Account 401.40 in a budget institution. What is included in deferred income? Return of unused balances of subsidies

The charts of accounts for budgetary, autonomous institutions provide for account 401 40 “Deferred income”. It has limited use among accountants, not least because of the sparse description in the instructions. Let's figure out what economic meaning is inherent in the concept of “deferred income” and what transactions can be reflected in the corresponding account.

What applies

Income is an object of accounting on the basis of clause 5 of Art. 5 of the Federal Law of December 6, 2011 No. 402-FZ. At the same time, instructions for accounting in institutions do not contain a clear definition of the concept of “income”.

From a literal reading of paragraph 3 of Instruction No. 157n, it follows that income and expenses of state (municipal) institutions are the financial result of changes in the state of assets and liabilities.

This interpretation is consistent with the definition of income in IFRS (IAS 18 “Revenue”), according to which income is economic benefit during a certain reporting period in the form of an increase in the organization’s assets or a decrease in liabilities.

At the same time, the concept of “deferred income” used in Russian accounting standards is absent in IFRS. It is likely that, as part of measures to reform the Russian accounting system in accordance with IFRS, changes will be made to Instruction No. 157n and other regulatory legal acts establishing the procedure for accounting and reporting in state (municipal) institutions.

One of the principles of accounting and reporting is the principle of correspondence, i.e. all income and related expenses must be reflected in the financial statements in the time period in which they occurred.

According to paragraph 301 of Instruction No. 157n, income accrued (received) in the reporting period, but relating to the following reporting periods, is income of future periods.

Here are examples of such income:

- income accrued for individual stages of work and services completed and delivered to customers that are not related to the income of the current reporting period;

- income received from livestock products (offspring, weight gain, animal growth) and agriculture;

- income from monthly, quarterly, annual subscriptions;

- other similar income.

When classifying future income, it is very important to distinguish them from the amounts of prepayments (advances) received, payments for the upcoming performance of work (rendering services). If the terms of the contract are changed or terminated, the prepayment (advance payment) is partially or fully refundable to the customer (buyer). But future income is income that with a high degree of probability will not be returned.

Therefore, other similar income may include, for example, income from the grant of non-exclusive rights to intangible assets if the payment is received one time.

Accounting procedure

To account for future income, the account of the same name 401 40 is intended (clause 301 of Instruction No. 157n). The credit of this account reflects the amounts of income relating to future reporting periods, and the debit - the amount of income credited to the corresponding income accounts of the current financial year upon the onset of the period to which these incomes relate.

Clause 157 of Instruction No. 174n and clause 185 of Instruction No. 183n for budgetary and autonomous institutions, respectively, provides for the use of analytical accounts:

- 0 401 40 130 “Future income from the provision of paid services”;

- 0 401 40 180 “Other deferred income”.

Accounting entries for account 401 40 are established for budgetary institutions - clause 158 of Instruction No. 174n, for autonomous ones - clause 186 of Instruction No. 183n.

Example

A budgetary educational institution, as part of its income-generating activities, entered into an agreement with the customer to carry out research work (R&D) in the amount of 1,500,000 rubles. The work will be carried out in two stages:

- Stage I – from 07/01/2014 to 12/01/2014. The cost of work is 1,000,000 rubles;

- Stage II – from 12/02/2014 to 05/31/2015. The cost of the work is 500,000 rubles.

The contract provides for calculations for individual stages of work. The transfer of research results is carried out after completion of all stages.

In the accounting of the institution, this operation is reflected in the following correspondence:

- income was accrued in accordance with the contract and settlement documents for the first stage of work completed and handed over to the customer (December 2014), 1,000,000 rubles.

Debit 2,205 31,560 Credit 2,401 40,130; - paid by the customer for the first stage of work (December 2014), 1,000,000 rubles.

Debit 2,201 11,510 Credit 2,205 31,660,

at the same time, the receipt is recorded in off-balance sheet account 17 (code 130 KOSGU); - the income of the current period is reflected in the amount of the contract value of the research results delivered and accepted by the customer (June 2015), 1,000,000 rubles.

Debit 2,401 40,130 Credit 2,401 10,130; - income was accrued in accordance with the contract and settlement documents for stage II of work completed and handed over to the customer (June 2015), RUB 500,000.

Debit 2,205 31,560 Credit 2,401 10,130.

Analytical accounting of future income is carried out according to the types of income (receipts) provided for by the plan of financial and economic activities of the institution, in the context of contracts and agreements. When developing an accounting policy, an institution has the right to provide additional conditions for analytical accounting of future income, taking into account the specifics of its activities. These conditions may be consistent with the requirements of tax legislation, for example, paragraph 2 of Art. 271 Tax Code of the Russian Federation.

Prospects for reform

Currently, account 401 40 is used mainly with code 130 KOSGU within the framework of income-generating activities, as a rule, in cases where contracts are concluded for a long period exceeding one financial year, with phased delivery of the results of work. However, as we have seen, such a restriction on the use of this account is not established by law.

In addition, the Russian Ministry of Finance plans to expand the functional purpose of the account. It is expected that in the future it will be used to reflect the following transactions:

- 0 401 40 172 – sale of property if the contract provides for installment payment on the terms of transfer of ownership of the object after completion of settlements. When maintaining accounting using the accrual method in the period from the moment of concluding the purchase and sale agreement until the termination of the right of operational management, income from the sale of property is reflected in the subaccount 0 401 40 172;

- 0 401 40 180 – receipt of funds under agreements on the provision of subsidies in the next financial year (years following the reporting year), including for other purposes, under agreements on the provision of grants, under other agreements. If the agreement is concluded for several years, then income under it should be reflected in account 0 401 40 180. They will be recognized as income of the current financial period according to the payment schedule.

In the letter of the Ministry of Finance of Russia No. 02-07-007/57698, the Treasury of Russia No. 42-7.4-05/2.3-870 dated December 26, 2013, the possibility of reflecting the listed transactions on account 401 40 under codes 172, 180 KOSGU was allowed as a recommendation. In the future, these changes are planned to be made to the accounting and reporting instructions.

October 10

When maintaining accounting records of state and municipal institutions, accountants need to pay attention to some clarifications of the Ministry of Finance of Russia in the rules and procedures for applying accounting accounts, introduced by the new edition of Order of the Ministry of Finance of the Russian Federation dated August 29, 2014 No. 89n in the Instructions for accounting of institutions, approved by the Order of the Ministry of Finance of the Russian Federation dated 01.12.2010 No. 157n.

Account 101 00 “Fixed assets”- currently, in the debit of account 101 00, all tangible assets are subject to accounting as fixed assets:

- intended for repeated or permanent use with the right of operational management during the activities of the institution when performing work or providing services ( used in operation);

- for the exercise of government powers (functions) or for the management needs of the institution;

- institutions that are in reserve on the basis of the relevant organizational and administrative documents of the authorized body of the founder;

- transferred for conservation for a period of more than 3 months based on an order from the management of the institution;

- transferred to restoration work (reconstruction, modernization, completion and additional equipment) by order of the management of the institution (superior body) for a period of more than 12 months;

- leased, free use and trust management on the basis of relevant agreements and orders of the head of the institution (authorized body of the founder);

- received on lease on the basis of a leasing agreement, subject to the transfer of the leased property to the balance sheet of the lessee (institution).

Thus, in the debit of account 101 00 “Fixed assets”, all objects of fixed assets of the institution are taken into account, for a certain time and requiring expenses for their maintenance.

Using separate accounting (opening analytical accounting of the following procedures), it is necessary to ensure the division of fixed assets into categories: exploited and unexploited. This is due to the fact that in the category “non-operating fixed assets” expenses for their maintenance and operation are not allowed in the economic feasibility study at the planning stage. It is also necessary to remember that the category “non-operating fixed assets” must be confirmed by supporting documents. Otherwise, in the absence of relevant documents, financial control authorities have the right to interpret it as ineffective use of fixed assets in the activities of the institution.

The new edition of paragraph 38 of Instruction No. 157n clarifies the procedure for generating documents related to the procedure for mothballing (re-mothballing) a fixed asset object for a period of more than 3 months. This procedure is subject to registration by the primary accounting document - the Act on conservation (re-preservation) of fixed assets, containing information about the object of accounting (name, inventory number of the object, its original (book) value, amount of accrued depreciation), as well as information about the reasons for conservation and period conservation. At the same time, an object of fixed assets that is under conservation continues to be listed on the corresponding balance sheet accounts of the institution’s Working Chart of Accounts as an object of fixed assets. Reflection of conservation (re-preservation) of an object of fixed assets for a period of more than 3 months is reflected by making a record of conservation (re-preservation) of the object in the Inventory card of the accounting object, without reflecting account 010100000 “Fixed Assets” in the corresponding analytical accounts.

When accepting fixed assets for accounting, you should pay attention to the new paragraph 8 of paragraph 45 of Instruction No. 157n, which emphasizes that individual premises of buildings that have different functional purposes, as well as being independent objects of property rights, are accounted for as independent inventory objects of fixed assets. The road environment (technical means of organizing traffic, including road signs, fencing, markings, guide devices, traffic lights, automated traffic control systems, lighting networks, landscaping and small architectural forms) is taken into account as part of the road, unless otherwise established by the procedure for maintaining the register property of the relevant public legal entity.

The new edition of paragraph 27 of Instruction No. 157n emphasizes that the results of the repair of fixed assets, without changing its value(including the replacement of elements in a complex fixed asset object) are subject to reflection in the accounting register - the Inventory card of the corresponding fixed asset object by making entries about the changes made, without being reflected in the accounting accounts.

For the purpose of maintaining accounting records of fixed assets, the Ministry of Finance of the Russian Federation clarifies the following terminology:

- decommissioning of fixed assets- i.e. seizure of that part of the property of a given institution that is active and can be used in the future in the activities of other institutions,

- thereby bringing future economic benefits to these institutions;

- decommissioning of fixed assets- i.e. decommissioning of that part of the institution’s property that cannot be further used by it due to its unsuitability. In these cases, it is necessary to take into account the availability of relevant documents and technical reports on the unsatisfactory technical condition of these fixed assets. Documents are drawn up through the authorized bodies of the founder for property management of budgetary property (department, committee, section, etc.). On the basis of documents duly executed in accordance with the established procedure, mandatory disposal of decommissioned fixed assets is carried out.

Account 103 00 “Non-produced assets”- in accordance with the new edition of paragraph 71 of Instruction No. 157n on the debit of account 103 11 “Land”, all state and municipal institutions must, at the cadastral value, register the right to permanent (indefinite) use of land plots (including those located under real estate) on the basis of a document ( evidence).

Since the land tax paid by all state and municipal institutions is recognized as expenditure obligations, the justification for which is covered for state institutions at the expense of the budget estimate - by the limits of budget obligations, for budgetary and autonomous institutions at the expense of the financial and economic activity plan - subsidies for other purposes, therefore land plots as an asset, institutions must be accounted for as a debit account 103 11 "Earth" at cadastral value. At the same time, at present, in order to generate a reliable annual report for 2014, it is necessary to make the following adjustment in accounting based on the completed Certificate f. 0504833:

- in 2014 must be accepted at cadastral value for balance sheet accounting in the following correspondence:

* for government institutions:

* for budgetary and autonomous institutions:

- land plots received by the institution on the basis of a Certificate for the right of operational management previously until January 1, 2014 and accepted for off-balance sheet accounting under account 01 “Property received for use” must be transferred to balance sheet accounting before drawing up the annual balance sheet (f. 0503130, f. 0503730) for 2014 in the following order:

- close off-balance sheet accounting of land plots “minus” account 01 “Property received for use”;

- open balance sheet accounting of land plots under account 103 11 “Land”:

* for government institutions in correspondence of accounts:

Debit 1,103 11,330 Credit 1,304 04,330, 1,401 10,180;

* for budgetary and autonomous institutions in correspondence of accounts:

Debit 4,103 11,330 Credit 4,210 06,660

In order to ensure reliable disclosure of information on land plots on the balance sheet of institutions, it is necessary to review the cadastral (market) value of land plots at the end of the year, thereby fixing the right to additional funding from the budget.

Based on the results of 2014 after submitting the annual report for accounting purposes to all state and municipal institutions should be clarified:

- if the land plots are demarcated, but not transferred for the right of operational management of institutions, then these land plots must be taken into account on the balance sheet of the authorized bodies of the founder (KUI, etc.) under account 108 51 “Real estate constituting the treasury”;

- if the land plots are demarcated, not transferred to the right of operational management of institutions, and leased out on the basis of agreements, then these land plots must be taken into account on the balance sheet of the authorized bodies of the founder (KUI, etc.) under account 108 51 “Real estate constituting the treasury”;

- if land plots are located on the basis of a Certificate of the right to free use of authorized, budgetary and autonomous institutions, then they must be taken into account on the balance sheet of these institutions under account 10311 “Land”.

Account 106 01 “Investments in fixed assets” The methodology for budget investments in capital investments of institutions is being clarified. Account 106 01 “Investments in fixed assets” takes into account the costs of capital investments and is a collective calculation account that collects all expenses associated with capital investments and forms the initial (inventory) cost of the fixed asset for the purpose of accepting the object for accounting in the form of property on account 101 00 “Fixed assets”. Thus, in account 106 01 “Investments in fixed assets” there is no property object, since there are no property rights to the fixed asset object.

Currently, budgetary investments in capital investments of the institution are carried out in the following order:

- by transferring authority to the customer(unitary enterprises). At the same time, the customer - a unitary enterprise - is obliged to keep accounting records of the execution of budget investments in accordance with Instruction on Budget Accounting No. 162n;

- institutions' own efforts. At the same time, financing of capital investments in fixed assets real estate is carried out for budgetary and autonomous institutions in the form of subsidies for the purpose of capital investments (18th category code 6). In this case, budgetary and autonomous institutions perform the functions of the customer.

If the powers of the customer of capital construction are exercised by a government institution, then budget financing is carried out either at the expense of limits on budget obligations or at the expense of budgetary appropriations (18th category code 1).

In the event that a government institution transfers a fixed asset completed by construction to a budgetary or autonomous institution, account 106 01 “Investments in fixed assets” is closed and the budgetary and autonomous institution accepts it on the balance sheet in the form of property to account 101 10 “Fixed assets - real estate of the institution.”

Thus, in this situation, capital construction of a real estate property is carried out by one legal entity (a government institution - the customer), and the right to use this property is received by another legal entity (budgetary or autonomous institution). In this situation, it is necessary to pay attention to the preparation of documents for the capital construction of real estate and the transfer of capital investments and take into account the following:

- availability of a document for capital construction in the form of a tripartite Agreement between the customer, developer and founder (copyright holder) with signatures and details of all participants, including the Property Management Committee;

- the transfer of capital investments is carried out on the basis of the Acceptance and Transfer Certificate of the fixed assets object, assessed by the volume of completed capital construction work. In this case, it is necessary to submit certified copies of primary accounting documents confirming the costs of capital construction of the property.

Objects of completed construction can be transferred by a budgetary and autonomous institution performing the functions of a customer to the treasury of the corresponding budget, and then this object can be transferred for the right of operational management to institutions according to the following scheme of accounting accounts:

Budgetary (autonomous) institution - customer

account 106 01

Property Management Committee (treasury)

score 108 51

State, budgetary, autonomous institution

score 101 10

The Property Management Committee is authorized to make a decision on behalf of the owner (founder) on the transfer of the right of operational management to budget property. It is necessary to take into account that the withdrawal of the right of operational management of property from one institution and the acquisition of the right of operational management of this property by another institution must be recorded in the accounting records of these institutions in one reporting period.

State registration of a real estate property (Certificate) is not a document that gives rise to the right to operationally manage budget property. It is necessary to take into account that the right to operational management of property is confirmed by the corresponding entry in the property register, made by the Property Management Committee and brought to the establishment by the authorized body exercising the functions and powers of the founder in the form of a formalized Notice (f. 0504805).

It must be taken into account that the obligation to register property did not always exist (the Federal Law “On State Registration of Rights to Real Estate and Transactions with It” has been in force since 1997), therefore unregistered property acquired by an institution before the entry into force of this law can be accounted for in account 101 10 “Fixed assets and real estate of the institution” without registration.

On January 1, 2014, a new form of subsidies appeared - subsidies for capital investments , provided to budgetary and autonomous institutions for the acquisition of real estate and for capital investments in capital construction projects.

According to the Guidelines for the Application of Budget Classification in the Russian Federation (Order of the Ministry of Finance of the Russian Federation dated July 1, 2013 No. 65n), subsidies for capital investments are used by budgetary and autonomous institutions in the following areas:

- for the acquisition of real estate;

- for the implementation of capital construction of real estate.

Thus, the costs associated with the reconstruction of real estate objects, as well as their completion, must be covered by this form of subsidy. However, using subsidies for capital investments in acquisition of movable property is unacceptable, since the acquisition of movable property is carried out at the expense of a subsidy for financial support for the implementation of a state (municipal) task, otherwise the misdirection of this subsidy will be recognized.

The new version of paragraph 27 of Instruction No. 157n clarifies that actual investments in fixed assets in the amount of costs for their modernization, additional equipment, reconstruction (including elements of restoration), technical re-equipment are reflected in the accounting of the organization exercising the powers of the recipient of budget funds. After these procedures are completed, capital investments in fixed assets are transferred to the balance sheet holder of the object in order to attribute them to an increase in the initial (book) value of the objects.

It is unacceptable to reconstruct buildings - objects of non-state property, leased by budgetary and autonomous institutions at the expense of subsidies for capital investments. At the same time, reconstruction of leased buildings by budgetary and autonomous institutions is allowed, but subject to further compensation by the lessor for reconstruction costs incurred by these institutions water reporting period. Repair of rented buildings by budgetary and autonomous institutions at the expense of budget subsidies (code 225) is possible, provided that this is specified in the contract.

Account 206 00 “Settlements for advances issued” the application in accounting is clarified in the following areas:

- this account is opened only on the basis of procurement contracts;

- ensures the right to participate in tenders of counterparties.

Thus, when an institution transfers funds in the form of an advance payment on the basis of a purchase agreement with a counterparty, together with the opening of account 206 00 “Settlements for advances issued,” the right to participate in the counterparty’s competition is recorded in the form of a bank guarantee on off-balance sheet account 10 “Securing the fulfillment of obligations.” The bank guarantee is written off from account 10 “Securing the fulfillment of obligations” after passing the procurement quotation. While the procurement contract is not completed, the bank guarantee continues to be listed in account 10 “Securing the fulfillment of obligations.”

State-owned, budgetary and autonomous institutions wishing to participate in one or another procurement-related competition pay for ensuring the fulfillment of obligations with the type of expense code 290 for the participation of institutions in the execution of the contract. If for some reason the advance payment is returned by the counterparty who has not fulfilled the contract, then the security for the fulfillment of obligations is returned (recovery of cash expenses under the contract and security).

The new edition of paragraph 235 of Instruction No. 157n expands the load of application account 210 05 “Settlements with other debtors”, which should be used to account for accounts receivable:

- on operations of the institution providing security for applications for participation in a competition or closed auction, security for the performance of a contract (agreement), other collateral payments, deposits;

- to reflect in the accounting of budget revenue administrators calculations for taxes, fees, and other payments expected to be received, the obligation to pay which, in accordance with the current legislation of the Russian Federation, is considered fulfilled;

- to reflect settlements under agency contracts (agency agreements), contracts (agreements) with the participation of international financial organizations;

- for other transactions arising in the course of conducting the activities of the institution and not provided for reflection on other accounts of the Unified Chart of Accounts.

Thus, currently account 210 05 “Settlements with other debtors” can be used not only for the purposes of accounting for transactions on the revenue side (for example, reimbursement of utility bills by tenants), but also transactions on the expense side (for example, reimbursement by the Social Insurance Fund for sick leave payments) .

It is necessary to take into account that the use of this account is possible as part of the formation of the accounting policy of the institution, taking into account the requirements of the legislation of the Russian Federation, bodies exercising the functions and powers of the founder through the establishment in the Working Chart of Accounts of an additional grouping of settlements with other debtors, i.e. additional analytical codes accounting account numbers.

In accordance with the new edition of paragraph 220 of Instruction No. 157n account 209 00 gets a new name “Calculations for damage and other income” and additional load. Currently, this account is used not only to account for settlements of identified shortages, thefts of funds and other valuables, losses from damage to material assets and damage caused to the property of the institution subject to compensation by the perpetrators in the manner established by the Russian Federation, but also in calculations:

- on the amount of debt of dismissed employees to the institution for unworked vacation days before the end of the working year for which he has already received annual paid leave;

- on the amounts of preliminary payments subject to reimbursement by counterparties in the event of termination, including by a court decision, of state (municipal) agreements (contracts), other agreements (agreements), under which payments were previously made by the institution;

- on amounts of debt of accountable persons that were not returned in a timely manner (not withheld from wages), including in the case of challenging the deductions;

- for the amount of damage subject to compensation by a court decision in the form of compensation for expenses associated with legal proceedings (payment of legal costs);

- calculations for other damages, as well as other income arising in the course of the economic activities of the institution, not reflected in settlement accounts 20500 “Calculations based on income”.

When determining the amount of damage caused by shortages and thefts, one should proceed from current replacement cost material assets on the day the damage was discovered, which means the amount of money required to restore these assets.

In this regard, clause 221 will clarify the grouping of calculations for damage and other income by income groups and analytical groups of the synthetic account of the accounting object in the following order:

30 “Calculations for cost compensation”;

40 “Calculations for forced seizure amounts”;

70 “Calculations for damage to non-financial assets”;

80 “Calculations for other income.”

At the same time, calculations for other income, arising from the economic activity of the institution, not reflected in the settlement accounts 20500 “Calculations for income” are recorded in the account containing the analytical code of the group of synthetic account 80 “Settlements for other income” and the corresponding analytical code for the type of synthetic account of financial assets.

Thus, budgetary and autonomous institutions in the formation of a plan of financial and economic activities (hereinafter - PFHD) and maintaining accounting records in the revenue side Income-generating activities must take into account the following:

- income-generating activity is an activity aimed at continuously generating income that is recognized functional income (as a rule, KOSGU code 130, but possibly code 120), associated with the joint activities of the institution, are planned (predicted) income, in the form of expected (potential) income. These incomes must be approved by the PFHD of the institution (for example, in educational institutions all income from the provision of educational services, in medical institutions - income from the provision of medical services, etc.). Functional income is accounted for using the accrual method of account 205 00 “Income calculations” (Debit 2,205 30,560 Credit 2,401 10,130);

- income coming from the business operations of the institution and not related to the activities of the institution , for the sake of which the institution was created by the founder, and those associated with settlements of damage to property and other income (for example, fines, sale of assets, reimbursement of expenses, sale of products created by students during labor lessons in an educational institution, etc.) are recognized unpredictable income. Therefore, these receipts do not create expenditure obligations, and they should not be taken into account when forming the institution’s financial financial statements, since they are not the object of planning. In accordance with the new methodology, these incomes are subject to accounting according to account 209 80 “Calculations for other income” .

Account 401 40 “Deferred income” used to account for amounts of income accrued (received) in the reporting period, but relating to future reporting periods. Currently, this account, in accordance with paragraph 301 of the new edition of Instruction No. 157n, is also applied in the following order:

- when reflecting income from transactions involving the sale of treasury property, if the agreement provides for installment payment on the terms of transfer of ownership of the object after completion of settlements;

- when reflecting income under agreements on the provision of subsidies in the next financial year (years following the reporting year), including for other purposes;

- when reflecting subsidies for capital investments in capital construction projects of state (municipal) property and the acquisition of real estate objects in state (municipal) property;

- when reflecting income under contracts (agreements) for the provision of grants;

- when reflected other similar income.

Thus, currently account 401 40 “Deferred income” must be used to reflect the right to receive budget subsidies by budgetary and autonomous institutions.

The right of recipients of budget subsidies is fixed in the Agreement on the procedure and conditions for providing subsidies for financial support for the implementation of state (municipal) tasks for the provision of state (municipal) services, thereby the founder (budget) assumes the obligation to cover the costs of providing state (municipal) services in accordance with the task approved by him. In turn, the recipient of the subsidies (budgetary and autonomous institution) consents to state (municipal) financial control carried out by the founder through the analysis of their financial statements. At the same time, for the subsidies approved in the annual volume, it is necessary to accrue subsidies in the accounting records of the budgetary and autonomous institution, thereby securing the obligation of the founder (budget) to provide them with subsidies in the following order:

- if the Agreement is concluded (signed) in the current period (December) for a state (municipal) task and the amount of financial support (subsidies) for the next financial year or in the first days of January of the current financial year, then on the last day of December of the reporting year (2014) subsidy calculation ( Debit 4,205 80,560 Credit 4,401 40 180 );

- reflect the balances as of January 1, 2015 for accounts 205 80 assets and 401 40 liabilities in the balance sheet (form 0504730).

It must be borne in mind that even if in fact a subsidy for financial support for the implementation of a state (municipal) task was not received during the corresponding period, the possibility of accepting monetary obligations associated with the acquisition of assets and other economic needs is not excluded, i.e. temporary accounts payable are allowed due to non-receipt of subsidies.

Clause 302.1 of the new edition of Instruction No. 157n introduced a new account 401 60 “Reserves for future expenses” for the purpose of accruing future expenses and reflecting deferred obligations of the institution. The mechanism for reserving upcoming expenses allows you to formulate the real financial result of the activities of institutions. With this mechanism, monetary obligations by the institution are not accepted as these are deferred obligations. This account must record transactions arising as a result of accepting another obligation (transactions, events, operations that have or are capable of influencing the financial position of the institution, the financial result of its activities and (or) cash flow):

- upcoming payment of vacations for actually worked time or compensation for unused vacations, including upon dismissal, including payments for compulsory social insurance of an employee (employee) of the institution;

- upcoming payment at the request of buyers for warranty repairs, routine maintenance in cases provided for in the supply agreement;

- other similar upcoming payments;

- arising by virtue of the legislation of the Russian Federation when making a decision on restructuring the activities of an institution, including the creation, changing the structure (composition) of separate divisions of the institution and (or) changing the types of activities of the institution, as well as when making a decision on the reorganization or liquidation of the institution;

- arising from claims and claims as a result of facts of economic life, including within the framework of pre-trial (out-of-court) consideration of claims, in the amount of amounts presented for the establishment of penalties (penalties), other compensation for damages (losses), including those arising from the terms of civil agreements (contracts);

- arising in the event of claims (claims) being made against a public legal entity: for compensation for damage caused to an individual or legal entity as a result of illegal actions (inaction) of government bodies or officials of these bodies, including as a result of the issuance of acts of government bodies, not in accordance with the law or other legal act, as well as expected legal expenses (expenses), in the event of claims (claims) being presented to the institution in accordance with the legislation of the Russian Federation, and other similar expected expenses;

- for the institution’s obligations arising from the facts of economic activity (transactions, operations), the accrual of which there is uncertainty in their size at the reporting date due to the lack of primary accounting documents;

- for other obligations not determined by the amount and (or) time of fulfillment, in cases provided for by an act of the institution adopted when forming its accounting policies.

In this case, the procedure for the formation of reserves (types of reserves formed, methods for assessing liabilities, date of recognition in accounting, etc.) is established by the institution as part of the formation of accounting policies. The reserve should be used only to cover those costs for which the reserve was originally created. Recognition in accounting of expenses for which a reserve for future expenses has been formed is carried out at the expense of the amount of the created reserve.

Thus, in the liability side of the balance sheet of a budgetary and autonomous institution the information of account 40160 “Reserves for future expenses” is disclosed, and in the asset side of the balance sheet the information of account 201 11 (21) “Cash of the institution on personal accounts” is disclosed as collateral with cash.

The financial and economic justification for certain management decisions should be taken into account at the planning stage of the institution’s activities through the accrual of the following reserves in the accounting records in the prescribed manner:

- reserve for future expenses and deferred obligations (for example, for the future procedure of reorganization of the institution). In this case, upcoming expenses associated with the reorganization procedure are provided for (predicted) and all social payments (benefits) are justified based on the decision made by the founder. Thus, in account 401 60 “Reserves for future expenses,” the procedure for reorganizing the institution is assessed and at the time the decision on reorganization is made, the risk is recorded;

- reserve for vacation pay for employees of the institution for the purpose of calculating payment for the next vacation, as well as future compensation for unused vacation upon dismissal of employees. The purpose of creating this reserve: the amount for unused vacations from previous years must be justified and declared to the budget. Otherwise, when an institution’s employees are dismissed, compensation for unused vacation from previous years can significantly reduce the institution’s wage fund for the current period. Thus, it is necessary, as of January 1, to create a wage fund for past years in the form of a reserve for vacation pay in order to accrue future compensation for unused vacation upon dismissal of employees of the institution.

Account 401 60 “Reserves for future expenses” reserves the amount of compensatory payments for unused vacation upon dismissal of employees, and also records the right to annual paid leave in the form of a monthly accrual of the vacation reserve for the current expenses of the institution.

In order to create a reserve for vacation pay without fail all institutions need as of January 1, 2015 calculate the amount of compensation for unused vacations from previous years and the average salary for vacations in 2015. This business transaction in accounting must be reflected in the expenses of the institution in the following order:

Debit 1 401 20 211, 213- for government institutions,

0 109 60(80) 211, 213 - for budgetary and autonomous institutions

Credit 0 401 60 211, 213

As of January 1, 2015 in the balance sheet of budgetary and autonomous institutions (f. 0504730), it is necessary to show the credit balance of account 401 60 “Reserves for future expenses.”

Thus, the creation of a reserve for vacation pay, including compensation for unused vacations, is a need to fix the risks of the economic activities of institutions. In this case, the method of calculating the reserve for vacation pay is established independently by the institution within the framework of its adopted accounting policies.

The use of the reserve for payment of regular vacations and for calculating compensation for unused vacation upon dismissal of employees during the financial year is reflected in accounting in the following order:

Debit 0 401 60 211, 213 Credit 0 302 11 730, 0 303 02….730;

- reserve for expenditure obligations for contested cases in the courts , since the obligation for legal claims against legal entities should be created (planned) not at the time of its execution. In accounting, this operation is reflected in the following order:

- reserve accrual:

Debit 0 401 20 290 Credit 0 401 60 290

- use of reserve:

Debit 0 401 60 290 Credit 0 302 91 730;

- reserve for compensation of damage caused to an individual , including legal costs, state fees, etc. The accounting for transactions related to this reserve is carried out similarly to the reserve for expenditure obligations for contested cases in the courts;

- reserve for the costs of disposal of the institution's property is created at the time of acquisition of property and is used, for example, during the liquidation of fixed assets, during the disposal of materials consumed in medical institutions, etc.

When creating this reserve, a problem arises in estimating the reserve for the disposal of property, therefore, if necessary, this reserve must be indexed and adjusted at the end of the year.

Operations related to the movement of the reserve for the disposal of the institution’s property are reflected in accounting in the following order:

- accrual of a reserve at the time of acquisition of property for the initial cost of fixed assets and inventories:

Debit 0 106 01 310, 0 105 01 340 Credit 0 401 60 226

- use of the reserve for disposal of property at the time of its disposal from the register:

Debit 0 401 60 226 Credit 0 302 26 730

- At the end of the financial year, an adjustment (indexation) was made to increase the reserve for disposal of property:

Debit 0 401 10 171 Credit 0 401 60 226

If necessary, budgetary and autonomous institutions, as part of the formation of accounting policies, can create other reserves (for example, for compensation for travel on vacation, for payment of remunerations for official inventions, etc.).

Account 502 00 “Accepted obligations” Currently, this account is used for the purpose of accounting for budgetary obligations accepted by government institutions at the expense of the budget estimate and by budgetary (autonomous) institutions of obligations assumed at the expense of PFHD (account 502 11), as well as monetary obligations assumed by institutions to legal entities and individuals (account 502 12). Currently, the acceptance of budgetary (planned) obligations under account 502 11 “Accepted obligations” should be carried out at the stage of concluding agreements (contracts) with counterparties. Acceptance of monetary obligations under account 502 12 “Accepted monetary obligations” is carried out at the stage of execution of agreements (contracts). In this regard, the new edition of paragraph 319 of Instruction No. 157n introduces a grouping of accepted ( accepted ) establishment of obligations containing the corresponding analytical code of the synthetic account group and the corresponding analytical codes:

1 “Accepted obligations”;

2 “Accepted monetary obligations”;

7 “Obligations accepted”;

9 “Deferred obligations”.

From January 1, 2015, the acceptance by government institutions of budgetary obligations, budgetary and autonomous institutions of planned obligations under account 502 11 “Accepted obligations” must be carried out at the time of the announcement of the competition, quotations, i.e. before concluding agreements (contracts) related to transactions.

Thus, tenders and quotations declared by institutions are recognized as deferred liabilities and are subject to reflection in accounting under account 502 11 “Accepted obligations”, as well as disclosure of this information in the reporting of institutions (f. 0503128, f. 0503738).

Account 504 10 “Estimated (planned, forecast) assignments” Currently, it should be used not only by budgetary and autonomous institutions for the purpose of accounting for the amounts approved for the corresponding financial year of planned assignments for income (receipts) and expenses (payments), but also by government institutions for the purpose of maintaining a cash plan and forecasting budget revenues.

The new edition of clause 324 of Instruction No. 157n provides for the use of this account in the following order:

- for institutions to take into account the amounts approved for the corresponding financial year of estimated (planned) assignments for income (receipts), expenses (payments);

- to take into account the amounts of changes made to the indicators of estimated (planned, forecast) assignments approved in the prescribed manner;

- for budget revenue administrators to take into account data on forecast (planned) budget revenue indicators for the corresponding financial year (their changes).

Thus, account 504 10 “Estimated (planned, forecast) assignments” should be used when maintaining accounting records:

- budgetary and autonomous institutions on the credit turnover of account 504 10 when reflecting the planned assignments of income (receipts) in an annual volume in accordance with the approved Plan of financial and economic activities of the institution;

- government agencies The credit turnover of account 504 10 should reflect forecast assignments for budget revenues.

The new edition of Instruction No. 157n clarifies the use of the following off-balance sheet accounts in the accounting of institutions:

Account 03 “Strict reporting forms” can also be used to account for sanatorium and resort vouchers. It is also emphasized that, under certain conditions, strict reporting forms can be developed and approved as part of the formation of accounting policies by the institution independently.

Account 04 “Written off debt of insolvent debtors”- a different deadline for writing off this debt is specified in the event of liquidation of the debtor. This account also records the debt to the budget established by the chief administrator of budget revenues. In accordance with the new edition of clause 339 of Instruction No. 157n, writing off debt from off-balance sheet accounting is carried out on the basis of a decision of the institution’s commission for the receipt and disposal of assets in the presence of documents confirming the termination of the obligation by the death (liquidation) of the debtor, as well as upon expiration of the period for possible resumption of the collection procedure debts, in accordance with the current legislation of the Russian Federation.

Account 09 “Spare parts for vehicles issued to replace worn-out ones”- the procedure for writing off spare parts accounted for in this account is clarified. The new edition of clause 349 of Instruction No. 157n clarifies that when a vehicle is disposed of, spare parts installed on it and accounted for in an off-balance sheet account are written off from off-balance sheet accounting.

In accordance with the new edition of paragraphs 365, 367 of Instruction No. 157n, accounts 17 “Receipts of funds to the accounts of the institution”, 18 “Outflows of funds from the accounts of the institution” must be opened for all analytical accounts of account 201 00 “Cash of the institution”, including to accounts 201 03 “Institutional funds in transit”, 201 34 "Cash desk" .

It should be taken into account that the information in account 17 “Receipts of funds to the institution’s accounts” reveals the need for these cash balances.

In accordance with the new edition of clauses 381, 383 of Instruction No. 157n, accounts 25 “Property transferred for paid use (rent)”, 26 “Property transferred for free use” must be used in the accounting of authorized government bodies, self-government bodies (Committee , department for property management of budgetary property).

In the absence of information on the cost of these fixed assets, the property is subject to accounting in the amount of lease payments.

The edition of Instruction No. 157n introduced a new off-balance sheet account 27 “Material assets issued for personal use to employees (employees)”, which is intended to account for property issued by an institution for personal use to employees for the performance of their official (official) duties, in order to ensure control over its safety, intended use and movement.

Acceptance of property items for accounting is carried out on the basis of the primary accounting document at book value.

The disposal of property items from off-balance sheet accounting is carried out on the basis of the primary accounting document at the cost at which the objects were previously accepted for off-balance sheet accounting.

A new off-balance sheet has been introduced account 30 “Settlements for the fulfillment of monetary obligations through third parties”, which is intended for accounting for settlements for the fulfillment of monetary obligations through third parties (when paying pensions, benefits through Russian Post offices, paying agents).

Thus, this account should be used to reflect accrued but not received by individuals compensation and benefits from the Social Insurance and Social Protection Fund.

The financial result of an institution reflects the difference between income and expenses received and incurred in the current reporting period. But if an institution received one-time income or incurred one-time expenses, in an economic sense, which should be distributed over subsequent reporting periods, then for the purposes of accounting and ensuring the formation of the financial result of the activities of a budgetary institution in the next financial periods, accounts 0 401 40 LLC “Future Income” are used. and 0 401 50 LLC “Future expenses”.

In accordance with si. 301 of Instruction No. 157n, as part of deferred income, takes into account revenues received by a budgetary institution in the current period, but relating to the following reporting periods:

- 1) income accrued for individual stages of work and services completed and delivered to customers that are not related to the income of the current reporting period;

- 2) income received from livestock products (offspring, weight gain, animal growth) and agriculture;

- 3) income from monthly, quarterly, annual subscriptions;

- 4) income from operations of the sale of treasury property, if the agreement provides for installment payment on the terms of the transfer of ownership of the object after completion of settlements;

- 5) income under agreements on the provision of subsidies in the next financial year (years following the reporting year), including for other purposes, as well as for capital investments in capital construction projects of state (municipal) property and the acquisition of real estate in state ( municipal) property;

- 6) income from contracts (agreements) on the provision of grants;

- 7) other similar income.

In accordance with the current regulatory legal framework of accounting, we can say that deferred income is assets already received, but according to the principle of comparability they should be compared with the expenses that relate to this income.

Accounting for future income is kept on the same account 0 401 40 000 by type of income (receipts) provided for by the plan of financial and economic activities of a budgetary institution, in terms of contracts and agreements.

In accordance with si. 157 of Instruction No. 174n to reflect the income of a budgetary institution relating to future periods, the following analytical accounting accounts are used in accordance with the object of accounting and the economic content of the business transaction for the income of the institution:

- 0 401 40 130 “Future income from the provision of paid services”;

- 0 401 40 172 “Deferred income from operations with assets”;

- 0 401 40 180 “Other deferred income”.

As part of the formation of accounting policies, budgetary institutions have the right to establish additional requirements for the analytical accounting of future income, including taking into account the industry characteristics of their activities, as well as the requirements of the tax legislation of the Russian Federation on separate accounting of income (receipts) of state and municipal institutions.

When the period to which deferred income relates occurs, their amount is written off. It is included in the current income of a budgetary institution and reflected in accordance with the analytical account. The correspondence of accounts for accounting for deferred income is presented in table. 9.3.

Table 9.3

Correspondence of accounts for accounting for deferred income in budgetary institutions

|

Fact of economic life |

Account correspondence |

||

|

debit |

credit |

||

|

Received future income from performing work or providing services |

|||

|

Future income received from livestock and agricultural products |

0 105 26 340 0 105 36 340 |

||

|

Accrual of future income in the amount of subsidies for the implementation of state (municipal) tasks |

4 205 30 000 (4 205 31 560) |

||

|

Deferred income is included in current income |

|||

The accountant of a budgetary institution needs to separate income (receipts) of future periods from the amounts of advances received. Thus, advances are transferred to pay for goods, works or services that will be supplied or performed in the future. Otherwise, the advance will be refunded. At the same time, future income is those income that most likely will not be returned. This is due to the fact that the budgetary institution has already fulfilled its obligations, against which future income was received (for example, it has carried out a separate stage of work).

Recently, a situation has become quite common when budgetary institutions enter into contracts for the implementation of research and development work (R&D).

Scientific research can be carried out over a long period of time. Long-term contracts can be classified as follows:

- 1) as contracts providing for special conditions for the transfer of ownership of the results of work with phased implementation;

- 2) contracts that do not have special conditions for their implementation.

Contracts for work with a long execution period

may provide for special conditions for the transfer of ownership, namely the transfer of ownership to the customer at the time of signing the act of completed work as a whole under the contract.

A phased transfer of work is also possible. Accounting for such agreements has some peculiarities. As a rule, before the completion of work, income from stages of work delivered to the customer is subject to reflection in the contractor’s accounting as deferred income.

Upon final delivery of work under the contract, the amounts of the indicated income are written off as income for the current period. Therefore, account O 401 40 LLC “Future Income” should be opened if the contract stipulates that ownership of the results of work passes after the final completion of research or design work, and the work is delivered in stages.

Example 1. A state budgetary institution entered into an agreement to carry out research work. In accordance with the agreement, the work is delivered to the customer in two stages, and ownership of the results of the work passes after the final completion of the work. The cost of work under the contract is 300,000 rubles. (including the cost of the first stage of work - 140,000 rubles, the second - 160,000 rubles).

The accounting records of a state budgetary institution must contain the entries presented in table. 1.

If the contract for the performance of research and development work does not provide for special conditions for the transfer of ownership, but only stipulates the period for completing the work without dividing it into separate stages, then there is no need to use account 0 401 40 LLC “Future Income” Table 1

Accounting for the implementation of research work in two stages (ownership of the results of the work passes after the final completion of the work)

Dov." In this case, income for the current period is recognized immediately (account 0 401 10 000).

Invoices issued for prepayment to customers, i.e. advances receivable are not deferred income.

Example 2. A state budgetary institution entered into an agreement to carry out research work for the Institute of Further Professional Education. The cost of work under the contract was 300,000 rubles. The deadline was set for April 30, 2016. The work completion certificate was signed on April 25, 2016.

Payment for work performed is made by the customer within five days from the date of signing the work acceptance certificate. Work is not subject to value added tax (subclause 16, clause 3, article 149 of the Tax Code of the Russian Federation).

In the accounting of a state budgetary institution, the records presented in table are compiled. 1.

If the cost of work (services), in payment for which “future” income was received, is subject to VAT, then when it is received, the budgetary institution needs to accrue its amount.

In the future, it can be taken for deduction. In this case, VAT must be calculated in the same manner as when receiving an advance (i.e. at the calculated rate of 10/110, 18/118).

Table 1

Accounting for operations of a budgetary institution when performing research work (no special conditions for the transfer of ownership are provided)

Example 3. The budgetary institution receives income from the sale of passes to visit the health center. The cost of a six-month subscription is 11,800 rubles. (including VAT - 18%).

The income of a budgetary institution, which, in accordance with Art. 298 of the Civil Code of the Russian Federation may carry out income-generating activities in accordance with its constituent documents, which are at its independent disposal.

In accordance with the instructions on the procedure for applying the budget classification of the Russian Federation, income received by a budgetary institution from the sale of such subscriptions is included in Art. 130 “Income from the provision of paid services (work)” KOSGU.

The sale of such services on the territory of the Russian Federation is subject to VAT taxation (subsection 1 and 1 of Article 146 of the Tax Code of the Russian Federation). The tax base for calculating VAT will be determined twice: on the day the payment for the subscription is received and on the day the services are provided, i.e. monthly on the last day of the month based on 1/6 of the cost of the subscription excluding VAT (paragraph 6, clause 1, article 154, clause 14, article 167 of the Tax Code of the Russian Federation).

In the first case, a tax rate of 18/118% is applied in accordance with and. 4 tbsp. 164 of the Tax Code of the Russian Federation, and the second time a tax rate of 18% is applied (clause 3 of Article 164 of the Tax Code of the Russian Federation).

Based on i. 1 tbsp. 271 of the Tax Code of the Russian Federation using the accrual method, such income is recognized in the period in which it occurred, regardless of the actual receipt of funds, and is subject to corporate income tax in accordance with and. 1 tbsp. 248, i. 1 tbsp. 249 of the Tax Code of the Russian Federation.

The income received from the sale of subscriptions is distributed by the budgetary institution independently, taking into account the principle of uniform recognition of income and expenses, i.e. monthly in the amount of 1/6 of the cost of the subscription. The procedure for reflecting entries in the accounting records of a budgetary institution is presented in table. 1.

Table 1

Reflection in the accounting records of a budgetary institution of income received from the sale of subscriptions

|

Fact of economic life |

Account correspondence |

Sum, |

primary document |

|

|

debit |

credit |

|||

|

Received funds from the institution's cash desk for a subscription |

||||

|

Accrual of future income |

Accounting |

|||

|

VAT is reflected on the payment received (11,800 x 18%/118%) |

Accounting |

|||

|

During the subscription period (monthly on the last day of the month) |

||||

|

Reflection in the income of the current reporting period of the cost of services provided (11,800/6) |

Accounting |

|||

|

VAT reflected on income from the provision of services (1,966.67 / 118) x 18% |

Accounting |

|||

|

Acceptance of deduction of VAT accrued upon receipt of payment |

Accounting |

|||

The budgetary institution should reflect in its accounting policies the procedure and timing for attributing income of future periods to income of the current period.

Account 0 401 50 LLC “Future Expenses” is intended to record the amounts of expenses accrued by a budgetary institution in the reporting period, but relating to future reporting periods (clause 302 of Instruction No. 157n).

In particular, in this account, in the event that the organization does not create an appropriate reserve for future expenses, expenses related to:

- with preparatory work for production due to its seasonal nature;

- voluntary insurance (pension provision) for the organization’s employees;

- acquisition of a non-exclusive right to use intangible assets for several reporting periods;

- repairs of fixed assets carried out unevenly throughout the year;

- other similar expenses.

Accounting for future expenses is carried out in the context of types of expenses (payments) of the organization, under state (municipal) contracts (agreements), agreements.

Accounting for future expenses by budgetary organizations is carried out, accordingly, in the manner established by clause 160 of Instruction No. 174n.

Table 9.4

Reflection of future expenses in the accounting records of a budgetary institution

|

Fact of economic life |

Account correspondence |

||

|

debit |

credit |

||

|

Reflection of expenses incurred in the current reporting period, but relating to the following reporting periods: 1) for wages; |

|||

|

2) other payments; |

|||

|

4) other works, services; |

|||

|

5) social benefits |

|||

|

Recognition of expenses incurred earlier and taken into account as expenses of future reporting periods as expenses of the current financial year, including: 1) wages; |

|||

|

2) other payments; |

|||

|

3) works, services for the maintenance of im- |

|||

|

4) other works, services; |

|||

|

5) social benefits |

|||

Costs incurred by a budgetary institution in the reporting period, but relating to the following reporting periods, are reflected in the debit of account 0 401 50 000 as deferred expenses and are subject to inclusion in the financial result of the current financial year (on the credit of account 0 401 50 000) in the manner established institution (evenly, in proportion to the volume of products (works, services), etc.), during the period to which they relate (Table 9.4).

As part of the formation of its accounting policy, a budgetary institution has the right to establish additional requirements for analytical accounting of expenses of future periods, including taking into account the industry characteristics of the organization’s activities, as well as the requirements of the tax legislation of the Russian Federation on separate accounting of expenses (payments) of the organization.

The accounting policy of a budgetary institution should reflect the procedure and timing for writing off future expenses for the financial result of the current year.

Analytical accounting of future expenses by a budgetary institution is carried out in the context of the types of expenses provided for in the plan of financial and economic activities, under contracts (I. 302 of Instruction No. 157n).

When forming an accounting policy, an institution may establish additional requirements for analytical accounting of income and expenses of future periods, taking into account the sectoral characteristics of the institution’s activities and the requirements of the tax legislation of the Russian Federation on separate accounting of income and receipts of the institution.

Since 2018, accounting of leased objects has been carried out in accordance with the Federal Accounting Standard for public sector organizations “Rent”, approved by Order of the Ministry of Finance of the Russian Federation dated December 31, 2016 No. 258n (hereinafter referred to as the GHS “Rent”). In this regard, the Ministry of Finance prepared Letter No. 02-07-07/83463 dated December 13, 2017, which provides methodological recommendations for the transition to the application of the new rules.

Starting from 2018, lease accounting objects are divided as follows: operating lease accounting objects (rights to use property); objects of accounting for non-operating (financial) lease (right to use property); fixed assets (under finance lease). At the same time, operations related to accounting for these objects also include (depending on the situation): depreciation on rental accounting objects (including the right to use property); accrual of obligations arising from the terms of contracts for the payment of lease and conditional lease payments, and the implementation of settlements on them; accrual of income (expenses); accounting for tax liabilities on rental income.

It should be noted that in state (municipal) institutions, property leased (received) is generally recognized as the object of an operating lease.

In this article, we will consider the main activities that need to be carried out to identify and evaluate the operating lease objects by the lessor during the first application of the GHS "Rent", as well as the formation of opening balances for lease accounting objects in edition 2 of the program "1C: Public Institution Accounting 8".

The GHS Lease does not contain transitional provisions when it is first applied. The guidelines for the transitional provisions of the Standard upon first application are communicated by Letter of the Ministry of Finance of Russia dated December 13, 2017 No. 02-07-07/83463, hereinafter referred to as the Guidelines.

If, as of January 1, 2018, the lessor institution has valid transferable lease agreements, you must:

- conduct an inventory of property transferred for use in accordance with contracts concluded before January 1, 2018 and valid during the period of application of the GHS "Rent";

- determine the remaining useful life of operating lease assets;

- determine the amount of obligations to pay lease payments for the remaining useful life of the objects (starting from 2018 and until the expiration of the lease agreements);

- for each valid lease agreement, reflect in accounting the receivables for the lease obligations of the lessee and the upcoming income from granting the right to use the asset in the amount of lease payments for the remaining period of use of the lease accounting object.

Thus, for each valid lease agreement, the lessor must create the following accounting entries during the inter-reporting period in the amount of settlements with property users for lease payments for the remaining useful life of lease accounting objects:

- Debit 205 21 000 "Settlements with payers of income from operating leases"

Credit 401 30 000 “Financial result of previous reporting periods”;

- Debit 401 30 000 "Financial result of previous reporting periods"

Credit 401 40 121 "Deferred income from operating leases."

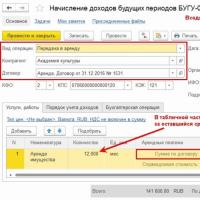

In the program "1C: Public Institution Accounting 8" edition 2, the document Accrual of deferred income (section Services, work, production - Long-term contracts, rent) is used to enter incoming balances for lease accounting objects.

For each lease agreement, you must enter a separate Accrual of Deferred Income document.

Example 1. A budget institution leases property under a lease agreement from 01/01/2017 to 12/31/2018. The monthly rental rate is 10,000 rubles. per month, plus VAT 18%. It is necessary to enter opening balances for operating lease accounting objects when applying the GHS "Lease" for the first time.

In the document Accrual of deferred income, you must enter data on lease accounting objects for the remaining period of use:

- set the transaction type Lease;

- select a counterparty (tenant) and a lease agreement;

- indicate KFO and KPS accounts 205.21 and 401.40 and KEK accounts 401.40 - 121 “Income from operating leases”.

In the tabular part, in the line Amount under the agreement of the column Lease payments, you should indicate the amount of calculations for lease payments for the remaining period according to the lease agreement. In our example, as of January 1, 2018, the remaining useful life of lease accounting assets is 12 months (indicated in the Quantity column).

If the institution is a VAT payer, the Total amount is indicated including VAT.

When maintaining tax accounting, it is also necessary to set the parameters for reflecting income in tax accounting for income tax.

According to paragraph 4 of Article 250 of the Tax Code of the Russian Federation, income from the rental of property (including land plots) for rent (sublease) is classified as non-operating income. In the program, they are reflected in tax account N91.01 “Other income” under items of other income with the type Renting or subleasing property

On the Accounting transaction tab, select the standard transaction Entering opening balances for lease accounting objects , indicate KPS account 401.30 and post the document.

When posting a document in the inter-reporting period, entries are generated in accordance with paragraph 24 of the GHS “Rent” to reflect:

- settlements with the user of the property for lease payments for the remaining useful life of lease accounting objects by debiting account 205 21 000 “Settlements with payers of income from operating leases”;

- the volume of expected income from lease payments on the credit of account 401 40 121 “Deferred income from operating leases”.

In addition, in the information register Parameters for writing off income of future periods, information is stored on the period for writing off income of future periods and the procedure for reflecting income of the current period in accounting and tax accounting.

From the document Accrual of income for future periods, we generate an Accounting Certificate (f. 0504833).

Subsequently, starting from January 2018, during the period of use of the asset in accordance with paragraph 25 of the Standard, income from granting the right to use the asset is recognized as income of the current financial year as part of income from property with a simultaneous decrease in future income from granting the right to use the asset or evenly ( monthly) during the period of use of the rental accounting object, or in accordance with the schedule for receiving rental payments established in the lease (property lease) agreement. In the program "1C: Public Institution Accounting 8" edition 2, the corresponding accounting records are formed by the documents Write-off of future income (section Services, work, production - Long-term contracts, rent) based on information about the procedure for reflecting income of the current period in accounting and tax accounting from the register Parameters for writing off future income under the relevant agreement.

According to the Methodological Instructions, it is also necessary to reconcile the forecast indicators for budget revenues (income according to the Financial and Economic Activity Plan) for 2018 and the planning period, taken into account according to KOSGU 121, with the volume of expected income from rental payments reflected in account 0 401 40 121, and, if necessary, clarify them.

Formation of opening balances for operating lease objects on preferential terms in the program "1C: Public Institution Accounting 8"

To enter balances for operating lease objects on preferential terms in the Accrual of deferred income document (section Services, work, production - Long-term contracts, lease), first of all, you should select the appropriate Operation Type:

- Lease on preferential terms;

- Transfer for free use.

Let's look at the procedure for filling out a document using a conditional example.

Example 2. The budgetary institution transferred the property under a free use agreement for the period from 01/01/2017 to 12/31/2018. If the right to use the property were granted on commercial (market) terms, the monthly rental rate would be 10,000 rubles. per month, plus VAT 18%. It is necessary to enter opening balances for operating lease accounting items when applying the GHS Leases for the first time at the fair value of lease payments.

In the document you must enter data on lease accounting objects for the remaining period of use:

- set the date to 12/31/2017 and the Reflect in the inter-reporting period flag;

- set the type of operation Transfer for free use;

- select a counterparty - the recipient of the property and an agreement for free use;

- indicate KFO, KPS accounts 205.21 and 401.40 and KEK accounts 401.40 - 121 “Income from operating leases”.

In the tabular part, in the Fair value line of the Lease payments column, you should indicate the amounts of calculations for lease payments for the remaining period of use of the property “as if the right of use had been granted on commercial (market) terms” (clause 26 of the GHS “Rent”). The amount of deferred expenses for lost profits is calculated automatically. In our example, as of January 1, 2018, the remaining useful life of lease accounting assets is 12 months (indicated in the Quantity column).

On the Income Accounting Procedure tab, you should set the parameters for writing off future income from account 401.40:

- The procedure for recognizing income is “By months”, “By calendar days” or “In a special order” (for more details, see the reference to the document);

- The deadline for writing off income to the account of the financial result of the current period (401.10). In our example, the remaining period of use of the leased objects by the tenant is from 01/01/2018 to 12/31/2018;

- Accounting and analysis of income accounting for the current period in accounting (401.10).

On the Accounting transaction tab, you should

- select a standard transaction Entering opening balances for lease accounting objects ,

- indicate KPS account 401.30;

- indicate KPS and KEC accounts 401.50;

Deferred expenses for lost profits are accounted for in account 401.50 “Deferred expenses” under the predefined item “Lost profits under lease agreements on preferential terms” (the value of the Deferred expenses subconto). The account (401.20) and the accounting analytics of expenses for lost profits in the current period are established in the specified predefined directory element Deferred expenses.

When posting a document in the inter-reporting period, accounting records are generated in accordance with clause 29.1 of the GHS "Rent" to reflect:

- the volume of deferred income from granting the right to use an asset on the credit of account 0 401 40 121 “Deferred income from operating leases”;

- the volume of deferred expenses for lost profits from granting the right to use the asset in the debit of account 0 401 50 000 “Deferred expenses”.

From the document Accrual of income for future periods, you should generate an Accounting Certificate (f. 0504833).

Subsequently, starting from January 2018, during the period of use of the asset in accordance with clause 29.2 of the Standard, deferred income from granting the right to use the asset, as well as deferred expenses for lost profits from granting the right to use the asset, are applied evenly (monthly) to the financial result of the current period with isolation on the corresponding analytical accounting accounts of the Working Chart of Accounts of the accounting entity (property income, expenses for gratuitous transfers).