, clause 9 of Instructions No. 15).

Leasing payments due to the lessor are reflected by the lessee by postings (paragraph 2, clause 9 of Instructions No. 15):

Debit 76 “Settlements with various debtors and creditors” subaccount “Rental obligations”

Credit 76 “Settlements with various debtors and creditors” subaccount “Debt on leasing payments”

At the end of the contract, the leased property must be returned by the lessee or acquired into ownership (Clause 5, Article 15 of Law No. 164-FZ).

In accordance with the Tax Code, the lessee has the right to deduct VAT on the entire amount of lease payments, which is indicated in the invoice (subclause 1, clause 2, article 171, paragraph 2, clause 1, article 172 of the Tax Code of the Russian Federation).

For the purpose of calculating income tax, the leased asset is taken into account as part of depreciable property at its original cost - the amount of the lessor's expenses for the acquisition, construction, delivery, production and bringing it to a state in which it is suitable for use, excluding the amount of taxes subject to deduction or taken into account in composition of expenses (clause 1 of article 257 of the Tax Code of the Russian Federation).

According to paragraph 10 of Article 258 of the Tax Code of the Russian Federation, property leased is included in the appropriate depreciation group (subgroup) by the party for whom this property should be accounted for in accordance with the terms of the leasing agreement.

Leasing payments for the use of leased property recorded on the balance sheet of the lessee are considered other expenses associated with production and (or) sales, less depreciation amounts accrued on this fixed asset (subclause 10, clause 1, article 264 of the Tax Code of the Russian Federation).

If the leased asset is taken into account on the balance sheet of the lessee as a fixed asset, then in respect of it it is necessary to pay corporate property tax (letter of the Ministry of Finance of Russia dated January 20, 2012 No. 03-05-05-01/04, clause 3 of the Information letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated 11/17/2011 No. 148).

The lessee must pay transport tax if the vehicles that are the subject of leasing are registered in his name (Article 357 of the Tax Code of the Russian Federation).

IS 1C:ITS

For more information about the tax consequences arising for the lessee, read the reference book “Agreements: conditions, forms, taxes” in the “Legal support” section.

Note that the initial cost of the leased asset, depreciation costs and the procedure for including lease payments in expenses are different in accounting and tax accounting, so temporary differences arise. They are accounted for in accordance with PBU 18/02 “Accounting for calculations of corporate income tax”, approved. by order of the Ministry of Finance of Russia dated November 19, 2002 No. 114n.

In the 1C: Accounting 8 program, starting with release 3.0.40, subaccounts have been added to account for transactions with leased property, including when accounting for transactions in foreign currency and in conventional units (cu) (see Table 1) .

|

Subaccount in "1C: Accounting 8" (rev. 3.0) starting from version 3.0.40 |

What is it for? |

|

76.07.1 “Rental obligations” |

To summarize information on long-term financial obligations under lease agreements in Russian currency |

|

76.07.2 “Debt on leasing payments” |

To summarize information about current payments under a leasing agreement in Russian currency |

|

76.27.1 “Rental obligations (in foreign currency)” |

To summarize information on long-term financial liabilities under lease agreements in foreign currencies |

|

76.27.2 “Debt on leasing payments (in foreign currency)” |

To summarize information about current payments under a leasing agreement in foreign currencies |

|

76.37.1 “Rental obligations (in monetary units)” |

To summarize information about long-term financial obligations under lease agreements, payments for which are actually carried out in rubles, but are accounted for in conventional units. Account balances and turnover are simultaneously formed in rubles and in cu. Any currency from the directory can be used as a conventional unit Currencies programs |

|

76.37.2 “Debt on leasing payments (in cu)” |

To summarize information about current payments under a leasing agreement, payments for which are actually carried out in rubles, but are taken into account in conventional units. Account balances and turnover are simultaneously formed in rubles and in cu. Any currency from the directory can be used as a conventional unit Currencies programs |

|

01.03 “Leased property” |

To summarize information about the availability and movement of fixed assets of an organization that are leased until their disposal |

|

02.03 “Depreciation of leased property” |

To summarize information about depreciation of leased property |

|

76.07.9 “VAT on rental obligations” |

The amounts of value added tax due to be paid by the organization related to the acquisition of fixed assets under lease agreements in Russian currency are taken into account. |

|

76.37.9 “VAT on rental obligations in (cu)” |

The amounts of value added tax due to be paid by the organization related to the acquisition of fixed assets under lease agreements are taken into account, the calculations for which are actually carried out in rubles, but are accounted for in conventional units. Account balances and turnover are simultaneously formed in rubles and in cu. Any currency from the directory can be used as a conventional unit Currencies programs. |

Let's look at how "1C: Accounting 8" edition 3.0 reflects the main leasing accounting operations if the property is listed on the lessee's balance sheet without taking into account the redemption value.

Receipt of fixed assets for leasing and acceptance of the leased object for accounting by the lessee

The receipt of leased property is reflected in a new program document Entry into leasing(chapter OS and intangible assets group Receipt of fixed assets).

The document indicates the initial cost of leased fixed assets in accounting (AC) and tax accounting (TA).

To put a fixed asset object into operation, a document is created Acceptance of fixed assets for accounting(chapter OS and intangible assets group Receipt of fixed assets) - see Figure 1.

Bookmarks are filled in the document:

- Non-current asset;

- Fixed assets;

- Accounting;

- Tax accounting;

- Depreciation bonus.

To document Acceptance of fixed assets for accounting added a new method of admission According to the leasing agreement, which allows you to specify the lessor and the method of reflecting the costs of leasing payments in tax accounting.

When choosing an admission method According to the leasing agreement additionally required fields are displayed:

- Counterparty and Agreement on the Non-current asset tab;

- The method of reflecting expenses in tax accounting on the Tax accounting tab in the Leasing payments group of details.

Since the property is listed on the balance sheet of the lessee, then on the tab Tax accounting in field The procedure for including costs in expenses indicated Depreciation calculation, and the flag is set Calculate depreciation.

In field Special coefficient the increasing or decreasing coefficient is indicated (if it is not equal to 1).

Reflection of the monthly lease payment

Starting from release 3.0.40 in 1C:Accounting 8, leasing payments are calculated using the document Receipt (act, invoice), to which the operation is added Leasing services(Fig. 2).

To accept VAT for deduction, you must register and post the document Invoice received.

A document has been added to the program Change in the reflection of expenses on lease payments of fixed assets. It is intended to change the method of reflecting expenses on lease payments after the leased property has been accepted for accounting (section OS and intangible assets group Depreciation of fixed assets hyperlink OS depreciation parameters).

Depreciation and recognition of lease payments in tax accounting

Since the property is accounted for on the lessee’s balance sheet, its value is repaid through depreciation charges over its useful life.

To perform operations to calculate the amount of depreciation for the month for accounting and tax accounting, recognition of leasing payments in tax accounting, as well as to reflect taxable temporary differences (TDT) and recognition of deferred tax liability (DTL), it is necessary to use processing Closing the month(chapter Operations group Closing the period hyperlink Closing the month), which contains a list of necessary regulatory operations.

Before processing Closing the month it is necessary to restore the sequence of documents.

To do this, click on the hyperlink Retransfer of documents per month, press the button Perform operation, then button Perform month end closing, after which all scheduled operations will be performed in a list, including:

- Depreciation and depreciation of fixed assets;

- Recognition of leasing payments in NU;

- Calculation of income tax.

In a program when performing a routine operation the difference between the lease payments reflected in the document is determined Receipt (act, invoice), and accrued depreciation in tax accounting. If the lease payment for a month exceeds the amount of accrued depreciation, the difference is reflected in tax accounting expenses. If the accrued depreciation exceeds the amount of the lease payment, then the depreciation amount is reversed by this difference.

Create a printed form Statement of depreciation of fixed assets maybe from the group Reports of the OS and intangible assets section.

In processing Closing the month from the document form Regular operation -> Recognition of leasing payments in NU or from the context menu you can generate a help calculation Recognition of expenses on fixed assets received under lease.

The report is intended to illustrate the reflection of the amounts of leasing payments in the accounting and tax accounting of the lessee.

The concept of leasing appeared in our country relatively recently. This is a kind of form of lending to an enterprise when it purchases fixed assets. Leasing objects can be: equipment, structures, enterprises, transport, etc. In essence, leasing is a long-term lease of property with subsequent acquisition of ownership.

Lease purchase and registration

To record leasing on the lessee’s balance sheet, the 1C 8.3 program provides a special document “Receipt of leasing”, which can be found in “OS and intangible assets - Receipt of OS”.

Fig.1

Inside the document, please note that the accounting account is 76.07.1. We will also enter data on the purchased equipment into the tabular section. We indicate the accounting account 08.04.2* – “Acquisition of fixed assets”.

*Does not work on account 08.04.2 release 3.0.66.60.

Fig.2

We carry it out and check the accounting entries.

- Type of operation – equipment (in our example);

- Number/date – fill in the date, the number is entered automatically;

- MOL (material-responsible person) – we select and appoint an employee of the organization;

- In the location we indicate where the equipment will be used;

- OS event – in accordance with our task, we indicate what will be registered and put into operation.

After that, fill out the tabs that are below, the first of them is Non-current asset. We fill in the following information:

- Under a leasing agreement;

- Counterparty - lessor;

- Agreement – indicate our leasing agreement;

- Equipment is a leased item;

- Warehouse – indicate the warehouse where our equipment will be delivered;

- Our account is 08.04.2 “Purchase of OS”.

Fig.4

The OS tab is filled out from the directory of the same name, where we must create a new position. Click “+” and proceed to filling out the directory.

Fig.5

Fill in the following fields in the form that opens:

- Accounting group – vehicles;

- Name – we have “Car”;

- Included in the group - OS.

Fig.6

Click “Save and close.” A new position has appeared in the directory, so we feel free to continue filling out the tab by selecting our new fixed asset from the list; the inventory number is assigned automatically.

Fig.7

Filling out data for accounting purposes is carried out in the tab of the same name in the following fields:

- Account – 01.03 Leased property;

- The order is from the “Depreciation calculation” list;

- Method – Linear;

- In the accrual account we put 02.03 “Depreciation of leased property”;

- In the display of expenses, we set the debit of which accounting account the depreciation will be reflected. We have 20.01 “OS”.

- In the term, we indicate how many years we plan to depreciate this equipment; in our example, 10 years x 12 months equals 120 months.

Fig.8

On the next tab, fill in the tax data in the following fields:

- In order of inclusion in expenses – Depreciation;

- Initial cost - indicates the amount of costs excluding VAT of the lessor for the purchase of equipment. This information can be found in the leasing agreement;

- In the method of displaying costs for leasing payments, set “Depreciation” (account 20.01);

- On a monthly basis – 10 years x 12 months. That is, it turns out that the equipment is planned to be depreciated over 120 months.

Fig.9

We post the document and use the DtKt button to control the postings: Dt 01 – Kt 08 “The asset has been accepted for accounting.”

The lessor will issue a monthly invoice for leasing services. To reflect these services in the 1C 8.3 program, “Receipts (acts, invoices)” is used, which is located in the “Purchases” menu.

Fig.10

When creating a receipt, indicate “Leasing services”.

Fig.11

We begin to fill out the document, be sure to indicate the number and date of the act received from the lessor, the details of the leasing agreement, as well as the organizations of the lessor and the lessee. In the “Nomenclature” we indicate “Leasing payment”, in “Amount” - the amount from the lessor’s act (invoice). Fill in the invoice number and date and click the “Register” button.

Fig.12

Please also note that our accounting account for settlements with the counterparty is 76.07.2, and for advances – 60.02.

Fig.13

The receipt data is filled in, select Post. Records of expenses for leasing services are generated in accounting and accounting records. Click DtKt and check the generated wiring.

Fig.14

In accounting, leasing payments are not included as expenses, but are accounted for as a debit 76.07.1 Lease obligations. The cost of leased equipment is recorded as a credit to this account. Thus, after all leasing payments have been made under the leasing agreement, account 76.07.1 will be closed.

Although equipment purchased on lease is not the property of the organization, it still must be registered and depreciated accordingly. This is done through the routine operation of closing the month in “Operations - Closing the period”.

Fig.15

In conclusion, it is important to pay attention to the fact that for leasing transactions there is a difference between accounting and tax accounting, since in the latter leasing expenses are taken into account minus tax depreciation. The 1C 8.3 program will automatically calculate depreciation and leasing expenses, and also reflect the difference between accounting and tax accounting. To do this, in 1C 8.3 it is necessary to correctly draw up the accounting policy of the enterprise.

Transfer of the leased object to the lessee There is no standard document for implementing this operation in 1C 8.3 Accounting. Therefore, the transfer of fixed assets for leasing is documented using the Operation document. You can create an Operation document from the Operations section, where we select Operations entered manually, then click Create and select Operation: Filling out the Operations document:

- Contents – the field describes the contents of the business transaction, so you can write “Transferred to the lessee”;

- Transaction amount – Initial (Residual) value of the transferred object.

The tabular part is filled in with the posting Dt 03.03 Kt 03.01; in the posting, do not forget to select our leasing object. The amounts for NU and BU do not differ, so no differences arise.

Accounting for leasing by the lessee

It is necessary to indicate the initial cost for tax accounting purposes, which is equal to the amount of expenses of the LESSON (namely the lessor, that is, the other party - not us!) for the acquisition of the leased asset. “Method of reflecting expenses on leasing payments.” As we remember, this is an account and analytics where expenses are written off.

In this case, for the purposes of NU. We called the “method of reflecting expenses on leasing payments” “Leasing payments”. From the inside it looks like this: Tab “Depreciation bonus”: We did not touch it in our example.

That's why we won't look at it. The postings of the document “Acceptance for accounting of fixed assets” will be as follows: Let’s comment on these postings.

Leasing in 1s:bukhgalteriya 8

Important! The ownership of the leased property does not pass to us. The lessor does not issue us an invoice! Invoice (received) – absent in this operation (not issued).

There is no button or fields “Register an invoice” on the document form. The VAT amount on account 76.07.9 is “deferred”. It will be written off gradually.

We will see this in an example. To summarize this operation in our example, we can say this: the document “Receipt for Leasing” accepts the Leasing Subject for accounting on account 08.04 and records the “deferred VAT” for the entire leasing agreement. 2. We transfer the Leasing Item into fixed assets.

MENU: Fixed assets and intangible assets \ Receipt of fixed assets \ Acceptance for accounting of fixed assets. Let's open the document Acceptance for accounting of fixed assets dated March 31, 2015. The header of the document is easy to fill out.

We will not comment on its completion. There are many bookmarks in the document. Let's go through each one.

Accounting for leasing on the lessee's balance sheet in 1s 8.3 step by step

Personal income tax on lottery winnings: who pays Who should transfer personal income tax from winnings to the budget (the lottery distributor or the winning citizen) depends on the amount of the prize won.< … Выдать увольняющемуся работнику копию СЗВ-М нельзя Согласно закону о персучете работодатель при увольнении сотрудника обязан выдать ему копии персонифицированных отчетов (в частности, СЗВ-М и СЗВ-СТАЖ).

Attention

However, these reporting forms are list-based, i.e. contain information about all employees. This means transferring a copy of such a report to one employee means disclosing the personal data of other employees.

< … Компенсация за неиспользованный отпуск: десять с половиной месяцев идут за год При увольнении сотрудника, проработавшего в организации 11 месяцев, компенсацию за неиспользованный отпуск ему нужно выплатить как за полный рабочий год (п.28 Правил, утв. НКТ СССР 30.04.1930 № 169).

Accounting for leasing on the lessee's balance sheet in 1s 8.3 and example of postings

In the “Calculations” detail the account for accounting for debt on lease payments is indicated - 76.07.2 (76.27.2, 76.37.2) · In the tabular part in the column “Accounting account” the account for accounting of lease obligations is indicated - 76.07.1 (76.27.1, 76.37.1) We remember that in account 76.07.1 we keep the amount of all our rental obligations - A LARGE AMOUNT! On account 76.07.2 - we take into account the debt on current leasing (usually monthly) payments. This is a small amount if we pay it strictly according to the lease payment schedule, without delays.

Info

Everything is filled in almost automatically. You just need to indicate the number and date of the Act on leasing payments. And don’t forget to register the invoice at the bottom of the Receipt of Goods and Services document.

Accounting for leasing in 1C 8.3 from the lessor (property on the lessor’s balance sheet)

Right in paragraph 1, paragraph 2, it is written: “The initial cost of a fixed asset is determined as the amount of expenses for its acquisition (and if the fixed asset was received by the taxpayer free of charge, or identified as a result of an inventory, as the amount at which such property is valued in accordance with with paragraphs 8 and 20 of Article 250 of this Code), construction, production, delivery and bringing it to a state in which it is suitable for use, with the exception of value added tax and excise taxes, except as provided for by this Code.” What are our acquisition costs? That's right - the redemption value of the Leased Item.

There is another kind Letter from the Ministry of Finance of the Russian Federation dated February 6, 2006 N 03-03-04/1/90.

Leasing: postings

Operation Account debit Account credit Amount, rub. The leasing object was accepted for accounting (3,540,000 * 100 / 118) 08 “Investments in non-current assets” 76, sub-account “Lease obligations” 3,029,000 Submitted VAT by the lessor 19 76, sub-account “Lease obligations” 545,220 The object was accepted for accounting as part of fixed assets 01 “Fixed assets”, sub-account “Property under leasing” 08 3,029,000 Lease payment transferred (3,540,000 / 60) 76, sub-account “Debt on leasing payments” 51 59,000 Monthly lease payment was taken into account 76, sub-account “Lease obligations” " 76, subaccount "Debt on leasing payments" 59,000 Accepted for deduction of VAT regarding the leasing payment 68 19 9,000 Monthly depreciation was accrued (3,029,000 / 60) 20, 26, 44, etc.

Reflection of transactions under leasing agreements in the enterprise accounting program 3.0

Closing the month: Depreciation and Recognition of Leasing Payments in Tax Accounting MENU: Operations \ Closing the period \ Closing the month. We are simply conducting the Closing of the month of MARCH 2015. There won't be anything special.

We will begin to accrue depreciation only from the next month after the fixed asset is put into operation. Leasing payments will also begin to accrue from next month.

Everything will happen only in APRIL 2015. Therefore, we are closing the Month of APRIL 2015. And now the first depreciation charge appears: The posting correspondence is clear.

Where did these numbers come from? According to accounting, our fixed asset “village” was credited to account 01 in the amount of 3,240,000 rubles (document Acceptance of fixed assets for accounting). The useful life in our accounting is 6 years = 72 months. This means depreciation in accounting for one month: 3,240,000 / 72 = 45,000 rubles.

Our depreciation in tax accounting is more than the monthly lease payment! And here the question arises: how do you want me to understand the Tax Code of the Russian Federation?! If depreciation were less than our monthly lease payment, then what would go into our expenses? First, depreciation. Secondly, the monthly lease payment minus depreciation. Let's add these two amounts: depreciation + monthly lease payment – depreciation = monthly lease payment. That is, the amount of the monthly lease payment would go into expenses! But our depreciation is more than the monthly lease payment.

Important

Why don’t we take into account the entire amount of depreciation in expenses - after all, it is more than the monthly lease payment. And by the way, in ConsultantPlus, in the situation we are considering, this is exactly what is done.

And this is not bad: more expenses – less profit – less taxes.

Leasing transactions in 1c 8 3 on the lessor’s balance sheet

Ninth Wiring: ATTENTION! Here you need to understand: what is the initial cost of a fixed asset! Before the buyout, we had a leased item. Now we have our OWN main tool. An old item, but in a new quality. All the costs and depreciation that we observed before the repurchase were all related to the Leasing Subject. Now we are dealing with OUR fixed asset and forming its initial cost. How the initial cost of a fixed asset is formed for tax accounting purposes is written in the Tax Code of the Russian Federation in Article 257 “The procedure for determining the value of depreciable property.”

On this tab we will adjust our information register:

- List of parameters - click on the Create button, the table field will be automatically filled with the necessary parameters from the subconto:

Click Record and close, the standard operation in 1C 8.3 is ready. When choosing a standard operation, you only need to enter the parameter data and click on the Fill button: And all the necessary data in 1C 8.3 will be automatically generated. Leasing on the lessor's balance sheet posting in 1C 8.3: Step 3. Accounting for revenue from lease payments To enter lease payments in 1C 8.3, use the document Sales (acts, invoice).

You can create a document from the Sales section - then Sales (acts, invoices) - Sales command - selecting Services (act). In the header of the document, you can set up accounting accounts with the lessee, as well as the procedure for crediting the advance.

Reflection of transactions under leasing agreements in the program

"1C:Accounting 8" (edition 3.0)

The word "leasing" is borrowed from the English language. It comes from the verb “to lease”, which means “to rent, to rent”. Indeed, there are many similarities between leasing and renting. However, these concepts should not be identified.

Rent consists of the lessor transferring his property for use and temporary possession to the lessee for a fee. The object of lease can be both movable and immovable property, including land plots.

Leasing(the so-called financial lease) consists in the fact that the lessor undertakes to acquire ownership of new property specified by the lessee from a specific supplier and provide this property to the lessee for a fee for temporary possession and use (clause 4 art. 15 Federal Law dated October 29, 1998 No. 164-FZ). The subject of a leasing agreement can be any non-consumable items. As a rule, these are fixed assets, with the exception of land plots and environmental management facilities. Moreover, depending on the terms of the agreement, the lessee has the right to buy this property at the end of the leasing agreement by paying the redemption price, or return it to the lessor.

Thus, unlike a lease agreement, a leasing agreement implies the emergence of legal relations between three parties: the seller of the property, the lessor and the lessee, and also gives the lessee the right to acquire ownership of the leased asset at the end of the agreement.

The redemption price is paid either in a lump sum at the end of the leasing agreement, or in equal shares as part of the leasing payments. According to Art. 28 Federal Law “On financial lease (leasing)” “Leasing payments mean the total amount of payments under the leasing agreement for the entire term of the leasing agreement, which includes reimbursement of the lessor’s costs associated with the acquisition and transfer of the leased asset to the lessee, reimbursement of costs associated with the provision of other provided service leasing agreement, as well as the lessor’s income. The total amount of the leasing agreement may include the redemption price of the leased asset if the leasing agreement provides for the transfer of ownership of the leased asset to the lessee."

In the event that, at the end of the contract, the property becomes the property of the lessee, the purchase price of the property must be indicated in the contract (or an addition/appendix to it) (letters from the Ministry of Finance of the Russian Federationdated 09.11.2005 No. 03-03-04/1/348 And dated 09/05/2006 No. 03-03-04/1/648 ) and the procedure for its payment. At the same time, the presence or absence of a redemption price in the contract affects only the tax accounting of leasing transactions.

The redemption price is taken into account for tax purposes separately from the other amount of lease payments in any order of its payment (letter from the Ministry of Finance of the Russian Federationdated 02.06.2010 No. 03-03-06/1/368 ). No matter how the redemption price is paid: in parts during the term of the contract as part of leasing payments, or at some point in full, or in several separate payments, the lessee is an advance paid. Like any other advance paid, until the transfer of ownership, the redemption price is not an expense taken into account when calculating income tax. Thus, the lessee's expense taken into account when calculating income tax is only reimbursement of the lessor's costs associated with the acquisition and transfer of the leased asset to the lessee, reimbursement of costs associated with the provision of other services provided for in the leasing agreement, as well as the lessor's income.

At the time of transfer of ownership, the redemption price paid to the lessor forms the initial tax value of the depreciated property. Depreciation is charged by the lessee in the usual manner, as when purchasing used property.

Accounting for transactions related to a leasing agreement is regulated Instructions on the reflection in accounting of operations under a leasing agreement, approved. by order of the Ministry of Finance of Russia dated February 17, 1997 No. 15.

During the period of validity of the leasing agreement, depending on its terms, the property may be on the balance sheet of the lessor or on the balance sheet of the lessee. The most difficult case from the point of view of accounting and tax accounting of leasing operations is the case when the property is on the balance sheet of the lessee (accounting from the position of the lessee). Let us consider, using a specific example, the sequence of accounting operations in the program “1C: Accounting 8”, edition 3.0 (hereinafter referred to as the “program”) for the lessee in the specified case, taking into account the options when the property is purchased at the end of the leasing agreement or returned to the lessor.

Example

Yantar LLC (lessee) entered into leasing agreement No. 001 dated January 1, 2013 with Euroleasing LLC (lessor) for a period of 6 months. The subject of leasing is a FIAT car, which was accepted on the balance sheet of Yantar LLC on January 1, 2013. The costs of its acquisition by the lessor amount to 497,016 rubles. (including VAT 18% - RUB 75,816). Under the terms of the leasing agreement, the cost of a FIAT car, taking into account the redemption price, is 1,416,000 rubles. (including VAT 18% - RUB 216,000). In this case, the redemption price of the vehicle is paid in equal monthly installments along with leasing payments. The monthly amount of leasing payments is 106,200 rubles. (including VAT 18% - 16,200 rubles). The redemption price is 778,800 rubles. (including VAT 18% - 118,800 rubles) and its monthly amount is 129,800 rubles. (including VAT 18% - RUB 19,800). The useful life of the vehicle is 84 months. Depreciation is calculated using the straight-line method. At the end of the contract, the FIAT car becomes the property of Yantar LLC.

The following transactions must be generated in the program (Table 1).

Table 1 - Accounting entries under the leasing agreement

|

Debit |

Credit |

||||||||

|

For accounting and tax accounting, appropriate entries are made in analytical registers |

|||||||||

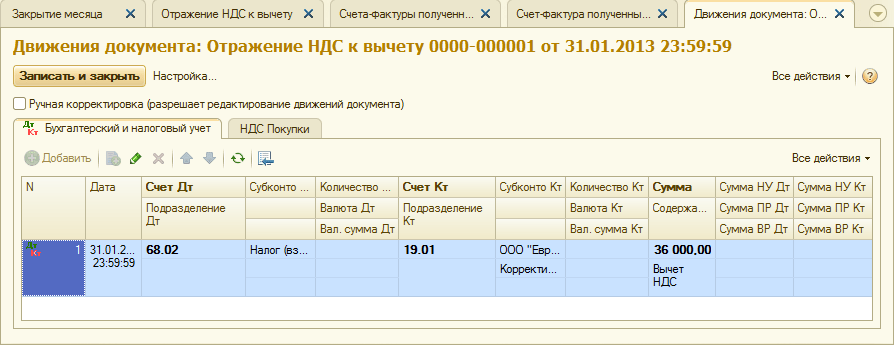

As a result of posting the “Receipt of goods and services” document, the following transactions will be generated (Fig. 2).

Rice. 2 - Postings of the document “Receipt of goods and services”

As mentioned above, until the transfer of ownership of the property to the lessee, the redemption price is not taken into account when calculating income tax. Therefore, we will resort to manual adjustment of document movements and in the columns “Amount NU Dt”, “Amount NU Kt” we will enter the amount of the lessor’s expenses for the acquisition of property (excluding VAT) - 421,200 rubles. Redemption price 778,800 rubles. We will reflect the difference as a constant, putting it in the appropriate columns (Fig. 3).

Rice. 3 - Manual adjustment of entries in the “Receipt of goods and services” document

3. To perform the operation of accepting a fixed asset for accounting, you must create a document “Acceptance for accounting of fixed assets” (Fig. 4). This document registers the fact of completion of the formation of the initial cost of a fixed asset item and (or) its commissioning. When creating a fixed asset, it is advisable to create a special folder in the “Fixed Assets” directory for fixed assets received on lease.

The initial cost of the object, which is planned to be taken into account as fixed assets, is formed on account 08 “Investments in non-current assets”.

Rice. 4 - Acceptance of fixed assets for accounting

We will also fill in the “Accounting” and “Tax Accounting” tabs of the document “Acceptance of fixed assets for accounting”, as shown in Fig. 5 and 6.

Rice. 5 - Filling out the “Accounting” tab

Rice. 6 - Filling out the “Tax Accounting” tab

As a result of the document “Acceptance for accounting of fixed assets”, the following transactions will be generated (Fig. 7).

Rice. 7 - Postings of the document “Acceptance for accounting of fixed assets”

4. At the end of the first month of the leasing agreement, the next leasing payment is accrued. To reflect this operation, you can enter the operation manually or use the “Debt Adjustment” document (the “Purchases and Sales” tab, the “Settlements with Counterparties” section) with the “Debt Transfer” operation type (Fig. 8).

Rice. 8 - Filling out the “Debt Adjustment” document

In the “Amount” field, we will manually enter the amount of the next lease payment of 236,000 rubles. = 1,416,000 rub. / 6 months (contract time).

In the “New accounting account” field, indicate account 76.09 “Other settlements with various debtors and creditors.” It is he who will appear as a loan account as a result of posting the document (Fig. 9).

Rice. 9 - Posting the accrual of the lease payment

All other monthly lease payments can be calculated in the same way.

5. We will transfer the next lease payment to the lessor. To do this, we will first create the document “Payment order” (Fig. 10), and then, based on this document, we will enter the document “Write-off from the current account” (Fig. 11).

Rice. 10 - Payment order for transfer of lease payment

Rice. 11 - Debiting the lease payment from the current account

After receiving a bank statement, which records the debiting of funds from the current account, it is necessary to confirm the previously created document “Writing off from the current account” to generate transactions” (checkbox “Confirmed by bank statement” in the lower left corner of the form in Fig. 11).

When posting the document, posting Dt 76.09 - Kt 51 is generated (Fig. 12), because according to the conditions of our example, the fact of receiving material assets (fixed assets) is first recorded, then the fact of payment, i.e. at the time of payment there was an account payable to the supplier. As a result of business transactions, accounts payable were repaid.

Rice. 12 - Result of posting the document “Write-off from the current account”

6. The initial cost of the leased object is included in expenses through depreciation charges. Since the leased asset is on the balance sheet of the lessee, he charges monthly depreciation charges on the leased asset in the amount of the depreciation rate calculated based on the useful life of this object.

To calculate the amount of depreciation charges, we will perform the “Month Closing” procedure in the “Accounting, Taxes, Reporting” section (this can also be done using the routine operation “Depreciation and depreciation of fixed assets” on the “Fixed Assets and Intangible Assets” tab). First, we will close January (depreciation will not be accrued in January, since fixed assets were taken into account in this month), and then February (Fig. 13). Before calculating depreciation and carrying out any other routine operations to close the month, it is necessary to monitor the sequence of documents.

Rice. 13 - Calculation of depreciation using the “Closing of the month” operation

As a result, the following wiring will be generated (Fig. 14)

As you can see, the posting reflects a constant difference of 9271.43 rubles, which arose due to the difference in the cost of fixed assets in accounting and tax accounting. This difference will be formed throughout the entire period of depreciation in tax accounting.

In addition to depreciation deductions, expenses in the form of leasing payments minus the amount of depreciation on the leased property are recognized monthly in the tax accounting of the lessee. In this regard, taxable temporary differences arise, which lead to the formation of deferred tax liabilities, reflected in the debit of account 68 “Calculations for taxes and fees” and the credit of account 77 “Deferred tax liabilities”. The adjustment amount is determined as the difference between the monthly lease payment excluding VAT and the amount of depreciation, multiplied by the income tax rate.

If the monthly depreciation amount exceeds the lease payment amount, only depreciation on the leased object will be taken into account in tax accounting expenses.

Obviously, in our example, the amount of monthly depreciation deductions is less than the amount of leasing payments. The difference is

200,000 - 14,285.71 = 185,714.29 rubles.

Therefore, it is necessary to reflect this difference as temporary for tax accounting purposes.

To pay off monthly deferred tax liabilities in accounting, you can use the operationentered manually (tab “Accounting, taxes, reporting”, section “Accounting”, item “Operations (accounting and accounting)”). The generated wiring is shown in Fig. 15. The amount of the entered transaction is equal to the above temporary difference multiplied by the income tax rate:

185,714.29 * 0.2 = 37,142.86 rubles.

Rice. 15 - Entering a manual transaction to settle a deferred tax liability

7. To reflect VAT on the lease payment accepted for deduction, we will create a document “Reflection of VAT for deduction” (tab “Accounting, taxes, reporting”, section “VAT”). Let's fill it in as shown in Fig. 16. As a payment document, we will indicate the “Debt Adjustment” document corresponding to this lease payment.

Rice. 16 - Reflection of VAT on lease payment for deduction

It is also necessary to create an invoice received based on the created document (Fig. 17).

Rice. 17 - Form “invoice received” for lease payment

The posting generated by the document “Reflection of VAT for deduction” is shown in Fig. 18

Rice. 18 - Result of conducting the document “Reflection of VAT for deduction”

8 . Upon expiration of the lease agreement and payment of the entire amount of lease payments, including the redemption price, the object is transferred to its own fixed assets.

To reflect changes in the state of the OS, the document “Changes in the state of OS” can be used (tab “Fixed assets and intangible assets”). Let's fill out its form, as shown in Fig. 19. If the “Transition of ownership of the OS upon completion of leasing” event is not in the “Asset Event” list, it must be created. When creating, specify the OS event type as “Internal movement”.

Rice. 19 - Changing the OS state

After the transfer of ownership, depreciation parameters may change due to a change in the value of the fixed assets in tax accounting or a change in the acceleration coefficient (Fig. 20).

Rice. 20 - Changing depreciation parameters

The remaining useful life of the asset in months is indicated here (84 - 6 = 78), and the redemption price is entered in the “Depreciation (PR)” column (the difference in the initial estimate of the cost of the asset in the accounting book and NU). In the future, depreciation in NU will be calculated based on the redemption price.

In conclusion, let us consider the case when the property is returned to the lessor upon completion of the leasing agreement.

To register this fact in the program, you must use a manual operation (Fig. 21).

Rice. 21 - Reflection of the return of property to the lessor

We generate transactions Dt 01.09 (“Disposal of fixed assets”) - Kt 01.01, as well as Dt 02.01 - Kt 01.09. Thus, the property was returned to the lessor with full depreciation value.

Leasing in 1 with 8.3 accounting. Accounting info. How to reflect the monthly lease payment

Leasing in 1 with 8.3 accounting. Accounting info. How to reflect the monthly lease payment Electronic document management of invoices

Electronic document management of invoices Accounting of a state institution Novosibirsk 1s accounting 8

Accounting of a state institution Novosibirsk 1s accounting 8 Books by Galina Goncharova by series

Books by Galina Goncharova by series How to Win Friends and Influence People

How to Win Friends and Influence People The art of influencing people

The art of influencing people What is a session at a university? What do they do during a session at a college?

What is a session at a university? What do they do during a session at a college?