Report on those fired in 1s zup. We fill out the CV when dismissing an employee. What is the report for?

on filling out Form 2 “Report on dismissed employees”

I. General provisions

1.1. Form No. 2 “Report on dismissed employees” (hereinafter referred to as Form No. 2) is provided by business entities - legal entities, regardless of the form of ownership, and individuals - entrepreneurs (hereinafter referred to as employers) operating in the territory of the Donetsk People's Republic.

1.2. Employers submit Form No. 2 to city and district employment centers of the Donetsk People's Republic at their actual location.

1.3. Form No. 2 is submitted monthly before the 5th day of the month following the reporting month.

Form No. 2 is also submitted in cases where there were no dismissals of employees during the reporting period.

Number indicators in the report are reflected in whole units.

II. Procedure for filling out the form.

2.1. Column 1 indicates the number in order.

2.2. Column 2 indicates the last name, first name, patronymic and identification number of the employee dismissed in the reporting month, except for employees hired part-time, for temporary work and persons performing work under civil contracts and undergoing practical training.

2.3. Column 3 indicates the position of the employee dismissed in the reporting month.

2.4. Column 4 indicates the reason for the employee’s dismissal according to the employer’s order (own desire, agreement of the parties, etc.).

2.5. Column 5 indicates the number and date of the order to dismiss the employee.

2.6 Column 6 indicates the date of actual dismissal of the employee. The day of dismissal is the last working day.

2.7. The movement of workers should be presented in the form of a balance: number of employees at the end of the previous reporting period plusnumber of accepted for the reporting period (FORM No. 1) minus number of people fired during the reporting period equals number of employees at the end of the reporting period.

A dismissed employee is counted among those who have left from the day following the day of dismissal specified in the dismissal order.

2.8. Staffing at the beginning of 20____.

Staffing is the number of the enterprise, approved by the staffing table, providing for the enterprise's need for personnel, taking into account vacations. The staffing level is indicated according to the staffing table approved as of 01/01/20__. and is displayed in integer units.

The staffing table is a document that establishes the structure, staffing and official salaries of employees at a given enterprise, institution, or organization. The staffing table contains the names of positions, number of employees and salaries for each position.

2.9. Staffing at the end of the reporting period, people. It may be either more or less than the staffing level at the beginning of 20__.

2.10. Number of employees at the end of the previous reporting period, people, days must be equal to the number of employees at the end of the reporting period of the previous report.

2.11.Number of employees at the end of the reporting period.

The number of employees is calculated based on the number of employees at the end of the previous reporting period, including those hired (Form No. 1) and excluding dismissed employees (Form No. 2) in the reporting period.

The number of employees does not include:

Hired part-time from other enterprises;

Employed for temporary work;

Involved in the performance of work under civil contracts (contracts);

Students, students of vocational educational institutions, undergoing industrial training and practical training at the enterprise in accordance with agreements on the provision of jobs for these purposes.

An employee who holds one and a half pay rates at one enterprise, i.e., registered as a part-time employee at the same enterprise where his main place of work (internal part-time job), or less than one pay rate, is counted as one individual in the accounting number of full-time employees.

2.12. Form No. 2 is signed by the head (owner) of the enterprise or an individual entrepreneur. The surname, initials of the executor and the date of preparation of the report, telephone, fax numbers and e-mail address of the enterprise or individual entrepreneur are indicated. It is sealed with the seal of the enterprise.

2.13. Form No. 2 is submitted in two copies. Both copies are endorsed by the employment center specialist who accepts the report. One copy remains at the employment center, the other is returned to the employer.

The form is filled out, as a rule, automatically, using software, and is a copy of an extract from the report that the employer sends to the Pension Fund on a monthly basis. But if you don’t have the necessary program at hand, then first you need to take a report form.

Sample form SZV-M for an employee upon dismissal

Step 1. Fill in information about the employer

Here we simply indicate the statutory details of the organization and proceed to filling out the remaining columns of SZV-M for the dismissed.

Step 2. Specify the period

We write the month and year in which the person quits.

Step 3. Write the form type

When dismissing, we put the code “outcome” - in the sense, the document is outgoing.

Step 4. Fill in information about the employee

Here we write the personal information of the resigning person.

Step 5. Sign and give to the employee

This is what SZV-M looks like if the employee quits. A stamp is placed on the document if available. If there is no seal, then there is no need to put anything, this is not a violation.

Are dismissed employees included in SZV-M?

When handing out a copy to the person being dismissed

This form is personalized, that is, upon termination of the employment relationship, the document is issued to the person leaving personally. There is no need to include other people here, because this information is considered personal data and is protected by law.

In addition, in accordance with the law, the employer must not only issue this document, but also obtain documentary evidence that the SZV-M was issued to the person.

When submitting a report

How to show those fired in SZV-M when submitting reports is of concern to many. When submitting a report to the Pension Fund for the reporting period, it indicates all employees, including those dismissed. In the future, information about those dismissed is excluded, but if a person quit on April 1, then when submitting a report for April, information about him must be in the SZV-M form.

Upon dismissal of an employee, SZV-M is issued to him in accordance with clause 4 of Art. 11 of the Law “On individual (personalized) accounting in the compulsory pension insurance system” dated 04/01/1996 No. 27-FZ. We will tell you how to comply with all legal requirements.

Is it necessary to issue SZV-M if an employee quits his job?

All employers (organizations and individual entrepreneurs) are required to submit a monthly report to the regional pension fund in the SZV-M form “Information about insured persons.” This report records all citizens with whom official employment contracts or GPC agreements have been concluded.

For the nuances of filling out the SZV-M when concluding a GPC agreement, see this .

Officials say the report helps track working retirees.

In addition to submitting the SZV-M to the Pension Fund, it must be handed over to the employee.

IMPORTANT! Law No. 27-FZ states that a certificateSZV-M must be issued upon dismissal of employees, when submitting an application by insured persons upon retirement, as well as monthly along with submitting a report to the regulatory authority.

In this case, you need to obtain written confirmation from the insured person that the document was actually transferred to him.

When and in what form should an employee be issued a SZV-M certificate for those dismissed

When dismissing an employee, the copy of the SZV-M should indicate only his last name and his data. Information about other employees cannot be indicated, since it relates to personal data and is not subject to disclosure.

In column 3 you will indicate the type of “output” as usual, and in column 4 - information about the employee.

As a rule, filling out a report in various accounting programs allows you to generate SZV-M for dismissed employees for one insured person.

For more information about how a report is generated in 1C, for example, read the article .

In addition, it is necessary to obtain confirmation from the employee that the report has been received. There are several ways to do this.

- You can take written confirmation from employees. The approximate content is as follows: “I, Ivan Ivanovich Ivanov, confirm that in accordance with Art. 11 of Law No. 27-FZ dated April 1, 1996, upon termination of the employment contract, I received copies of SZV-M on 15 sheets for the entire period of work.”

- You can print out all SZV-M for an employee in two copies and upon issuance, ask the employee to sign on the second copy. However, if there are quite a lot of these copies, then this will be quite time-consuming.

- You can start a journal for issuing copies of SZV-M and take signatures from employees when issuing documents, indicating the reason for issuance. This is probably the easiest and most effective way to get confirmation.

Read more about drawing up a SZV-M certificate for dismissed employees in our article .

Employees are reported to the Pension Fund, Social Insurance Fund and the Tax Service. Since 2017, individual entrepreneurs as an employer are registered only with the Social Insurance Fund. Therefore, if you fired all your employees and are not going to hire new ones, deregister only with the Social Insurance Fund. There is no need to do anything with the Pension Fund.

The FSS will need to provide:

— Copies of documents that confirm that the employment relationship has terminated: a copy of the termination agreement or a copy of the dismissal order. And not for all fired employees, but only for the last fired one.

The application can be submitted through the State Services portal: “Authorities” → “FSS of the Russian Federation” → “Registration and deregistration of policyholders - individuals who have entered into an employment contract with an employee” → “Deregistration...”.

How to report for fired employees

We will only talk about IP. First, an LLC cannot operate without employees. Secondly, even if there are none, you still need to submit almost all zero reports, because LLC is the employer by default. We talked about this before.

Even if you fired all your employees in the middle of the year and deregistered with the Social Insurance Fund, continue to submit RSV, 6-NDFL to the tax office and 4-FSS to the Social Insurance Fund until the end of the year. These reports are built on a cumulative basis, so it is important not to interrupt it. 2-NDFL, SSC and SZV-STAZH at the end of the year will also need to be sent. Only SZV-M can not be submitted to the Pension Fund.

But you don’t have to submit reports for the next year. Of course, if you continue to work without employees.

In Elbe

To submit reports before the end of the year, do not uncheck the “I am registered as an employer” checkbox in your details. Simply move unnecessary tasks such as paying salaries, contributions and submitting SZV-M to completed ones.

Once you report for the whole year, you can remove the check mark.

Experience in the combat use of mortars Flight range of mines from a mortar 80 mm

Experience in the combat use of mortars Flight range of mines from a mortar 80 mm Konstantin Mikhailovich Simonov, alive and dead Before the evening drive, another meeting took place

Konstantin Mikhailovich Simonov, alive and dead Before the evening drive, another meeting took place US Eighth Air Force Museum 8th Air Force

US Eighth Air Force Museum 8th Air Force Differentiation of functions

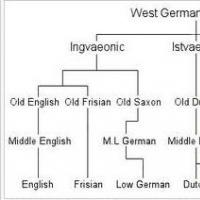

Differentiation of functions Classification of modern Germanic languages Main features of the Germanic group of languages

Classification of modern Germanic languages Main features of the Germanic group of languages Which scientist introduced the concept of valency?

Which scientist introduced the concept of valency? How does a comet grow a tail?

How does a comet grow a tail?