Tutorial for working in 1C 7. Payroll

1C: Accounting 7.7: review, description, capabilities

The 1C: Accounting 7.7 program is a tool created to automate accounting and tax accounting, which at one time became widespread in the Russian market due to the virtual absence of competitors, comprehensive functionality and reasonable prices for both commercial enterprises and individual entrepreneurs. This is a ready-made solution for accounting in organizations engaged in any type of commercial activity: wholesale and retail trade, provision of services, production, etc. Platform 1C:Enterprise 7.7 is the basis on which this standard configuration is written, as well as other standard 1C solutions of previous years.

Version 7.7 has an Accounting component that has been in production for over 10 years. It provides a solution to all the problems facing the accounting department of an enterprise and, based on them, contains the following groups of documents and, accordingly, journals:

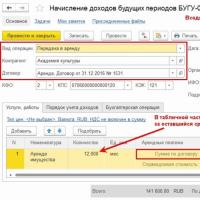

Fig.1

Fig.2

RKO, PKO, payment order, bank statement - these are some of the main documents that are used to reflect cash flows, so they are needed in any organization.

Fig.3

This section of documents allows you to manage trading activities, the range of goods, products and services, regulate their pricing, as well as automate trade document flow. Using various reports, you can analyze the effectiveness of trading activities, as well as forecast sales.

The block of documents related to the reflection of costs for capital construction projects (completed stages of work) is responsible for the formation in the accounts of the cost of fixed assets and objects during the contract construction method.

Any of the 1C 7.7 Accounting configurations also automates settlements with counterparties, as well as analysis of the status and dynamics of mutual settlements.

Fig.4

This section allows you to automate warehouse accounting and, using various reports, analyze the state of warehouses, control the movement of inventory, calculate the cost of production, and keep records of work in progress. Using reports, you can analyze the economic efficiency of an enterprise's production activities.

Fig.5

The program ensures accounting of fixed assets and intangible assets in accordance with PBU 6/01 “Accounting for fixed assets”. Transactions related to this - receipt, acceptance for accounting, modernization, transfer, write-off and others - are recorded with appropriate documents.

Fig.6

Fig.7

The program includes a comprehensive set of types of accruals, deductions, payments and compensations, taking into account the specifics of the enterprise, allows you to independently enter new types of accruals used in the enterprise, maintain personnel records and make settlements with the budget.

Fig.8

If an enterprise has a small staff and a simple remuneration system, payroll accounting is carried out in the standard version of the 1C: Accounting 7.7 program. Of course, the accounting and calculation of wages is most fully automated in the 1C: Salary and Personnel program, in which there are various types of accruals and deductions from wages, and more specialized reports. This program is suitable for enterprises with a more complex remuneration system. If you use the “1C: Salaries and Personnel” configuration, it can be synchronized with “1C: Accounting 7.7” and exchange data.

The program contains a block of documents for recording transactions related to the services of third-party organizations, which allows you to offset advances, adjust debt, and others.

Fig.9

The program also contains regulatory documents - Currency revaluation, Depreciation and repayment, Work in progress and Month closure.

Fig.10

In 1C: Accounting 7.7, in addition to the ability to enter transactions using predefined documents, you can manually enter transactions that allow you to create transactions for accounting and tax accounts. They are used in cases where the standard solution does not contain a document that allows reflecting the required operation.

The configuration provides the accountant with a set standard reports, allowing you to analyze data on account balances and turnover. With their help, you can plan, manage and analyze the financial results of an enterprise.

Fig.11

Custom Reports are used for individual specific cases and are characterized by a lack of flexible settings. They are focused on specific sections of accounting.

Of particular importance to accountants are regulated reports intended for submission to tax and other regulatory authorities. These include accounting forms, tax returns, reports for statistical authorities and government funds. These are unified forms, the composition of indicators of which is regulated by the legal framework.

Fig.12

1C:Accounting 7.7 supports the 1C-Reporting service, designed for sending electronic reporting and other types of electronic document flow between an enterprise and regulatory authorities via telecommunication channels directly from the program. The right to access the service is granted to users on the basis of a license agreement with a 1C partner.

1C: Accounting: basic or PROF

To find out which version is installed on your computer, you need to look at the title bar of the program or in the Help - About the program menu.

Fig.13

Let's look at the differences between the basic and professional versions of the Seven:

- In the basic version of the “seven”, you can keep records of only one enterprise in one database; the PROF version allows you to maintain several enterprises in one database at once. If an accountant manages several enterprises, then in the Professional version one database is enough to manage all enterprises, but in the basic version this will require creating several different databases for each organization.

- There are no differences in the structure of the basic and PROF versions, all types of reporting have a unified form, but the software license of the basic version does not allow changing the database configuration, while the PROF license makes it possible to supplement, create new and delete unnecessary configuration elements. This means that PROF can be changed to suit the needs of a specific enterprise, but no changes can be made to the basic version. Using the basic version only allows the addition of external reports, processing and printed forms for documents.

- The basic version is not intended for network operation. That is, if an enterprise has several accountants who need to work in one database at the same time, they should purchase a PROF.

- Another difference is that for the basic version you can download updates via the Internet for free, but for the PRO version you need to sign an ITS agreement.

Thus, the choice of version depends only on the volume and specifics of the enterprise’s activities and financial statements.

1C: Accounting 7.7 is a configuration that simplifies the document flow of an enterprise, which allows you to implement any accounting scheme and obtain the necessary reports. It can be used both stand-alone and with other configurations, being a ready-made solution for most areas of accounting and tax accounting.

Automation of accounting – This is accounting using computers and computer programs.

Automation of accounting allows you to:

- improve the quality, analyticality, and efficiency of accounting;

- receive reports in a variety of sections and forms, without spending additional effort on it;

- increase the efficiency and effectiveness of accounting.

Automation of accounting requirescomputer and software.Currently, they mainly use IBM PC - compatible computers of the Pentium brand, or better yet, Pentium III.

A much wider range of programs is used as software. The most common are: complex programs “1C: Enterprise”, BEST, FinEco, as well as many other programs for automating individual accounting areas.

Automation happens:local and complete (complex).Local is the automation of a separate section of accounting, complete is the automation of accounting as a whole.

Automation principleconsists in the fact that the accountant enters the initial data, and the computer calculates the results and prepares reports.

Stages of implementation of accounting automation. accounting:

- Selection of hardware and software.

- Training.

- Preparing accounting for automation.

- Conduct an audit.

- Revise:

- Organization of document flow;

- Chart of accounts and analytical accounts;

- Scope and content of reporting;

- Regulations on the accounting service of the enterprise and job descriptions of accounting employees.

- Setting up the program.

- Entering accounting data.

- Receiving and printing reports.

2. Program system “1C: Enterprise 7.7”

1C:Enterpriseis a system of programs for complex automation of various areas of economic activity: accounting, operational accounting, economic calculations.

1C:Enterprise consists of a Technology Platform and Configurations.

Technology platform

p is a set of different mechanisms used for automation and includes three main functional components:

- "Accounting"– designed for accounting based on accounting transactions. Provides maintenance of charts of accounts, entry of transactions, receipt of accounting results and reporting.

- "Calculation"– designed to perform complex periodic calculations. Used to calculate wages of any complexity, securities settlements, etc.

- "Operational accounting"– designed to record the availability and movement of funds in a variety of aspects in real time. Used to account for inventory inventories, mutual settlements with counterparties, etc.

Configurations

are focused on automation of a certain area of economic activity and comply with adopted legislation, working on the basis of appropriate technological platforms.

For example, the 1C: Accounting configuration works on the basis of the “Accounting” technology platform, the 1C: Payroll and Personnel Accounting configuration works on the basis of the “Calculation” technology platform, and the 1C: Trade and Warehouse configuration works on the basis of the “Operational Accounting” technology platform.

The 1C: Enterprise program system includes standard configurations, which can be adapted for a specific enterprise. There are also additional configurations supplied by 1C separately. The configuration can be changed by the user himself.

Program versions:

- Single-user versions (for one user)

- Network versions (multiple users)

- Basic versions (single user, but does not include configuration tools)

3. Launching the program, program window, service options, getting help, document editor, exiting the program.

To run the program:

- Click the button Start;

- Select line Programs;

- Select line 1C Enterprise 7.7;

- Click on the line 1C Enterprise(or 1C Enterprise Monopoly);

- Select information base 1c accounting. Typical configuration.

- Click the button Ok.

If the program version is network, then it can be launched inordinary or monopolymode. In exclusive mode, all functions of the program will be available, but only 1 accountant will be able to work in the information base. When working collectively, all accountants must run the program in normal (not exclusive) mode.

After launch, a window appears on the screenInformation about the organization(or window Configuration Guide, or Content), it needs to be closed, and you also need to close the Tip of the Day window. The program occupies the main window, in which sub-windows (internal) can be opened containing various components, for example, a chart of accounts, a journal of transactions, a directory, etc. At the bottom of the main window there is a panel containing buttons with the names of subwindows for convenient switching between them. All other operating principles are similar to those studied in the Windows-95 topic.

Service capabilities:

Municipal educational institution secondary school No. 5

G. Strezhevoy

Toolkit

Automated processing of the results of an enterprise’s economic activities in the 1C: Enterprise program.

Smirnov Nikolay Vasilievich

Computer science teacher, category I

Smirnova Tamara Viktorovna

IT-teacher

Strezhevoy – 2006

Introduction………………………………………………………………………………..…….3

General information………………………………………………………………………………4

Filling out reference books……………………………………………………………..……..6

Setting up the program for accounting…………………………………………...………11

Accounting for materials…………………………………………………………….….18

Accounting for fixed assets……………………………………………………….…..26

Advance report…………………………………………………………….…….35

Authorized capital……………………………………………………………..…...37

Entering balances………………………………………………………………………………….…..39

Payroll……………………………………………………40

Test work…………………………………………………………..………..42

References……………………………………………………..………48

Appendix No. 1. List of counterparties for training.

Appendix No. 2. List of contractors for practical work.

INTRODUCTION

According to the “Concept for the modernization of Russian education for the period until 2010,” approved by the Government of the Russian Federation, specialized training is provided at the senior level of secondary school. High school students study in specialized classes: socio-economic classes, technical school classes, where they study subjects in economic disciplines, they need to gain practical skills in work. The most popular and widely used program for processing the results of business activities of enterprises is the 1C: Enterprise program.

The manual is intended for 1C:Enterprise users. The fundamental principles of working with the 1C:Enterprise program are described here. The methodological manual takes into account that for small enterprises with a staff of less than 20 people, the 1C: Accounting configuration contains all accounting operations for payroll accounting. The manual describes the procedure for working with the 1C:Enterprise program, starting with the creation of an enterprise and ending with obtaining the final balance sheet. The main goal is to create conditions for the development of creative thinking, independence of students, the implementation of in-depth content of the chosen profile, systematization and generalization of knowledge previously acquired in the chosen specialty.

The teaching material includes a large number of practical tasks. The huge advantage of this work is that it contains an end-to-end test example, which allows you to simulate the work of an organization in conducting business accounting operations and obtain the final balance sheet of the enterprise, i.e., it allows you to learn how to do the work of both an ordinary accountant and a chief accountant. During the training, students gain an understanding of all accounting entries, which allows them to get a complete understanding of the work of all accounting in the 1C: Enterprise program. This teaching aid was used in additional education classes to train users of the 1C: Enterprise program (students of socio-economic classes, technical school classes, college and university students, economists and accountants) for three years. The teaching methodology is accessible and practical.

For training, 40 academic hours are required - an intensive course, 50 or more academic hours for students in grades 10 - 11.

General information.

The topic of our classes is “1C: Accounting version 7.7” typical configuration. First, let's look at the properties and purpose of the main objects of "1C: Accounting version 7.7", and then move on to how a business transaction can be formalized in the program.

Launch the program: Start/Programs/1C:Enterprise 7.7/1C:Enterprise. In the window that appears, in the “In mode” field, select the item

1C:Enterprise. 1C:Enterprise is the program itself that we will use.

The “Configurator” mode is used to reconfigure the program and save data (in some cases, for example: when installing other 1C:Enterprise modules.)

“Debugger” mode – for debugging modules written by the programmer.

“Monitor” mode – for monitoring the work of users with the information base.

Program structure

The typical structure of the 1C: Accounting version 7.7 program includes a set of objects that perform a specific function:

Chart of accounts containing a list of accounts of a self-supporting enterprise.

Constants are data whose values do not change over time or change quite rarely and are used to configure the program for accounting.

Directories – storing information about objects of analytical accounting (materials, goods, fixed assets, employees, rates of taxes and fees, etc.).

Operation, standard operation and documents that form the entries for the business transactions of the enterprise.

Journals that accumulate generated documents and transactions.

Reports reflecting summary information.

Interrelation of program objects when registering a business transaction.

The central place in it is occupied by three program objects - Operation, standard operation and document. It is these objects that serve to form a business transaction. Each of them has its own specific features. So, for example, when registering household. operations through the program object Operation correspondence of accounts are specified by the user independently. If the owner The operation is formalized through the program object Standard Operation, then the missing information is entered into the previously prepared standard operation template. And finally the householder. the operation can be completed using a Document. Since analytical accounting is maintained in most accounting accounts, analytical objects are selected from the directories for the executed transactions or documents. Once completed and saved, documents and transactions can be found in the appropriate journals. Completed transactions and most documents created in the program automatically generate transactions and change the summary information, which can be viewed through reports. The following diagram will help you understand the relationship between these program objects:

DIRECTORIES

Analytics objects

MAGAZINES

Saved documents and transactions

With wiring

Chart of accounts

accounts

DOCUMENT,

OPERATION

Accounts and Analytics Objects

REPORTS

Summary information on accounts and analytics objects

The sequence of working with program objects.

Information base "1C: Accounting." included in the delivery set is empty. It is intended to introduce accounting for a specific organization. Therefore, first you need to do:

Fill in the list of analytics objects. At this stage we use Directories.

Setting up the program for registration. For this purpose they are used Constants.

Entering initial balances for the accounts of a self-supporting enterprise. At this stage it is used Operation.

Entering business transactions for the current period. For this purpose, program objects such as Operation, standard operation and document.

5. Obtaining summary information using Reports.

COMPLETING DIRECTORIES.

Directory "Divisions"

Select the menu item Directories/Divisions:

The following window appears. Press the keyInsertor click on the icon"New line"on the window toolbarDivisions(1st icon). And we introduce the divisions sequentially:Administration, Accounting, Workshop No. 1.

Directory "Nomenclature"

The “Nomenclature” directory is intended to store a list of manufactured products, work performed, services provided and goods for resale. The directory is used when issuing primary documents: invoices, invoices, invoices, etc. Fill out the directory according to the nomenclature list.

Select a menu item Directories/Nomenclature.

Click on the “ A new group» on the toolbar of the Nomenclature window (2nd icon). In this case, the “Product Group,...” window is displayed, where on the “Group Name” tab, enter “Products” and click on the OK button. Similarly, we create groups: Work, Products, Services.

For the “Products” group we create a product item. To do this, double-click on the icon in front of the “Products” group, in the window that opens, click on the “New Row” icon on the toolbar of the “Products” window (1st icon) or press the Insert key.

In this case, the “Products” window is displayed.

We do not change the code if there is no need for it, “Type” – we set Products, “Name” – Women’s coat (our own). In the “View” field, click “ … "In the window that appears, enter the name of the product item "Women's knitted coat made of pure wool yarn." Press the Enter key 2 times. “Planned cost” – 2500, “Sale price (without taxes)” – 3000, “VAT rate” – 18%, “NP rate” – Excluding tax (NP), OK.

In the “Works” group we create a product item. ... “Type” - Work, “Name” - Sewing women's clothing. In the “View” field, click “ … "In the window that appears, enter the name of the product item “Sewing women's outerwear.” Press the Enter key 2 times. Planned cost – 4000. Cost of work (excluding taxes) – 5000, OK. Press Enter. The next nomenclature unit is Tailoring of men's clothing. In the “View” field, click “ … “In the window that appears, enter the name of the product unit “Tailoring of men’s outerwear.” Press the Enter key 2 times. Planned cost – 4000. Cost of work (excluding taxes) – 5000, OK.

In the “Product” group we create the 1st product item. ... “Type” - Product, Own “Name” - Women's coat. In the “View” field, click on “ … "In the window that appears, enter the name of the nomenclature unit - "Women's knitted wool coat." Press the Enter key 2 times. Registration (purchase) price - 2000, wholesale price (excluding taxes) - 2500 OK.

We create the 2nd nomenclature unit “Type” - Product, “Own”, “Name” - “Imported men’s coat”. In the “View” field, click on “ … “In the window that appears, enter the name of the product item “Men’s knitted coat made of cotton yarn.” Press the Enter key 2 times. Registration (purchase) price - 2500, wholesale price (excluding taxes) - 3000, Country of origin - Pakistan. OK.

We create the 3rd nomenclature unit “Type” - Product, “Own”, “Name” - “Men’s coat”. In the “View” field, click on “ … “In the window that appears, enter the name of the product item “Men’s knitted coat made of cotton yarn.” Press the Enter key 2 times. Registration (purchase) price - 3000, wholesale price (excluding taxes) - 3800 OK. We create the 4th nomenclature unit “Type” - Product, our own “Name” - Cloak. In the “View” field, click on “ … "In the window that appears, enter the name of the nomenclature unit "Women's knitted wool raincoats." Press the Enter key 2 times. Registration (purchase) price - 1000, wholesale price (excluding taxes) - 1300 Press Enter. OK

Services. We create a nomenclature unit. “Type” - Service, “Name” - Minor repairs. In the “View” field, click on “ … “In the window that appears, enter the name of the product item “Minor repairs after dry cleaning and dyeing.” Press the Enter key 2 times. The cost of services is 20. OK.

Directory "Employees"

Select the menu item Directories/Employees.

In the window that opens, enter the company’s employees by clicking on the button “New order” / “Order for employment.” ERROR!!! – enter employees by clicking on the “New Line” icon (1st icon) or pressing the keyInsert .

Type of deduction per employee – 400 rubles.

Tab.No.

TIN

Full name

Floor

Date of Birth

Job title

Subdivision

date of receipt

Salary

Northern (%)

Children

7022005755

Vasiliev Fedor

Stepanovich

Husband.

23.02.60

Director

Administration

01.01.03

8000

7022023179

Obolenskaya Galina Sergeevna

Women

16.05.75

Chief Accountant

Accounting

01.01.03

6000

7022023180

Mikhailova Olga

Nikolaevna

Women

04.07.80

Cashier

Accounting

01.01.03

3000

7022023165

Krylova Ekaterina Petrovna

Women

30.10.76

Seamstress

Workshop No. 1

01.01.03

4000

7022023166

Grigorieva Elena Ivanovna

Women

12.09.71

Seamstress

Workshop No. 1

01.01.03

4000

7022023167

Ivanova Maria Semenovna

Women

07.03.73

Seamstress

Workshop No. 1

01.01.03

4000

Salary

% north.

Check

General services Expenses

Divisions

UST

Payroll

From the reference book

From the reference book

Labor costs

Administration

UST

Insurance against accidents and damages

Salary

% Northern.

Check

Type of nomenclature

Production costs

Divisions

UST

Payroll

4000

From the reference book

Select from the directory

Labor costs

Workshop No. 1

UST

Insurance against accidents and damages

Directory "Banks"

Name

Location

BIC

Corr. Check

OJSC TOMSKPROMSTROYBANK

Strezhevoy

046913754

30101810800000000754

FAKB NEFTEENEERGOBANK

Strezhevoy

046913776

30101810600000000776

RCC STREZHEVOY

Strezhevoy

046913000

SETTING UP THE PROGRAM FOR ACCOUNTING

Entering information about the organization.

To generate reports, certificates, documents and transactions, you need to have basic data about your organization. Information about your organization is entered into the screen form using tabs.

Service/ Information about the organization.

(We enter the details of the enterprise from the enterprise registration documents).

In the window that appears, enter data on the tabs:Organization, Codes, Bank …

Registration date – December 31, 2001, TIN – 7022000050, OKONH – 71100,

Fills out the taxes and deductions window.

ABOUT  KPO – 01423955, OKOPF – 42, OKFS – 12, Bank/Edit (click button)

KPO – 01423955, OKOPF – 42, OKFS – 12, Bank/Edit (click button)

r/s – 40702810706130000187

Service/General settings/Initial values – (VAT, Warehouse…- note)

Service/General settings/Modes (Salary accounting, Document editing prohibition date...)

Service/ General settings/ Other – Regional coefficient – 1.7 (for the city of Strezhevoy).

6. Service/Options

This opens the system settings window, where we set:

Operation – Standard method;

…/ Accounting results – 2nd quarter 2006.

Logs – the beginning of the interval is 12/31/2005.

Accounting policy.

The “Accounting Policy” mode was created to set and change the basic values of an enterprise’s accounting policy. Service/Accounting policy.

Directory "Counterparties"

The Counterparties directory contains information about legal entities and individuals and is used to maintain analytical accounting on accounts: 03 06 19 36 45 58 60 61 62 63 64 74 76 82 83 90 92 93 94 95 96. Information about contracts concluded with the counterparty, stages of work , settlement accounts of the counterparty is entered into the “Information about the counterparty” card. Counterparties can be combined into groups.Fill out the reference book according to

Select the menu item Directories/Counterparties. Click on the “New Group” icon on the toolbar of the Nomenclature window (2nd icon). In this case, the “Counterparty Group” window is displayed, where on the “Group Name” tab, enter “Founders” and click on the OK button. In a similar way, we create groups: Budgets and funds, Buyers, Suppliers, Other.

We enter counterparties according to the list of counterparties which is attached.

For the “Founders” group, enter the founder. To do this, double-click on the icon in front of the “Founders” group and press the Insert key or click on the “New Row” icon on the toolbar of the “Founders” window (1st icon). At the same time, the “Founders” window is displayed.

Select Phys. face, type “Vasiliev F.S.” We do not change the code if there is no need for it, full name – Vasiliev Fedor Stepanovich, TIN – 7722005755.

Click on the “Current Accounts” tab and in the window that appears, enter the account number and the name of the bank in which the account is opened.

Then enter your passport details.

We are creating the next founder. The list of founders is an integral part of the list of counterparties, which is attached on the next page.

For organizations we choose – Other organization and fill in the details as in the previous example.

MATERIALS ACCOUNTING

The “Materials” directory is intended for storing a list of materials. And it is used both for issuing primary documents and as objects of analytical accounting on those accounts on which analytical accounting is kept under the subaccount of the type “Materials”:

10 – materials

002.1 – inventory items accepted for safekeeping

003 – materials accepted for processing.

Introducing new materials. Directories/Materials and press the keyInsert or icon New line.

The code is installed by the program. We do not change the code unless necessary.

Code

Name

View

Unit change

Registration price

Thread

10.1

Bean.

Button

10.1

Set

Wool fabric

10.1

Lightning

10.1

PC.

Office paper

10.6

Pack.

Receipt of materials

– At the same time, the document “Receipt order ", which is necessary fill in.

Enter the name of the materials by pressing a button or keyInsertWe finish filling out the document by clicking OK. We answer the question about posting a document Yes.

To view the transactions made by this operation, click on the “ Postings " and the program will open a window " Accounting entries " Please note that VAT is posted as a separate line.

HANDLING MATERIALS

Documents/Material accounting/Movement of materials.

Warehouse movement. For example, We move materials from Warehouse No. 1 to Warehouse No. 2.

the document opens " Request-invoice

"Movement type" - Warehouse transfer

“Warehouse” – Warehouse No. 1

“Receiver Warehouse” - Warehouse No. 2

Fill out the table part.

Clicking a button Selection allows you to view the amount of material in warehouses. At the same time, a window appears Materials (Selection) . In this window, activate the item Show balances in columns.

Transfer to production.

Documents/Material Accounting/Movement of Materials

For example, from Warehouse No. 1 we transfer 100 linear meters of “Jeri” Fabric to production.

Documents/Material Accounting/Movement of Materials - the document opens " Request-invoice » The screen form of the document consists of a header and a tabular part. The header states:

№ and date (No. is set by the computer and we do not change it unless necessary)

“Type of movement” - Transfer to production

“Warehouse” – Warehouse No. 1

Materials write-off account:

“Cost allocation account” – 20; “Type of nomenclature” – Women’s coat;

“Production costs” – Material costs; “Divisions” – Workshop No. 1

Fill out the table part. Fabric "Jeri" - 100 linear meters.

SHIPPING OF MATERIALS TO SIDE

Shipment of materials to the side consists of Sales And Outsourced processing.

A) Sale. Atelier LLC, under contract No. 13 dated 10.19.03, sold 50 linear meters of Geri Fabric at a price of 300 rubles. Operations by sales of materials

– “Shipment of materials to the third party” (Invoice). In the attribute “Type of materials issue” - sale; Settlement of advance payment – Without specifying the contract. Items of other income and expenses – sale of Geri fabric.

B) Invoice issued. You need to open the document and click on the “Actions” icon – Enter based on

In this case, the Select document type window appears, where we select the item - Invoice issued.

The program automatically fills out this document, but you can edit it if necessary. (After posting, the document is stored - Journals/Invoices issued).

Select an Account

B) Payment for goods. “Actions” – Enter based on – Extract. In the window that appears, select the item Receipts from buyers. Double clicking this item creates a document

Bank statement

Program 1C automatically corr. the account establishes 62.1, but allows it to be adjusted within the limits allowed in accounting. To do this, double click on this item.

D) Recording the sales ledger. Open the document Invoice issued and click on the “Actions” icon – Enter based on – Sales book entry. The program automatically fills out this document, but you can edit it if necessary. (After posting, the document is stored - Journals/Invoices issued)

Materials transferred for processing to third parties . When posting a document, entries are generated to transfer the cost and quantity of materials issued from the credit account in which they are recorded as the debit of subaccount 10.7. “Jeri” fabric in the amount of 50 linear meters was transferred for cutting to LLC “Raskroy T” under agreement No. 22 dated 10.20.03.

Documents/ Materials accounting/ Shipment of materials to third parties . The “Recipient” details include “Raskroy T” LLC; in the “Type of materials issue” detail - transfer to third party processing; In the details “Agreement” we indicate the number and date of the agreement.

Write-off of materials transferred for processing . Write-off of processed materials from subaccount 10.7. Documents/Material Accounting/Receipt of Materials .

In the “Type of receipt” attribute. – Receipt from processing.

The “Contractor” requisite is “Raskroy T” LLC; In the details “Agreement” - the number and date of the agreement under which the materials were transferred for processing. On the tab " Cost account » indicate an account that records the costs of producing products (for example, 20) using recycled materials.

Type of nomenclature – Women's coat made of “Jeri” fabric. Production costs are material costs. Workshop No. 1.

ACCOUNTING FOR FIXED ASSETS

Directories/ Non-current assets/ Fixed assets.

Fill out the Basic Information tab. We indicate: Name, Inventory No., ..., Put a tick in front of the item Calculate depreciation.

Fill out the Accounting/Account tab – 20 or 26;

Tax accounting/Account – N07.04 or N05.02

The inventory number is set by the program; we do not change it unless necessary.

Inventory number

Name

Group

Subdivision

Initial cost

Commissioning date

Pentium IV computer

Machinery and equipment.

Administration

25000

01.01.01

Printer HP 1100

Machinery and equipment.

Administration

9000

01.01.01

Rack

Machinery and equipment.

Sewing factory

5000

01.01.01

Sewing machine

Machinery and equipment.

Sewing factory

15000

01.01.01

Shop

Building

Administration

100000

01.01.95

Arrival of OS.

To register an operating system in computer accounting, you must do the following: Documents/Asset Accounting/Receipt of Assets

(in this case, the fixed asset is registered as an object of a non-current asset). For example:

A) Receipt of OS. On May 21, 2006, under Agreement No. 13 dated September 6, 2003, a Xerox worth RUB 236,000 was received from Horizon LLC, including VAT RUB 3,600; scanner - 3540 rubles, including VAT 540 rubles. Invoice No. 17 dated May 18, 2006 is attached to the supplier’s documents. Since the cost of the computer is indicated together with VAT, we select VAT on top of taxes.

Left-click on the button OK and to the question Post document we answer Yes .

D  To view transactions made by this document, click on the icon Postings

To view transactions made by this document, click on the icon Postings

This will give us the opportunity to see on the screen the transactions made by this document. From the postings we see that fixed assets are registered as non-current assets.

B ) Payment to the supplier for the OS. Documents/Payment order.

Filling out the document

Documents/Extract.

Click on the icon Selection by board. documents. The Payment Documents journal will be displayed.

IN  Select the required payment order. Double click on it. And click OK.

Select the required payment order. Double click on it. And click OK.

The program will automatically fill out the statement, except for the item that we fill in manually by double-clicking on the item, Flow of funds, where we choose Payment to the supplier.

![]()

C) To recover VAT, you need to fill out the document “Record of the purchase book”. Open the document , then Actions/News based on/Zap.purchase book . OK.

Let the purchase be made through mediation Share LLC. For the cost of services in the amount of 2714 rubles. Invoice No. 18 dated October 15, 2003 was presented. Select the document " Receipt of individual OS objects " and using " Actions/ Enter based on"Choose" Third-party company services».

Payment for the service. Similar to the previous one. Document/Payment order. Document/Extract. To recover VAT, you need to fill out the document “Record of the purchase book”.

In order to register non-current asset objects as a fixed asset in electronic accounting, a purchased scanner and printer, you must perform the following operation: Documents/ OS accounting/ OS commissioning.

When purchasing fixed assets, it is registered as a non-current asset.

We click on the “…” button and a window appears with a list of non-current assets. We select one of the non-current asset objects, for example, a photocopier, then enter the name of the fixed asset, that is, under what name it will be listed as a fixed asset. Objects are registered one at a time. Clicking a button Show displays the cost of the OS excluding VAT. 20,000 – purchase price, 2,000 – services of third-party organizations, total - 22,000.

Advance report.

Documents/Advance report

On October 19, 2003, Ivanova received a report for household needs from the cash register for 3,000 rubles. For the purchase of material A from Gorizont LLC and equipment repairs from Kvant LLC.

Documents / Expendable cash registerorder. Correspondent account - 71.1; Cash flow - Issue against advance report.

2. Documents/Material Accounting/Receipt of Materials Material A - 20 meters at a price of 100 rubles. per meter

3. Documents/General Purpose/Third Party Services

Documents/Advance report

By clicking the buttonShow We highlight the funds held by the accountable person. Fill inReverse side according to the documents provided.

5 . Return of unused funds. Ivanova contributes the remaining 720 rubles to the organization’s cash desk.

Documents/ Cash receipt order.

Authorized capital.

Entering the authorized capital.

Documents/Enter transaction manually.

Fill out the directory according to the list of founders.

Vasiliev – 40,000; OJSC "Cheryomukha" - 100,000; LLC "Luch" - 60,000. Total - 200,000.

Date - 31.05.03;Content– Cash contributions to the authorized capital; Debit 75.1 SubcontoDt. – Vasiliev S F; Credit 80; SubcontoKt. – Vasiliev S F; Sod.Prov. - Contribution to the authorized capital; No. F - UC.

The entered operation changed the state of two accounts – active and passive. Thus, at the moment the balance sheet balance looks as follows.

Assets

Passive

Debt of the founders (account 75) = 200,000 rubles.

Authorized capital (account 80) = 200,000 rub.

This balance sheet presents information on two items, one of which is an asset and the other is a liability. The enterprise has households. remedy - debt of the founders in the amount of 200,000 rubles. The source of this fund is the authorized capital. Household the transaction increased the cost total of both sides of the balance sheet.

Payment of authorized capital

Documents/Extract.

The paid amount is debited to account 51 “Current account” and credited to account 75.1. "Settlements with founders." That. active account 51 is debited (increased), reflecting the state of the enterprise’s bank account, and another active account is credited (decreased) - 75.1, reflecting the debt of the founders to their company - their debt becomes smaller.

ENTERING BALANCES

Registration of transactions for entering incoming account balances.

The principle of entering balances. To enter balances, use account – 00.

IN Current balances on accounting accounts are entered using a program object Documents/Enter transaction manually.

In the posting in the Dt field. the account code with the debit balance is indicated, and in the field Kt. – code 00. If the balance is in credit, then the order of filling out the fields in the transaction is reversed – and in the Dt field. code 00 is indicated, and in the field Kt. – account code with credit balance.

Determining the date for entering balances

Fixed assets

Assets

Sum

Passive

Sum

01

Machine K3

20000

02

Depreciation - Machine K3

4000

Materials

Chintz

110 m.

100 rub.

Needles

3 pcs.

10 rub.

Now you can create standard accounting reports (turnover balance sheet), including balance sheet.

Reports/balance sheet – indicate the period and uncheck all the boxes.

To get a balance sheet you need: Reports/Regulated/Balance Sheet (Form No. 1)/Open/Indicate the period/Fill out.

PAYROLL PREPARATION

Documents/ Salary/ Payroll.

The screen form of the document consists of a header and a tabular part.

The header states:

Use directory accounts.

Divisions – Select a specific division, if we clear the window with a cross (X), then the calculation is for the entire organization.

Payment of wages from the cash register.

Documents/Salary/Payment of salary from the cash register.

Depreciation calculation

Documents/ Regulatory/ Depreciation.

PRACTICAL WORK ON "1C: ACCOUNTING"

Cross-cutting example.

Organization LLC "Beryozka".

Directory "Divisions"

Select the menu item Directories/Divisions. Press the keyInsert. And we introduce the divisions sequentially:Administration, Accounting, Workshop No. 1 .

Directory/Nomenclature

Products – Products K; Type – QC Products;

planned cost – 2500, selling price excluding VAT – 3000.

Directory "Employees"

Select the menu item Directories/Employees. We enter the employees of the enterprise by clicking on the “New order” / “Order for employment” button.

Tab.No.

TIN

Full name

Date of Birth

Job title

Subdivision

date of receipt

Salary

Northern (%)

Children

702200023178

Vasiliev Fedor

Stepanovich

23.02.60

Director

Administration

01.01.06

8000

702200023179

Obolenskaya Galina

Sergeevna

16.05.75

Main

accountant

Accountant

01.01.06

6000

702200023180

Mikhailova Olga

Nikolaevna

04.07.73

Cashier

Accountant

01.01.06

3000

702200023181

Ivanov Ivan

Ivanovich

30.10.66

Manager

Administration

01.01.06

5000

702200023182

Petrov Petr

Petrovich

12.09.61

Manager

Administration

01.01.06

5000

702200023183

Sidorov

Michael

Nikolaevich

07.03.63

Driver

Workshop No. 1

01.01.06

5000

702200023184

Savelyev Alexey

Semenovich

17.11.73

Worker

Workshop No. 1

01.01.06

4000

“Salary accrual” tab for ITR account 26

Salary

% north.

Check

General services Expenses

Divisions

UST

Payroll

5000

Labor costs

Administration

UST

Insurance against accidents and damages

“Salary accrual” tab for workers – 20.

Salary

Northern.

Check

Type of nomenclature

Production costs

Divisions

UST

Payroll

3000

QC Products

Labor costs

Workshop No. 1

UST

Insurance against accidents and damages

Directory "Banks"

Name

Location

BIC

Corr. Check

OJSC TOMSKPROMSTROYBANK

Strezhevoy

046913754

30101810800000000754

FAKB NEFTEENEERGOBANK

Strezhevoy

046913776

30101810600000000776

RCC STREZHEVOY

Strezhevoy

046913000

Limited Liability Company "Beryozka"

Service/ Information about the organization. Registration date – 12/31/2001, TIN – 7022000050, OKONH – 71100, OKPO – 01423955, OKPOF – 42, OKFS – 12. TPSB r/s – 40702810706130000187

Type of activity – Wholesale trade, Tax Inspectorate No. 7 for the Tomsk Region, Code – 7022.

Operations/Accounting Management results – Calculation of results is established for – I quarter 2006

Service/ Accounting policy/ General/ Method of determining revenue – By payment.

Service/General settings/Initial values.

Service/ General settings/ Modes.

Service/ General settings/ Other – Regional coefficient – 1.7

Service/Options/Operation – Standard method;

…/ Accounting results – I quarter 2006;

…/ Logs – the beginning of the interval is 12/31/2005.

Directory "Counterparties"

Fill in according to the enclosed .

STARTING BALANCE

Date of entry – 12/31/02, Contents of transaction – Incoming balances, N F – SA.

Assets

Sum

Passive

Sum

01.1

Fixed assets

24000

02.1

Depreciation of fixed assets

6000

10.1

Materials

12 000

60.1

Debt to the supplier for goods (“Volna”)

1180 0

43

Finished products (6 pcs.)

15 000

68.2

VAT

27 00

51

Current accounts

3028 0

82.1

Reserve capital

40000

60.2

Debt of suppliers for advances issued (“Olga”)

1062 0

99

Financial results

49100

62 .1

Buyers' receivables (“Irina”)

177 00

Balance

109600

Balance

109600

Turnover balance sheet

98980

Turnover balance sheet

98980

Fixed assets

Name

State

Method of admission

Date of purchase

Price

Depreciation

computer

In use

Purchase for a fee

21.07.99

9600

2800

Printer

In use

Purchase for a fee

11.03.01

4800

1300

Xerox

In use

Purchase for a fee

16.02.01

9600

1900

Total

24000

6000

“Accounting” tabs: “Account – 26”; (Useful life – 96 months)

“Tax accounting”: “Expenses – N07.04 or N05.02.”

Materials

Name

Quantity

Price

Sum

Material A

110 pcs.

100 rub.

11000 rub.

Material B

10 pieces.

100 rub.

1000 rub.

Business transaction log

behind March 2006 G.

date

Contents of operation

Debit

Credit

Sum

1

2

3

4

5

6

3 .03

Received at the cash desk for household needs, business trips from the bank

50.1

3500

4.03

Received from supplier "Volna" material A (40 pcs.)

(Invoice No. 7 03/04/06)

Payment to the supplier.

Paid VAT credited

10.1

19.3

60.1

68.2

60.1

60.1

19.3

4000

72 0

472 0

72 0

4.03

Material A was released into production 150 pcs.

10.1

150 00

7.03

Issued from the cash register to report to Ivanov for household needs

71.1

50.1

1800

8 .03

Issued from the cash register to report to Petrov for household needs

71.1

50.1

1700

11.03

Retail sale of K products (5 pcs.)

Store No. 13

Invoice issued

Sales ledger entry

90.2.1

50.1

90.3

76.N.1

90.1.1

76.N.1

68.2

12500

177 00

27 00

27 00

11.03

Sold to buyer LLC "Irina" material B 10 pcs.

a) written off for sale at cost

b) for the total amount (price 150 rubles per piece)

c) VAT charged (invoice issued)

d) received on the current account for materials (statement)

f) VAT accepted for offset (entry in the sales book)

91.2

62.1

91.2

76.N.1

10.1

91.1

76.N.1

62.1

68.2

1000

177 0

27 0

177 0

27 0

11.03

Dolg LLC "Irina" (In statement)

62.1

177 00

11.03

Cash delivery to the bank

50.1

17700

13.03

250000

13.03

"Quantum" services consumed in production:

(Invoice No. 17 dated March 13, 2006)

a) VAT is charged on the cost of services

b) Statement (Payment to supplier)

c) VAT paid is credited

c) VAT is accepted for credit

19.3

60.1

68.2

60.1

60.1

19.3

25000 4 500

295 00

4 500

15.03

a) Ivanov’s advance report is approved. JSC "Volna"

b) Material C. Price – 200, quantity – 4 pcs.

c) VAT (Invoice No. 13 dated March 15, 2006)

d) VAT accepted for offset

e) Third party services. Computer repair.

f) VAT (Invoice No. 14 dated March 15, 2006)

i) VAT accepted for offset

60.1

10.1

19.3

68.2

01.1

19.3

68.2

71.1

60.1

60.1

19.3

60.1

60.1

19.3

1770

15.03

Ivanov deposited the balance of the advance into the cash register. (PKO)

50.1

71.1

16.03

a) Petrov’s advance report was approved. JSC "Volna"

b) Material C. Price – 200, quantity – 8 pcs.

c) VAT (Invoice No. 16 dated March 16, 2006)

d) VAT accepted for offset

60.1

10.1

19.3

68.2

71.1

60.1

60.1

19.3

1888

1600

16.03

Received at the cash desk from the bank

50.1

16.03

Issued to Petrov

71.1

50.1

17 .03

Material C released into production 12 pcs.

10.1

2400

6th operation – (Retail sales; Invoice issued; Entry in the purchase book; PKO without posting).

Operation 9 – Documents/Materials/Transfer of finished products

1 operation. Documents/Advance report.3, 8d, 14 and 16 transactions. (VAT) Enter based on – Zap.book.purchase and etc.; Invoice1

17.03

"Electronics" computer reconstruction:

a) for the amount of services (Services of third parties)

b) VAT is charged (Invoice No. 21 dated March 17, 2006)

c) Entry in the purchase book

01.1

19.3

60.1

68.2

60.1

60.1

19.3

3000

540

3540

540

19

18.03

An MZ-8 machine was purchased, the advance payment previously issued to Olga LLC was counted as payment:

a) Purchase costs (Invoice No. 25 dated March 18, 2006)

b) VAT

c) Advance credited

c) Entry in the purchase book

08.4

19.1

60.1

68.2

60.1

60.1

60.2

19.1

9000

1620

1 0620

1620

20

18.03

18.03

The MZ machine was included in fixed assets

01.1

N05.01

08.4

N01.01

9000

9000

21

20.03

Received a free car from an individual. persons at market value (now from account 98-2 the amount is written off to account 91 as depreciation is calculated, and taxable profit increases)

08.4

98.2

20000

22

20.03.

Credited "Quantum" for

a) Setting up a car (Invoice No. 23 dated 03/20/06)

b) VAT

c) Payment to the supplier

d) Entry in the purchase book

08.4

19.1

60.1

68.2

60

60

51

19.3

5000

900

5900

900

23

20.03

20.03

The car was included in fixed assets

01.1

N05.01

08.4

N01.01

25000

25000

24

21.03

Copier sold to Vesna LLC:

a) Depreciation for March

b) Depreciation written off (including March)

c) its book value is written off

d) Residual value written off

e) Revenue from the sale of a photocopier

e) Actions/ Enter based on/ Extract

f) Invoice issued

g) Entry in the sales book

26

02.1

01.2

91.2

62.1

51

91.2

76.N.1

02.1

01.2

01.1

01.2

91.1

62.1

76.N.1

68.2

100

2000

9600

7600

1 1800

1 1800

1800

1800

25

21.03

Charged to the intermediary for the service when selling a copier.

a) cost of services (Invoice No. 26 dated 03/21/06)

b) VAT

c) Statement (Payment to supplier)

c) Entry in the purchase book

44.2

19.3

60.1

68.2

60

60

51

19.3

1000

180

1180

180

26

23.03

Selling expenses to the intermediary are written off against the cost of selling the copier

91.2

44.2

1000

27

25.03

Finished products were shipped to the warehouse, 50 pcs.

43

40

125 000

28

25.03

Products sold to Store No. 777 in the amount of 150 pcs.

b) For the total amount

c) Received from buyer Y (Input based on -Extract)

d) Invoice issued

d) Entry in the sales book

90.2.1

62.1

51

90.3

76.N.1

43

90.1.1

62.1

76.N.1

68.2

375000

531000

531000

81000

81000

21 operations – Entering an operation manually

1

2

3

4

5

6

29

25.03

Workers' wages accrued

a) Savelyev

b) Income tax

c) Sidorov

d) Income tax.

20

70

20

70

70

68.1

70

68.1

8800

754

9000

663

30

25.03

Received at the cash desk for salary

50

51

1 6383

31

25.03

Savelyev

Sidorov

70

70

50.1

50.1

8046

8337

32

27.03

Personal income tax transferred (Workshop No. 1)

68.1

51

1417

3 3

27 .03

Finished products were shipped from production to the warehouse in the amount of 100 pcs. at cost

43

4 0

250 000

34

28.03

Accrued salaries for accounting department employees

a) Obolenskaya

b) Income tax

c) Mikhailova

d) Income tax.

26

70

26

70

70

68.1

70

68.1

11400

1209

6600

468

35

28.03

Received at the cash desk to pay salaries to accounting department employees

50

51

16323

36

28.03

Salaries paid through the cash register:

Obolenskaya

Mikhailova

70

70

50

50

10191

6132

37

28.03

Personal income tax transferred (accounting)

68.1

51

1677

38

29.03

Products sold to Store No. 5 in the amount of 100 pcs.

a) Written off for sale at cost

b) For the total amount

c) Received from the buyer

d) VAT accrued (invoice issued)

e) Entry in the sales book

90.2.1

62.1

51

90.3

76.N.1

43

90.1.1

62.1

76.N.1

68.2

250000

354000

354000

54000

54000

39

29.03

Administration staff salaries accrued

a) Vasiliev

b) Income tax

c) Ivanov

d) Income tax.

c) Petrov

d) Income tax.

26

70

26

70

26

70

70

68.1

70

68.1

70

68.1

16000

1690

9000

780

9000

663

40

29.03

Received to the cash desk to pay salaries to administration employees.

50

51

30867

41

29.03

Salaries paid through the cash register:

Vasiliev

Ivanov

Petrov

70

70

70

50

50

50

14310

8220

8337

42

29.03

Personal income tax has been transferred. Administration

68.1

51

3133

43

31.03

Depreciation has been calculated on fixed assets:

a) computer

b) Printer

26

26

02

02

100

50

43 operation Documents/ Regulatory/ Depreciation

1

2

3

4

5

b

44

31.03

Transferred from current account:

debt (JSC Volna)

60.1

51

11800

45

31.03

Products K (1 piece) were written off from the warehouse due to a fire as non-compensable losses (according to s/s)

99

43

2500

46

31.03

Finished products were shipped from production to the warehouse in the amount of 50 pieces at cost

43

40

125000

47

31.03

Products sold to store No. 5 in the amount of 50 pcs.

a) Written off for sale at cost

b) For the total amount

c) Extract

d) Invoice issued

e) Entry in the sales book

90.2.1

62.1

51

90.3

76.N.1

43

90.1.1

62.1

76.N.1

68.2

125000

177000

177000

27000

27000

48

31.03

VAT

68.2

51

1604520

49

Closing the month

The financial result from sales for the reporting month is determined by comparing debit turnover

90-2, 90-3 and credit 90-1

The balance of other income and expenses for the reporting month is determined by comparing the debit turnover of account 91-2 and credit 91-1

90.9

91.9

99

99

1525 00

1900

Table 7 1. Final balance

Assets

Sum

Passive

Sum

01

Fixed assets

5 2100

02

Depreciation of fixed assets

4250

20

Primary production

4 2900

40

Output

732 600

26

General expenses

5215 0

82

Reserve Fund

40000

51

Checking account

85070 0

98

revenue of the future periods

20000

99

Profit of the reporting period

201000

Balance

997850

Balance

997850

49 – Documents / Regulatory / Closing of the month. (Delete۷ before all accounts except accounts 90 and 91).

LITERATURE.

E. P. Kozlova, T. N. Babchenko E. N. Golenina. Accounting in organizations. Moscow, Publishing house "Finance and Statistics", 1999

E. P. Kozlova, N. V. Parashutin, T. N. Babchenko E. N. Golenina. Accounting. Moscow, Publishing house "Finance and Statistics", 1997

Accounting Regulations “Accounting Policy of the Organization” PBU 1/9

Basic accounting standards. - Ed. "Tominform", 2003

Regulations on accounting “Accounting for intangible assets” PBU 14/2000 Ed. "Tominform", 2003.

1C:Enterprise 7.7 Accounting. User guide. Moscow Publishing house "1C", 1999

1C:Enterprise 7.7 Accounting. Accounting Guide. Moscow Publishing house "1C", 1999

1C:Enterprise 7.7 Accounting. Installation and Startup Guide Moscow Publishing House. "1 C", 1999

1C:Enterprise 7.7 Salaries and personnel. Secrets of work. St. Petersburg Publishing house "BHV-Petersburg", 2003

Currently, software products on the 1C:Enterprise 7.7 platform are sold only through partners with franchisee status upon special requests. Support for software products in the 1C:Enterprise 7.7 line is provided as part of a subscription to information technology support ().

Software products of the 1C:Enterprise 7.7 system were developed from 1999 to 2003. They met the requirements of their time and gained wide popularity in Russia and other CIS countries. However, since 2004, the development of application solutions from 1C has been carried out on a new promising platform of the next generation "". The 1C:Enterprise 7.7 technology platform is not updated after 2003.

Currently, a number of users feel the need to further purchase 1C:Enterprise 7.7. For example, the user has his own development on the 1C:Enterprise 7.7 platform or there is a need to increase the number of enterprises of the same group, which were previously automated in a standard way on the 1C:Enterprise 7.7 version. For such users, the sale of 1C:Enterprise 7.7 software products is carried out through partners with franchisee status on special requests. These applications must include information about the client, the motivation for the need to purchase software products of the 1C:Enterprise 7.7 system, as well as confirmation that the end user has been notified that the software product of the 1C:Enterprise 7.7 system does not fully comply with modern requirements. At the same time, the existing procedure for supporting these software products of the 1C:Enterprise 7.7 line within the framework of a subscription to information technology support (ITS) is maintained.

The 1C company strongly recommends that users consider the possibility of transferring systems running on the 1C:Enterprise 7.7 platform to the " " platform. This will help improve the efficiency of organizations through the use of new capabilities of the 1C:Enterprise 8 platform and application solutions created on its basis.

Learn more about the terms and conditions for the sale of 1C:Enterprise 7.7 software products, effective from July 1, 2011.

List of 1C:Enterprise 7.7 software products that can be purchased through partners with franchisee status:

|

vendor code |

Software |

Dealer |

Permanent partner |

|

|

1C:Predpr.7.7 PROF.Complex delivery + ITS USB |

25 000 |

|||

|

1C:Enterprise 7.7 (network version). Complex delivery + ITS USB |

||||

|

1C: Accounting 7.7 PROF + ITS USB |

||||

|

1C:Enterprise 7.7 (network version). Accounting. Typical configuration + ITS USB |

||||

|

1C: Trade and warehouse 7.7 PROF + ITS USB |

||||

|

1C:Enterprise 7.7 (network version for 3 users). Operational accounting. Configuration "Trade + Warehouse" + ITS USB |

||||

|

1C:Enterprise 7.7 (network version). Operational accounting. Configuration "Trade + Warehouse" + ITS USB |

||||

|

1C: Salaries and personnel 7.7 PROF + ITS USB |

||||

|

1C:Enterprise 7.7 (network version for 3 users). Calculation. Configuration "Salary + Personnel" + ITS USB |

||||

|

1C:Enterprise 7.7 (network version). Calculation. Configuration "Salary + Personnel" + ITS USB |

33 40 0 |

|||

|

1C: Set of reports 7.7 (basic version) with a standard configuration for preparing reports from government agencies |

||||

|

1C: Clothing allowance 7.7 |

||||

|

1C:Enterprise 7.7. Web extension version 2.0 |

||||

|

1C:Enterprise 7.7. Management of distributed USB infobases |

||||

|

1C:Enterprise 7.7 PROF. Complex supply for Ukraine + ITS USB |

||||

|

1C:Enterprise 7.7 (network version). Complex supply for Ukraine + ITS USB |

||||

|

1C: Accounting 7.7 PROF for Ukraine + ITS USB |

||||

|

1C:Enterprise 7.7 (network version). Accounting. Typical configuration for Ukraine + ITS USB |

||||

|

1C: Trade and warehouse 7.7 PROF for Ukraine + ITS USB |

||||

|

1C:Enterprise 7.7 (network version for 3 users). Operational accounting. Configuration "Trade + Warehouse for Ukraine" + ITS USB |

||||

|

1C:Enterprise 7.7 (network version). Operational accounting. Configuration "Trade + Warehouse for Ukraine" + ITS USB |

||||

|

1C: Salaries and Personnel 7.7 PROF for Ukraine + ITS USB |

||||

|

1C:Enterprise 7.7 (network version for 3 users). Calculation. Configuration "Salary + Personnel for Ukraine" + ITS USB |

||||

|

1C:Enterprise 7.7 (network version). Calculation. Configuration "Salary + Personnel for Ukraine" + ITS USB |

||||

|

1C:Enterprise 7.7 Configuration "Production + Services + Accounting for Ukraine" CD. Sales only through franchisees |

||||

|

1C:Enterprise 7.7 PROF with a set of configurations for Kazakhstan + ITS USB |

||||

|

1C:Enterprise 7.7 (network version) with a set of configurations for Kazakhstan + ITS USB |

||||

|

1C: Accounting 7.7 PROF for Kazakhstan + ITS USB |

||||

|

1C:Enterprise 7.7 (network version). Accounting. Typical configuration for Kazakhstan + ITS USB |

||||

|

1C: Trade and Warehouse 7.7 PROF for Kazakhstan + ITS USB |

||||

|

1C:Enterprise 7.7 (network version for 3 users). Operational accounting. Configuration "Trade + Warehouse for Kazakhstan" + ITS USB |

||||

|

1C:Enterprise 7.7 (network version). Operational accounting. Configuration "Trade + Warehouse for Kazakhstan" + ITS USB |

||||

|

1C: Salaries and Personnel 7.7 PROF for Kazakhstan + ITS USB |

||||

|

1C:Enterprise 7.7 (network version for 3 users). Calculation. Configuration "Salary + Personnel for Kazakhstan" + ITS USB |

||||

|

1C:Enterprise 7.7 (network version). Calculation. Configuration "Salary + Personnel for Kazakhstan" + ITS USB |

Economic programs of previous versions (2.0, 5.0, 6.0)

|

Name |

Dealer |

Permanent partner |

||

|

1C: ACCOUNTING basic version 5.0 for DOS |

||||

|

1C: ACCOUNTING PROF 2.0 for DOS |

||||

|

1C: ACCOUNTING PROF 2.0 network version |

||||

|

1C: ACCOUNTING basic for Windows version 6.0 |

||||

|

1C: ACCOUNTING basic for Windows "95 version 6.0 |

||||

|

1C: ACCOUNTING PROF for Windows version 6.0 |

||||

|

1C: ACCOUNTING PROF for Windows network version 6.0 |

||||

|

1C: ACCOUNTING PROF for Windows "95 version 6.0 |

||||

|

1C: ACCOUNTING PROF for Windows"95 network version 6.0 |

COURSE CURRICULUM

"ACCOUNTING AND TAXATION

USING THE PROGRAM "1C: ACCOUNTING 7.7"

General characteristics. The offered accounting courses allow students to gain the knowledge and skills necessary to work as an accountant in enterprises of any form of ownership. The training is based on the principle of combining lectures with practical exercises. The program includes the principles of organizing accounting in the Russian Federation, such as regulatory regulation, basic principles of accounting organization, documentation, inventory procedures and many others. The program covers issues of the relationship between the enterprise and regulatory (tax inspection) authorities. Accounting courses include the topic of reporting on a PC (computer program “1C: Accounting”). The organization of accounting is considered: cash, monetary documents, financial investments; settlements with enterprises, organizations and individuals. The accounting methodology is explained for all sections and specific examples are given.

Gained skills. After completing this program, the knowledge gained enables the graduate to independently receive and control primary documentation, keep records of fixed assets, inventory, production costs, financial results and their distribution; conduct payroll calculations; fill out reporting forms, prepare and protect a balance sheet.

Upon completion of training, graduates receive a standard certificate. Students can find employment in any type of enterprise as an accountant or assistant accountant.

1. Subject and method of accounting.

1.1. Subject of accounting.

1.2. Regulatory regulation of accounting.

1.3. Chart of accounts and related instructions.

1.4. Economic assets of the enterprise and sources of their formation.

1.5. Accounting method. Documentation. Inventory. Calculation. Accounts and double entry. Balance sheet and reporting.

1.6. Logical problem (practical lesson).

2. Accounting for cash, bank credits and loans.

2.1. Accounting for cash transactions. Receiving and issuing cash. The procedure for filling out cash documents and conducting an inventory. Characteristics of the “50” account. Account transactions.

2.2. Accounting for settlements with accountable persons. Expenses and preparation of advance reports. Characteristics of the account "71".

2.3. Accounting for funds in the company's current account. The procedure for opening a current account and relationship with the bank. Filling out a checkbook and payment orders. Bank statement for the company's current account. Letter of credit payment form. Characteristics of the account "51".

2.4. Accounting for settlements with suppliers and contractors. Characteristics of the “60” count.

3. Accounting for fixed assets (FA).

3.1. Classification. Evaluation and revaluation. Receipt and departure. Free transfer. Characteristics of account “01”.

3.2. Accounting for depreciation on fixed assets (account “02”). Accounting for investments in non-current assets (account “08”).

3.3. Accounting for intangible assets, accounts “04”, “05”.

4. Accounting for material assets.

4.1. Materials accounting. Composition and evaluation of materials. Method of accounting for materials, according to the accepted accounting policy. Characteristics of the "10" count.

5. Accounting for labor and wages.

5.1. Types of wages.

5.2. Documentation on labor accounting and wages.

5.3. Calculation of basic salary, next vacation and temporary disability benefits, alimony, personal income tax (personal income tax).

5.4. Accounting for social insurance and security expenses. UST (unified social tax), insurance contributions to the pension fund, contributions to compulsory accident insurance, account “69”.

5.5. Preparation of payroll statements.

5.6. Score "70".

6. Accounting for production costs and distribution costs in trade. Calculation of unit cost of production.

6.1. Characteristics of production costs and distribution costs.

6.2. Accounts “20”, “26”, “44”.

7. Accounting for finished products, goods and their sales.

7.1. Accounting for finished products and their distribution.

7.2. Differences between finished products and goods.

7.3. Accounts "41" and "43".

7.4. Accounting for shipped goods.

8. Accounting for settlements between enterprises.

8.1. Features of accounting for settlements between enterprises depending on the presentation of payment documents and direct payment for goods.

8.2. Calculations for advance payments.

8.3. Accounts "62" and "90".

9. The concept of income and expenses. Accounts “90”, “91”, “99”.

9.1. Profit from the sale and its distribution (account “99”).

9.2. Determination of the amount of gross and taxable profit.

9.3. Balance sheet reformation, account “84”.

9.4. Enterprise property tax. VAT. Income tax.

9.5. Accounting for loans and borrowings. Accounts “66”, “67”.

10. Accounting statements.

10.1. Balance sheet

10.2. Gains and losses report.

11. General characteristics of the 1C: Enterprise system. Configurations of the 1C: Enterprise complex. (20 academic hours)

11.1. Launch modes of the 1C: Enterprise system.

11.2. Description of system objects: transfers, constants, directories, chart of accounts, operation and posting, documents and journals, reports.

11.3. Familiarization with the interface of the 1C: Accounting program.

11.4. General information about the configurator.

11.5. Setting up a chart of accounts.

12. Principles of working with the program.

12.1. Entering constants Setting the working period.

12.2. Methods for entering information: postings, documents.

12.3. Review of reference books. Features of filling out individual directories (contracts, employees, taxes and deductions, nomenclature).

12.4. Postings (manual entry, entry of complex transactions).

12.5. Transaction log.

12.6. Chart of accounts.

13. Entering documents.

13.1. Entering and editing directories.

13.2. Filling out information about the organization.

13.3. Working with primary documents.

13.4. Typical documents: cash receipt and debit order, payment orders, invoice, invoices, invoice.

13.5. Carrying out documents. Editing and deleting documents and transactions. Printing documents.

13.6. Formation of the Sales Book and the Purchase Book.

14. Accounting and reporting in the “1C: Accounting” program.

14.1. Accounting for fixed assets and intangible assets, inventories (materials), goods and materials (inventory assets).

14.2. Personnel accounting, calculation and payroll, cash accounting.

14.3. Settlements with accountable persons, non-cash payments, cost accounting.

14.4. Accounting and sale of finished products.

14.5. Formation of financial results.

14.6. Reporting forms. Standard, regulated and specialized reports.

14.7. Regulated reports (quarterly and annual balance sheet of the enterprise).

14.8. Specialized reports.

15. Administration.

15.1. Saving and restoring data.

15.2. Creating a list of users, setting a password for logging into the system.

15.3. Creation of new databases.

15.4. Procedure for updating regulated reports.

15.5. Data archiving.

15.6. Configuration release update.

Test (interview).

40 in a budget institution

40 in a budget institution Chairman of the SNT - duties, rights and powers and their provision

Chairman of the SNT - duties, rights and powers and their provision Tutorial for working in 1s 7

Tutorial for working in 1s 7 Timothy's name day. Timofey. Name day. The meaning of the name Timothy's Name Day

Timothy's name day. Timofey. Name day. The meaning of the name Timothy's Name Day April 19 dates holidays events

April 19 dates holidays events The name Fedor in the Orthodox calendar (Saints)

The name Fedor in the Orthodox calendar (Saints) Boris's name day according to the Orthodox calendar

Boris's name day according to the Orthodox calendar