Payments in currency 1s 8.3. Accounting for foreign currency earnings under the simplified tax system. Examples. Sale of foreign currency earnings

This article will cover the main cases of exchange rate differences, as well as how to reflect exchange rate differences in 1C 8.3.

According to clause 4 of PBU 3/2006, the value of assets and liabilities in foreign currency or cu. for display in accounting and reporting, it is recalculated into rubles. The difference in grade that arose as a result of this is called coursework.

According to clause 5 of PBU 3/2006, recalculation is carried out at the official exchange rate to the ruble, i.e. at the rate of the Central Bank of the Russian Federation or at another possible rate, if such a rate is established by agreement of the parties. Another rate by agreement of the parties may be, for example, USD + 1%.

Funds are subject to recalculation (in the bank, at the cash desk), as well as the value of the “debtor” and “creditor”* in foreign currency, which is carried out according to the following rules:

- By the date of receipt or write-off of DS in foreign currency/repayment of obligations;

- By reporting date, i.e. on the last day of the month.

*Advances issued and received in this structure are not subject to revaluation.

The difference resulting from the recalculation will be reflected in accounting as other income or expenses (depending on whether it is negative or positive) in 91 accounts. In the tax (profit tax) it is reflected as non-operating income or expense in the same account, but in the simplified tax system it will not be reflected.

Setting up accounting for exchange rate differences in 1C 8.3

To set up exchange rate differences in 1C 8.3, first of all you need to correctly set the details of the agreement with the counterparty. In this case we are talking about contracts expressed in currency.

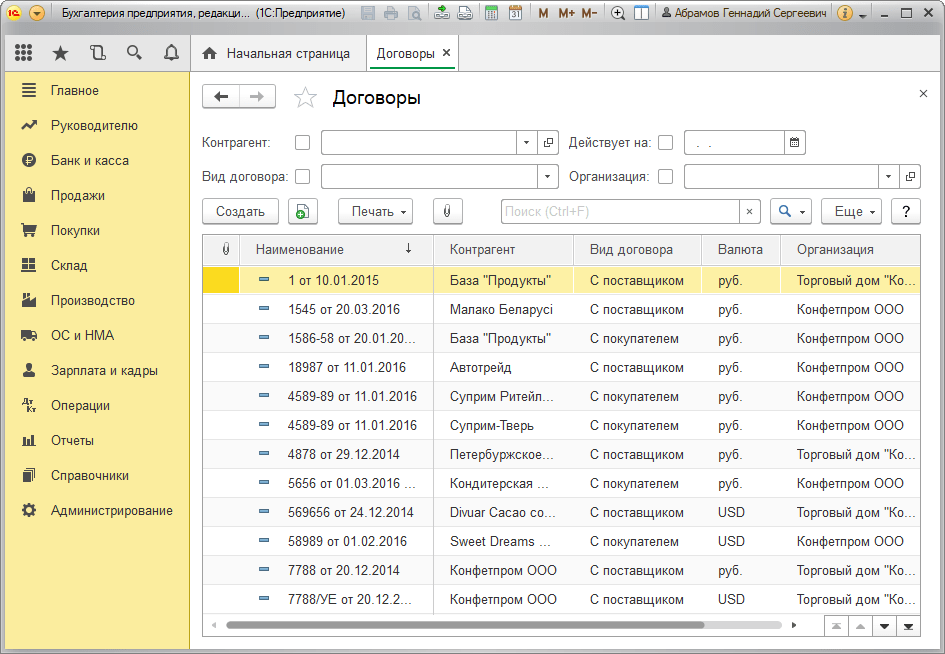

In 1C: Accounting 8.3, an agreement with a counterparty can be found using the “Agreements” link in the “Counterparties” directory element or in the “Agreements” directory. Both directories are located in the “Directories – Purchases and Sales” section.

Figure 1 – Section “Agreements” of the directory element “Counterparties”

Figure 2 – Directory “Contracts”

Let's consider two cases of concluding contracts in foreign currency.

If it is concluded with a resident, mutual settlements can only occur in rubles, because in accordance with the Law of December 10, 2003 No. 173-FZ “On Currency Regulation and Control,” currency transactions between residents are prohibited.

In the 1C 8.3 program, setting up an agreement with a resident expressed in currency will look like this. In the "Calculations" section for details "Price in" the currency value will be set, and the switch "Payment in" rubles will matter.

Figure 3 – Agreement settings with a resident

An agreement with a non-resident implies the possibility of mutual settlements in foreign currency, because in accordance with the Law of December 10, 2003 No. 173-FZ, non-cash currency transactions between residents and non-residents can be carried out without restrictions.

In the 1C 8.3 program, setting up an agreement with a non-resident expressed in currency will look like this. In the "Calculations" section for details "Price in" and switch "Payment in" the currency value will be set.

Figure 4 – Contract settings with non-residents

If the details are configured correctly and the downloaded courses are current*, all the data necessary for calculations will be filled in in 1C documents automatically.

*Rates can be loaded manually or automatically into the “Currency Rates” information register.

To manually download, open the “Currencies” directory in the “Directories/Bank and Cash Desk” section and click “Download exchange rates.”

Figure 5 – Directory “Currencies”

You can add a new currency to the directory using the “Create – New” button or select the required one from the classifier using the “Create – By Classifier” button.

Figure 6 – Adding currency from the classifier

For automatic loading, the settings of the scheduled task of the same name are performed.

Accounting for exchange rate differences in 1C 8.3

So, if the listed settings in the 1C program are made correctly, then the exchange rate difference is reflected automatically:

- By date of operation, through the document that registers this transaction. For example, through the documents “Receipt/write-off from current account”, “Sales/Receipt of goods”.

- At the end of the month through the “Revaluation of Currency Funds”, which is automatically launched in the “Month Closing” procedure.

Reflection of exchange rate differences in 1C 8.3

Example No. 1. In terms of purchasing goods under a contract in foreign currency

In our example, under the agreement with the supplier, the goods were shipped before payment. This event was recorded using the Goods Receipt document.

Figure 7 – Contract with supplier

Figure 7 – Contract with supplier

The rate in “Goods Receipt” was filled in automatically from the “Currency Rates” information register.

Figure 8 – “Receipt of goods”

Figure 8 – “Receipt of goods”

Figure 9 – Postings for “Receipt of goods”

Figure 9 – Postings for “Receipt of goods”

Payment occurred several days later than shipment and was registered in the program using the document “Write-off from account.” The currency rate in it was filled in automatically from the “Currency Rates” register, the “Amount” variable contains the value of the write-off amount in rubles, the “Settlement Amount” variable contains the value of the write-off amount in foreign currency. The exchange rate on the date of payment is filled in the “Settlement rate” detail.

Figure 10 – Document “Write-off from account”

Figure 10 – Document “Write-off from account”

The posting of the exchange rate difference in this case was reflected in the document “Write-off from the account”, because recalculation of the value of the creditor occurred on the date of repayment of obligations, i.e. on the date of payment.

The exchange rate difference is 702,752.79 - 706,446.64 = |-3,693.85| = 3,693.85 rubles. The resulting value coincides with the value in the posting for the exchange rate difference Dt 91.02 – Kt 60.31 in the document “Write-off from the current account”. Thus, the negative exchange rate difference was reflected in account 91.02 “Other expenses”.

Figure 11 – Postings according to the document “Write-off from account”

Figure 11 – Postings according to the document “Write-off from account”

Example No. 2. In terms of currency trading

As part of the operation currency purchases transfer of DS to the bank is carried out through the document “Write-off from account” (type “Other settlements with counterparties”). The “Account Account” detail contains account 51 “Settlement Accounts”, and the “Settlement Account” – 57.02 “Purchase of Foreign Currency”.

Figure 12 – Transfer of funds to the bank for the purchase of currency from the document “Write-off from account”

Figure 12 – Transfer of funds to the bank for the purchase of currency from the document “Write-off from account”

Figure 13 – Postings “Write off from account”

Figure 13 – Postings “Write off from account”

To credit the purchased currency to an account (respectively, a foreign currency account), it comes from “Receipts to the account” with the operational type “Purchase of foreign currency”. The line “Account” contains account 52 “Currency accounts”, and the “Settlement account” - 57.02 “Purchase of foreign currency”. “Bank rate” contains the exchange rate set by the bank for the purchase of currency. The Central Bank rate is filled in automatically in the details of the same name on the date of the transaction. To display the difference, activate “Reflect exchange rate differences as expenses.”

Figure 14 – Crediting purchased currency to a foreign exchange account through “Receipt to account”

Figure 14 – Crediting purchased currency to a foreign exchange account through “Receipt to account”

DS in the amount of 312,406.05 rubles is credited at the Central Bank exchange rate and is reflected by entries Dt 52 - Kt 57.02 “Purchase of foreign currency”.

Here, the exchange rate difference occurs as a result of the recalculation of the DS on the date of receipt, so it is displayed in the “Receipt on account”.

The exchange rate difference is 312,406.05 - 315,700.00 = |-3,293.95| = 3,293.95 rubles. The resulting value coincides with the value in the posting for the exchange rate difference Dt 91.02 – Kt 57.02 in the document “Receipt to the current account”.

Thus, the negative exchange rate difference was reflected in account 91.02 “Other expenses”. Posting exchange rate differences in 1C:

Figure 15 – Posting for exchange rate differences when purchasing currency in the document “Receipt to account”

Figure 15 – Posting for exchange rate differences when purchasing currency in the document “Receipt to account”

The amount of 320,000.00 rubles transferred for the purchase of currency was more than 315,700.00 spent. Therefore, the balance of funds in the amount of 320,000.00 – 315,700.00 = 4,300 rubles must be credited to the ruble account through the document “Receipt to current account” with the transaction type “Other receipt”.

Operation currency sales carried out in a similar way:

- The transfer of funds to the bank from a foreign currency account is registered in “Write-off from account” with the view “Other settlements with counterparties”. The detail “Account” contains account 52 “Currency accounts”, “Settlement account” - 57.22 “Sales of foreign currency”.

- Crediting of DS from the sale of foreign currency to a ruble account is carried out through “Receipt to the current account” with the type of operation “Receipts from the sale of foreign currency”. “Accounting account” and “Settlements account” contain accounts 51 and 57.22, respectively.

Example No. 3. In conditions of recalculation on the final day of the month

As part of the routine operation “Revaluation of foreign currency”, the document is automatically launched in the “Month Closing” procedure, located in “Operations/Period Closing” or in “Operations/Period Closing/Routine Operations”.

Figure 16 – “Month Closing” procedure

Figure 16 – “Month Closing” procedure

When performing the routine operation “Revaluation of foreign currency”, the value of balances is translated into rubles for all accounts with the sign of currency accounting at the rate of the Central Bank of the Russian Federation in the directory “Currencies”. When revaluing foreign currency funds, the balance in foreign currency is considered unchanged.

Figure 17 – Transactions of currency revaluation

Figure 17 – Transactions of currency revaluation

Balances in the regulated accounting currency (rubles) are calculated at the rate indicated in the “Currencies” directory at the time of revaluation, therefore, before the operation, you should make sure that the current rates of the currencies used are established on the desired date of the reporting period (the final day of the month).

Since January 1, 2015, the concept of “amount difference” has been excluded from the tax legislation of the Russian Federation. Deviations in amounts caused by changes in the foreign exchange rate established by the Central Bank or by agreement of the parties, when recalculating claims expressed in foreign currency and payable in rubles, are subject to the requirements of tax legislation established for exchange rate differences in Art. Art. 250, 265, 271 and 272 of the Tax Code of the Russian Federation.

In this article, we will look in detail, using a simple example, at how, from January 1, 2015, settlements with the buyer for goods supplied are reflected in the accounting records of the supplier organization, if the contract price of the goods is established in foreign currency, and settlements are made in rubles. To demonstrate the above example, we will use the 1C: Accounting 8 edition 3.0 program.

According to Art. 506 of the Civil Code of the Russian Federation, under a supply contract, the supplier-seller engaged in business activities undertakes to transfer the goods produced or purchased by him to the buyer within a specified period or terms.

The buyer pays for the supplied goods in compliance with the procedure and form of payment provided for in the supply agreement (Clause 1, Article 516 of the Civil Code of the Russian Federation).

In accordance with paragraph 2 of Art. 317 of the Civil Code of the Russian Federation, a monetary obligation may provide that it is payable in rubles in an amount equivalent to a certain amount in foreign currency or conventional monetary units. In this case, the amount payable in rubles is determined at the official exchange rate of the relevant currency or conventional monetary units on the day of payment, unless a different rate or another date for its determination is established by law or by agreement of the parties.

Let's look at an example.

The organization "Rassvet" applies the general taxation regime - the accrual method and PBU 18/02 "Calculation of corporate income tax." The organization is a payer of value added tax.

On January 20, 2015, the Rassvet organization shipped goods to the Buyer organization. In accordance with the agreement, the price of the goods is set in foreign currency and is 1000 euros plus VAT 18% (180 euros).

Payment for the goods, in accordance with the contract, must be made in rubles at the official euro exchange rate on the day of payment plus 5%. The buyer paid for the goods on February 13, 2015. Euro exchange rates (conditional) on the date of shipment of goods, at the end of the month January and on the date of payment are presented in the table in Fig. 1.

Since the agreement of the parties defines a special (original) rate of payment for goods (euro + 5%), the first thing that needs to be done in the program is to create a new currency (conventional unit), which will be linked to the rate of another currency (euro).

To do this, you need to create a new element in the Currencies directory (we will call it “Euro + 5%”) and use the switch to indicate that it is associated with the rate of another currency - EUR, and the markup is 5%. An example of a created element in the Currencies directory is shown in Fig. 2.

Next, you need to correctly draw up an agreement with the buyer, let’s call it the UE Agreement. The type of contract, naturally, should be “With the buyer”, and in the Calculations section it is necessary to indicate that the prices in the contract are in currency (conventional unit) - EUR + 5%, and payment is in rubles.

An example of filling out the form for the Contracts directory element is shown in Fig. 3.

To perform the operation of shipping goods to the buyer, we will use the document Sales of goods and services with the Goods operation.

In the header of the document, we will indicate the counterparty-buyer and select the Agreement we have formed in the UE. In the upper right part of the document, in the Prices link in the document, the currency used in accordance with the agreement (EUR + 5%) and its exchange rate on the date of sale will be reflected. In accordance with our example, the rate of a conventional unit (cu) is determined as the official euro rate plus 5%: EUR rate + 5% = 74.00 rubles. * 105% = 77.70 rub.

In the tabular part of the document we will indicate the product being sold, its quantity and cost. In accordance with the contract, the cost of the goods is 1000 USD. (euro + 5%) plus VAT 18% (180 USD).

When carried out, the document will write off the goods sold (Dt 90.02.1 “Cost of sales for activities with the main tax system” - Kt 41.01 “Goods in warehouses”), accrue the buyer’s debt and recognize revenue (Dt 62.31 “Settlements with buyers and customers (in y. e.)" - Kt 90.01.1 "Revenue from activities with the basic taxation system") and will charge VAT (Dt 90.03 "Value Added Tax" - Kt 68.02 "Value Added Tax"). The document will also create an entry in the sales book (Sales VAT accumulation register).

The document Sales of goods and services and the result of its implementation are presented in Fig. 4.

In accordance with the presented transactions, the buyer's debt in rubles at the time of shipment is 91,686 rubles. (1180 cu * 77.70 rub.) in accounting and tax accounting.

The accrued VAT amount is RUB 13,986.

The seller is required to issue an invoice. The document Invoice issued is created in the usual way, using a link in the footer of the implementation document.

The printed form of the Invoice document issued is shown in Fig. 5.

The tax base for VAT on the sale of goods is determined at the time of shipment as the contractual value of these goods excluding VAT (clause 1 of Article 154 of the Tax Code of the Russian Federation).

In accordance with paragraph 4 of Art. 153 of the Tax Code of the Russian Federation, if when selling goods (work, services), property rights under contracts, the obligation to pay for which is provided in rubles in an amount equivalent to a certain amount in foreign currency or conventional monetary units, the moment of determining the tax base is the day of shipment, when determining tax base, foreign currency or conventional monetary units are converted into rubles at the official exchange rate on the date of shipment. Upon subsequent payment, the tax base is not adjusted. Differences in the amount of VAT incurred by the seller upon subsequent payment for goods are taken into account as part of non-operating income or non-operating expenses in accordance with Art. 250 and Art. 265 Tax Code of the Russian Federation.

In accounting, the recalculation of debt expressed in foreign currency and conventional units, in accordance with clause 7 and clause 8 of PBU 3/2006, is carried out on the date of the transaction in foreign currency (payment date) and the reporting date (end of the month).

When recalculating the value of liabilities, the exchange rate difference is reflected in accounting (clause 11 of PBU 3/2006). The exchange rate difference is subject to credit to the financial results of the organization as other income or other expenses (clause 13 of PBU 3/2006).

For income tax purposes on transactions concluded from January 1, 2015, settlements in conventional units, as well as settlements in foreign currency, are revalued on the date of the currency transaction and on the last day of the month (clause 8 of article 271, clause 10, Article 272 of the Tax Code of the Russian Federation). When revaluing liabilities, the value of which is expressed in foreign currency or conventional monetary units, non-operating income or non-operating expenses are recognized - exchange rate differences (clause 11 of Article 250, subclause 5 of clause 1 of Article 265 of the Tax Code of the Russian Federation).

Posting of the routine transaction Revaluation of foreign currency at the close of the month January is presented in Fig. 6.

More detailed information on the revaluation of foreign currency can be obtained from the corresponding calculation certificate. When setting up this certificate, we will indicate that we want to receive accounting and tax accounting data, taking into account permanent and temporary differences.

From the certificate we see that the buyer’s debt is 1180 cu, the exchange rate of a conventional unit as of January 31, 2015 is equal to 81.90 rubles. (EUR rate + 5% = 78.00 rubles * 105%), the amount of debt in rubles before revaluation is equal to 91,686 rubles. The euro exchange rate has increased since the goods were shipped, the debt in rubles after revaluation is 96,642 rubles. (1180 cu * 81.90 rub.). The amount of debt in rubles as a result of revaluation increased by 4956 rubles. (96,642 rubles - 91,686 rubles), therefore, other income is recognized in accounting, and for income tax purposes, non-operating income in the amount of 4,956 rubles is recognized.

The reference calculation for the revaluation of foreign currency assets is shown in Fig. 7.

Payment for goods was made on February 13, 2015. Currency rate on this date is 78.75 rubles. (rate EUR + 5% = 75.00 rubles * 105%), therefore, in accordance with the agreement, the buyer transfers 92,925 rubles. (1180 cu * 78.75 rub.).

As we have already noted, in accounting since 2015, for income tax purposes, the recalculation of debt expressed in conventional units is carried out on the date of the transaction (in our case, the date of payment).

To reflect the transaction of payment of debt by the buyer, the program uses the document Receipt to the current account with the transaction type Payment from the buyer.

The header of the document indicates the payer-buyer and the amount of funds transferred by him.

In the tabular part of the document, select the agreement in accordance with which the payment was made. Debt repayment can be set either Automatically or By document. All other details in the table section will be filled in automatically.

When carried out, the document will revaluate the debt in conventional units in accounting and tax accounting, close the debt and capitalize the funds.

The document Receipt to the current account and the result of its implementation are presented in Fig. 8.

The buyer's debt is 1180 cu, the exchange rate of a conventional unit as of the date of the last revaluation (January 31, 2015) was 81.90 rubles. (EUR rate + 5% = 78.00 rubles * 105%), the amount of debt in rubles was 96,642 rubles. At the time of payment, the euro exchange rate dropped to 75.00 rubles. Accordingly, the rate of our conventional unit decreased - 78.75 (rate EUR + 5% = 75.00 rubles * 105%). The amount of debt in rubles on the date of payment is 92,925 rubles. (1180 cu * 78.75 rub.). As a result of revaluation, the amount of debt in rubles decreased by 3,717 rubles. (96,642 rubles - 92,925 rubles), therefore, other expenses are recognized in accounting, and for income tax purposes, non-operating expenses in the amount of 3,717 rubles are recognized.

Let's check the closure of the debt account - 62.31. The Account balance sheet report is presented in Fig. 9.

Let's see how regulated reporting is completed.

In accordance with paragraphs. 11th century 250 of the Tax Code of the Russian Federation, a positive exchange rate difference relates to non-operating income and is reflected in line 100 of Appendix 1 to Sheet 02 of the Profit Tax Declaration.

In accordance with paragraphs. 5 p. 1 art. 265 of the Tax Code of the Russian Federation, negative exchange rate differences relate to non-operating expenses and are reflected in line 200 of Appendix 2 to Sheet 02 of the Profit Tax Declaration.

A fragment of the income tax declaration of the organization “Rassvet” for the first quarter of 2015 is presented in Fig. 10.

A fragment of the VAT Declaration of the organization “Rassvet” for the first quarter of 2015 is presented in Fig. eleven.

- Select a course - Microsoft Office Excel course - 16 hours Microsoft Office PowerPoint course - 18 hours Intensive seminar Technology of creating financial models in EXCEL - 8 hours Express seminar Applied budgeting for beginners - 8 hours General 1C Operator course - 26 hours 1C Operator course - 16 hours 1C course Accounting 8 ed.3.0. Practical mastery of accounting from the very beginning - 80 hours Course 1C Accounting 8 ed.3.0. Using the configuration - 32 hours Course 1C Accounting of a public institution 8 - 24 hours Course Step-by-step transition to new standards of budget accounting in 1C: Accounting of a state institution 8 - 16 hours Seminar 1C Features of VAT accounting in the 1C program: Accounting of an enterprise 8 (version 3.0) - 8 hours Seminar Calculations with accountable persons: from theory to practice in 1C:Accounting 8 - 6h Seminar Accounting for foreign employees in 1C:ZUP 8 - 8h Seminar Children in 1C:ZUP 8 - 8h Seminar VAT and income tax 2019 - 7h Seminar Salary 2019 - 7 h. Seminar Financial analysis for an accountant - 7 h. Seminar Accounting for foreign economic activity operations - 7 h. Course 1C Errors in accounting - find and neutralize! - 9h Course 1C Simple transition to VAT 20% - 5h Course 1C VAT accounting (value added tax) - 24h Course 1C Accounting 8. First steps - 10h Course 1C Salary and personnel management 8. First steps - 10h Course 1C Trade Management 8 First steps - 10 hours Course 1C:Enterprise 8 Automation of tax accounting - 24 hours Course Theory of accounting for beginners - 24 hours Course 1C Trade Management edition 11.3 - 40 hours Course 1C Trade Management 8, edition 11. In-depth study of the program's capabilities - 32 hours Course 1C Personnel Management 8 - 16 hours Course 1C Salary and Personnel Management 8 ed. 3.1 - 32h Course 1C Theory and practice of payroll calculation in 1C Enterprise 8 - 80h Course 1C Salaries and personnel of a budgetary institution - 32h Course Personnel accounting in 1C: Salary and Personnel Management 3.0 - 24h Express course Management accounting in 1C: Salary and management CORP staff - 6 hours Course 1C Retail 8. Using configuration - 20 hours Course 1C: Complex automation 8 - 40 hours Course 1C: Complex automation 8. Trading operations - 24 hours Course 1C: Complex automation 8. Regulated accounting - 32 hours Course Operational management in small businesses with using the 1C program Managing our company 8, ed.1.4 - 24h Course 1C: Document flow 8 – 16h Course 1C UPP 8. (ed. 1.3) Concept and trading functionality - 24h Course 1C UPP 8. (ed. 1.3) Planning and Budgeting - 16h Course 1C UPP 8. (rev. 1.3) Regulated accounting, Personnel, Salary - 24 hours Course 1C UPP 8. (rev. 1.3) Production accounting - 16 hours Course Concept of the 1C:ERP application solution Enterprise management 2 - 24 hours Course Management of production and repairs in the 1C:ERP application solution Enterprise management 2 - 32 hours Course Management cost accounting, financial results in the applied solution 1C:ERP Enterprise management 2 - 24 hours Course Concept of the applied solution 1C:ERP Enterprise management 2 - 24 hours Course Content manager 1C-Bitrix: Site management. Basic course - 16 hours Course 1C-Bitrix Administrator: Site Management" and "1C-Bitrix24: Corporate Portal" - 16 hours Course 1C-Bitrix Developer: Site Management" and "1C-Bitrix24: Corporate Portal" - 16 hours 1C-Bitrix Developer Course: Site Management" and "1C-Bitrix24: Corporate Portal. Level 2" - 16 hours Course 1C Enterprise. Introduction to configuration - 24 hours Course Basics of programming in the 1C:Enterprise 8.3 system - 24 hours Course Tools for integration and data exchange in the 1C Enterprise system 8 - 24 hours Course Using the query language in the 1C Enterprise system 8.3 - 24 hours Course 1C Data composition system - reporting in the "1C:Enterprise 8" system - 24h Course Administration of the 1C:Enterprise 8 system - 32h Course 1C Accounting when applying a simplified taxation system in 1C:Accounting 8 - 24h Course 1C:Enterprise 8. Solution of operational issues tasks - 16 hours Course 1C Configuration in the 1C:Enterprise system 8.3 Solving accounting problems - 24 hours Course 1C Configuration in the 1C:Enterprise system 8. Solving calculation problems - 20 hours Course Basics of graphic design in Adobe Photoshop for beginners - 16 hours Course Practical application of BIT.FINANCE in parts of the Treasury and Budgeting subsystems - 32 hours Course Practical settings of the translation mechanism IN BIT.FINANCE - 16 hours CSO course “Practice of using the 1C: Accounting 8 program at manufacturing enterprises - 16 ac. Parts CSO course Practice of using the “1C: Accounting 8” program in trade - 16 hours CSO course Practice of using the “1C: Accounting 8” program in the service sector - 16 hours Course Practical application of BIT.FINANCE in terms of IFRS and Consolidation subsystems - 24 hours Course Practical application BIT.FINANCE in terms of the Contract Management subsystem - 16 hours Course BIT.CONSTRUCTION module Contractor - 16 hours Course BIT.CONSTRUCTION.Salaries - 4 hours Course BIT.CONSTRUCTION module "Supply and warehouse" - 16 hours Course Quick start in the program "BIT. Housing and communal services 8" - 8h Course Benefits and recalculations in the BIT program. Housing and communal services 8" - 8h Course Integration of BIT. Housing and communal services and "1C: Accounting Prof" - 8h Seminar 1C: Trade Management 8 rev.11.3 for warehouse employees and operators 1C - 8h Seminar 1C: Trade Management 8 rev.11.3 for warehouse employees and operators 1C - 8h Seminar 1C: Trade Management 8 rev.11.3 for warehouse employees and operators 1C - 8h Seminar 1C Tax accounting and reflection of PBU 18/02 in the 1C: Accounting program 8 - 5h Seminar Features of VAT accounting in the 1C program Enterprise Accounting 8 ( edition 3.0) - 10 hours Seminar Advanced accounting of fixed assets in the 1C Accounting program 8 edition 3.0 - 6 hours Seminar of UPP for an accountant - 6 hours Course 1C: Salaries and personnel management. Transition from 2.5 to version 3.1 Programming school for children Educational literature on 1C Participation in the promotion, difficult to answer / another courseUntil 01/01/2015 tax accounting provided for two types of differences associated with changes in exchange rates:

- Exchange notes under contracts concluded and paid in foreign currency, which were formed due to changes in the official exchange rate established by the Central Bank of the Russian Federation;

- Amounts under contracts, the cost of which is expressed in conventional units, and payment is made in rubles at the rate agreed upon by the parties.

These differences were taken into account in different ways:

- Exchange differences were recognized on the date of repayment of obligations or on the last day of the reporting (tax) period, whichever occurred earlier.

- Amount differences were calculated only on the date of debt repayment, and in the case of prepayment on the date of sale of inventory and materials. At the same time, these differences in terms of VAT upon subsequent payment of goods were not adjusted, but were included in the non-operating income (expenses) of the taxpayer.

For transactions concluded before 01/01/2015, this procedure has been preserved, so let’s look at an example of how amount differences are taken into account in such a case.

Step-by-step instructions for accounting for transactions in monetary units concluded before 01/01/2015 in 1C 8.3

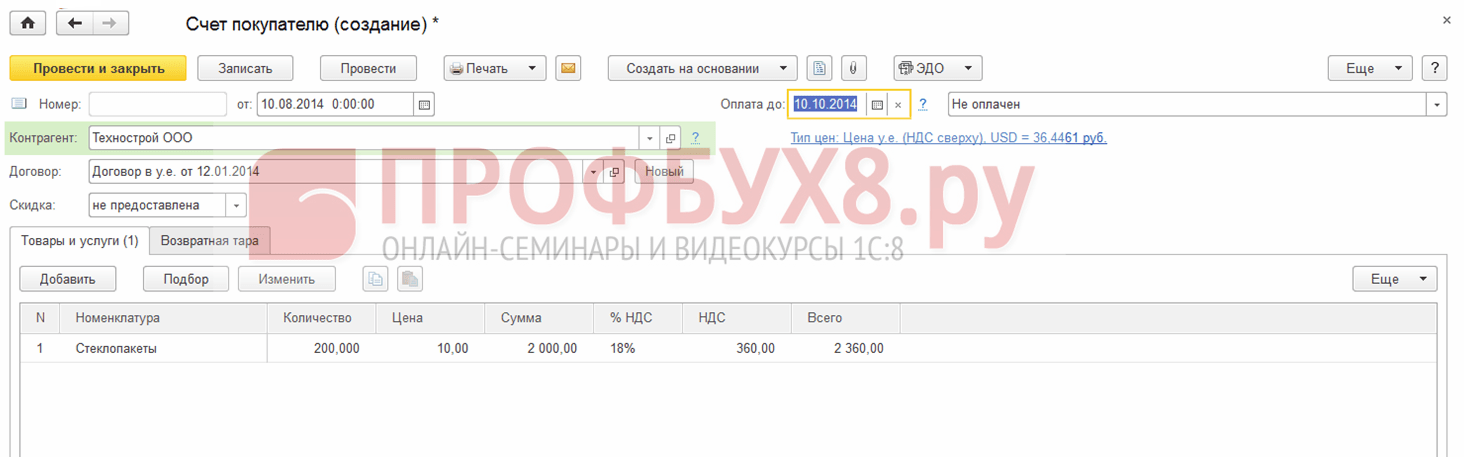

Let's look at an example. 08/10/2014 Remina LLC shipped goods to the buyer Tekhstroy LLC in the amount of 2,360 USD, including VAT 360 USD. According to the agreement dated January 12, 2014. Payment is made in rubles at the exchange rate of the Central Bank of the Russian Federation on the date of payment. The goods were paid for on September 15, 2014.

Step-by-step instructions for accounting for this transaction are presented in the table below:

Step 1

Let's draw up an agreement for this transaction in 1C 8.3:

It is important to install the appropriate functionality of the program:

Let's create the document Invoice to the buyer in the section Sales → Invoices to buyers → Create:

We download exchange rates in 1C 8.3 from the Internet:

Step 2

We will reflect the shipment of goods in the 1C 8.3 program. The document Sales of goods can be generated based on the Invoice to the buyer or from the Sales section:

Wherein:

- The exchange rate of the Central Bank of the Russian Federation is 36.4461 rubles;

- We enter the issued invoice using the link in the Sales of goods document:

Let's check the transactions according to the document (DtKt button):

We see that 1C 8.3 reflects revenue in rubles and dollars. Let's check the Sales Book (section Reports). We see that revenue and VAT are reflected correctly:

Step 3

Knowing that exchange rate differences, in case of non-repayment of debt, are calculated at the end of the reporting period, we will generate a document Closing the month for August 2014. The rate of the Central Bank of the Russian Federation is 36.9316 rubles:

Please note that a link has appeared in the menu. By opening the Show transactions command using this link, we will see that the accounting records reflect the exchange rate difference in the amount of 1,145.78 rubles, which was formed due to changes in the exchange rate as of 08/31/2016. :

Since the exchange rate difference is not reflected in tax accounting, but there are differences in accounting and tax accounting, a temporary difference arises. In our case, this is a constant difference, on the basis of which a deferred tax asset is accrued in the amount of 229.16 rubles. (1,145.78 × 0.2 = 229.16 rubles) In 1C 8.3, this can be checked using a certificate - calculation of tax assets and liabilities.

Let's move on to the routine operation Closing the month:

In 1C 8.3 the calculation was made correctly:

Step 4

We will reflect in the 1C 8.3 program the payment for goods dated September 15, 2014. Go to the section Bank and cash desk → Bank statements → Receipt to the current account. The exchange rate of the Central Bank of the Russian Federation was 37.6545 rubles:

We see that in tax accounting the amount difference was formed as the difference in revenue at the exchange rates on the dates of payment and shipment, respectively: )

Sign of cutting your finger: who thinks about you

Sign of cutting your finger: who thinks about you Fortune telling on coffee grounds: Flower - Meaning of the symbol

Fortune telling on coffee grounds: Flower - Meaning of the symbol Methods of fortune telling for the loss of a lost item

Methods of fortune telling for the loss of a lost item Soup with beans and chicken

Soup with beans and chicken Tuscan white bean soup

Tuscan white bean soup Test “Are you a conflict-ridden person?”

Test “Are you a conflict-ridden person?” Baby meatballs with gravy

Baby meatballs with gravy