How to implement management accounting. Management accounting: problems of formulation and implementation Implementation of management accounting for enterprise shipments

Introduction

1. Management accounting system at the enterprise: concept, tasks, functions

2. Main aspects of organizing management accounting

Options for organizing management accounting: with and without accounts

Stages of implementation of management accounting in an enterprise

Modern concept of management accounting system

Conclusion

Bibliography

Application

Introduction

In the conditions of market relations in our country, the effective management of the production activities of an enterprise increasingly depends on the level of information support of its individual divisions and services.

Currently, few Russian organizations have accounting set up in such a way that the information contained in it is suitable for operational management and analysis.

Enterprises with a complex production structure are in dire need of operational economic and financial information that helps optimize costs and financial results and make informed management decisions. The information necessary for the operational management of an enterprise is contained in the management accounting system, which is considered one of the new and promising areas of accounting practice. The effective operation of a modern enterprise is impossible without a well-established system of management accounting and reporting at all levels of management.

The relevance of the topic is due to the following aspects:

Firstly, at the moment there is no unambiguous, independent definition of management accounting. There is no regulatory legislative framework for management accounting. Often, for simplicity, management accounting is limited only to the process of creating an information environment for executives and managers making management decisions;

secondly, in order to make management decisions, operational information is required, which ordinary accounting, due to its frequency, operating with already completed transactions and legislative regulation, cannot provide; the company’s competitiveness in the market may suffer from this;

thirdly, in order to strengthen the position of an enterprise in the market and its expansion, it is necessary to competently manage its cash flows, production and investment projects. Obviously, traditional accounting methods are not enough for this;

fourthly, in a market economy, the process of managing an enterprise has become significantly more complicated, which has been granted complete economic and financial independence. Economic independence consists in choosing the organizational form of the enterprise, type of activity, business partners, determining markets for products (services), etc. The financial independence of an enterprise consists of its complete self-financing, development of a financial strategy, pricing policy, etc. Consequently, the tasks facing the accounting system become more complicated. The accounting system of the administrative system today would not be able to satisfy the needs of a modern market enterprise. Under these conditions, the emergence of management accounting as an independent branch of accounting activity becomes inevitable.

Based on the above, the purpose of the course work is to disclose the procedure for developing the implementation of management accounting in an enterprise.

To achieve this goal, the course work has the following tasks:

1)define the concept of a management accounting system at an enterprise, highlight its subject, tasks and functions;

2)characterize the main aspects of the organization of management accounting;

)highlight and disclose options for organizing management accounting;

)identify the problems of implementing management accounting at an enterprise.

The theoretical basis of the course work is materials from periodicals, scientific articles, textbooks and lecture materials on the discipline “Management Accounting”.

The structure of the work corresponds to the goal and contains:

introduction;

main part, which includes the following parts:

1)Management accounting system at the enterprise: subject, tasks, functions;

2)Basic aspects of organizing management accounting;

)Options for organizing management accounting;

)Concept of management accounting system;

)Problems of implementing management accounting at an enterprise

conclusion;

list of used literature;

application.

1. Management accounting system at the enterprise: subject, tasks, functions

To date, there is no unambiguous definition of management accounting. There is no regulatory legislative framework for management accounting. Sometimes, for simplicity, management accounting is limited only to the tasks of collecting, aggregating (grouping) information and generating management reporting, that is, creating an information environment for executives and managers making management decisions. Some view it as a system for managing enterprise profits through cost management.

Management accounting in any interpretation is not accounting in the narrow sense of the word, but also includes planning, control, and analysis.

Management accounting is a system:

· planning expenditure and income indicators;

· attracting financial resources;

· distribution of received funds in accordance with the plan;

· accounting for actual expenses and correlating them with planned indicators;

· generating internal and external reporting on funds received and spent;

· control measures over all these processes.

Based on the above, the following definition can be derived:

Management accounting is a system of planning, financing, spending and controlling processes using accounting and reporting tools.

The main goal of management accounting is to provide executives and managers with the necessary information for decision-making and effective management of the enterprise.

The main tasks of management accounting, solved within the framework of the set goal:

·planning;

· cost determination and control;

· making decisions.

Planning is the process of specific actions to be performed in the future. Planning is based on analysis of past financial and non-financial information. Financial information is collected and processed in an accounting system. Planning within the framework of management accounting is called budget planning - the most detailed planning.

Cost determination (cost accounting and product costing) is a process that begins with the collection of all information related to the costs incurred when purchasing or producing finished products or services by an enterprise. A scientifically based classification of costs is of great importance for the correct organization of cost accounting.

The control system, as an establishment of feedback, must ensure, on the one hand, cost planning interconnected with real activities, past and future events in the organization. On the other hand, the control system provides clear tracking of the implementation of plans, accounting for deviations of actual indicators from previously planned ones, as well as analysis of these deviations.

So, decision making is the final, final task of management accounting. Management accounting is aimed at ensuring the ability to make the right decisions.

2. Main aspects of organizing management accounting

The objects of management accounting are the costs (current and capital) of the enterprise and its individual structural divisions - centers of responsibility; results of economic activities of both the entire enterprise and individual responsibility centers; internal pricing, which involves the use of transfer prices; budgeting and internal reporting.

Business transactions that are exclusively financial in nature (transactions with securities, sale or purchase of property, rental and leasing transactions, investments in subsidiaries and affiliates, etc.) are beyond the scope of management accounting.

As noted, the subject of management accounting is the production activities of responsibility centers (segments of the organization), therefore, sometimes management accounting is called accounting by responsibility centers, or segmental accounting. However, it is wrong to identify these concepts, since segmental accounting is the most important component of management accounting.

Segmental accounting can be defined as a system for collecting, reflecting and summarizing information about the activities of individual structural divisions of an organization.

In a market economy, it is difficult to overestimate the importance of accounting by business segments. Based on segmental accounting information, a management control system of the enterprise is built. Segmental accounting data satisfies the information needs of intra-company management, allows you to control costs and results at different levels of management, and prepare segmental reporting. By analyzing the latter, one can judge the effectiveness of the functioning of a particular structural unit of the organization. In addition, based on information from segmental accounting and reporting, the enterprise administration can make various management decisions, for example, on the advisability of disaggregating (decentralizing) the business. Let's look at these issues in more detail.

In modern conditions, the control aspect of accounting comes to the fore, increasingly acquiring not a state character, but an internal focus associated with the search and mobilization of reserves for increasing production efficiency. Accounting that is not used for control is pointless, and control that is not based on documentary accounting data is pointless. The management control system, based on segmental accounting and reporting information, allows managers at all levels to implement one of their management functions - the function of monitoring the implementation of decisions made.

The main task of management control is to ensure consistency of assigned tasks, when the interests of each individual employee coincide with the interests of the entire organization. To achieve this goal, managers must properly distribute the responsibilities of their subordinates and develop appropriate criteria for assessing their activities based on segmental accounting and reporting data.

Management control includes a set of rules and procedures used by managers to measure the performance of responsibility centers and determine whether the results obtained correspond to planned indicators, and if not, to develop corrective measures. In other words, we are talking about control and regulation of income and expenses for individual structural divisions (or products) based on an economic analysis of plans and actual segmental accounting data.

The first step towards the formation of a management control system in an organization is segmental planning - the development of estimates (budgets) for structural divisions. Without a sound plan, the control process is impossible. In other words, segmental planning is one of the components of the information support system for management control. Other components include segmental accounting and segmental reporting.

Information support is the collection, processing and transmission of financial and non-financial information used by managers to plan and monitor the progress of the activities of the units entrusted to them, measure and evaluate the results obtained. This information is characterized by regularity, timeliness, capacity, simplicity of form and perception.

Information support in the management control system assumes:

identification of costs and results with the activities of a specific structural unit;

personalization of accounting documents;

preparation by managers of estimates for the future and reports on the results of activities for the reporting period. These reports must be understandable to both those assessing and those whose performance is being assessed.

The management control system is based on the principles of trust, controllability and the availability of appropriate authority for managers and is effective if two main conditions are met:

) the enterprise has criteria for assessing the performance of performers in which the interests of employees coincide with the interests of the company;

) management control is implemented through a system of segmental accounting and reporting, which is trusted by the organization’s employees.

The consequence of management control is that managers make adequate management decisions regarding the functioning of the structural units entrusted to them. In particular, this may manifest itself in the adjustment of plans they have developed for the future.

The entire system considered is the prerogative of management accounting, so its content should be interpreted more broadly than accounting itself. In addition to accounting functions, this refers to planned, analytical work, the results of which are intended for use within the enterprise in order to develop effective management decisions. Maintaining segmental planning, accounting and reporting is the job responsibilities of an accountant-analyst.

An enterprise is free to choose management accounting methods that are convenient for it: in this area there are no such strict legislative requirements as in tax (accounting) and financial accounting (many countries have standardized financial reporting forms).

The traditional task of management accounting is cost calculation, and, accordingly, cost accounting. It is necessary to choose the most suitable accounting methods for the enterprise, which will not interfere with the production process with unnecessary bureaucratization, but will allow costs to be attributed to a particular process, project, and, as a result, to a specific product without unnecessary costs. Management accounting includes the following processes:

· Determining the break-even point

Budgeting

· Process cost accounting (process cost accounting system) is used in mass production of monotonous products or in a continuous production cycle; cost accounting is correlated with products produced over a certain period.

· Project cost accounting (job order cost accounting) is a method used in the manufacture of a product according to a special order. Costs for materials, labor and general expenses are allocated to each individual project or batch of products.

· Redistribution cost calculation (transfer method) is typical for mass production, when initial raw materials or materials are sequentially converted into finished products. Groups of production processes form processing stages, each of which ends with the release of an intermediate product (semi-finished product), which can go to the next processing stage or be sold.

· Standard cost calculation (accounting for deviations of the actual cost from the standard cost) for each product, based on current standards and cost estimates, a preliminary calculation of the standard cost is compiled, at the end of the period deviations are calculated; deviations are divided into negative (overconsumption of raw materials, materials, fuel, semi-finished products due to equipment breakdowns, poor-quality tools, replacement of materials), positive (achieving savings in material, labor and financial resources, more rational cutting of materials, use of waste instead of full-fledged materials, use of more productive equipment and devices) and conditional (can be negative and positive and appear as a result of differences in the methodology for drawing up planned and normative calculations).

· The inventory-index method of cost accounting differs from the normative one in that the accounting of past costs is organized without subdivision according to norms and deviations: the cost of manufactured products is determined on the basis of inventory data and assessment of work in progress balances at the end of the month.

· Direct costing determines the cost of production in the amount of direct costs, and overhead costs are charged directly to sales accounts. Management accounting methods are closely related to controlling methods and are essentially one of its (controlling) components.

3. Options for organizing management accounting

Currently, there are several main ways to organize management accounting.

The difference in the methods and purposes of management and financial accounting does not exclude the need for informational interconnection between them. In particular, such a connection is presupposed by the current Chart of Accounts, which is based on the possibility of accounting for production costs within a unified accounting system (financial and managerial) or separately using a specialized system of accounting accounts. Thus, the possibility of the existence of one-circle (monistic, integrated) and two-circle (autonomy option) accounting systems is allowed.

Options for forming a management accounting system can be very diverse: autonomous accounting, integrated, a variant of dualism or monism. However, they should be based on the principles:

Consistency with the general principles of formation of the organizational and production management structure;

Using the existing information base;

Compliance of the goals and objectives of management accounting with the strategy of the enterprise;

Income from the implementation of management accounting should be significantly higher than the costs of organizing accounting.

Integrated accounting. The Unified System of Accounts is a traditional option for Russian accounting. It is well known and used in practice. The final result of the organization's activities is determined by subtracting sales expenses from sales revenue (excluding VAT) and adding the difference in other income and expenses to the resulting result. To identify the financial result within a year, in this case it is necessary to close all main accounting accounts. An integrated system usually operates without the use of special management accounting accounts, but uses a single system of accounts and accounting entries. For management purposes, it groups financial accounting information in special cumulative registers, supplementing it with its own data and calculation results.

To preserve trade secrets, only balances are recorded in the accounting accounts, and turnover showing business transactions is reflected in the management accounting system.

This version of accounting technology assumes that management and accounting accounts reflecting production costs are maintained in accounting without separating costing accounts into the management accounting system. At the same time, direct correspondence of management accounting expense and income accounts with accounting control accounts is ensured.

Further improvement of the integrated system is associated with the allocation of special management accounting accounts for each cost element. Instructions for using the Chart of Accounts allow organizations themselves to determine the composition and methodology of using accounts. 20 - 39. In the third section of the Chart of Accounts “Production Costs” you can open accounts: 30 “Material costs”, 31 “Labor costs”, 32 “Deductions for social needs”, 33 “Depreciation”, 34 “Other costs” , 37 "Reflection of total costs." By debit account 30 in correspondence with accounts 10 “Materials”, 16 “Deviations in the cost of material assets”, 60 “Settlements with suppliers and contractors” reflects the cost of materials spent on production, purchased energy, industrial work performed by third parties, material components of other expenses in correspondence with the corresponding accounts. To account 30 open sub-accounts by types and areas of material costs. This account is rarely used in trade organizations. By debit account 31 in correspondence with accounts 70 “Settlements with personnel for wages”, 96 “Reserve for future expenses and payments” the amounts of accrued wages are reflected, including bonuses and other forms of remuneration for the organization’s personnel. The debit of this account also includes accruals to the reserves for upcoming vacation pay, for the payment of annual remuneration for long service, etc. Sub-accounts must be opened for this account, characterizing the types and directions of accruals for wages.

By debit account 32 in correspondence with account. 69 “Calculations for social insurance and security” reflects the amounts accrued for the formation of the pension fund and other similar social protection funds. If contributions for social needs take the form of a social tax, then the account. 32 corresponds with the credit account. 68 "Calculations with the budget for taxes and fees." Upcoming social payments, which were previously made at the expense of profits remaining at the disposal of the organization, are, by decision of the owner or his representatives, reflected in the debit of the account. 32 in correspondence with account. 96 "Reserves for future expenses." To account 32 it is necessary to open sub-accounts according to the types of contributions for social needs.

By debit account 33 in correspondence with account. 02 “Depreciation of fixed assets”, 04 “Intangible assets”, 05 “Depreciation of intangible assets” reflect the organization’s expenses for depreciation, accrued in accordance with its adopted methods and depreciation standards.

By debit account 34 in correspondence with account. 60, 71 “Settlements with accountable persons”, 76 “Settlements with various debtors and creditors”, 79 “Intra-business settlements” and other accounts reflect expenses that are not reflected in other accounts for accounting expenses for economic elements, since they are not related to none of these elements. Opening sub-accounts to the account. 34 is mandatory, since the expenses reflected in the account are too heterogeneous.

Every month, accounts for accounting for cost elements are closed with the following entry:

D-tsch. 37, K-tsch. 30, 31, 32, 33, 34.

For management purposes, cost accounting is organized by cost items, a list of which the enterprise establishes independently.

In an integrated accounting system, the task of interaction between accounting and management accounting comes down to the following. Internal accounting is reorganized into the main information base for the formation of alternative management decisions, based on the requirements of the approved policy.

The proposed construction of an integrated accounting system will not require significant additional costs, since the existing accounting service at the enterprise, in addition to the traditional task of generating external reporting, will expand the demand for existing accounting information for internal production purposes. The integrated accounting system is suitable for implementing management accounting in small businesses.

A developed integrated system ensures the dynamism of accounting and its adaptability to production conditions. This system is used in small organizations where the ability to control costs is limited and different estimates are not allowed.

The autonomous system is widely used in large and medium-sized companies, where the need for detailed and separate management accounting is especially acute. With the autonomy option, each accounting system (financial and management) is closed. The Chart of Accounts provides for the possibility of implementing an option with two systems of accounts. With a two-circle (autonomous) system, each type of accounting has an independent chart of accounts or, in general terms, separate accounts are allocated for management accounting, and all others are used in financial accounting. Financial and management accounting under this system can be carried out independently of each other and have different final data, since the purpose and purpose of financial and management accounting are different. In financial accounting, costs are grouped by economic elements, in management accounting - by costing items. It is recommended to organize the connection between financial and production accounting using so-called reflective accounts, or screen accounts.

Reflective accounts are designed to transfer information important for management accounting from financial accounting to management accounting, and vice versa. To record sales expenses, free invoice codes (screen invoices) have been selected. Financial accounting deals only with synthetic accounting of costs, and therefore contains information about the total amount of sales expenses, without taking into account the place of their occurrence. Management accounting details this information in the sales expense and revenue accounts reported in financial accounting according to management accounting needs.

As a result, they obtain generalized and detailed information about costs in a costing context, by structural units and other parameters. On sales expense accounts by type of goods, expenses are grouped and detailed by items, media, highlighting standard expenses and deviations from the norms. A similar grouping can be made by responsibility centers. Account 37 combines the organization's fixed costs, which are included in the reduction of marginal profit of the reporting period in which they arose. In most cases, they are distributed according to their places of occurrence. The accounts for the redistribution of income and expenses take into account data on the transfer of all or part of the costs from the management accounting system to financial accounting and vice versa. Analytical accounting on these accounts is carried out on an accrual basis from the beginning of the reporting year, and at the end of it all accounts are closed. The use of transition accounts allows you to determine the financial result within a year mainly based on management accounting without closing all financial accounting accounts. This creates conditions for effective business planning.

An autonomous system using mirror accounts of financial and management accounting can also exist in isolation from each other. Mirror accounts provide numerical reconciliation of accounting data. As a rule, financial accounting keeps records of expenses for the entire organization in the context of cost elements without division into responsibility centers. The financial result is determined by comparing the total sales revenue (excluding VAT) with the total sales expenses (taking into account the balance of inventory items). Management accounting uses these data as totals, mirroring is carried out by comparing the final cost items with the output data of financial accounting. Other mirror reflection options are also possible.

A stand-alone system using transition accounts and mirroring is best suited for managing an organization and for reflecting costs across think tanks. It is most appropriate when it comes to geographically separate branches of an organization. At the same time, while maintaining the unity of financial accounting and management of the entire organization, individual accounting is provided for each division, which increases the degree of responsibility.

The choice by an enterprise of an option for interacting accounting systems certainly depends on the scale of the enterprise and its needs for management information. At some small businesses, the needs for management information can be reduced to two or three blocks with a limited level of requirements for the accounting system.

There is no doubt that the separation of management accounting accounts, in addition to improving information services for various management structures, creates conditions for maintaining trade secrets about the level of production costs and the profitability of certain types of products.

So, the choice of management accounting option depends on factors such as the size of the enterprise, the degree of centralization of accounting, the organizational and production structure of the enterprise, etc. Only the enterprise can decide which option to give preference to.

4. Stages of implementation of management accounting in an enterprise

management accounting costs direct costing

In the context of dynamic market development, any company needs a simple and logical system for obtaining management information to quickly make business decisions. Unfortunately, Russian accounting cannot satisfy all the internal needs of a business for such information, and the rules for maintaining management accounting in companies are often not written down or even defined.

The need to develop a management accounting system (methodology) becomes obvious, i.e. an ordered set of interrelated rules and algorithms that ensure timely collection of reliable and adequate information for making management decisions.

Each financial director has his own recipe for solving this problem, and the specifics of the company play a leading role here: what works great at one enterprise may not be suitable for another. On the one hand, there are no uniform standards for management accounting; in each industry and each company its principles and structure are individual. On the other hand, management accounting is focused on the company’s information needs, and such needs can be analyzed and streamlined. And despite significant substantive differences in the accounting methodology of enterprises from various industries, it is possible to identify an optimal sequence of accounting stages that is universal for all companies and allows the development of a management accounting methodology that meets the company’s goals.

It is advisable to carry out work on establishing management accounting within the framework of a separate company project, using project management procedures. Third-party specialists are often involved in the implementation of such a project (or its individual stages) (including consultants for automation of accounting processes, if the company plans to support it in a new information system). Let's take a closer look at each stage of such work, the main tasks and risks of the management accounting construction project.

Stage 1. Setting the task, getting started

At the beginning of work, naturally, it is necessary to decide what main tasks management accounting should solve in the company.

Basic steps

1. Identification of key data consumers. The accounting methodology should be clearly focused on the information needs of the company. Excessive reporting, which is rarely used and takes a long time to prepare, has no place in a management environment. Therefore, it is necessary to immediately determine the circle of people who use the information. Moreover, these should not be ordinary specialists, but top managers and leading methodologists who make basic business decisions, and the generated reporting should adequately reflect the state of affairs in the company. It is advisable to conduct a kick-off presentation in which you outline the purpose of the project, expected results, and the project plan (timing and main actions). Project participants must understand what will be done and why they personally need it. Also at this stage, it is advisable to evaluate the possible payback period of the project and be sure to include this assessment in the presentation. Shareholders (management) of the company must understand that such projects are aimed at increasing efficiency in making management decisions, achieving greater “transparency” of the company, and, consequently, increasing its value.

2. Formation of a list of required reports. It is necessary to agree with all responsible persons on the composition of the reports they need, including a description of the required indicators and analytics. For each of the reports, you also need to determine the timing of generation (by what date and with what frequency the report should be compiled). As a result, all required reports must have a clear description - in fact, this is the statement of the task for implementing the management accounting process. The main risks of the first stage:

· concentration of efforts on minor reports that will make life easier for performers, but will be too detailed for top managers - the risk of not achieving goals and increasing the cost of the project;

· insufficient support for the project from management - risks of a situation when, having “played enough”, management will leave everything as it is.

Stage 2. Definition of the accounting concept. Project work planning

Basic steps

1. Definition of the basic concepts and structure of future accounting. First of all, it is necessary to select and approve the basic accounting concepts, which, in fact, determine the requirements for the management accounting system. Concepts must contain answers to fundamental accounting questions:

· Will accounting be built in accordance with IFRS or not?

· Will management accounting be conducted in parallel with accounting?

· Who controls the preparation of management accounting data and the systematic “closing” of the period?

· What automated system will be used to prepare reports?

The choice of automation system can play a significant role, because many systems impose an inherent limitation on the accounting methodology. Some systems have deeply developed accounting mechanisms, while others have very flexible process implementation capabilities, but there are certain restrictions on the number of analytics and the volume of data, etc.

2. Breaking down the accounting implementation project into stages and setting priorities. It is necessary to plan further work and highlight the main stages (specific actions in the project). Moreover, you immediately need to determine what is priority and urgent for the company, and what can wait.

3. Defining the project boundaries. It is important to immediately determine the scope of work in the project. It can be difficult and risky to multi-task, so it makes sense to prioritize the areas that matter most.

4. Clarification of the work plan. It is necessary to clarify the desired timing of work for each stage. The main point of these works is to estimate the maximum allowable duration of the stage, otherwise it will be very difficult to control the work and manage the project budget.

The main risks of the second stage.

· Inadequate choice of priorities. To reduce this risk, it is better to go from the top down, starting with simple basic reports and ending with more complex and detailed ones.

· Incorrect assessment of deadlines, as a result of which the accounting process will become endlessly long. It is best to focus on an end date and start planning backwards from that date.

Stage 3. Analysis of the “as is” state

The main task of this stage is to determine the individual characteristics of the company’s work and the accounting specificities determined by these characteristics; identifying the difficulties that will be encountered when implementing the system. This stage allows you to identify the weaknesses of the formed project work plan and determine the main risks of the project. The emphasis must be placed on checking the correctness of the identification of the main areas of management accounting carried out at the previous stages, and on identifying the available resources for accounting.

Basic steps

1. Study of the features and pitfalls of current accounting. It is necessary to determine what nuances and difficulties (from the standpoint of accounting) exist in the company, what problems the company’s specialists have already encountered when preparing reports, and how these problems were solved. Particular attention should be paid to the structure of income and expenses, identifying items with the greatest share.

2. Clarification of the project work plan. After studying the features of accounting, the work plan for the project should be adjusted. The duration of each stage should be estimated. Do not forget that innovation involves not only the development, but also the implementation of procedures, which also requires significant effort.

Stage 4. Preparation of a sketch of the methodology and accounting model “as it should be”

After analyzing all the available features, the actual management accounting model of the company is compiled. At this stage, it is necessary to put the basic accounting scheme and previously developed concepts into a harmonious form of methodology, prescribe the relationships between reporting forms, think through lists and codifiers of accounting items, and the relationship between them. The main risk of the third stage is the construction of a system that in practice will not meet the stated accounting objectives. Therefore, it is necessary to involve company specialists who understand the specifics of its business.

Basic steps

1. Preparing a model for generating output reporting forms. It is necessary to assess the fundamental relationship of all elements of the required reporting, set the main reporting blocks and areas of accounting, and determine the depth of the required analysis.

2. Development of interim reporting forms and methods for calculating the required indicators. The main task is to think through the detailed procedure for calculations, determine all the data required for calculations, and calculation methodologies.

3. Development of a scheme for entering into the information system and storing primary data. Development of accounting details: charts of accounts, analytics, formation of a unified list of business transactions indicating the required data, necessary calculations, etc.

4. Development of data control measures, ways to systematically ensure accounting reliability. A check is made to ensure the “transparency” of the data in the underlying accounting model. The model should provide the ability to simply and reliably control system data: data should, if necessary, be obtained quickly and clearly; analysts should be comfortable both for entering information and for its control by the financial service. It is also necessary to provide for the possibility of future expansion of the model, taking into account changes in the number and composition of analytics, deeper data granularity, the use of more complex cost distribution algorithms, etc.

5. Development of a draft procedure for the preparation of information It is necessary to describe the functional distribution of responsibilities of employees performing data preparation, the timing and procedure for entering data, fundamentally design a scheme for the flow of information, and check its realism.

6. Checking and assembling the draft methodology The management accounting methodology is being assembled, checking the coherence and completeness of the resulting model.

7. Preparation of a test version of the methodology, trial calculations. The main goal of these works is to check the correctness of the calculations and the consistency of the resulting methodology; assess whether the developed methodology model is sufficiently clear.

The main risks of the fourth stage.

· Excessive workload of the model, an attempt to do “everything at once”. It is necessary to take into account both the technical capabilities for implementing the accounting methodology and the actual time and effort of the performers in relation to the value of the information received.

· Technical errors in the methodology.

Stage 5. Discussion of the sketch methodology

After preparing and testing the methodology, it is necessary to present the resulting version to specialists and discuss with them the adequacy of the accounting system. We are talking, first of all, about managers and performers who will directly enter data and process information. The main task of this stage is to identify the weaknesses of the methodology and check solutions to problematic issues for reliability.

The main risks of the fifth stage.

· There may be resistance from performers due to conservatism and inertia of thinking. It is necessary to understand that this is a natural reaction and to convince people of the need and benefits of a new accounting system.

· During the period of implementation of changes, it is necessary to provide in advance means to soften the transition to the new model. This could be a bonus for a temporary increase in workload, active collaboration, etc. At the same time, you should be persistent in making changes, otherwise the innovation may be sabotaged.

Stage 6. Coordination and approval of the methodology

The developed methodology must be documented and approved by the company. This is usually accompanied by a presentation to management of the developed model. It is obvious that in this case, unlike the discussion with managers and performers, the presentation contains significantly less details and is more aimed at describing the final achievements.

Stage 7. Development of regulations and documented procedures

The draft procedures that were developed at the stage of preparation of the methodology must be clarified, formalized in the form of separate regulations, indicating the specific names of the performers, deadlines and responsibilities.

Stage 8. Implementation

If all previous stages of work are successfully completed, both the company management and project participants will understand what specific changes need to be implemented in order to launch the procedures for collecting data and generating reports using the new methodology. At this stage, the main difficulties may arise when implementing changes in the accounting system.

Thus, the organization and implementation of management accounting is an extremely important process for the enterprise and therefore cannot be rushed. For a correct and effective management accounting system, it is necessary to divide the process of its creation into stages, each of which involves its own specific procedures.

Stage 1. Statement of the problem, beginning of work Stage 2. Definition of the accounting concept. Planning of work on the project Main actionsStage 3. Analysis of the “as is” stateStage 4. Preparation of a sketch of the methodology and accounting model “as it should”Stage 5. Discussion of the sketch of the methodologyStage 6. Coordination and approval of the methodologyStage 7. Development of regulations and documented proceduresStage 8. Implementation

5. Modern concept of management accounting system

Historically, Russian accounting is focused on the interests of a single user - the state. Therefore, accounting and reporting at most Russian enterprises are of a clearly tax nature.

However, the development of market relations in our country and the emergence of a large number of non-state (commercial) domestic and foreign organizations have posed new challenges for accounting. One of them was the provision of information to managers for making management decisions. In this regard, the need arose to create a system of internal information - management accounting.

In Russia and foreign countries, experience has already been accumulated in the field of accounting for production costs and their analysis, however, despite this, there is no unified concept of management accounting. There are several basic theories, the main difference between which is the range of tasks solved by management accounting.

Each organization must independently decide whether or not to maintain management accounting. Thus, the introduction of management accounting will be effective and economically justified only in large and medium-sized companies. For small businesses, the value of management information in many cases will be lower than the cost of obtaining it, and therefore they can use operational accounting data.

The establishment of a management accounting system is a rather labor-intensive and lengthy process. At large enterprises it takes several years. The management accounting system requires large amounts of money and qualified labor resources. When it is established at an enterprise, it is necessary to solve a number of problems: reorganizing the financial service, developing a cost accounting system and installing a software package.

Currently, there are three main positions of management accounting specialists:

1.Complete denial of the concept of “management accounting”. Management accounting is the same production accounting, but in relation to modern terminology, and there is no reason to distinguish it as an independent type of accounting (for example, M.Yu. Medvedev).

2.Management accounting is a well-established independent discipline (V.F. Paliy).

.Accounting in modern conditions is a system that includes three subsystems: financial accounting, management accounting and tax accounting (M.Z. Pizengolts).

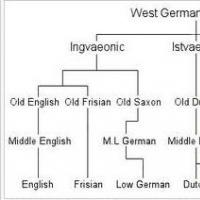

Rice. Positions of specialists regarding the place of management accounting

In our opinion, the third position is the most justified. This is due to the following:

· the basic principles of accounting in financial, management and tax accounting are the same;

· the data that is used in financial, management and tax accounting is the same - the business transactions of the enterprise, the only difference is in the groupings, conditions for acceptance for accounting and cost estimates in which each type of accounting uses it (units of measurement, completeness of reflection, etc.) d.);

· According to the American Accounting Association, accounting is the process of identifying information, calculating and evaluating indicators, and providing data to users of information for developing, justifying, and making decisions. The main task of accounting is to provide information in a volume sufficient to satisfy the requirements of various users (internal and external), and at minimal cost. The provision of information is carried out through the provision of reporting (financial, management and tax). Thus, accounting is an accounting system that includes three subsystems (financial, tax and management);

· This principle is used to define the teaching of accounting in the new standard of higher professional education in the specialty “Accounting and Auditing”;

· it is necessary to adhere to a unified approach in types of accounting, because Only this will make it possible to achieve comparability of data resulting from accounting procedures.

Management accounting is an accounting subsystem that, within one organization, provides its management apparatus with information used for planning, actual management and control of the organization's activities. Management accounting covers all types of accounting information necessary for management within the organization itself. Part of the general scope of management accounting is production accounting, which usually refers to the accounting of production costs and the analysis of data on savings or overruns compared to data for previous periods, forecasts and standards (A.D. Sheremet).

Management accounting is the identification, measurement, collection, systematization, analysis, interpretation and transmission of information necessary to manage any objects. The main purpose of production accounting is to calculate the cost of products and services. Production accounting is management accounting plus a small part of financial accounting (K. Drury).

Production accounting is also management accounting - accounting that studies the costs and profits related to various types of activities (Longman Business English Dictionary).

Management accounting is the process of identifying, measuring, accumulating, analyzing, preparing, interpreting and providing financial information necessary for the management level of an enterprise to plan, evaluate and control business activities. This information also allows you to organize the optimal use of enterprise resources and control over the completeness of their accounting. In addition, management accounting includes the preparation of financial statements for groups of external users of information, such as shareholders, creditors, government and tax regulators (SMA 1A, Objectives, Definition of Management Accounting).

Management accounting is a system of internal operational management. Management accounting includes the tasks of current operational management of the financial and economic activities of an organization throughout the entire structure: from the highest to the lowest levels of management (V.F. Paliy).

There is no official definition of management accounting in legislative acts included in the regulatory system of the Russian Federation. This is justified, since the organization of management accounting is an internal matter of each enterprise; the state cannot oblige enterprises to maintain management accounting or prescribe uniform rules for its maintenance. This is evidenced by the current practice of developed countries. Management accounting standards are developed without government intervention.

Based on the above, we can conclude that management accounting is an internal information system that provides information for decision making. The tasks of this system primarily include the calculation of the cost of work and services (production accounting), planning (budgeting), analytical calculations and, as a result, the provision of management reporting. It is on the basis of management reporting that managers make decisions and monitor the activities of the enterprise. Information for management accounting is generated on the same basis as information for financial and tax accounting - data on the economic activities of the enterprise. The only difference is in the groupings in which information is provided and in the acceptance for accounting.

Management accounting includes three main parts: production accounting (cost accounting and costing), planning and analysis. It is production accounting that collects information for further analysis and planning, so if production accounting data is incorrect, then all other information obtained on their basis (planning and analysis) will be unreliable and useless, and this can lead to making an incorrect decision and, consequently, to very sad consequences for the enterprise. Summarizing the above, we can conclude that when organizing a management accounting system, more attention should be paid to production accounting.

Conclusion

During the course work, the tasks assigned to it were solved.

As a result, the following conclusions can be drawn:

Firstly, management accounting is an orderly system of identifying, measuring, collecting, registering, interpreting, summarizing, preparing and providing information and indicators that are important for making decisions on the company’s activities for the management level of the company (internal users - managers). This is a process within the organization that provides the management apparatus of the organization with information used for planning, actually managing and monitoring the activities of the organization.

Secondly, management accounting, like any process, has its own specific goals, objectives, functions and methods.

Thirdly, the choice of management accounting option depends on factors such as the size of the enterprise, the degree of centralization of accounting, the organizational and production structure of the enterprise, etc. Only the enterprise can decide which option to give preference to.

Fourthly, the organization and implementation of management accounting is an extremely important process for the enterprise and therefore cannot be rushed. For a correct and effective management accounting system, it is necessary to divide the process of its creation into stages, each of which involves its own specific procedures.

Fifthly, management accounting is a dynamic process that depends on many economic factors, and therefore requires a quick response from managers.

Literature

1) Vakhrushina M.A. "Management Accounting": a textbook for university students studying economics/. - 7th ed., erased. - M.: Omega-L, 2008. - 327 p.;

3)www.bigspb.ru - “Management accounting and accounting systems” Yu. Minkin;

4)www.topsbi.ru "Technology for setting up management accounting in a company. Main stages and nuances" Ilya Borisovsky, Grigory Sukhov;

5) www.cfin.ru .Corporate management, #"justify">Appendix

Practical assignment for course work No. 4

An enterprise engaged in the transportation of goods around the city has 10 ZIL vehicles, each costing 70,000 rubles. The carrying capacity of each vehicle is 4 tons. As a result of the analysis of the shift use of cars, it turned out that they are distributed among shifts as indicated in Table 1.

Table 1 Distribution of cars by shift

ShiftsNumber of cars1st shift92nd shift63rd shift2

Moreover, it turned out that only three vehicles in the first shift carry out transportation with a vehicle load of about 3 tons. In other cases, the vehicle load did not exceed 1.5 tons.

Determine the effectiveness of extensive and intensive use of equipment. It is necessary to give your proposals for changing the structure of the vehicle fleet and improving their use, based on the fact that customers may agree to change the delivery schedule by shift when the transportation tariff changes.

We will determine the actual amount of cargo transported per shift

- shift = (3 tx3 vehicles) + (1.5 tx 6 vehicles) = 18 t

- shift = 1.5 t x 6 vehicles = 9 t

- shift = 1.5 t x 2 vehicles = 3 t

Total amount of cargo transported over 3 shifts = 18t + 9t+3t = 30t

2. Determine the amount of cargo according to the plan with a carrying capacity of each vehicle of 4 tons

shift = 4t x 9 vehicles = 36t

shift = 4t x 6 vehicles = 24t

shift = 4 t x 2 vehicles = 8 t

The total amount of cargo for 3 shifts according to plan is 68 tons

.Let's determine the intensity coefficient

Ki = Pf / Tpl,

where Pf is the actual productivity of vehicles, Ppl is the planned productivity of vehicles Ki = 30/68 = 0.44

Answer: To transport 30 tons of cargo with a vehicle carrying capacity of 4 tons, (30 tons / 4 tons = 7.5) 8 vehicles will be required. Consequently, the vehicle fleet can be reduced by 1 vehicle, saving 70,000 rubles.

The remaining 9 vehicles, working with a load of (30 tons / 9 vehicles) 3.3 tons, can transport the entire cargo in one shift. Consequently, it is possible to reduce the number of shifts to 1, thereby reducing vehicle wear. Provided that the customer is satisfied with a single-shift work schedule.

Tutoring

Need help studying a topic?

Our specialists will advise or provide tutoring services on topics that interest you.

Submit your application indicating the topic right now to find out about the possibility of obtaining a consultation.

Classifier example

An example of a typical classifier is given in Table. 3. If necessary, you can use a five-digit code in the classifier, breaking each of the cost elements into subelements. For example, in the cost item “Purchased raw materials and supplies” with code 101, subitems 10101 - “Fuel”, 10102 - “Basic materials”, 10103 - “Auxiliary materials”, etc. will appear.

Having developed all the necessary classifiers, the enterprise can move on to determining methods for management cost accounting and cost calculation.

Implementation of a management accounting system.

The main goal of implementing a management accounting system at an enterprise is to provide the company's management with the most complete information necessary for effective work. Often in Russian enterprises, the introduction of management accounting is carried out on the initiative of senior management, which lacks specific management information.

The development and implementation of a management accounting system requires a lot of effort and time (in large enterprises this process can take several months) and does not immediately produce results. It will take time both to test the system and to accumulate information that will help adjust the management accounting system during implementation.

Organizations planning to implement a comprehensive management accounting system are recommended to clearly identify the responsible person or form a special team of individuals responsible for the implementation of management accounting. Such a team is usually accountable to the executive body of the organization and consists of highly qualified specialists who are fully involved in the process, whose task is to ensure that the overall goals that management sets in the process of implementing a management accounting system are realized at the level of specific activities, understood and executed by all involved units.

The minimum set of skills of specialists in such a team should include knowledge of the concepts and principles of management accounting, the basics of accounting and financial reporting, information technology, personnel policies and process modeling. The team should be led by a person appointed by the head of the organization, who has professional qualities and knowledge sufficient to promote the project.

The management accounting system implementation team typically has the following responsibilities:

ensuring the implementation of a management accounting system;

coordination and adjustment of the functioning of the management accounting system;

ensuring constant interaction and dialogue between the departments and specialists involved;

ensuring vertical coordination of actions.

In large organizations, special units can be created that on an ongoing basis ensure the organization and development of the management accounting system, the administration of such a system, and analytical functions.

In a number of cases, companies resort to the help of external consultants to set up management accounting, which ensures the recognized quality of the methodology used, the involvement of performers with experience of similar work in other organizations and the comparative independence of all work from solving various political issues within the organization. However, the involvement of external consultants requires more significant material costs in the absence of guarantees of the effectiveness of the specialists sent by the contractor.

To successfully implement a management reporting system, it is necessary to draw up a detailed action plan:

Set goals and objectives for the system

Identify and assign a project manager

Set up the system and break down the implementation process into specific tasks

Establish data sources and responsibilities

Determine how reports will be compiled

Set deadlines for implementing the dashboards

Assign responsibility for preparing reports

Appoint someone responsible for managing the system (senior manager for all sectors plus general management)

Assess available resources

Required personnel, their professional level, degree of dependence

Computer equipment (if the system is computerized)

Prepare a detailed plan describing all required purchases or services and associated costs.

Prepare detailed budgets for internal and external expenses

Execute the implementation plan - start with an executive order and inspirational speeches from senior managers

Monitor and control the process of system implementation, and, if necessary, make adjustments and changes along the way.

Implementation planning

List the main steps in the implementation process. Assign responsibility, timelines, and budgets for each of the steps listed. (Tables 4, 5, and 6 provide templates for planning the implementation process.)

Table 4. Implementation: Key steps and responsible persons

|

Steps |

Tasks |

Responsible persons |

Deadlines |

|

I. Planning |

Define goals |

||

|

Appoint a project manager |

|||

|

Set up the system |

|||

|

II. Resource assessment |

Determine staffing needs |

||

|

Conduct staff recruitment - internal and external |

|||

|

Determine the infrastructure and technical requirements of the system |

|||

|

Draw up a plan for creating infrastructure and technical support for the system. |

|||

|

III. Budgeting |

Create a budget for system implementation |

||

|

IV. Education |

Provide additional training for personnel involved in system implementation |

||

|

VII. System installation |

Implement the system and test it |

||

|

VII. Surveillance and control |

Monitoring the implementation process and adjusting it |

Table 5. Work plan for the system implementation process

Table 6. Budgeting for the implementation process

Problems during the implementation of management reporting.

The first problem that you may encounter when implementing management accounting is unrealistic goals or implementation deadlines. The deadlines may be too long to effectively solve the problem, or too short, in which it is impossible to correctly implement the system.

Particular attention should also be paid to planning, because... poor planning leads to poor results.

If adequate control is not created in the system, inaccurate data appears. This may happen for the following reasons:

Those who write summaries and reports have reasons (or are simply able) to manipulate data.

Persons compiling reports receive incorrect data.

Care must be taken in selecting a project manager. He must have the ability to lead and understand the business as a whole, must be respected within the company, and have the power to effectively implement the system.

The project manager will be under pressure from different sides. From lower-level system users who will have to change their work habits and perhaps do something new, from the CEO who expects quick results, from division directors who will be reluctant to provide information for fear that new data will will present the unit entrusted to them in a different light (or more accurately) than they would like.

Control during the implementation of management reporting.

It is necessary to constantly check for completeness of information. All data subject to processing must be processed. Consistent check of all pre-numbered documents and verification of each document with the forms from which the data is taken will be the key to error-free implementation.

It is required to check compliance with the basic relationships between the data

for example, beginning finished goods inventory + production - shipping = ending finished goods inventory

Variance analysis and reasonable explanation of discrepancies

Constantly strive for timeliness of information. All data must be collected and processed in accordance with the specified frequency. Monthly, weekly or daily.

If problems arise with the implementation of the system or the data is inaccurate, you need to look for the main reasons for the problems that arise:

Human error

Done accidentally due to poor training or carelessness

A technical error

The system infrastructure does not prevent incorrect data from entering the system (through no human fault)

Poor relationships between management and staff

Lack of motivation among staff

Poor security planning is a dangerous area (see also below)

Personnel are involved in fraudulent activities

Customizing the installed system to meet the needs of a specific enterprise and specific users

Customizing an installed system to meet the needs of a specific enterprise and specific users is a continuous process that involves continuous improvement of the system.

To achieve the desired result, you need to establish a system of regular feedback from the user by asking the following questions:

What additional information is vital for effective decision making at your level?

Is information provided in time for effective decision making?

Does the system help identify important problems and weaknesses?

Does the system help identify problems in advance?

Is the information obtained at different points in time comparable?

establish a system of regular feedback with persons involved in all stages of the preparation of summaries and reports

What are the challenges in compiling and receiving data summaries?

What are the problems with creating reports?

Where are the bottlenecks causing information delay? For example:

Lack of staff

Untrained personnel

Communication problems

Problems related to technology and infrastructure

Are there situations where there is no defined data processing procedure?

Final steps aimed at establishing control over the implemented system.

In any field, in order to verify the operation of a system, testing is required

Let's look at the main tests and questions that a manager responsible for implementing management reporting should ask.

Test for completeness and accuracy

Are the reports consistent with each other? For example, are sales, accounts receivable and cash receipts recorded based on the same input data?

Whether the information provided makes sense and is relevant; Does the report provide all the information needed to make informed decisions?

Are there significant problems affecting the production and dissemination of reports?

User Acceptance Test

Does the new report make more sense to the user than the existing one?

Do users need additional training to analyze the information provided in the report?

Business Improvement Test

Are business goals being achieved?

Safety test

Is the information accessible to unwanted users?

Conclusion

A good management reporting system provides management with extremely important information about their organization and its activities. The reports contain information in the following seven areas:

General picture of the company's work

How stable is the company’s financial position, are key indicators looking good, such as production, sales, etc.

Existing problems and inefficient use of resources

whether the procurement department plans purchases correctly; whether we produce what we intend to sell; Do we have a lot of unfinished products lying around without any use?

Potential problems that may arise in the near future

It is likely that if we are unable to place this order in the near future, we will face a cash flow shortage and be forced to stop production

Daily decision making and problem solving

how much do you need to buy?

do we need to accept this new order

Strategic and long-term decision making

Should we continue to produce this product? Do we need to invest in the production of a new product?

Direction of planning and budgeting

where are the weakest points in our planning system? do we need to improve our sales forecasting technique?

It is clear that the best strategy for establishing management accounting is to have employees themselves knock on the door of the General Director’s office every day, talk about the need for implementation, bring reasoned technical specifications, and show interim test results of any accounting systems created by the structural unit. However, in practice, not all enterprise employees are interested in implementing such systems. There may be several reasons:

reluctance to disclose all the features and pitfalls of one’s direction, since transparency can reveal incompetence;

the habit of working the old fashioned way - the implementation of management accounting is sometimes comparable to teaching an elderly person to work on a computer from the basics;

reluctance to switch from one accounting program to another - this is very important for accounting employees, who are sometimes tied to one of the generally accepted accounting programs;

reluctance to participate in an unclear process.

The last reason is perhaps the main one and requires the most attention from the General Director, since if he fails to explain to his subordinates the benefits of implementing a management accounting system, sooner or later it will stop working. But, unfortunately, the General Director cannot always find like-minded people on such issues, and very often he has to win the hearts and minds of people gradually.

There is one last factor that needs to be mentioned. Management accounting and its setup is a long and very interesting process (the system takes months to implement, and in large companies – years). It is important to remember that accounting is not an end in itself, but only a tool for the General Director, allowing him (and, accordingly, the company as a whole) to work more efficiently.

Thus, we can say with confidence that the introduction of management accounting is necessary for Russian enterprises in order to ensure “transparency” of production, primarily for the company’s management, as well as to increase production efficiency.

From the experience of companies that have already implemented management accounting, we can conclude that it is worth all the effort and money spent. Of course, first of all, this will have a beneficial effect on the management of large enterprises and holdings.

It is absolutely obvious that there is a need for agitation and various explanatory events for the introduction of management accounting at the enterprise.

In order to understand what management accounting is, it is necessary to classify its components. The main indicators of this system include:

Planning of income and expenses;

Distribution of incoming funds, which must be carried out in strict accordance with planning;

Accounting for expenses actually incurred by a business entity and comparing them with projected indicators;

Generating reports on resources received and spent both for internal use and for external consumers;

Exercising control over all of the above processes.

Thus, in an enterprise it is a set of planning, financing and spending, as well as control over all these actions, carried out using reporting. The implementation of all these processes is necessary to provide information to managers and executives, on the basis of which decisions should be made aimed at improving the efficiency of the organization. Management accounting at an enterprise sets itself the task of planning, determining expenses and controlling them. At its final stage, administrative decisions are made.

The planning process is about determining the actions that need to be performed in future periods. It is based on an analysis of the already obtained performance indicators of the enterprise.

Accounting for costs incurred in the production process begins with the collection of information that relates to the costs incurred during the procurement or production of goods or services. Establishing control should ensure real planning related to the activities of the organization and monitor the implementation of forecast indicators, analyzing deviations if they occur.

After carrying out all these stages, management accounting at the enterprise helps to complete the final task - making the right decision aimed at more efficient production.

The information that is provided to develop a strategy for the activities of a business entity has traditionally been financial and provided in monetary units. Recently, management accounting at an enterprise has expanded its boundaries. To make the necessary decisions, physical and operational data regarding the quality of the products and the duration of the technological process are additionally collected.

Subjective indicators also began to be taken into account, such as satisfaction of consumer demand and performance characteristics of the new product, as well as the presence of the creative potential of the enterprise team.

Thus, the information required for management accounting includes operational and financial data characterizing the types of activities of a business entity and processes carried out for the purpose of producing finished goods, as well as information about the structural divisions of the organization, the products or services it produces, and clients.

The correct organization of management accounting at an enterprise is an extremely important factor for its normal development and functioning. With the help of the necessary information, leaders and managers develop the necessary directions of the organization's activities. Strategic objectives are determined taking into account existing and customer demand.

Properly organized management accounting will make it possible to realistically assess the existing external and internal factors that influence the solution of specific problems and ensure the relationship between organizations. Analysis of the provided indicators will also reduce costs and open up additional internal sources of resources.

Probably, every head of a company at least once in his life found himself in a situation where he was required to quickly make some very important management decision with “long-lasting” consequences. But, as luck would have it, there is no information at hand. Or rather, it is, of course, somewhere, but it will take too long to look for it.

What way out does the leader see in this case?- Search for data yourself or entrust it to subordinates and lose valuable time, perhaps missing out on the considerable benefits that rapid action would bring.

- Make a decision based on the notorious “sixth sense”. Of course, the business intuition of most successful businessmen is quite well developed. But you will agree that relying only on it, without being based on data supporting the decision, is a little dangerous.

So, in the first case, the manager risks wasting time, in the second - making a hasty, possibly erroneous decision. Both situations carry danger: either missing out on a profitable offer or making a mistake with your choice. So what's the solution?

Modeling accounting in an organization is the best solution

From time to time, a business owner may wonder about its profitability and try to answer the following questions.

- Is the business he is doing profitable?

- If so, how much?

- Is it worth continuing to work in this direction?

- Or maybe change the type of activity?

- Or leave the market altogether?

To answer these questions you need:

- understand the formation of the cost and final price of the goods or services produced;

- budget planning;

- determining centers of financial responsibility;

- analyze events in the external environment;

- engage in many other aspects of the job necessary to gain complete control over the activities of your enterprise.

That is why most of the company boss’s working time is occupied by a myriad of small, but at the same time significant matters - analyzing reports, taking inventory and many other things that quietly, bit by bit, “eat up” the day, not allowing the manager to fully engage in more global tasks .

Using primitive methods of collecting information, the head of the organization cannot obtain relevant and timely data on issues that interest him at the moment, including, as a rule:- demand for certain types of services and products;

- current assortment;

- production rates.

What about accounting? Has it already lost its effectiveness?

Of course not. It’s just that, first of all, accounting is carried out for external users - tax and other authorities for the purpose of reporting. The disadvantage of accounting is that it is not manager-oriented.

Using only accounting methods, a top manager is simply not able to “see at a glance” the full picture of the enterprise’s business activities, which means he will not be able to correctly assess what the prospects for its development are and quickly respond to events in the work process. Accounting reports only allow the boss to state what happened, but, as you know, no one has ever succeeded in turning back time to avoid mistakes (and in business this is always lost profit).

Effectively managing a company using solely accounting data is very difficult, since accounting standards require documentary evidence of any, even the most insignificant information, and accounting employees regularly perform their duties. However, if any document is missing or it is incorrectly executed, then there will simply be no accounting record about it. As a result, the manager will either receive distorted information or not receive it at all. For example, due to a delay in the invoice or invoice, the manager will not know that a commercial transaction has been carried out, although the goods may have already been shipped.

Such accidents not only make continuous monitoring of expenses and income problematic, but can also cause disruptions in the sale of products - shortages or, on the contrary, overstocking.

Introduction of management accounting at the enterprise- one of the most effective solutions to all problems that arise in the company. Therefore, it has long been successfully used in the West, and is now actively used in Russia.

The use of management accounting methods makes it possible to promptly detect errors when a company carries out its business activities, quickly correct them, and make the right decisions based on the information received.

Setting up management accounting is what any company needs

What is management accounting?

Management accounting is understood as a data collection system, which, along with accounting, carries out their measurement, registration and generalization.

What is classical management accounting?

This is the management of company expenses with their distribution between central financial districts. In one form or another it is present in any organization.

Why is management accounting sometimes also called forecasting?

This is due to the fact that accounting demonstrates what has already happened, and management, based on planning and forecasting, shows how it should be.

What is the difference between management and accounting systems?