Commissioning works PNRM. Commissioning works. General information Commissioning of electrical equipment

An integral part of the production and technological process are highly focused special activities known as commissioning. In the process of carrying out these activities, the equipment is checked for failure-free operation and safety, the possibility of putting it into operation and bringing it to its design parameters. First of all, the documentation of the project to be verified is reviewed. Equipment is checked and tested in case of possible failures and emergency situations. In addition, this also includes a lot of additional work performed in the process of preparing and conducting individual tests of the entire equipment complex.

The procedure for commissioning work

Commissioning work is carried out after the equipment is installed. The main objective of these activities is to comprehensively test the installations being tested. During the inspection, the degree of their safety and reliability and compliance with the declared design characteristics are determined. Based on the results of the work, all identified deficiencies that impede the normal operation of the equipment are eliminated.

Installation and commissioning work is carried out by specialized organizations with which the enterprise enters into a business agreement. If the enterprise has trained engineering and technical personnel and the necessary instrumentation, then this work can be performed in-house. These workers belong to the category of operational personnel. They must complete a training course. After passing the exam, a protocol is drawn up and a certificate is issued for the right to perform commissioning work. For workers, repeated knowledge testing is carried out annually, and for engineering and technical workers - once every 3 years.

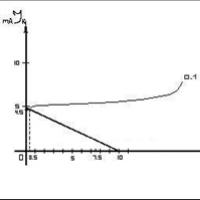

Commissioning work ends with the preparation of a technical report, reflecting all the stages completed, with conclusions and recommendations for further improvement of the operation of equipment and installations. Thus, this report is the main document characterizing the volume and effectiveness of the work performed. Practical experience shows that the cost of commissioning and commissioning activities pays off already in the first months of operation. For example, the results of calculations and comparative tests show that due to proper start-up and adjustment, fuel savings can be 3-5%.

To carry out commissioning work, a team of specialists is involved, who must be supervised by a qualified engineer. The number of workers is determined in accordance with the volume of work to be done, usually no more than 5 people. The main activities are carried out by engineering and technical workers, and enterprise personnel are used for auxiliary work.

For each type of equipment, a commissioning program is drawn up, agreed with the management of the enterprise. During its development, the main attention is paid to practical experiments, during which individual components are tested, design flaws are identified, and the quality of installation is determined. Great importance is attached to experiments to test the reliability of operation of all types of equipment and its ability to maintain specified parameters. The maximum value of the unit’s performance and the stability of its operation at low loads are determined.

Such checks are carried out in sufficient quantities to draw up an approximate regime map, which takes into account the entire range of operational loads. To determine some parameters, instrumentation of the equipment itself is used.

At the end, the most important activity is carried out to comprehensively test the equipment and put it into operation. This operation is carried out only with the permission of the adjuster group leader. No one should interfere with his orders, except in cases where there is a threat to the safe operation of the equipment and operating personnel.

Electrical commissioning works

Commissioning work is carried out at the final stage of electrical installation work. During this period, electrical equipment is tested and checked for compliance with the design, current PUE, technical specifications and documentation of the manufacturer. All units must comply with the declared technological indicators. After all settings, testing and testing have been carried out, conclusions are issued on the performance of the entire installation and each of its components.

Our organization will perform a wide range of such work in a short time and with high quality, including commissioning of electrical equipment systems. The company’s specialists will carry out activities in several stages:

- Receiving from the customer and thoroughly studying the technical characteristics of installations, technical documentation and the electrical part of the project, its relationship with technological processes.

- Preparation of a work program and project for commissioning work, including measures related to safety precautions, coordinating them with the customer.

- Analyzing finished documentation, identifying shortcomings and other comments.

- Preparation of instructions, technological maps and guidelines on commissioning issues. Particular importance is attached to protocols and other forms of reporting documentation, preparation of the necessary tools, instruments and devices.

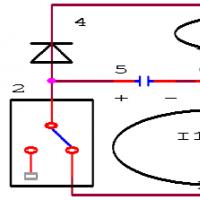

After the preparatory period, commissioning activities are carried out jointly with. A timing circuit is used to supply voltage to the equipment. When combining work, special attention is paid to compliance with safety regulations. By this time, all construction work, heating, lighting and ventilation in the rooms with electrical equipment have been completed. The electrical equipment itself is already installed and grounded. Wells, openings and cable channels were closed.

At this stage, the installed electrical equipment is tested by applying voltage through test circuits to individual devices. When performing this operation, electrical installation personnel should not be in the adjustment area. If defects in electrical equipment are identified, they are eliminated by the customer, and installation errors and shortcomings are eliminated by the electrical installation organization. Based on the results of the second stage, the company’s employees draw up the following documents:

- Protocol of tests and measurements of insulation.

- Protocol.

- Protocol for setting up protection and relay contactor equipment.

- Executive diagrams of objects subject to power supply, connected to voltage.

At the next stage, individual tests of electrical equipment are carried out, in which voltage is supplied according to the normal operating circuit. First of all, for electrical installations, the operating mode is entered and personnel permits are issued in accordance with safety regulations. After this, the adjusters adjust the equipment parameters, test the protection, control and alarm circuits. Before testing process equipment, it is necessary to set up and check the operation of electrical equipment at idle speed.

After the company’s specialists conduct individual tests, the electrical equipment will be considered accepted for operation. Based on the test results, all necessary documents will be drawn up and handed over to the customer:

- Protocols for testing grounding and grounding.

- Test reports for electrical equipment at elevated voltage.

- Basic executive diagrams, as in the previous stage.

The remaining documentation is provided to the customer within two months after the equipment is put into operation. For objects of increased technical complexity, this period increases to four months. At the end of this stage, a technical readiness report is drawn up for comprehensive testing of electrical equipment.

Comprehensive testing is carried out according to special programs agreed with the customer. This activity tests the interaction of electrical systems and electrical circuits under various operating conditions. Parameters in individual devices and functional groups are regulated and configured, their mutual connections are ensured, and specified operating modes are created. Electrical installations are tested according to a complete scheme, which makes it possible to prepare and conduct comprehensive testing of process equipment.

Commissioning of equipment

In order to put the installed technological equipment into operation, it is necessary to carry out commissioning work. The volume of these activities can be up to 20% of the entire project. These works are carried out at the final stage, before putting the equipment into operation.

In our organization, we efficiently and quickly carry out commissioning work on all major types of equipment. The company’s specialists will competently carry out the following activities:

- They will check the compliance of the design documentation with the actual execution.

- They will prepare and test production lines.

- Perform inspection, testing and calibration of various instruments and automation.

- They will test individual components and assemblies, auxiliary systems, and run-in dynamic equipment.

- Organize activities for comprehensive testing of the facility and its commissioning.

- They will train personnel for subsequent operation of the equipment.

As a rule, the organization of commissioning work at any facility is carried out at the last stage of construction and installation work. Already during this period, engineers discover possible inconsistencies between the design documentation and the installed equipment. Because of this, malfunctions may occur in the future, so it is very important to eliminate all shortcomings in a timely manner. This stage is of great importance and guarantees reliable operation of the facility in the future.

Our commissioning organization offers a full range of services, from setting up individual technological elements to complex facilities in various industries.

Commissioning works include a set of works performed on the process equipment of the compressor station, electrical devices, automation equipment and other equipment, carried out during the preparation and conduct of individual tests and comprehensive testing.

Under period of individual tests is understood as a period including installation and commissioning work that ensures compliance with the requirements stipulated by the design documentation, standards, and technical specifications of manufacturers, in order to prepare the equipment for acceptance by the working commission for comprehensive testing.

Under period of comprehensive testing CS equipment is understood as a period including commissioning work performed after acceptance of the equipment by the working commission for comprehensive testing and carrying out the most comprehensive testing before the facility is accepted into operation by the acceptance committee.

The complex of commissioning works includes the following equipment: mechanical, electrical, instrumentation and automation, communications, process control systems, thermal power equipment and other types of equipment and systems.

At the design stage of a compressor station, the composition of the start-up complex is determined. Possible changes to the start-up complex made during the construction of the CS must be documented in the appropriate manner, since commissioning and then acceptance into operation of the CS, the start-up complex of which has been amended in violation of the established procedure, is not allowed.

The date of commissioning of individual buildings, structures, premises included in the facility is considered the date of signing the act of acceptance of these facilities and structures by the working commission. The date of commissioning of the facility as a whole is considered to be the date of signing the act by the acceptance committee.

Work prior to commissioning . The contractor and subcontractors must complete construction and installation work on the main and auxiliary equipment. In addition, installation must be completed:

Pipelines;

Shut-off valves;

Power cables;

Instrumentation and automation panels;

Automation and security equipment;

Fire and drinking water supply systems, foam and carbon dioxide fire extinguishing systems;

Ventilation, heating, sewerage, lighting systems;

Communication structures;

Cathodic protection stations, installation grounding devices, power supply devices for protection circuits and control units of direct and alternating current, as well as their inspection, cleaning, purging, testing for strength and density in accordance with the requirements of the instructions of equipment suppliers, gas inspection, SNiP and project requirements.

Adjustment and commissioning works. This work includes setting up:

Systems of gas pumping units in mechanics, instrumentation and automation

electrical;

External and internal power supply systems and electrical equipment;

Process gas preparation systems;

Scrubbers, filter separators, gas air coolers, etc.;

Gas shut-off and control valves, including security

Installations for launching a gas pipeline cavity cleaning and diagnostic system;

Fuel, starting, pulse gas preparation units and gas reduction point for own needs;

Station-wide oil storage and regeneration systems and antifreeze preparation systems;

Systems for supplying compressor stations with compressed air;

Pumping methanol;

Station automated process control system;

Process and gas metering units for the CS’s own needs;

Fire extinguishing systems;

Heat recovery systems;

Boiler houses, heat supply systems and chemical water treatment systems

Emergency power plants and power plants for own needs;

Water supply systems;

Sewage and treatment facilities, pumping stations;

Industrial ventilation and air conditioning systems;

Gas distribution stations;

Telemechanics systems.

Let's consider the main stages of commissioning and commissioning of the facility.

Commissioning of the main process equipment of the compressor station and commissioning of the compressor station is carried out under the guidance of the acceptance committee.

Before the objects and equipment are presented to the acceptance committee, the acceptance is carried out by a working commission appointed by the customer.

Before the start of commissioning work, the working commission is provided with production and technical documentation, which was compiled during the entire period of construction and installation work (working drawings, installation diagrams, acceptance certificates for certain types of work, acts for hidden work, etc.). The operation of facilities and equipment not accepted by the working commission is not permitted.

To check the initial condition of the CS equipment before commissioning and testing, organizations participating in the commissioning must send their representatives before the start-up work as directed by the lead commissioning organization.

The readiness of the installed equipment to perform adjustment work, providing the possibility of individual testing, is documented by a certificate of completion of installation work in the prescribed form.

Before commissioning begins, the acceptance committee does the following:

Determines the readiness of the compressor station equipment or its individual stages (start-up complexes) for commissioning;

Specifies what construction and installation work must be completed before the start of commissioning and commissioning of the compressor station;

Reviews and approves start-up schemes and clarifies commissioning schedules.

Determines the composition of the CS launch complex.

For the entire period of commissioning work, a schedule is drawn up for the phased implementation of this work, conditionally divided into three stages (periods).

First stage - gas is not supplied to the gas communications of the compressor station. At this stage, all commissioning work that does not require gas supply is performed. The task of the first stage is to identify the readiness of the compressor station equipment for unit-by-unit inspection and individual testing. At this stage, the instrumentation and control system of the gas pumping unit is checked and adjusted, the unit’s protection system is checked and commissioned, as well as the power supply system, the oil system of the gas compressor unit and the compressor station.

Second phase - gas is supplied only to the starting and pulse manifolds (gas is not supplied to process and fuel pipelines). At this stage, all commissioning work is performed that does not require gas supply to the process and fuel pipelines. The task of the second stage is unit-by-unit testing and testing of machines and equipment at idle speed to identify faults and prepare the unit for comprehensive testing.

Third stage - gas is supplied to the process, fuel, starting and impulse pipelines of the compressor station. Before commissioning work with the supply of gas to the CS pipelines, a representative of the gas inspection checks the readiness of the CS facilities to carry out commissioning work with gas intake into the pipelines and issues a written permit for this work.

Before supplying process gas to the CS site, all work related to electric and gas welding, as well as work using open fire, must be completed, and commissioning work on plant-wide gas detection and fire extinguishing systems must be completed. These systems must be put into operation. At the third stage, all commissioning work is completed, including operation of units under load and comprehensive testing of the station.

The task of the third stage is a comprehensive testing of the equipment, checking the joint operation of the CS equipment, identifying possible equipment defects that impede the regular and reliable operation of the CS, and developing measures to ensure the reliable operation of the CS.

Commissioning work is considered completed if there are no comments from the acceptance committee regarding the operation of the equipment for 72 hours under a load determined by the operating mode of the gas pipeline, but not exceeding its nominal value.

The end of commissioning work at the compressor station (completion of comprehensive testing of equipment) is the continuous operation of gas pumping units and the constant or alternate operation of all auxiliary equipment of the compressor station according to the design scheme at parameters that allow for normal operation.

The completion of commissioning work is documented by an act of transfer of equipment into operation.

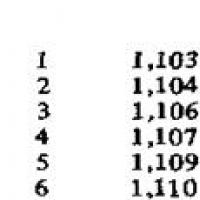

Basis for work

Agreements No. 15B1515 “idle”, No. 15B1515 “under load” of 2015, concluded between CJSC Doninvest and LLC Profkarkasmontazh.

Tasks and purpose of work

Carrying out commissioning of electrical equipment, 0.4 kV network for the purpose of commissioning.

Equipment and work location

The technical solutions adopted in the working drawings comply with the requirements of environmental, sanitary-hygienic, fire-fighting and other standards in force in the Russian Federation, and ensure safe operation of the facility for human life and health, subject to compliance with the measures provided for in the working drawings.

The consumers of the telemechanics control rooms No. 1-10, BKES are powered from the RUNN-0.4 kV switchgear unit of the BKES power supply unit with a capacity of 40 kVA.

The project provides for external lighting and grounding of the platforms and the reinforcement unit and grounding of the platforms of the telemechanics control room No. 1-10

External lighting of the platforms and the reinforcement unit is carried out with ZHKU16-250 lamps.

According to the PUE (clause 1.7.3, edition 7), the project provides for a “TN-S” grounding system (zero protective PE and zero working N conductors are separated throughout).

In accordance with the requirements of VSN 012-88, all cables laid in the ground, as well as an external grounding device, are subject to intermediate acceptance with the drawing up of an act for hidden work.

The equipment for power supply and control of the linear valve is located in a block-packaged power supply device (hereinafter referred to as BKES-1) (see design materials EGI.BKES.005).

BKES-1 includes a complete 10/0.4 kV transformer substation with a 40 kVA dry transformer, a backup power source - a diesel generator (hereinafter referred to as DG) with a power of 35 kW, an automatic transfer switch device (hereinafter referred to as ATS), as well as equipment for auxiliary systems that support life activities ( heating, lighting, fire safety and security alarms).

The BCES block-box consists of three modules (DG block-container, KTP and ECP block-container, TMIS block-container). Each block container (for the KTP block container, ECP - each room) has an auxiliary switchboard (SCSN), containing automatic switches for lighting, heating, module sockets. The circuit breaker and electrical equipment for its own needs are selected by the manufacturer of the BKES. Installation of personal equipment (lamps, sockets, heaters, switches) according to the manufacturer’s design.

The ATS device provides starting of the diesel generator, blocking, excluding the supply of voltage from the backup source to the supply line and returning the circuit to its original state when voltage appears in the supply line. The ATS functions in the RUNN cabinet are implemented by automatic circuit breakers with electromagnetic drives and mutual mechanical interlocking.

* equipment and materials, the type and brand of which are selected by the manufacturer of BKES-1. **for cable lengths, see the drawings according to the list of reference drawings of other kits on sheet 1 of this kit.

In the list of elements, the quantity is indicated for one BKES-1.

Type and length of cables *** from the SHUR ignition control cabinet to the torch tip, see drawings SR-01.04.00.000. These cables are included in the torch installation.

- The type and length of cables ***** from the BUZO obstacle light control unit to the ZOM lights are selected by the supplier of the communication mast (see questionnaire for the communication mast). Lay the cable from the BKES to the communication mast in the ground in a metal pipe. Fastening the cable to the mast according to the documentation of the communication mast manufacturer.

Customer of the work

CJSC "Doninvest"

Contractor

Profkarkasmontazh LLC

Terms and conditions of work

Commissioning work is carried out after completion of construction and installation work at the site, and transfer to the commissioning work, formalized by a 3-party act.

- Methodology of work

Commissioning of 0.4 kV networks includes the following types of work:

1. Preparatory work.

1.1 Before starting work, it is necessary (before leaving for the site):

— Conduct organizational and engineering training, familiarize yourself with design estimates, design and technical documentation, acts of incoming inspection, pre-installation preparation, etc.;

— Issue an order to LLC “Profkarkasmontazh” on the creation of a commissioning team, with the appointment of a responsible manager of work on the facility;

— Carry out safety measures before carrying out work, including obtaining all necessary approvals, permits and approvals from regulatory organizations;

— Develop a commissioning program for the VLZ, coordinate it with the operating organization and CJSC Doninvest.

1.2. Preparatory work at the site, assessment of readiness for acceptance of commissioning equipment (at the site):

— Checking the completeness of the installed main components and parts, the presence of spare parts included in the delivery kit;

— Visual inspection of the installed equipment, checking the compliance of the completed construction and installation work with the Design and Instructions (Installation Guidelines) of the manufacturer;

1.3 Drawing up an inspection report and a defect sheet indicating the time frame for eliminating identified installation defects and equipment incompleteness.

The documentation is drawn up in three copies, of which one copy each is transferred to the construction and installation organization, Doninvest CJSC and Profkarkasmontazh LLC.

1.4 The work performed by Yamalgazinvest CJSC includes:

— Replenishment of missing units and parts;

— Elimination of installation defects (by the construction and installation organization performing the work under an agreement with JSC Yamalgazinvest);

1.5 After eliminating the comments on construction and installation work, equipment, according to the defective list, an acceptance certificate for the overhead line in the commissioning area is drawn up. The act is coordinated with JSC Yamalgazinvest and the Construction and Installation Organization.

- Stage I: Commissioning works.

Commissioning work must be carried out, combined with electrical installation work, with voltage supplied according to a temporary scheme. Combined work must be carried out in accordance with current safety regulations.

The start of commissioning work at this stage is determined by the degree of readiness of construction and installation work: in electrical rooms, all construction work must be completed, including finishing, all openings, wells and cable channels must be closed, lighting, heating and ventilation must be completed, installation of electrical equipment must be completed and completed grounding

At this stage, the commissioning organization checks the installed electrical equipment by supplying voltage from the test circuits to individual devices and functional groups. Voltage must be supplied to the electrical equipment being adjusted only in the absence of electrical installation personnel in the adjustment area and subject to compliance with safety measures in accordance with the requirements of current safety regulations.

Tests and measurements are carried out by ETL personnel according to the following methods:

- Testing of transformers with power up to 10 MVA.

- Transformer oil testing.

- Monitoring the condition of power cable lines with voltage up to 35 kV.

- Testing with increased voltage of industrial frequency insulation of equipment, prefabricated devices and connecting busbars with voltages up to 35 kV.

- Measuring the resistance of grounding devices.

- Measurement of phase-zero loop resistance.

- Insulation resistance measurement.

- Checking contact connections and metal connections of equipment with a grounding device.

- Testing of high-voltage protective equipment in a stationary high-voltage laboratory.

- Testing of valve arresters.

- Testing of power paper-oil capacitors used to improve power factor.

- Testing of circuit breakers up to 1000 V.

- Testing of high-voltage circuit breakers up to 35 kV.

- Testing and adjustment of relay protection devices, automation and secondary circuits of electrical equipment.

- Testing of AC electric motors up to 10 kV.

- Testing of DC electric motors up to 0.4 kW.

- Testing of synchronous generators, compensators and collector exciters up to 5 MW.

- Testing of load switches up to 20 kV.

- Measuring compliance of RCD parameters.

Also used when carrying out work:

— regulations on the ETL of Profkarkasmontazh LLC;

— job descriptions;

— PUE, PTEEP, MPOT, additional instructions valid at the sites of the work performed;

— passports for the devices, installations and their electrical circuits used;

- manufacturer's instructions.

- I I stage

At the second stage of commissioning, the customer must:

— provide temporary power supply in the pre-commissioning area;

— ensure re-preservation and, if necessary, pre-installation inspection of electrical equipment;

— coordinate with the design organizations issues regarding the comments of the commissioning organization identified during the study of the project, as well as ensure designer’s supervision on the part of the design organizations;

— ensure replacement of rejected and supply of missing electrical equipment;

— provide verification and repair of electrical measuring instruments;

— ensure the elimination of electrical equipment and installation defects identified during the commissioning process.

At the end of the second stage of commissioning and before the start of individual tests, the commissioning organization must transfer to the customer in one copy the protocols for testing electrical equipment with high voltage, grounding and setting up protection, as well as make changes to one copy of the circuit diagrams of power supply facilities switched on under voltage.

The question of the advisability of preliminary testing and adjustment of individual electrical equipment devices, functional groups and control systems outside the installation area in order to reduce the time required to put the facility into operation should be decided by the commissioning organization together with the customer, while the customer must ensure the delivery of electrical equipment to the commissioning site and upon completion of commissioning work - to the place of its installation in the installation area.

- II I stage Individual tests.

At the third stage of commissioning, individual tests of electrical equipment are performed.

Voltage is supplied according to a constant circuit, first to the secondary circuits (protection control circuits, alarms, etc.) for testing under voltage in accordance with the rules for the electrical installation of mounted circuits and the interaction of their elements. Then voltage is supplied according to a constant circuit to the power and operational circuits.

An operational mode is introduced at this electrical installation, after which commissioning work should relate to work carried out in existing electrical installations.

At this stage, the commissioning organization adjusts parameters, protection settings and characteristics of electrical equipment, tests control, protection and alarm circuits, as well as electrical equipment at idle speed in preparation for individual testing of process equipment.

The operation of protection of electrical receivers up to 1000 V is checked in a power system with a solidly grounded neutral (checking the resistance of the “phase-zero” loop).

Participation of representatives of commissioning, electrical, mechanical installation organizations and the customer in individual tests is mandatory.

General safety requirements for combined electrical installation and commissioning work in accordance with the current Safety Rules are provided by the supervisor of electrical installation work at the facility. Responsibility for ensuring the necessary safety measures and for their implementation directly in the area of the commissioning work carried out lies with the head of the commissioning personnel.

When carrying out commissioning work according to a combined schedule on individual devices and functional groups of the electrical installation, the working area for the work must be precisely determined and agreed upon with the supervisor of electrical installation work. The working area should be considered the space where the test circuit and electrical equipment are located, to which voltage from the test circuit can be applied. Persons not related to commissioning work are prohibited from accessing the work area.

In the case of combined work, the electrical installation and commissioning organizations jointly develop an action plan to ensure safety during the work and a schedule for the combined work.

At the third stage of commissioning, maintenance of electrical equipment should be carried out by the customer, who ensures the placement of operating personnel, assembly and disassembly of electrical circuits, and also carries out technical supervision of the condition of electrical and technological equipment.

With the introduction of the operational regime, ensuring safety requirements, issuing work orders and permission to carry out commissioning work must be carried out by the customer.

After completing individual tests of electrical equipment, individual tests of process equipment are carried out. During this period, the commissioning organization clarifies the parameters, characteristics and settings of electrical installation protection.

After individual tests, the electrical equipment must be accepted into operation by the working commission with the execution of an act. At the same time, the commissioning organization transfers to the customer protocols for testing electrical equipment with high voltage, checking grounding and grounding devices, as well as executive circuit diagrams necessary for the operation of electrical equipment. The remaining protocols for setting up electrical equipment are transferred in one copy to the customer within two months, and for technically complex objects - within up to four months after the object is accepted into operation.

The completion of commissioning work at the third stage is formalized by a certificate of technical readiness of electrical equipment for comprehensive testing.

- I V stage Comprehensive testing.

At the fourth stage of commissioning work, a comprehensive testing of electrical equipment is carried out according to approved programs.

At this stage, commissioning work should be carried out to set up the interaction of electrical circuits and electrical equipment systems in various modes. The scope of these works includes:

— ensuring mutual connections, adjusting and setting the characteristics and parameters of individual devices and functional groups of an electrical installation in order to ensure specified operating modes on it;

— testing of the electrical installation according to the full circuit at idle and under load in all operating modes in preparation for a comprehensive testing of process equipment.

During the comprehensive testing period, maintenance of electrical equipment is carried out by the customer.

Commissioning work at the fourth stage is considered completed after the electrical equipment has received the electrical parameters and modes provided for by the project, ensuring a stable technological process for the production of the first batch of products in the volume established for the initial period of development of the design capacity of the facility.

The work of the commissioning organization is considered completed subject to the signing of the commissioning acceptance certificate.

- Industrial safety and environmental protection requirements

Qualified personnel of Profkarkasmontazh LLC are allowed to carry out commissioning work, having studied the factory documentation, undergone special theoretical training, practical training and testing of knowledge of general industrial safety requirements established by federal laws and other regulatory legal acts of the Russian Federation, as well as special industrial safety requirements established in the following regulatory documents:

- “Safety rules in the oil and gas industry PB 03-440-02;

- "Safety rules in the oil and gas industry." (PB 08-624-03);

- "Rules for the protection of main pipelines." Fast. Gosgortekhnadzor of Russia dated April 22, 1992. No. 9;

- “Safety rules for the operation of main gas pipelines.” Approved by Mingazprom 03/16/1984;

- “Unified occupational health and industrial safety management system of OJSC Gazprom.” (WRD 39-1.14-021-2001)4

- “Fire safety rules for enterprises and organizations in the gas industry.” (VPPB 01-04-98);

- “Regulations on the organization of technical supervision over compliance with design decisions and the quality of construction, major repairs and reconstruction at main pipeline facilities.” (RD 08-296-99);

- GOST 12.2.063 “System of occupational safety standards. Industrial pipeline fittings. General safety requirements"

- STO Gazprom 2-3.5-454-2010 “Rules for the operation of main gas pipelines”

An order for Profkarkasmontazh LLC must appoint a person responsible for performing work and ensuring labor protection, industrial and fire safety requirements, compliance with labor and production discipline. When performing his duties, the work manager (lead engineer) is guided by the requirements of VRD 39-1.14-021-2001.

The design organization specializes in performing work on the development of design estimates (hereinafter referred to as DED) for commissioning work. Some customers indicate in the design assignment when developing design documentation for commissioning work the following wording: “start-up and adjustment of heating and ventilation systems.”

What applies to commissioning work on residential buildings, industrial and public buildings and structures? Are the customer's actions legal?

Commissioning work is a set of works that are performed during the preparation and comprehensive testing of equipment.

During the comprehensive testing period, the installed equipment is checked, adjusted and ensured that the joint interconnected operation is carried out in the technological process envisaged by the project at idle speed, followed by the equipment being transferred to work under load and brought to a stable design technological mode, which ensures the release of the first batch of products in the volume established at the initial period of development of the design capacity of the facility. At the same time, before the start of comprehensive testing of equipment, commissioning work must be carried out to set up automated emergency and fire protection systems.

The installation rules and the procedure for testing the equipment, as well as the procedure for commissioning work, are determined by TKP 45-3.05-166-2009 “Technological equipment. Rules for installation and testing”, approved by order of the Ministry of Construction and Architecture dated December 29, 2009 No. 441.

When installing and adjusting electrical devices, one should be guided by SNiP 3.05.06-85 “Electrical Devices”, approved by Decree of the USSR State Committee for Construction Affairs dated December 11, 1985 No. 215; in the production and acceptance of installation and commissioning of automation systems (monitoring, management and automatic regulation) of technological processes and engineering equipment - SNiP 3.05.07-85 “Automation Systems”, approved by Decree of the USSR State Committee for Construction Affairs dated October 18, 1985 No. 175 , taking into account change No. 2.

In addition, the procedure for carrying out commissioning of the relevant systems and equipment is also defined in TCP 308-2011 “Rules for the acceptance into operation of automated control and metering systems for electrical energy installed in residential and public buildings”, approved by Resolution of the Ministry of Energy dated April 15, 2011 No. 15, and TKP 339-2011 “Electrical installations for voltage up to 750 kV. Overhead power lines and conductors, distribution devices and transformer substations, electric power and battery installations, electrical installations of residential and public buildings. Device rules and protective safety measures. Electricity metering. Standards for acceptance tests”, approved by Resolution of the Ministry of Energy dated August 23, 2011 No. 44.

Commissioning work is carried out on all systems of equipment installed in the building: power supply, sanitary, thermal power, etc. For machines, mechanisms and units with drives, commissioning work on these systems is carried out both before and during individual tests.

Work and activities carried out during the period of preparation and comprehensive testing of equipment (including commissioning work) are carried out according to the program and schedule, which is developed by the customer or commissioning organization on behalf of the customer and is agreed upon with the general contractor and subcontracted installation organizations, and in if necessary - and with supervision of installation of equipment manufacturers.

The full range of commissioning works established by the relevant technical regulatory legal acts is given in clause 2.19 of the Guidelines for the application of resource consumption standards in physical terms for commissioning works (NRR 8.01.402-2012), approved by order of the Ministry of Construction and Architecture dated December 23, 2011 No. 450, in edition dated 10/01/2015 No. 246, as amended by resolution No. 27 dated 10/01/2015 (hereinafter referred to as NRR 8.01.402-2012, order No. 450). It includes:

- study of design and technical documentation;

- determining the compliance of the technical characteristics of the installed equipment with the technical requirements established by the technical documentation of the equipment manufacturers and the project;

- organizational and engineering preparation of work;

- inspection of the facility, external inspection of equipment and installation work performed;

- individual tests of equipment carried out by installation organizations;

- adjustment, configuration of individual types of equipment included in technological systems (blocks, lines) in order to ensure their interconnected operation established by the project;

- trial run of equipment according to the design scheme in an inert environment with checking the readiness and setting up the operation of the equipment complete with support systems - control, regulation, blocking, protection, alarm, automation and communication, transferring the equipment to work under load;

- comprehensive testing of equipment with adjustment of the technological process and bringing it to a stable design technological mode, ensuring the release of the first batch of products envisaged by the project.

The detailed composition of commissioning work is specified by the project developer for a specific facility, taking into account the scope of work in the applicable standards for resource consumption, as well as the instructions given in the technical parts and introductory instructions of the Collections of standards for resource consumption in physical terms for commissioning work, approved by Order No. 450.

Works not related to commissioning, in accordance with clause 2.20 of NRR 8.01.402-2012, are:

- design and engineering work;

- inspection of equipment, elimination of its defects and installation defects, deficiencies in construction and installation work;

- maintenance and periodic inspections of equipment during its operation;

- development of operational and estimate documentation;

- coordination of work performed with supervisory authorities;

- adjustment and modification of application software;

- Submission of measuring instruments to state verification.

The composition of commissioning work and the conditions for their implementation must comply with the technical conditions of the equipment manufacturers, labor protection and technical safety rules, fire safety rules, and the rules of state supervisory authorities.

Thus, the scope and conditions for performing commissioning work on construction projects are determined in accordance with the design documentation and accompanying documentation for the installation of equipment.

Ensuring that commissioning works are carried out is the responsibility of the customer and developer. This is established sub. 1.4.14 clause 1 of the list of functions of the customer, developer, project manager (manager) for the construction, reconstruction, major repairs, restoration and improvement of the construction site, approved by Resolution of the Ministry of Construction and Architecture dated 02/04/2014 No. 4.

Checking the quality of installation, incl. individual testing of equipment, taken into account as part of the work standards for equipment installation in accordance with clause 4.1 NRR 8.01.104-2012. Guidelines for the application of resource consumption standards in physical terms (NRR 8.01.104-2012) were approved by order of the Ministry of Construction and Architecture dated December 23, 2011 No. 450 (hereinafter referred to as NRR 8.01.104-2012).

In some cases, when the standards do not take into account the costs of individual testing of systems, these costs are taken into account in the estimates for equipment installation. This provision applies to the startup and adjustment of heating and ventilation systems, which do not relate to commissioning work and are not additionally taken into account in the estimates for commissioning work.

According to clause 1.14 of the technical part of Collection No. 18 “Heating - internal devices” (NRR 8.03.118-2012), approved by Order No. 450, the costs of thermal testing of systems and the costs of builders when starting up the system, including external inspection of installed equipment, presence during testing and delivery and acceptance of heating systems by representatives of the installation organization, are calculated in the amount of 3% of the amount of wages and operation of machines and mechanisms included in the estimate for the installation of heating systems. The costs obtained by calculation are included in the estimate for the installation of the heating system.

Clause 1.12 of the technical part of Collection No. 20 “Ventilation and Air Conditioning” (NRR 8.03.120-2012), approved by Order No. 450, costs for individual testing of ventilation and air conditioning systems not taken into account in the standards are calculated at 5% of the amount of wages boards and operation of machines and mechanisms included in the estimate for the installation of ventilation and air conditioning systems. These costs are included in the corresponding estimates for the installation of ventilation and air conditioning systems.

Svetlana Filonenko, leading engineer of design and estimate documentation

"Industry: accounting and taxation", 2011, N 6

In what cases do the costs of commissioning work form the cost of depreciable property, and in what cases are they recognized as a lump sum? What documents can confirm the validity of the expenses incurred? How to prove the non-capital nature of commissioning work?

The concept of commissioning

Commissioning work, by nature and purpose, is a continuation of installation work and the final link of new construction, as well as reconstruction, expansion and technical re-equipment of existing enterprises, buildings and structures. Upon completion of commissioning work, the facility can be presented for commissioning. The main provisions for the procedure for carrying out commissioning work are set out in SNiP 3.05.05-84<1>.

<1>SNiP 3.05.05-84 "Technological equipment and technological pipelines", approved. Decree of the USSR State Construction Committee dated 05/07/1984 N 72.

Commissioning works include a set of works performed during the period of preparation and conduct of individual tests and comprehensive testing of equipment. At the same time, the concept of “equipment” covers the entire technological system of the facility, that is, a complex of technological and other types of equipment and pipelines, electrical, sanitary and other devices, automation systems that ensure the production of the first batch of products provided for by the project.

So, commissioning work is a set of works to check, test and configure equipment in order to ensure the specified operating parameters. The objectives of commissioning work are to identify possible errors in design, construction and installation work, and to detect deficiencies in the operation of equipment before the start of its operation. Before the start of individual testing of the installed equipment, commissioning work is carried out on electrical devices, automated control systems, heat power and some other types of equipment, the implementation of which ensures individual testing of process equipment - the final stage of the installation of this equipment. Commissioning work, which is carried out during the period of individual testing of equipment, ensures compliance with the requirements stipulated by the working documentation, standards and technical specifications for individual machines, mechanisms, devices and units, in order to prepare the equipment for acceptance by the working commission for comprehensive testing. During the period of comprehensive testing of equipment, the equipment is checked, adjusted and ensured to work together in an interconnected manner in the technological process envisaged by the project at idle speed, followed by the equipment being transferred to operation “under load” and brought to a stable technological mode, ensuring the release of the first batch of products.

Requirements for carrying out and accepting commissioning work on devices, systems and equipment are given in Part 3 of SNiP for carrying out relevant types of installation work. At the same time, the composition of commissioning works and the programs for their implementation must comply with the requirements of the technical specifications of equipment manufacturers, labor protection and safety regulations, and fire safety.

Commissioning work is carried out in three stages: preparatory work; individual tests; comprehensive testing of installations. At the stage of preparatory work, operational documents for the equipment must be studied, and the adjusters’ workstations must be equipped with the necessary equipment and auxiliary technical means. At the stage of individual testing, work is carried out to configure and adjust the equipment in accordance with their technical descriptions, instructions, etc. Individual tests are carried out during installation work. The comprehensive testing stage is carried out after completion of all installation work. At this stage, adjustments to previously carried out equipment adjustments should be made, all equipment should be brought to operating mode, and equipment interaction should be checked.

Expenses for preparation and development of production

The Tax Code does not regulate the procedure for recognizing expenses for commissioning work. Meanwhile, the Tax Code of the Russian Federation allows us to include among other expenses related to production and sales, expenses for the preparation and development of new enterprises, production facilities, workshops and units. Base - pp. 34 clause 1 art. 264 Tax Code of the Russian Federation. The content of the expense group of this subitem is not specified. Basic provisions for planning, accounting and calculating production costs at industrial enterprises<2>(hereinafter referred to as the Basic Provisions) costs for the preparation and development of production are allocated to a separate costing item (clause 31), which grouped, in particular, costs for the development of new enterprises, production facilities, workshops and units (start-up costs) and costs for preparation and mastering the production of new types of products and new technological processes. Clause 5 of the Basic Provisions explains what is meant by start-up costs: costs for checking the readiness of new enterprises, production facilities, workshops and units for putting them into operation through comprehensive testing (under load) of all machines and mechanisms (trial operation) with a trial release of the intended product design, equipment adjustment. It is also clarified here that they do not relate to start-up costs and are reimbursed from funds allocated for capital investments, in particular, costs for individual testing of certain types of machines and mechanisms and for comprehensive testing (dry) of all types of equipment and technical installations for the purpose of quality control their installation.

<2>Approved by the State Planning Committee of the USSR, the State Committee for Prices of the USSR, the Ministry of Finance of the USSR, the Central Statistical Office of the USSR on July 20, 1970.

The foregoing allows us to come to the conclusion that the costs of commissioning work carried out during the period of comprehensive testing of equipment (“under load”) with trial production of products are included in the start-up costs taken into account on the basis of paragraphs. 34 clause 1 art. 264 Tax Code of the Russian Federation. The costs of commissioning work carried out at the stages of preparation and individual testing of equipment do not apply to start-up costs.

Commissioning work “idle” and “under load” in construction estimates

The current procedure for allocating costs for commissioning work in the estimate documentation for construction is established by the Ministry of Regional Development in Letter dated April 13, 2011 N VT-386/08. This procedure is different for industrial and non-productive objects.

During the construction of new, reconstruction and technical re-equipment of existing housing, civil, social, and special purpose facilities not related to the production of products (with income from its sale), all costs of commissioning work necessary to bring the facility to a suitable condition for use, and carried out before the facility is put into operation and the initial cost of depreciable property (fixed assets) is formed, are included in Chapter. 9 “Other work and costs” (columns 7 and 8) of the consolidated estimate of the cost of construction without dividing into work performed “idle” and “under load”. At the same time, the composition and volume of commissioning work performed must comply with the requirements of the project, SNiP, technical regulations, technical documentation of equipment manufacturers, other regulatory and technical documentation of state control and supervision bodies, technical operation and safety regulations.

Commissioning costs for production facilities must be taken into account in accordance with clause 4.102 of the Methodology for determining the cost of construction products on the territory of the Russian Federation (MDS 81-35.2004<3>). According to this standard, the costs of commissioning work are:

- "idle" - included in Chapter. 9 “Other work and costs” (columns 7 and 8) of the consolidated estimate;

- “under load” - can be treated as non-capital expenses for the estimated cost that will be produced (provided) during the operation of the constructed facilities, and, as a rule, are not provided for in the estimate documentation for construction.

With the release of the Letter of the Ministry of Regional Development of Russia dated April 13, 2011 N VT-386/08, the explanations given in the Letter of the State Construction Committee of Russia dated October 27, 2003 N NK-6848/10 became invalid. The latter provided for the procedure for allocating and accounting for the costs of commissioning work in the estimate documentation developed from November 1, 2003. This procedure was agreed upon with the Russian Ministry of Finance, the Russian Tax Ministry and the Russian Ministry of Economic Development and remained unchanged until its cancellation<4>. As Gosstroy explained, the costs of carrying out commissioning work “idle”, associated with bringing the facility to a state suitable for use, in accordance with the norms of Art. 257 of the Tax Code of the Russian Federation are taken into account as capital expenses. Expenses for commissioning work “under load”, carried out after the initial cost of depreciable property (fixed assets) has been formed, according to paragraphs. 34 clause 1 art. 264 of the Tax Code of the Russian Federation as non-capital expenses are accepted for tax accounting as part of other expenses associated with production and sales, and are financed through the core activities of the operating organization. The costs of commissioning work “idle” were included in Ch. 9 “Other work and costs” (columns 7 and 8) of the consolidated estimate of construction costs. When attributing the costs of performing commissioning work "idle" to capital investments, one should be guided by the Structure of the full complex of commissioning work, taken into account in the new cost estimate and regulatory framework of 2001, developed by the State Construction Committee, in accordance with the Appendix to Letter No. NK-6848/10. The final part of the Letter contained a reservation: the procedure for attributing costs for commissioning works applies to the construction of new, expansion, reconstruction and technical re-equipment of existing enterprises, buildings and structures for housing, civil and industrial purposes. In other words, the procedure for financing commissioning works intended for industrial facilities also extended to residential and civil facilities. Actually, for non-production objects not related to the production of products, the division of commissioning work into work “idle” and “under load” was meaningless: by what means should the costs of performing work “under load” be compensated if the product is not produced and not implemented? The Ministry of Regional Development previously noted that the entire complex of commissioning work carried out in relation to non-production facilities is covered by the concept of “idle” work (Letter dated 09.10.2009 N 33354-IP/08), and with Letter N VT-386/08 it completely changed the state construction procedure for attributing costs for commissioning work in the construction estimate for non-production facilities.

<4>Letter from the Ministry of Regional Development of Russia dated October 13, 2009 N 33499-IP/08.

Recognition of expenses for commissioning work in tax accounting

Explaining the procedure for accounting for costs of commissioning work, financiers rely on Letter of the State Construction Committee of Russia N NK-6848/10<5>. In Letter dated 08/07/2007 N 03-03-06/2/148, the Ministry of Finance reported that the said Letter of the State Construction Committee distinguishes between accounting for the costs of commissioning work “idle” and “under load”:

- expenses for carrying out “idle” work are included in the consolidated estimate of the cost of construction as capital expenses and are an integral part of the initial cost of the fixed asset object under construction;

- the costs of performing work “under load” are not included in the estimate documentation and are taken into account as part of other expenses as non-capital expenses.

In Letter dated November 2, 2010 N 03-03-06/1/682, the Ministry of Finance indicated: non-capital expenses associated with the preparation and development of new production, which, in accordance with paragraph 1 of Art. 257 of the Tax Code of the Russian Federation are not taken into account in the initial cost of fixed assets, but are included in other expenses associated with production and sales, based on paragraphs. 34 clause 1 art. 264 Tax Code of the Russian Federation. Expenses for commissioning work “under load”, carried out after the initial cost of depreciable property (fixed assets) has been formed, as non-capital expenses are accepted for tax accounting as part of other expenses associated with production and sales, in accordance with paragraphs. 34 clause 1 art. 264 Tax Code of the Russian Federation. In the event that the initial cost of the fixed asset has not been formed, the costs of commissioning work as expenses associated with bringing the fixed asset to the state in which it is suitable for use, on the basis of clause 1 of Art. 257 of the Tax Code of the Russian Federation are taken into account in the initial cost of this fixed asset.

Similarly, Letters of the Ministry of Finance of Russia dated 04/20/2006 N 03-03-04/1/363, dated 08/24/2004 N 03-03-01-04/1/9 explain that the costs of commissioning work “idle” do not reduce the taxable profit is considered to be the current expenses of the organization, and is included in capital expenses for profit tax purposes (that is, included in the initial cost of fixed assets and taken into account as expenses as part of depreciation), and for accounting purposes, and for statistical accounting purposes. Expenses for commissioning work “under load”, carried out after the initial cost of depreciable property objects (fixed assets) have been formed, are accepted for tax accounting as non-capital expenses as part of other expenses associated with production and (or) sales, in in accordance with paragraphs. 34 clause 1 art. 264 Tax Code of the Russian Federation. The Ministry of Finance points out the same procedure for accounting for expenses for commissioning work “under load” in Letter No. 03-03-06/1/495 dated July 28, 2009. In the Letter of the Ministry of Regional Development of Russia dated 04/07/2010 N 13149-IP/08 it is noted: if the generator engine is run-in during the period of individual testing of the equipment (before acceptance by the working commission), the costs of the necessary material resources are taken into account as capital expenses. The cost of material resources necessary for running in the generator engine, carried out during the period of comprehensive testing of the equipment (after acceptance by the working commission), is not included in capital investments. These are the running costs of the organization.

Taxpayers using the accrual method recognize expenses associated with the preparation of proceedings in the period in which they were incurred, on the basis of clause 1 of Art. 272, paragraph 2 of Art. 318, paragraphs. 34 clause 1 art. 264 of the Tax Code of the Russian Federation (Letters of the Ministry of Finance of Russia dated 09/06/2007 N 03-03-06/1/646, dated 07/10/2003 N 04-02-05/1/72).

Since the procedure for recognizing commissioning expenses proposed by officials is not prescribed in the Tax Code, it cannot be called indisputable. Having analyzed arbitration practice, we will highlight individual judicial acts that refute the approach of officials to the procedure for accounting for commissioning costs. Thus, the FAS Moscow Region, in Resolution No. KA-A40/5083-08-2 dated July 11, 2008, indicated that from the norm of paragraphs. 34 clause 1 art. 264 of the Tax Code of the Russian Federation does not mean that the costs of commissioning work can be classified as other expenses only if the work is carried out “under load”. Therefore, any expenses for commissioning work (both “under load” and “idle”) are taken into account as other expenses in the tax period in which they were incurred. In Resolution No. 09AP-18689/2009-AK dated October 12, 2009, the Ninth Arbitration Court of Appeal supported the taxpayer, who recognized the costs of commissioning and testing of new equipment as current (and not capital) expenses, justifying it as follows. A special norm (clause 34, clause 1, article 264 of the Tax Code of the Russian Federation) allocates costs for the preparation and development of new production facilities, workshops and units as a separate group of expenses. These costs are subject to a one-time write-off as part of current costs by virtue of paragraphs. 3 paragraph 7 art. 272 of the Tax Code of the Russian Federation and, therefore, are not subject to inclusion in the initial cost of the fixed asset in accordance with clause 2 of Art. 257 Tax Code of the Russian Federation. The content of the disputed expenses corresponded to the concept of expenses for preparation and development and were legally taken into account by the taxpayer in accordance with paragraphs. 34 clause 1 art. 264 Tax Code of the Russian Federation. In the Resolution dated 06.02.2008 N 09AP-16922/07-AK<6>The Ninth Arbitration Court of Appeal also noted that the costs of preparing and developing new production facilities, workshops and units are allocated to a separate group and therefore are subject to inclusion in other expenses in accordance with a special norm (clause 34, clause 1, article 264 of the Tax Code of the Russian Federation), and not in the original cost of fixed assets. According to the arbitrators, if the costs of commissioning work can be characterized as costs for the development of production facilities, workshops and units, they are current, regardless of whether they are associated with bringing the OS facility to a state suitable for operation. At the same time, the costs of checking the readiness of equipment brought to a state suitable for operation for commissioning through its comprehensive testing are not capital. If commissioning costs cannot be characterized as costs for the development of production facilities, workshops and units, it is necessary to establish whether they are associated with bringing the fixed asset to a state suitable for operation, and depending on this, determine the nature of the costs (current or capital). The court concluded that the provisions of paragraph 1 of Art. 257 of the Tax Code of the Russian Federation does not establish that all expenses incurred prior to the execution of the act of putting the facility into operation, are capital and must be included in the initial cost of the operating system. Based on this rule, the arbitrators concluded that the costs of a facility that is already ready for operation cannot be of a capital nature. The court found that the commissioning work carried out by the taxpayer in relation to facilities that were already ready for operation, and aimed at checking the equipment being put into operation, setting up and checking the readiness of the facilities for operation, did not change the degree of readiness of the facilities for operation, and therefore the costs of such work can be taken into account at one time.

<6>Left unchanged by Resolution of the Federal Antimonopoly Service of the Moscow Region dated May 20, 2008 N KA-A40/4099-08-P.

Let's sum up the intermediate results. There are two positions on the issue of accounting for commissioning costs. The first (official) is that the costs of performing commissioning work “idle” are taken into account in the initial cost of the fixed asset, and the costs of carrying out work “under load” are other expenses recognized in the tax (reporting) period in which they are produced. The second point of view is that the costs of performing any commissioning work (both “idle” and “under load”) are taken into account as current. A taxpayer who chooses the second position is more likely to attract claims from controllers.

We confirm the non-capital nature of the expenses

So, the company decided to recognize start-up costs as officials recommend, that is, to divide them into capital and non-capital. Let us name the most important features of non-capital expenses.

- Non-capital work is carried out after the initial cost of the fixed asset has been finalized. The final cost of an asset is determined by the time it is put into operation, since:

- in accounting, the posting Debit 01 Credit 08 is drawn up when the object is put into operation (Instructions for using the Chart of Accounts);

- in tax accounting, the object is included in the depreciable property at the time of its commissioning (which is confirmed by the relevant act) (clause 4 of article 259 of the Tax Code of the Russian Federation).

Thus, the costs of commissioning work carried out before putting the equipment into operation are taken into account in its initial cost, and after commissioning they are taken into account as other expenses on the basis of paragraphs. 34 clause 1 art. 264 of the Tax Code of the Russian Federation (Resolution of the Federal Antimonopoly Service VSO dated March 10, 2006 N A33-22400/04-S3-F02-858/06-S1).

- Non-capital work is aimed at comprehensive testing (“under load”) of all machines and mechanisms (trial operation) with trial production of products. In the Resolution dated 02/18/2010 N A35-5033/08-С21, the FAS CO named the distinctive features of the costs that form the initial cost of an asset (Clause 1, Article 257, Clause 5, Article 270 of the Tax Code of the Russian Federation), and the costs of preparation and development productions (clause 34, clause 1, article 264 of the Tax Code of the Russian Federation). The first are aimed at the formation of a specific object and its subsequent bringing to a state suitable for use, but without releasing finished products, the latter are associated with the production and sale of finished products, and therefore do not affect the cost of the fixed asset used in each specific case, but are included in the cost of the manufactured product. In other words, if an organization carries out comprehensive testing, preparation and development of new production with simultaneous release of finished products(commissioning work “under load”), the corresponding costs are to be included among other costs associated with the production of products. Such expenses are indirect and form the tax base of the current tax period. But checking the readiness of equipment for production, during which testing, startup, testing of equipment is carried out without releasing finished products (“empty”), corresponds to the concept of “bringing equipment to a state in which it is suitable for use,” and expenses incurred by the taxpayer for these purposes, are subject to attribution to the cost of fixed assets. In Resolution dated 02/22/2007 N A19-12474/06-50-F02-210/07, FAS VSO established that the organization checked production readiness through comprehensive testing (“under load”) of all machines and mechanisms with trial production. The arbitrators recognized that the taxpayer’s expenses are related to the development of new production and, accordingly, are classified as other expenses by virtue of paragraphs. 34 clause 1 art. 264 of the Tax Code of the Russian Federation, and are not expenses for bringing the object to a state in which it is suitable for use, as the tax authority insisted. In Resolution No. KA-A40/3877-09 dated June 10, 2009, the Federal Antimonopoly Service of Moscow sided with the taxpayer, who took into account the costs of commissioning the unit as non-capital expenses. Having examined the contract agreements for commissioning work and certificates of work performed, as well as evidence of the release of finished products during testing of the unit’s performance, the arbitrators came to the conclusion that the commissioning work was not related to testing work, but was an additional adjustment of the equipment during the period of its industrial operation, were carried out after the initial cost of fixed assets was formed. This means that expenses for such work are rightfully included in other expenses in accordance with paragraphs. 34 clause 1 art. 264 Tax Code of the Russian Federation<7>.

Carrying out comprehensive testing of equipment “under load”, but before its commissioning

We found out that if an enterprise carried out commissioning work after putting the equipment into operation and these works were aimed at comprehensive testing (“under load”) of all machines and mechanisms with trial production of products, then commissioning costs are taken into account as other expenses. But what if the company carried out commissioning work "under load" before putting equipment into operation(and, accordingly, before the execution of the act in Form N OS-1, which, according to the Instructions for the use and completion of forms of primary accounting documentation for accounting of fixed assets<8>used to include objects in fixed assets and record their commissioning)? In this case, is it possible to recognize the costs of commissioning work as part of other expenses (clause 34, clause 1, article 264 of the Tax Code of the Russian Federation)? Or do you need to increase the initial cost of the OS object by them? Tax authorities, naturally, insist on the second option for recognizing expenses. However, one can argue with them. From clauses 1, 3, 6 of Appendix 1 to SNiP 3.05.05-84, clause 1.5 SNiP 3.01.04-87<9> it follows that commissioning work for comprehensive testing in operating modes (“under load”) is carried out after the equipment is accepted by the working commission and before it is accepted into operation by the state acceptance commission, that is, before the equipment is put into operation. The conclusions of the arbitrators will help to justify the legality of a one-time recognition of commissioning costs “under load” before the equipment is put into operation. Let us turn to the Resolution of the Federal Antimonopoly Service dated January 15, 2009 N A55-5612/2008. The taxpayer included in the expenses of the current period the costs of commissioning work on equipment with the release of finished products (more than 517 million rubles), carried out after the signing of the equipment acceptance certificates by the working commission, but before the acceptance of the equipment by the state acceptance commission. FAS PO noted that checking the readiness of equipment for production, during which testing, startup, testing of equipment is carried out without releasing finished products, meets the concept of “bringing equipment to a state in which it is suitable for use” within the meaning of clause 1 of Art. 257 of the Tax Code of the Russian Federation, therefore, expenses incurred by the taxpayer for these purposes are subject to inclusion in the cost of fixed assets. And on the basis of paragraphs. 34 clause 1 art. 264 of the Tax Code of the Russian Federation, if an organization carries out comprehensive testing, preparation and development of new production with the simultaneous release of finished products (commissioning work “under load”), expenses associated with the development of new production and trial production of products during the commissioning period are subject to inclusion in the number costs associated with the production of finished products. These expenses are indirect and form the tax base of the current tax period. In addition, based on clause 1.5 of SNiP 3.01.04-87 and clause 3 of Appendix 1 to SNiP 3.05.05-84, commissioning work “under load” with trial production of finished products, that is, comprehensive testing of equipment, is carried out before acceptance of the facility operation when the fixed asset has already been formed, but is not put on the balance sheet of the enterprise. The taxpayer proved that after acceptance of the workshop equipment by the working commissions, he carried out a comprehensive testing of this equipment with the release of finished products and the costs of performing commissioning work “under load” were not included in the estimate for the construction of the production complex (costs of raw materials, semi-finished products, energy resources, wages of production workers and shop expenses). As a result, the court found it legitimate to classify the disputed costs as non-capital expenses. The Resolution of the Ninth Arbitration Court of Appeal dated May 27, 2009 N 09AP-7603/2009-AK is also of interest<10>. The company reconstructed the installation and carried out its commissioning twice: first “without load” and then “under load”. Based on the results of commissioning work "without load", the working commission of the enterprise drew up an equipment acceptance certificate, confirming that the reconstructed installation is in a condition suitable for use, ready for operation and production of products provided for by the project, in a volume corresponding to the norms for the development of design capacities. After the act was signed, work began on conducting a comprehensive testing of the installation “under load”. The taxpayer included the costs of work “idle” in the cost of the fixed asset, and the costs of performing work “under load” (more than 10 million rubles) he recognized as a lump sum in accordance with paragraphs. 34 clause 1 art. 264 Tax Code of the Russian Federation. After conducting an audit of the taxpayer, the tax inspectorate came to the conclusion that expenses for performing commissioning work “under load” were unlawfully included in other expenses of the reporting period, and assessed additional income tax and penalties. The tax authorities proceeded from the fact that the initial cost of an asset is formed at the time of its commissioning, and not at the time the working commission signs the equipment acceptance certificate; therefore, all expenses incurred before the facility is put into operation should form its cost. But the court supported the taxpayer, citing the following arguments:

- in the case under consideration, the moment when the equipment is brought to a state in which it is suitable for use is the date of acceptance of the equipment and the signing of the corresponding act. This means, within the meaning of paragraph 1 of Art. 257 of the Tax Code of the Russian Federation, upon completion of commissioning work “without load”, the initial cost of the OS object was formed, that is, commissioning work “under load” was carried out on an installation ready for operation after its initial cost had been formed;

- the taxpayer’s complex technological equipment could not be put into operation without going through the commissioning stage (including “under load”), which preceded the signing of the act of putting the facility into operation;

- commissioning work ended with the release of finished products;

- the costs of performing commissioning work “under load” were not included in the design and estimate documentation for the reconstruction of the installation, but were approved in a separate estimate and were not of a capital nature in their content.

<9>SNiP 3.01.04-87 "Acceptance into operation of completed construction facilities. Basic provisions", approved. Decree of the USSR State Construction Committee dated April 21, 1987 N 84.

<10>Left unchanged by Resolution of the Federal Antimonopoly Service of the Moscow Region dated September 1, 2009 N KA-A40/8619-09.