How to implement management accounting. Problems of implementing management accounting in organizations Implementation of management accounting using the example of an enterprise

Management accounting is a system for collecting, registering, summarizing and providing objective information on the activities of an organization necessary for decision-making by the management level of the organization (managers). Thanks to the organization and implementation of a management accounting system, it becomes possible to analyze the financial and economic state of the enterprise, allocate resources, optimize costs, and improve financial performance indicators.

Objectives of management accounting, methods and means of their implementation

The introduction of management accounting allows you to effectively and efficiently solve a set of problems:

- Carry out planning of economic activities through budgeting;

- Control and optimize costs by promptly obtaining information;

- Analyze the deviation of actual indicators from planned ones based on management reports.

Ways to implement management accounting tasks:

- Management (internal) and financial (external) reporting;

- Operational accounting;

- Budgeting.

The means of implementation are:

- Budget of income and expenses;

- Cash flow budget;

- Forecast (planned) balance.

In accordance with all types of budgets used at enterprises in Moscow or in small towns in remote regions of Russia, automation of enterprise management accounting allows for monitoring the implementation of plans, analyzing the deviation of actual indicators from budget ones, making adjustments, and making management decisions. At the end of the planning period, the following are compiled:

- Cash flow statement;

- Gains and losses report;

- Balance.

Basic principles of policy for organizing a management accounting system

The organization of management accounting is based on certain principles of the company’s management policy. These include:

- Frequency corresponding to production cycles.

- Continuity of information and its repeated use.

- Formation of reporting indicators acceptable for all levels of management.

- Application of budgeting.

- Evaluation of the performance of individual structural divisions (CFD).

- Reliability, completeness, timeliness of information, possibility of analysis.

- Use of common units of measurement.

Requirements for the management accounting system at the enterprise

Automation of management accounting of an enterprise must meet certain requirements:

- Completeness and objectivity of displaying all facts of economic activity.

- Timely recording and provision of data.

- Relevance of indicators.

- Integrity of the management accounting system.

- Clear for all users.

- Regularity.

Objects of management accounting

Cost accounting is one of the most important tasks of enterprise management accounting. The objectivity and efficiency of information received by managers at all levels, especially in terms of costs, affects the effectiveness of the decisions they make. Therefore, the process of timely recording of resource use indicators is very relevant in the current activities of enterprises in Moscow and other regions of the Russian Federation. Its effective implementation is possible through the use of management accounting software. The set of management accounting objects can be combined into groups:

- Production resources;

- Business processes;

- Income and expenses;

- Structural units (with localization of income and costs by place of origin (CF)).

Budgeting in management accounting

The budgeting process allows you to systematize enterprise management, determine goals and ways to achieve them, thanks to the planning and specification of indicators for all areas of activity and structural divisions. The organization of budgeting is carried out by centers of financial responsibility, by distributing functions, powers and responsibilities, determining the area of responsibility, and forming certain types of plans with maximum detail. This approach allows:

- achieve planned goals;

- optimize costs;

- rational use of resources;

- optimally distribute funds;

- improve the performance of business activities in general.

Enterprise Forecasting

The formation of a budget model depends on the specifics and type of activity of the enterprise. But the same principles are still used in its creation.

1. Budgetary integration. To ensure planning efficiency, a significant number of types of budgets can be created: operational and financial. They can be formed for each Central Federal District individually. But they are all interconnected and combined into a common budget system. The master plan is the company's consolidated budget.

2. The principle of consistency. All budgets are drawn up in accordance with certain regulations and are interconnected with each other. The primary ones are operating budgets, the indicators of which are summarized in the overall Budget of Income and Expenses, sometimes called the Profit and Loss Budget. On its basis, financial types of budgets are drawn up: Cash flow budget, forecast balance, capital budget.

3. The budgeting system is implemented on the basis of regulations (certain norms and standards).

4. End-to-end budgeting. The consolidated budget combines all types of enterprise plans, all of them are interconnected with each other.

5. Methodological comparability. When drawing up all types of budgets, uniform methodologies and approaches are used. This is necessary in order to carry out qualitative analysis and control over the implementation of plans based on comparable indicators.

Organization of management accounting

All types of reporting that accompany management accounting are sources of information for analysis. In synthesis with the reports used in budgeting, they are the basis for:

- decision making,

- assessing the financial condition of the company, its solvency and liquidity,

- forecasting development dynamics in the future,

- investment attractiveness,

- identifying bottlenecks and developing measures to eliminate them,

- adjustments to plans,

- monitoring the execution of plans,

- cost optimization,

- rational distribution of income,

- preventing cash gaps (current shortage of funds),

- system resource management,

- optimizing the quantity of inventory,

- determining the sufficiency of own funds for the implementation of investment projects,

- the need to attract borrowed funds for the successful implementation of new technologies and the purchase of fixed assets;

- identifying promising areas of development,

- analysis of deviations of actual indicators from planned ones in order to monitor the execution of budgets and adjust them to achieve set goals;

- implementation of measures aimed at improving financial performance results in general.

The main goal of management accounting is to find reserves to improve the efficiency of the enterprise. All information obtained through automation of management accounting should be in demand by managers at all levels, be of economic interest to them and be the basis for making rational decisions that contribute to the further positive development of the company.

Types of management reporting

All types of management reporting must eliminate uncertainty and provide an objective picture, which is necessary for the performance of management functions. Therefore, for example, automation of management accounting is a system of related indicators that have a full set of characteristics necessary to justify decisions based on objective data.

All types of management reporting have standard forms (in accordance with the approved Accounting Policies), but they can be detailed depending on the company’s needs for data decoding. For example, to determine categories of potential buyers or priority groups of goods, a special report can be used that involves generalizing the range of goods and target buyers according to a number of characteristics.

Formation of management accounting

The formation of management accounting can be grouped into three main blocks:

- Reporting on the financial position of the company and its changes, results of operations.

- Reporting on key performance indicators.

- Reporting on budget execution.

Most often, at enterprises where projects are implemented for the purpose of administrative accounting, the following reporting forms are used:

- Cash flow statement

- Sales report

- Production report

- Procurement report

- Raw Materials Inventory Report

- Finished Products Report

- Accounts receivable report

- Accounts payable report.

For an unambiguous interpretation of objects, various classifiers can be used. Their types and quantity are determined based on the needs of the company and are enshrined in the provisions of the management policy, which is formed by the administrative accounting department.

At enterprises in Moscow and other cities in the Russian Federation, the following types of classifiers are most often used:

- Types of products

- Types of work

- Types of services

- Types of income

- Cost centers

- Financial Responsibility Centers

- Types of costs

- Types of assets

- Types of equity capital

- Types of obligations

- Directions of investment

- Projects

- Main and auxiliary business processes

- Personnel categories

- Categories of counterparties.

The management accounting chart of accounts “WA: Financier” can correspond to standard accounting (financial) accounts. It is a tool for systematically displaying information and grouping it according to general characteristics. The chart of accounts can be formed in accordance with the company’s objectives; it allows you to systematically accumulate all information about the economic activities of the enterprise.

Common features and differences between management and financial reporting

All enterprises in Moscow and other cities of Russia must keep financial records, since they are regulated by the legislation of the Russian Federation. Its purpose is to provide information for external users, including government agencies (for example, the tax inspectorate). The purpose of introducing management accounting tools is to provide complete and objective information for internal users, which can facilitate the adoption of effective management decisions. Internal information may be the subject of a trade secret and its distribution outside the company may be accompanied by sanctions against violators. Financial statements are the basis for analyzing the financial viability of a company, used by investors, creditors or other parties interested in investing capital. The formation of management accounting is primarily the basis for effective management, since it displays objective information about the current financial condition of the enterprise. With its help, operational decisions can be made in order to respond in a timely manner to changes in the external situation or adjust paths that contribute to the achievement of strategic goals.

Financial reporting forms are standardized, therefore understandable to external users and comparable in terms of indicators. Forms of internal management reporting can be varied and are approved in accordance with company regulations. But in turn, they must also be unified in order for performance indicators to be comparable across the functioning of individual structural units.

Management and financial systems are interconnected and have commonality:

- Unified objects;

- General approach to defining goals and monitoring their achievement;

- Similar principles if an identical chart of accounts is used;

- One-time input of primary data;

- The information base is used for analysis and management decision-making;

- Application of similar techniques.

Many business transactions in the financial and management systems are displayed identically, others still require a specific approach, depending on the company policy applied to the management system. These two types of accounting also have significant differences; they relate to the following aspects:

- Periodicity. In management, reporting periods are regulated by internal Regulations, in financial – by state legislation.

- Nature of indicators. In financial - all indicators are measured in value terms, in management - the range of units of measurement is wider; in addition to cost criteria, natural values and quality indicators can be used.

- Level of detail. Management reporting presents analytical information in more detail.

- Method of grouping data. The two systems may use different principles for grouping information.

- The degree of accuracy of the information. In management, tolerances are possible, that is, certain errors, which are unacceptable in finance.

The main stages of setting up and implementing automation of management accounting

The main stages of setting up and implementing automation of management accounting include:

- Development and approval of technical specifications

- Development of a company strategy with identification of goals and priority areas

- Analysis and diagnostics of the existing organizational structure, system of financial and economic relations, organization of production, planning and accounting systems.

- Creation of an information base for the implementation of a management system.

- Development of the company's financial structure and identification of financial responsibility centers.

- Development of a cost management system, classification of costs.

- Formation of a management reporting system.

- Construction of a budgeting system.

- Introduction of administrative accounting.

- Process automation.

At each stage of setting tasks and implementing automation of management accounting, appropriate regulations are developed that define norms and rules. They are displayed in specific Regulations, which are documents reflecting company policy.

Methodological approaches

Management accounting tools can be classified according to various criteria, depending on methodological approaches.

1. Depending on the volume of information processed, the formation of management accounting can be:

- Systematized.

Conducted on a regular basis, it includes measurement, assessment and control of costs for all types of processes (supply, production, sales). All costs are grouped by items and elements, sources and media. An internal report is being compiled, the content, timing and frequency of provision of which satisfy internal users and allow an assessment of the activities of the enterprise as a whole and individual structural divisions. - Differentiated.

The content is selective and depends on the objectives.

2. Depending on the goals and objectives of management, the formation of management accounting can be:

- Strategic.

Focuses on determining the company's development prospects and providing information to senior management. - Operational.

Ensures achievement of goals in the short term - Production.

The task is to provide information about the cost of production, the amount of profit, and the cost of inventory.

3.Depending on methodological approaches to organizing management accounting, the following can be used:

- Integrated (monistic) system. The management system is interconnected with the financial one. The chart of accounts in the management system is linked to financial accounts.

- Autonomous (dualistic) system It is assumed that management and financial systems will be created separately. The chart of accounts of the management system is not linked to the financial one. The process focuses only on management needs.

4. Based on the scope of activities and organizational structure of enterprises, the management system can be:

- Complete system. This type applies to the activities of the enterprise as a whole and its individual structural divisions.

- A sufficient system (with a limited set of indicators). The essence of this type is that it is carried out only for individual objects or their group.

5. For efficiency and data control, accounting can be used:

- Factual data.

The method of attributing actually consumed resources to expenses, calculating the actual cost and financial results from product sales is used. - Regulatory data.

In this case, it is assumed that certain cost norms will be developed and accounting will also be carried out according to norms (standards) with deviations highlighted.

6. Based on the completeness of costs, the following types can be distinguished:

- Full costs.

The cost price is calculated by including all costs - Marginal.

The reduced cost is calculated.

Rules promoting the effective implementation of management accounting in an enterprise

Automation of management accounting should be a systematic process. In practice, when solving this problem, company managers, even in Moscow, the center of concentration of business information, make a number of typical mistakes, the correction of which leads to additional financial costs and loss of time. To avoid such problems, keep the following rules in mind.

1. Internal management reports should contain only the necessary information and be in a form that is easy to understand. They should be structured, easy to read, and visual. They should include only those details that are necessary for management purposes. This approach not only reduces document processing time, but also makes them more informative and useful.

2. The assessment of reporting elements should be made not only on the basis of financial methods, but also using other methodologies. When creating rules, international standards should be used along with Russian rules.

3. Effective implementation of automation of management accounting can be carried out only after a detailed diagnosis of the company and carrying out explanatory work among managers about the need for such an action.

4. A significant number of employees should be involved in the process of creating management accounting, since a fairly wide range of personnel will use the information base for the purpose of managing and implementing the sales process. This task cannot be entrusted only to accountants, economists and financiers.

5. When implementing automation of management accounting, it is necessary to accurately determine the scheme of business processes, optimize it and distribute functions, create job descriptions. This approach will avoid duplication of functions.

6. The introduction of management accounting involves solving a whole range of problems in order to increase the efficiency and quality of management and improve performance results in all areas. Therefore, it cannot be focused on solving a single problem. For example, ensuring document flow.

7. The process of improving the formation of management accounting should be permanent. It is impossible to allow optimization carried out once to be considered a sufficient action. The system must be regularly improved, new software products introduced and innovative methodologies used.

8. It is necessary to create document flow regulations that specify the deadlines for submitting documents, submitting reports, and motivating staff for compliance with the rules. A document flow schedule can be an effective solution.

9. Corporate culture involves the exchange of information within precisely defined time frames. The introduction of information technology makes it possible to effectively implement this process.

10. Management accounting tools must correspond to the tasks set by the company. Limitation of capabilities due to technical factors should not cause additional problems at the enterprise.

Management accounting in “WA: Financier” (1C 8 platform) - a modern solution

As a company develops, its organizational structure becomes more complex, and the volume of information processed increases. There is a need to automate processes. Effective organization of a management system is inevitably associated with the use of various software products. A significant number of business transactions, a large range of goods, a large list of counterparties - this is a small part of the list of criteria that contribute to the complexity of the process.

In the first stages after the creation of an enterprise in Moscow or another city in Russia, management accounting can be carried out using simple EXEL tables. This approach is effective for small volumes of business transactions. It is quite natural that with a small amount of start-up capital, small enterprises resort to methods that can be obtained for free. As a company grows, not only the number of business transactions that can be processed increases, but also the amount of capital that can be invested in information technology and software. Special programs provide systematization and efficiency of obtaining information. The most popular solution to the problem is the implementation of management accounting tools in “WA: Financier”.

Large companies use ERP systems that allow them to maintain all types of accounting simultaneously. But such solutions are very expensive.

Conducting forecasting at an enterprise using automated management accounting allows you to quickly process significant amounts of information. In combination with additional modules, the system's functions can be expanded. Users receive a number of benefits:

- a wide range of tools for accounting and control, allowing you to quickly obtain information and analyze it from various angles;

- the systems and modules used are easily customizable in accordance with the accounting policy and specifics of the company’s activities;

- High performance of automation tools allows you to instantly process significant amounts of information.

Automation of management accounting

Management accounting programs allow you to solve problems of process automation, control and reporting. Universal and effective solutions are the “WA: Financier” line of software products. They can be used at enterprises with different specifics and volumes of document flow at enterprises in Moscow and other regions of Russia. They are effective for use in organizations with a dedicated financial service, as well as in companies that operate with aggregated data received from external systems.

Suggested modules for automation:

- To ensure the efficient operation of the treasury and the formation of the cash flow management system, the “Cash Management” module (abbreviated as “UDS”) can be used;

- To create a budget of income and expenses and a forecast balance sheet, the “Budgeting” module is used;

- To maintain management accounting according to corporate standards and IFRS, the “Management Accounting/IFRS” module can be used;

Using “WA: Financier” software products, you can implement various options to ensure automation of accounting and budgeting processes.

A. Budgeting.

To solve budgeting problems and automate processes, you can use various “WA: Financier” products:

1. If it is necessary to implement a full range of budgeting, use the module “WA: Financier. Budgeting."

2. If the enterprise is tasked only with cash management on the basis of cash flow records, the “WA: Financier” module can be used. UDS".

B. Operational management accounting.

To effectively organize operational management accounting and automate the process using WA: Financier products, you can use the following solutions:

3. For operational accounting of cash flows, the module “WA: Financier” is used. UDS" (Cash Management);

4. For management accounting, it is effective to use the module “WA: Financier. UprUchet/IFRS";

5. If for operational accounting and analysis of working capital it is necessary to use the functions of reserving goods, complex cost calculations and other specific trade operations, then the module “WA: Financier. UprUchet/IFRS" is used as an addition to a specialized program for management accounting (for example, in 1C 8 Trade Management). In this case, the system will provide automation of the purchasing and selling functions, and the module “WA: Financier. UprUchet/IFRS" - functions of the financial service for transmitting operational analysis data.

B. Management reporting.

The following modules can be used to generate and analyze reports:

6. By cash flow - “WA: Financier. Cash management";

7. "WA: Financier." Management accounting/IFRS" - for the generation of management (internal) reporting and financial (external) reporting, including according to IFRS standards.

Based on the results of diagnostics of management accounting and reporting systems of three domestic enterprises, the most characteristic shortcomings of existing management accounting systems were identified, limiting the ability to make balanced management decisions by managers at various levels. Below are also recommendations for improving the management reporting system and optimizing the information base that provides it.

The following areas for improving the management accounting and reporting system were selected as priorities:

1. Improving the structure, hierarchy, content and presentation of management reports;

2. Development of a financial planning and budgeting system;

3. Development of a company development strategy with subsequent linking of short-, medium- and long-term planning horizons;

4. Improvement of the cost accounting system.

Based on the results of an analysis of a wide range of educational and methodological literature, publications and research, some shortcomings of management accounting and reporting systems characteristic of Russian enterprises were identified.

The current system of reports, certificates and reports currently operating at Russian enterprises is, as a rule, extremely fragmentary and does not meet the requirements for information support for production management in current conditions (completeness of information, its comparability, efficiency, accuracy, brevity, expediency, etc. .);

There are a number of specific forms of analytical reports missing;

There is no hierarchy of report forms for different management levels. There are no detailed regulations on the frequency of compiling analytical reports for various users.

Designing an optimal hierarchy of reports and adapting them to the needs of managers at various levels. IN table 2 An approximate reporting model for a management accounting system at an enterprise is presented.

Development of a long-term (5 - 10 years) and medium-term (3 - 5 years) planning system based on an assessment of the competitiveness of the enterprise in the domestic and global markets. Linking long-term, medium-term and current planning;

Optimization of the budgeting system;

Improving the cost accounting system and the regulatory framework for calculating their planned level.

Within the first direction - improving the management reporting system, defining the hierarchy of reports and adapting them to the needs of managers at various levels - the following activities seem to be the most significant:

Analysis of the current management reporting system, its composition, structure and functions, as well as organizational and technical aspects of its functioning;

Assessing the level of automation of information flows and decision-making processes and, if necessary, bringing them into compliance with the requirements of the management accounting reporting system.

Table 2. Approximate reporting model of a management accounting system.

|

Material flows / activities |

“Purchasing” and distribution of material resources |

"Production" (expenses) |

"Sales" (implementation) |

|

Operating activities |

Assessment of the need for material resources |

Sales and Marketing Cost Report |

|

|

Report on the consumption of material resources |

Product release report |

||

|

Inventory report resources |

Finished goods inventory report |

Sales report |

|

|

Report on the procurement of material resources |

Manufacturing Cost Reports |

Shipping report |

|

|

Investment activities |

Report on the purchase and movement of fixed assets |

Investment Performance Report |

Report on work with securities |

|

Financial activities |

Control and regulation of financial results |

Reports on the results of core activities |

|

|

Control and regulation of accounts receivable |

Accounts payable reports |

||

|

Control of receipt and use of funds |

Accounts receivable report |

||

|

Monitoring the implementation of the profit distribution plan |

Cash flow statement |

||

|

Summary reports for management |

|||

Organizational structure of the enterprise and management accounting reporting system

The management accounting system is superimposed on the existing organizational structure of the enterprise. Therefore, the effectiveness of this system largely depends on the efficiency of the enterprise organization. Quite often, the improvement of the management accounting system (especially involving the introduction of expensive hardware and software) must be accompanied, and possibly follow, changes in the organizational structure of the enterprise, since it is impractical and ineffective to impose modern management accounting methods, much less computerize them in conditions of ineffective organizational enterprise structure.

As practice shows, the organizational structures of the vast majority of enterprises are linear-functional.

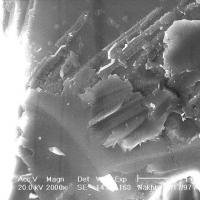

Linear-functional stage of the evolution of the organizational structure ( figure 3) is characterized by a deepening of the process of specialization, expansion and creation of new divisions and services. This organizational model assumes that functional managers manage only their departments. Personnel management is carried out through their superiors, through the issuance of orders and other internal regulations. At the same time, managers of line departments have the right to approve and protest functional change projects. This leads to improved interaction between functional and line services.

With the further growth of the enterprise, the activity of functional departments increases, as does the pressure on employees to comply with many new requirements objectively put forward by specialized subsystems. Departments develop internal regulatory documents that introduce additional conditions and restrictions related to the quality of labor, products, etc. At the same time, the problem of clearer coordination of many conditions and parameters formulated by functional units comes to the fore.

The linear-functional structure provides advantages for working in stable conditions, which involve the gradual establishment of connections between functional and main departments. If the situation changes quickly and requires a permanent revision of controlled indicators and restrictions, it is difficult to achieve coordinated work of all services, especially when this happens in conditions of growth of the organization. The deeper the specialization and the more functional subsystems, the higher requirements for consistency in their work to achieve an integrated result.

Figure 3. Linear-functional organizational structure

The organizational structures of a wide range of Russian enterprises are characterized by the following features and disadvantages ( table 3).

Table 3. Advantages and disadvantages of the main types of organizational structures.

|

Characteristics/types of organizational structures |

A team of like-minded people |

Linear |

Functional |

Linear-functional |

Centralized linear-functional |

Matrix |

|

Advantages |

(1) Creative collaboration; (2) Consistency; (3) Like-mindedness. |

(1) Responsibility for the final result; (2) Unity of command. |

(1) Uniform distribution of load between managers; (2) specialization; (3) increased attention to quality. |

(1) Greater coordination between functional and line managers; (2) Greater development of functional specialization; (3) Increased influence on the quality of work and products. |

(1) Separation of administrative, functional and operational management; (2) Possibilities for coordinating activities in terms of time and other resources; (3) Increased orderliness and organization. |

(1) A combination of administrative, functional, operational management with the positive qualities of a team of like-minded people in breakthrough design work. |

|

Flaws |

(1) Applicable to enthusiasts and decent people; (2) Team of no more than 10 people. |

(1) Long information channels; (2) Weak specialization and low focus on quality. |

(1) Many superiors for the final performer; (2) poor coordination of control “centers”. |

(1) A large number of controlled parameters and conditions; (2) Difficulties in coordinating activities in terms of time and content. |

(1) Strong regulation; (2) Insufficient use of creative potential. |

(1) High costs of maintaining the system in equilibrium; (2) Requires extensive management team experience. |

Based on the signs of subordination and functional specialization, as a rule, the following levels of the organizational structure of company management are present:

First level. General Director, Deputy General Director for Financial Affairs, Deputy General Director for Strategic Development and Shareholding, Deputy General Director for Commercial Activities, Deputy General Director for Production, Deputy General Director for Capital Construction, Deputy General Director for Foreign Economic Relations, Chief Engineer, Chief Accountant.

Second level. Heads of departments - Head of the Materials and Technical Supply Department (UMTS), Head of the Personnel Department, Head of the Work Supply Department (WRS), Chief Power Engineer, Chief Mechanic, Quality Director, Head of the Department of Communal and Social Facilities, Chief Metrologist, Deputy. chief engineer for reconstruction and technical re-equipment.

Third level. Heads of departments.

Fourth level. Deputy heads of departments, services and line specialists.

This number of levels indicates a fairly normal hierarchical structure. In the most flexible organizational structures, the number of management levels ranges from three to five. The effective functioning of such structures depends on the availability of proven management procedures, the completeness of the internal regulatory framework, and the comprehensive use of management functions.

At the same time, at a number of enterprises the regulatory framework, primarily the regulations on departments and services, is often characterized by incompleteness. There are no regulations on the activities of some structures; in some cases, there is a certain discrepancy between the regulations and the tasks and management mechanisms of today. In addition, at present, Russian enterprises are undergoing changes in the structure and mechanisms of management, including: the emergence of strategic planning, the creation of a corresponding new unit for managing strategic development and shareholder ownership, reforming planning based on its reorientation to planning based on sales, and optimizing the budgeting system. The new planning system at most enterprises is at the stage of formation, so the functions of the departments, especially the Economic Department as central in the management accounting system, have not yet been precisely defined.

In the organizational structure of most Russian enterprises there is excessive concentration of management functions at the senior level— General Director and his staff. Very often, 10 or more deputies (including the chief accountant and assistant to the general director) report to the General Director. At one of the largest domestic metallurgical enterprises, about 100 divisions and services were formally assigned directly to the General Director, which he, naturally, could not fully control, concentrating his attention on key services. Imposing a management accounting and reporting system on such a structure makes no sense.

Therefore, the introduction of modern management reporting systems at most enterprises should be preceded by a structural reorganization, the most rational direction of which, in our opinion, is the transition to a divisional management structure. At the same time, with the much greater efficiency of such structures, the transition to them may be accompanied by objective difficulties caused not only by purely technical reasons, but also by the existing balance of interests in the enterprise as a whole and its top management.

Overload of management functions is often observed at the level of Deputy General Directors. In particular, at one of the large enterprises, the deputy general director for commercial activities had 6 blocks consisting of 9 departments.

The lack of consolidated management reporting also attracts attention, which, in our opinion, is partly explained by both the shortcomings of the management accounting system itself and the imperfections of the organizational structures of enterprises. It's possible that this is one of them significant reasons for which most management decisions are made at the highest level of enterprise management - the level of the General Director and, in some cases, the commercial director.

The development of a management accounting system, accompanied by an improvement in the organizational structure, could provide the necessary information support for making responsible management decisions at a lower management level and facilitate the delegation of corresponding responsibility from the top to the middle level of management.

Another characteristic shortcoming of the organizational structures of Russian enterprises is partial duplication of functions by several departments.

For example, at one of the enterprises such duplication was observed in terms of accounting and control of expenses and revenues, operational assessment and control of the production of finished products, inventories of raw materials and materials, work in progress. Due to the significant share of offsets in the structure of payments of this enterprise and the shortage of funds, the functions of the Contracts and Sales Department and the Materials and Technical Supply Department are duplicated (for example, in terms of monitoring the shipment of products under offsets).

In addition, the information transmission channels used at a number of enterprises do not always ensure its reliability and efficiency. This leads to duplication of channels and sources of information. When analyzing the information received, managers do not always use a standard data presentation format and regulated analytical procedures; the methods used to analyze information do not always meet the needs of its users.

Thus, to the typical shortcomings of existing organizational management structures Russian enterprises include:

High level of concentration of management decision-making at the level of the general director and some of his deputies, often the commercial director;

Weak delegation of responsibility from senior managers to the middle level of management;

Unreasonable dispersion of a number of management functions for planning and control across services, departments and individual structural units;

Duplication of functions by several departments.

A properly conducted internal audit of the management accounting system will allow timely detection and identification of various types of risks, including in the field of management (for example, systematic errors and abuse of personnel), as well as the development of measures to prevent their occurrence.

The implementation of procedures within the framework of the internal audit of the management accounting system contributes to and is aimed at creating additional prerequisites for increasing the efficiency of the enterprise management system at all levels in particular and the enterprise as a whole.

Internal audit of the management accounting system at the enterprise

As you know, there are a large number of types of audits. Thus, when using the classification “by purpose”, management audit is also distinguished (Table 4).

Table 4. Main types of audit.

To clarify the essence of the terms used and their content, I would like to emphasize that when using the concept of “production audit”, we rather narrow the scope of the audit of the management system. This is due to the fact that with this approach to assessing the effectiveness of the management audit, we narrow down only to the cost part, which, of course, has priority over other components of the management audit, but is by no means the only important one. So, when we use the term “management audit of management systems” the following components are added to the “production audit”: (1) the organizational system of the company, (2) personnel and staffing, (3) analysis and assessment of individual business processes of the enterprise, identified according to which -criterion, (4) issues of automation of economic and business processes in the company, (5) system of regulatory and reference information, (6) document flow diagram, (7) management accounting reporting.

Figure 4. Correlation of different types of audit from the point of view of internal audit of the effectiveness of the management system.

Thus, the term “management audit of the management system” is broader than the “production audit of the management system”, at least by the seven elements of the management system listed above.

The main stages of organizing control activities of the internal audit of the management accounting system at the enterprise are presented in Figure 5.

Conducting an internal audit of the management accounting system has informational and consulting significance for the management and (or) owners of an economic entity, since it is intended to help optimize the activities of the economic entity and fulfill the responsibilities of its management.

Figure 5. The main stages of organizing control activities of the internal audit of the management accounting system at the enterprise.

Internal audit provides information on these activities and confirms the accuracy of managers' reports. An internal audit of the management accounting system is necessary mainly to prevent the loss of resources and implement the necessary changes within the enterprise. In light of the above, it should be noted that the internal audit of the management accounting system and, in particular, the assessment of the effectiveness of the management accounting system is an important internal audit tool.

The main objects of internal audit of the management accounting system are the solution of individual functional management problems, development and testing of enterprise information systems. The objects of internal audit may be different depending on the characteristics of the economic entity and the requirements of its management and (or) owners. Internal audit— an integral part of the enterprise’s internal control.

When conducting an internal audit of a management accounting system, its content changes depending on the stage of management subject to control. Thus, at the planning stage, the volume of available resources is assessed, the degree of its compliance with the volume of set goals and tasks to be solved, and it is determined to what extent the set goals and tasks correspond to the overall strategy established in each specific area of enterprise management.

In the process of budget execution, ongoing monitoring is carried out in all areas of the management system, the reliability and objectivity of the data is determined, and intermediate results are assessed. The main task at this stage is to ensure the necessary and timely adjustment of the management process, while simultaneously ensuring control over the progress of these actions.

In addition, issues related to the organization of the accounting and internal control system, the creation of the necessary organizational structures and the development of appropriate procedures are subject to control. And finally, the subsequent internal audit of the management accounting system assesses the degree of implementation of the set goals and the possibility of more effectively achieving them in the future.

As a rule, to internal audit functions relate:

Checking the activities of various management levels;

Assessing the effectiveness of the internal control mechanism;

Development and provision of proposals to eliminate identified deficiencies and recommendations to improve management efficiency.

An internal audit of a management accounting system can be considered effective if, firstly, it effectively warns about the occurrence of unreliable management accounting information, and secondly, it effectively identifies unreliability within a limited time after the unreliable information has arisen.

The report obtained as a result of the audit is a final document that should contain not only the identified deficiencies and violations, but also , which in the future may become the basis for the formation of general recommendations in the field of management accounting. This is due to the fact that it is the reports on control activities that are subject to the most careful study by management and management at various levels.

Figure 6. The procedure for drawing up the conclusion of the internal audit of the management accounting system at the enterprise.

After approval of the report and, accordingly, all the recommendations contained in it, the internal audit service must ensure that checks are carried out on their implementation and, based on all the work done over a certain period, evaluate the volume of work performed and their effectiveness.

The subject of internal audit of the management accounting system are issues of assessing the effectiveness of the management accounting system at the enterprise; certain issues of making management decisions and managing funds, namely:

Areas of activity and functions of “responsibility centers”;

Budget funds allocated to solve assigned tasks by the management of the enterprise;

Selected critical issues of financial resource management;

Organization of budget execution.

Using the results of an internal audit of the management accounting system to develop management decisions throughout the enterprise is effective only on the condition that control measures cover all of the above management issues. However, the extent of their coverage should be determined by the specific objectives set by management. Speaking about the audit methodology of the internal audit of the management accounting system, it is important to clearly define what in this case plays the role of audit objects.

Objects of audit of the effectiveness of the management accounting system are:

Management accounting system at the enterprise;

Management system and organizational structure;

Document flow diagram;

The procedure and principles for the formation of management reporting;

Management activities;

Departments of the enterprise that are the main managers of budgets;

Departments of an enterprise that use borrowed funds or manage the property of the enterprise.

In this case, the subject of inspection is understood as the activity of the specified economic entities, which is divided into functional (functions and tasks) and production activities, respectively, in the first case it is assumed that a certain result will be achieved, and in the second - an economic result, expressed in the production of specific goods, services, etc. . Evaluation of these results involves comparing them with established performance assessment criteria, which are determined taking into account the goals of the control measure. This ultimately makes it possible to determine the effectiveness of management decision-making and funds management.

An internal audit of a management accounting system involves conducting various types of audits, which differ depending on the subject and objects of the audit, the set goals and objectives. The entire range of checks within the framework of the internal audit of the management accounting system can be divided into two main blocks:

— First block includes control measures to assess the effectiveness of the management accounting system related to the performance of functions.

— Second block— this is monitoring the efficiency of enterprise management.

The internal auditor carries out procedures ( table 5 - pp. 1.2, 1.3, 2.1, 2.1.2 and 2.2.) for evaluating and completing audit documents.

In some cases, the assessment can be carried out by direct users of management accounting information (Table 5, clause 1.1). If there are several users, then it makes sense to resort to measurement information user satisfaction index.

Table 5. System for assessing the effectiveness of the management accounting system at the enterprise.

|

Components of the evaluation system |

Result |

||

|

Monitoring |

Creation of an information field on the functioning of the management system as a source for analysis on necessary issues. |

Determining the strengths and weaknesses of the existing management system, drawing up recommendations for correcting shortcomings and errors, and optimizing the management system. |

|

|

Components of Monitoring |

|||

|

Quality of information |

Determining whether the information provided by the management system meets the required quality parameters. |

Forming an opinion and concluding whether the information provided by the management system meets the required quality characteristics. |

|

|

Test for the composition of control system elements and their interaction. |

Determination of the presence of the main elements of the management system and the quality of their interaction and consistency. |

Forming an opinion and making a conclusion about whether the existing elements of the management system meet the needs of the enterprise and assessing the quality of their interaction. |

|

|

Optimality of the organizational structure and the selected management system. |

Determining the optimality of the organizational system and the feasibility of the selected management system option. |

Forming an opinion and making a conclusion about whether the existing organizational system of the enterprise is optimal and assessing the feasibility of the chosen management system option. |

|

|

Autonomy of the management system from financial accounting. |

Determine whether the management system is monistic or autonomous. |

Forming an opinion on the nature of the independence of the management system from financial accounting. Determining the positive and negative aspects. |

|

|

Whether or not the management system satisfies the requirements of the modern level of production development and increasing competition. |

Determining the degree of compatibility of the current management system with modern requirements of the level of production development and competition. |

Forming an opinion on the degree of compatibility of the control system and the requirements imposed by modern requirements of the level of production development and competition. |

|

|

Does the management system pay due attention to the surrounding business environment in which the enterprise operates? |

Implementation of Benchmarking activities. |

Forming an opinion on whether the adopted management system pays the necessary attention to the surrounding business environment in which the enterprise operates. |

|

|

Determination of effectiveness |

|||

|

Regulatory efficiency |

Determination of the degree of implementation and compliance assigned to the management accounting system in the “Accounting Policy”, tasks and functions of management accounting at the enterprise. | ||

|

Strategic plan for the development of the management system |

Determining the degree of development and implementation of the strategic development plan for the management system. |

Determining the percentage of efficiency by comparing the set (planned) and achieved actual results. |

|

|

Relative efficiency |

Determination of the ratio of benefits and costs for the functioning of the management system. |

Determining the percentage of participation of the management system in the generated profit of the enterprise. |

|

Methods of internal audit of the effectiveness of the management accounting system

In practice, conducting an internal audit of the effectiveness of a management system involves the use of certain methods, which, due to the analytical audit of efficiency, differ significantly from the methods used in financial audits and significantly overlap with the methods used in conducting comprehensive economic analysis.

Internal performance audit method- this is a certain set of techniques that allows you to assess the state of the objects under study from the point of view of the effectiveness of the management carried out. It should be noted that the specifics of the audit presuppose the use of a combination of different methods during the audit, which relative to each other can act as multi-level methods. For example, the examination method may require the use of a graphical method, an analogy method, etc. In turn, the analogy method is an independent method of performance audit.

All methods used in auditing the effectiveness of a management system can be divided into two main blocks: examination methods And analytical methods (Figure 7).

Figure 7. Classification of methods used in internal audit of the effectiveness of the management accounting system

(Click on the picture to enlarge it)

The analytical nature of the audit of the effectiveness of the management system predetermined the key place of analytical techniques in the system of methods used in the audit of the effectiveness of the management system management system.

For example, to the number analytical methods of internal performance audit This includes, among other things, the method of analogy.

The application of the analogy method can be carried out by constructing certain analytical tables. An example of these tables would be Table 6(subject to ensuring the same quality of relevant products, works, services):

Table 6. Application of the analogy method

An important point when developing a performance audit methodology is to determine systems of criteria and performance assessment indicators. It would be rational to begin implementing an audit of the effectiveness of management systems first of all in those areas of management where it is already possible to determine target performance indicators (for example, investment activities) or where generally accepted procedures already exist.

Criteria and indicators for assessing the effectiveness of the management accounting system are the basis for the formation of conclusions and conclusions based on the results of the control event. At their core, these criteria represent established and justified management quality standards that allow for comparative analysis and assessment of the effectiveness of program implementation, activities, economic transactions or the performance of functions by the objects of inspection, that is, the results achieved.

In practice, conducting an internal performance audit involves the development of certain analytical tables (Table 7), which should reflect the standard level of individual indicators, the actual level, the size of the deviation, and the reason for the deviation.

Instead of a standard indicator, data on other similar objects of control, or the level of the specified indicator for a given object for previous periods, etc. can also be used.

Table 7. Analytical table for conducting an internal audit of the effectiveness of the management system

Criteria and performance indicators act as a “normative model”, that is, they reflect what result in the area being inspected or the activity of the object being inspected is evidence sufficient efficiency enterprise management accounting systems. If the actual indicators of the audited area of management accounting correspond to the established criteria and indicators, the management system corresponds to the established level of efficiency. The definition of these indicators should not be established at a specific level, it should be a certain range.

In order to systematize the accumulated experience, it is advisable to propose that all indicators used when conducting an internal audit of the management accounting system be classified according to a number of characteristics (Table 8).

Table 8. Classification of indicators used when conducting an internal audit of the management accounting system.

|

Classification sign |

Types of indicators |

|

By time |

Perspective / Annual / Current |

|

By nature of distribution |

General economic / Industry / Regional |

|

By degree of detail |

Specific / Summary |

|

By scale of application |

Group / Private |

|

By development methods |

Calculation and analytical / Experienced / Reporting and statistical |

|

By the nature of the tasks being solved |

Economic / Industrial / Functional |

|

By calculation method |

Absolute / Relative |

|

According to the obtained characteristics |

Qualitative/quantitative |

|

According to the used meters |

Labor / Cost Conditional-natural / Full-value |

|

By time period |

Statistical / Dynamic |

When choosing performance evaluation criteria In our opinion, it is necessary to proceed from the fact that the selected criteria must correspond to the specifics of the area being inspected or the activity of the object of inspection and serve as the basis for obtaining the results of the inspection. Moreover, for each purpose of this inspection, its own criteria for assessing the effectiveness of the results of the activities of the inspected objects are used, which must be reliable, understandable and sufficient.

Unlike an audit, the priority goal of which is only to identify facts of abuse and violations, as well as to identify those responsible, the main result of an internal audit of the effectiveness of the management system is the preparation and communication to management of a list of recommendations to improve the efficiency of the company.

The purpose of preparing recommendations is the need to eliminate identified violations. At the same time, they must be clearly justified by previously formed findings and conclusions in order to exclude the possibility of their contestation or ambiguous interpretation by the party being inspected, which may negatively affect the effectiveness of the control itself. The recommendations generated must be precisely focused on the adoption of specific measures and be targeted, that is, sent to officials directly responsible for making specific management decisions.

Another important condition when developing recommendations is that the possible results from their implementation must exceed the amount of resources required for this, otherwise they lose their meaning, reducing the efficiency of management activities. When forming recommendations, it is necessary to determine indicators for assessing their implementation, which would make it possible to objectively monitor this process. At the same time, they themselves must be aimed at achieving specific measurable results.

After drawing up the conclusions and results of the inspection, the inspection team carrying out the control activity must inform the management of the inspected facility about its results, finding out their opinion and listening to any suggestions that have arisen.

The report is a final document that should contain not only the identified shortcomings and violations, but also positive results of the activity of the control object, which in the future may become the basis for the formation of general recommendations in the field of management accounting. This is due to the fact that it is the reports on control activities that are subject to the most careful study by management and management at various levels. At the same time, we also focus on internal control bodies.

After approval of the report and, accordingly, all the recommendations contained in it, the control body must ensure that checks are carried out on their implementation and, based on all the work done over a certain period, evaluate the volume of work performed and their effectiveness.

Improving the internal audit of the company’s management accounting system

Studying methodological audit, some scientists project it onto business planning in organizations, in particular, V.V. Burtsev defined the range of tasks of management audit in relation to business planning by segment (enterprise, product, sales market, marketing plan, production plan, organizational and legal plan).

At the same time, it is necessary to expand the scope of application of management audit, extending it to the accounting and analytical subsystem, personnel management (managerial audit of personnel) and other elements of the organization. This approach is associated with the need to fully cover all elements of the organization with management audit methods, since the omission of one of their elements will not allow the formation of a holistic picture of the financial situation of the organization and will make it difficult to make effective decisions. Currently, original methods have been developed for some of the listed objects of management audit, including the methodology for management audit of personnel.

While recognizing the novelty and effectiveness of these techniques, it is worth pointing out the fragmented nature of the research. This indicates the formation of management audit and the search for optimal ways of its development.

The effective functioning of an organization is predetermined by the optimization of its structure and the activities of segments, which in turn requires the improvement of the accounting and analytical subsystem, the system of internal control, etc.

In this context, improving management auditing occupies a special place. Specifics of management audit as a relatively new branch of economic knowledge in Russia and its versatility require the use of non-traditional tools. These include diagnostics and system decomposition.

The implementation of the goals and objectives of management audit, its improvement through the use of diagnostics allows for a system-problem approach and a logical-critical analysis of management subsystems (sales, supply, pricing, etc.). Identification of the features and development trends of each subsystem determines the identification of global problems in the development of the organization as a whole and the construction of a clear “financial picture” of the economic entity. Diagnostics can be used in the context of checking the effectiveness of the functioning of sections of the accounting and analytical subsystem and the internal control system.

It is advisable to use system decomposition in parallel with its diagnostics, which will provide an integrated approach to solving management audit problems.

Summarizing the above, we can characterize the diagnosis and decomposition of the management system within the framework of a management audit as powerful and effective tools for studying the economic and other problems of an organization.

Naturally, auditors in practice can use many other methods and methods for studying the management system, in particular methods of econometrics, economic statistics, etc. However, these methods are largely labor-intensive and difficult to understand for specialists who are superficially familiar with financial mathematics and mathematical disciplines.

Therefore, when developing programs to improve the performance audit of management systems management systems a compromise between general scientific, special methods, methods of mathematics and its derivative disciplines will be reasonable.

Summarizing the above, it can be noted that in order to ensure at the present stage the possibility for the control bodies of an enterprise to carry out inspections as part of the internal audit of the management accounting system, it is necessary to concentrate the main efforts on solving the most important tasks of forming an appropriate methodological base that establishes the basic procedures and algorithms for carrying out control measures for internal audit of the management accounting system.

Bibliography

1) Bereznoy A. Practical experience of Russian organizations in maintaining and organizing a management accounting system. Role in strategic and current management of enterprises. — KPMG company research, Report, Moscow, Balchug, 2001.

2) Vilensky P.L., Livshits V.N. and Smolyak S.A. Evaluating the effectiveness of investment projects. - Delo, 2001.

3) Volkov I.M., Gracheva M.V. Project analysis: financial aspect. 2nd ed., revised. and additional - Faculty of Economics, TEIS, 2000.

4) Drury K. Introduction to management and production accounting. - UNITY, 1998.

5) Nikolaeva O.E., Alekseeva O.V. Strategic management accounting. — Editorial URSS, 2003.

6) Nikolaeva O.E., Shishkova T.V. Management Accounting. - URSS, 4th edition, 2003.

7) Khan D. Planning and control: the concept of controlling. Ed. and with a foreword: Turchak A.L., Golovako A.G., Lukashevich M.L. - Finance and Statistics, 1997.

8) Horngren C.T., Foster J. Accounting: a managerial aspect - Finance and Statistics, 2000.

9) Chernov V. A. Management accounting and analysis of commercial activities - Finance and Statistics, 2001.

10) Sheremet A.D. (ed.) Management accounting. Tutorial. - FBK-Press, 2002.

11) Collection of abstracts of the 4th annual conference “The role of the analyst in company management”, Moscow, June 2003.

12) Management accounting: official CIMA terminology - FBK-Press, 2004.

13) Drury C. Management and Cost Accounting // International Thomson Business Press, 5th Edition. 2000.

14) Scarlett R. C., Wilks C. Management Accounting - Performance Management // CIMA, London 2001.

15) Thomson A. and Strickland A. J. Strategic management: Concept and Cases // Plano, Business Publication, 1987.

16) Ward Keith Strategic management accounting // Butterworth - Heinemann, CIMA, 1999.

Regulated costs are also known as discretionary costs or managed or policy costs. The amount of discretionary spending can be changed relatively easily. The following are usually considered as regulated costs: costs of marketing, research, training, etc.

Committed costs are costs that arise as a result of decisions made in the past. These decisions cannot be reversed in the short term.

A control system organized at an economic entity in the interests of its owners and regulated by its internal documents. It is one of the ways to monitor the efficiency of the links in the structure of an economic entity.

The Tacis project PRRUS 9701 was carried out in 2003.

It is the fourth stage in the development of organizational structures for enterprise management: (1) A team of like-minded people; (2) Linear structure; (3) Functional structure; (4) Linear-functional structure; (5) Centralized linear-functional structure; (6) Matrix structure.

The effectiveness of the management accounting system can be considered, firstly, as an assessment of effectiveness (typical for the public sector) - the degree to which a certain result is achieved. This, in turn, requires studying, as part of performance assessment, not only relative indicators of management effectiveness, but also the effect of certain management decisions. Secondly, as a ratio of costs and benefits - the profitability of the project for direct participants (financial efficiency).

Internal audit (Internal audit - English, Betriebsinterne revision - German) is a control system organized at an economic entity in the interests of its owners and regulated by its internal documents. It is one of the ways to monitor the efficiency of the links in the structure of an economic entity.

The organization of management accounting is an internal matter of the organization itself. Just as there are no two identical people, there are no two identical organizations; their differences are determined by differences in forms of ownership, scale of activity, various combinations of external and internal environmental factors - all this necessitates the introduction of certain forms of accounting (both financial and management) accounting.

Maintaining management accounting, unlike maintaining financial accounting, is not mandatory for the organization. The management accounting system serves only the interests of effective management, therefore the decision on the advisability of its implementation in one form or another should be made based on an assessment of the cost-benefit ratio of its operation. In order to consider the management accounting system in an organization effective, it is necessary that it facilitates the achievement of the organization’s goals with the least cost for the organization and operation of the system itself.

The organizational structure of the management accounting system is built taking into account:

- the structure of the organization itself;

- information needs of management; -technical capabilities and features of computer

information system used in the organization;

- qualifications and personal qualities of managers and accountants-analysts.

Large and medium-sized organizations have special divisions in their organizational structure, whose tasks are to implement certain management accounting procedures (we discussed this in the previous section). Such services, operating at the level of the entire organization, can be called headquarters. In addition, in individual divisions and responsibility centers, special employees are appointed to coordinate accounting and management work both within the division and with higher levels of management.

In management theory, it is known that currently the most common are three forms of organization:

1. Unitary (linear-functional) structure with an established hierarchy of relationships and responsibilities that exists indefinitely (Fig. 3.4). This is a classic form of organizational structure, it is characterized by the strict subordination of lower-level employees to senior managers and the transfer of information and commands primarily vertically. Already at the dawn of the industrial era, production in many industries was organized according to this scheme.

The linear-functional form of organization has undoubted advantages, in particular:

- stimulates professional specialization;

- does not allow duplication of functions and responsibilities within the organization;

- improves vertical coordination in each of the functional branches.

Most manufacturing and trading companies of small and medium-sized businesses still have a linear-functional organization. However, the disadvantages of this form of organization are also significant: the lack of formal horizontal connections leads to the fact that information can reach lower levels on the “adjacent vertical” only by rising to the very top along our “functional branch.” This complicates coordination between individual functional branches, promotes conflicts of interests and goals of individual functional branches, and thereby increases the costs (financial and time) of managing such a system. Therefore, companies operating in the most technologically advanced industries or producing products for single orders (aerospace, consulting and auditing, software production), not content with such a scheme, have at least the rudiments of a matrix form of organization. In a linear-functional form of organization, in addition to accountants-analysts working directly in the structure of the accounting and financial service (in the financial vertical), economists, standard setters, administrators of workshops, departments, services (accounting and financial employees at the middle and lower levels of production, sales and other verticals).

2. A divisional (holding) structure is a group of relatively independent divisions united by common financial management and (most often) ownership relations (Fig. 3.5).

In terms of products, a holding can be a vertically integrated structure (in which the results of one division are transferred for further operations to another) or act as a fully diversified group of companies (if they produce unrelated products or sell in different markets). From the point of view of the form of organization, large companies with noticeable territorial or product disunity, which require a high level of decentralization and delegation of authority, fall into this category. The head office of the holding company is engaged in strategic planning and centralized distribution of resources, primarily financial, and also monitors the achievement of the divisions' goals, also formulated primarily in terms of profit. Companies included in the holding (divisions, divisions, segments) develop their own plans to achieve these goals and are responsible for their implementation. Thus, by delegating the authority to make operational and tactical decisions to divisions, the holding’s managers also transfer responsibility for achieving their goals to the levels of these divisions. The other side of the coin is the inevitable duplication of functions by individual departments and the conflict of interests of their managers. With a divisional (holding) form of organization, accounting and financial services are formed not only in the management company, but also in each holding company separately, and just as in a linear-functional system, in each company specialists can work as in the administration , and in departments.

3. Matrix structure, in which divisions (subsidiaries, projects, etc.) have a certain independence in carrying out their tasks. At the same time, holders of a certain profession perform their functions only on a temporary basis, for the duration of a separate project, and easily move between departments, forming a single labor market for functional groups. In matrix-form organizations, the problem of the attitude of heads of functional units and projects is particularly acute.

The principle of organizing the activities of matrix organizations at the operational level is illustrated in Fig. 3.6)

Martian meteorite and terraces

Martian meteorite and terraces How Martian meteorites fall to Earth

How Martian meteorites fall to Earth Man's first flight to the Moon: how it happened

Man's first flight to the Moon: how it happened Rhubarb decoction How to close rhubarb without sugar for the winter

Rhubarb decoction How to close rhubarb without sugar for the winter Broccoli: how to store the most whimsical type of cabbage Broccoli cabbage when to harvest and how to store

Broccoli: how to store the most whimsical type of cabbage Broccoli cabbage when to harvest and how to store Sumy State University

Sumy State University Kupyansk Motor Transport College, skating rink Kupyansk Motor Transport College

Kupyansk Motor Transport College, skating rink Kupyansk Motor Transport College