Tax consulting. Accounting support Accounting services consulting

The activities of any enterprise are connected not only directly with the production of goods, provision of services and performance of work. The manager has to solve a complex of organizational and management problems.

Not every enterprise has the means to support specialists in legal, accounting, investment and other matters. In such situations, consulting services come to the rescue. companies. Accounting consulting is considered today one of the most promising areas in business. Let's look further at what it is.

General information

Consulting is a set of activities for consulting management personnel and other employees on various issues. It includes analytics, research into the company’s development prospects, and the study of the organization’s resources and reserves.

There are quite a lot of companies on the market that deal with business processes. The need to contact them may be due to various reasons. Eg, accounting consulting services are in demand if the enterprise does not have a specialist or department involved in reporting.

Historical reference

Companies engaged in accounting and consulting, began to appear in Russia at the end of the last century. This was due to changes taking place not only in the economic but also in the political system of the country. In the early 90s, there were about 20 consulting companies operating in the Russian Federation.

With the transition to a market economic model, consulting services have become in great demand. At the same time, their quality has improved significantly. Of course, competition has increased; Foreign companies appeared on the domestic market. Domestic companies, trying to maintain their place in the market, began to actively improve their activities. As a result, the field of consulting services has moved to a qualitatively new level.

Characteristics of companies

Firms providing consulting services are consultants to an enterprise on the most pressing issues for it. It is worth saying that these companies are not responsible for the actions that the organization’s management takes based on the recommendations.

Areas of activity

In general, the following areas of work of consulting firms can be identified:

- Providing assistance in solving management and organizational issues in problematic areas of activity.

- Consulting.

- Planning of administrative and organizational activities.

There are several principles that guide consulting companies:

- Application of scientifically based information.

- Active use of information technology in our activities.

Specialists from a consulting firm can offer their idea if it helps solve a problem the customer has.

Classification

It is carried out depending on the area in which the assistance of a consulting company is needed. The range of services offered by modern companies is quite wide. In this case, the client can choose either one or several of them. In addition, it is possible to take advantage of the full range of work.

For example, it could be accounting, auditing and consulting. In this case, the consulting company is engaged in maintaining documentation, analyzing it and advising on reporting issues.

A related area is financial consulting. It may include different services. As a rule, a consulting company conducts an audit, identifies problems, determines prospects, and formulates recommendations for the manager on profitable investments and measures aimed at strengthening the financial position of the enterprise.

In addition, consulting is provided:

- Managerial.

- Personnel.

- Investment.

- Expert.

- Educational.

Accounting and tax consulting

Its goal is not only to increase the efficiency of accounting for business transactions in an enterprise, but also to control the correctness of their reflection.

Usually, accounting consulting are carried out by highly qualified specialists. The need to address them is due to the fact that the current legislation on accounting, taxes, and payroll is quite extensive. At the same time, adjustments are constantly taking place, which the management of the enterprise does not always have time to follow. In addition, there are many gaps in the current legislation, and it is sometimes quite difficult for a non-specialist to understand any controversial issues.

Accounting audit and consulting- services in demand on the market. Not every manager is ready to spend his time and energy understanding the provisions of the PBU or Tax Code. However, finding a good accountant can be quite problematic.

Firms dealing accounting consulting, help solve pressing issues related to reporting. In addition, they can recommend a trustworthy specialist.

Accounting consulting- This is not just consulting. It involves a detailed analysis of issues related to reporting, with references to current legislation. It is important for a consulting company that the customer understands the information so that he receives well-founded and detailed answers to his questions.

Particular attention is paid to tax issues. As is known, violations of the Tax Code entail liability. However, quite often business entities commit unlawful actions due to a simple ignorance of the intricacies of the law. Consulting companies help prevent problems and solve existing ones.

Directions

Accounting consulting includes:

- Registration with the Federal Tax Service.

- Maintaining reports, including for special regimes.

- Restoration of accounting.

- Tax optimization.

- Formation of reporting (tax, accounting).

- Resolving accounting issues, including servicing the activities of the accounting department at the enterprise.

- Checking compliance with legislation when carrying out business transactions, analyzing their feasibility.

- Control of the availability and movement of property, use of financial and labor resources.

- Assessing the correctness and timeliness of settlements with suppliers and other contractors, with payroll employees, and with the budget for fees/taxes.

- Consulting on the preparation of financial statements under IFRS.

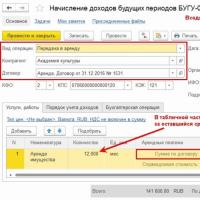

In addition, specialists from a consulting company can analyze the correctness of accounting in the automated 1C system.

Start of interaction

As you can see, consulting companies solve quite complex problems. Accordingly, specialists must have the necessary qualifications, experience, and knowledge. Choosing the right company is quite difficult. Experts recommend consulting with business partners who have already contacted such companies.

Interaction with a consulting company begins with an initial consultation. Based on its results, an agreement is concluded. The parties in the document establish:

- The time frame within which consulting services will be provided.

- List of events.

- Size, payment procedure.

- Responsibilities of the parties to the transaction.

- Conditions under which the amount of remuneration may change.

- The procedure for terminating the contract, including early termination.

The contract can be concluded for a short or long period. This will depend on the nature and complexity of the problem.

Work process

After signing the contract, the collection of information necessary to effectively solve the problem begins. At this stage, the consulting firm's staff must assess the severity of the problem.

The next step is to develop a solution. This stage of work can be considered the main one. The task of specialists is to draw up a plan to effectively solve the problem. In this case, as a rule, several options are formed, from which the most effective and economical is selected.

The next stage is the implementation of the decision and monitoring the execution of the plan. Employees of either a consulting company or employees of the customer company can monitor the accuracy of compliance with the plan. In the latter case, training is provided to the organization's employees.

Result evaluation

It is worth saying that it is not always possible to immediately assess their effectiveness upon completion of activities. Quite often it is necessary for some time to pass. However, in any case, the head will be involved in summing up the results together with the employees of the consulting company.

If production indicators have increased, the company’s profit has increased, a final settlement is made with the contractor.

Accounting consulting is a set of professional consulting services provided to the customer by highly qualified specialists from a third-party company in order to improve the efficiency of accounting and tax accounting.

Help from an external expert

When carrying out any kind of commercial activity, errors in the field of accounting and taxation threaten serious material losses in the future. In order to avoid possible contradictions with regulatory authorities, heads of organizations and private entrepreneurs try to attract experienced accountants to their staff or create entire financial services. Employees of the accounting department are responsible for document management, preparing and submitting reports.

Professional advice may be required at the stage of creating a new company, during the period of reorganization, as well as in the event of difficulties in accounting when carrying out the company’s current business activities. Problems and controversial issues regarding the correct reflection of financial transactions are faced by both novice specialists and accountants with extensive experience.

The cause of difficulties is most often the imperfection of Russian legislation, which is subject to constant changes; laws and regulations contain “vague wording” and inconsistencies. If difficult situations arise regarding the maintenance of financial accounting in a company, it is advisable to attract competent outside specialists to help the staff accountant.

Components of accounting consulting

Professional accounting consulting includes the following types of services:

- development of the company's accounting policy;

- developing a chart of accounts, building an effective accounting system in the organization;

- preparation of financial statements;

- preparation of tax returns;

- restoration of accounting;

- representing the interests of legal entities and private entrepreneurs in the tax authorities;

- consulting financial services employees on the practical application of current legislation;

- consulting on controversial accounting issues.

Accounting consulting from "F1 New Accounting"

Our company provides a full range of services in the field of accounting consulting. When contacting us for qualified assistance, the customer is guaranteed the following benefits:

- Prompt resolution of the issue - we help to cope with problems of any complexity in the shortest possible time. Our employees have significant experience in providing consulting services to commercial organizations and private entrepreneurs, which allows us to quickly find effective legal solutions.

- Cost-effectiveness – hiring outside specialists allows the organization to save on wages, since the services of highly qualified accountants on staff are quite expensive. It is more profitable to resort to accounting consulting when solving complex and non-standard problems.

- Individual approach – each client’s issue is considered individually, taking into account all available factors of the company’s internal and external environment.

- A team of professionals - our specialists have thorough knowledge and many years of experience not only in the field of accounting and tax accounting, but also in related areas: economic, legal and others.

The information obtained as a result of accounting consulting allows the manager to build effective systems for maintaining accounting, management, and tax accounting in the organization or to optimize existing schemes and methods.

Accounting consultation (Moscow) from RSF will help you avoid numerous mistakes that accompany accounting, calculation of taxes and fees. We will not only suggest the right solution, but we will find the best one for you.

The results of our services for LLCs and individual entrepreneurs are as follows:

- reduction in tax payments by at least 5-10%. We will definitely find a legal way to reduce your tax burden

- bringing accounting records into full order. We will help you untangle any accounting tangle. We will make sure that everything becomes extremely clear and understandable to you. You will always know what is in your accounting department where it is and what works how

- reduction of accounting costs. Confused or simply incorrect accounting is always a source of stress, rush jobs and additional expenses. Inexpensive services from RSF specialists will help you avoid all this

- building a reputation as an accurate taxpayer. Ordering our services will help you find yourself in good standing with regulatory authorities

- complete absence of claims from regulatory authorities. Our services will help you learn how these claims can be avoided and what to do if they do arise.

- complete absence of fines, as well as the risk of seizure of property or suspension of the company’s activities. We will point out weaknesses in your accounting and possible sources of conflicts with government agencies. Let us help you eliminate them. You just need to click on the “Order” button

- concluding contracts and agreements on the most favorable terms. We will conduct a full examination of your contracts and advise you on how they can be changed in your favor. Relevant for both legal entities and individuals

- successful resolution of controversial issues. We will help you with consultation or our direct participation in resolving them.

Accounting services Qualified accounting services, submission of financial statements, restoration and establishment of accounting records.

Consulting Management, personnel and tax consulting, support for your business and consulting services.

Prices for consulting services

Price for consulting services

| Type of consultation | Volume | Cost, rub.) |

| One oral consultation (by phone) | 1 hour | 1000 |

| One oral consultation with a response by email (A very short response is given with links to regulations and/or excerpts from them) | 1500 | |

| One written consultation per agreed issue. The answer is given on an official form as quickly as possible, with prior verbal approval of the answer provided. | 2500 | |

| One written response to three agreed upon questions. The answer is given on an official form as quickly as possible, with prior verbal approval of the answer provided. | 6000 | |

| One meeting at the performer's office for oral consultation for 2 working hours. Meeting time is no more than two hours. During the meeting, consultation is provided without reviewing the Customer’s documents. | 2 hours | 4000 |

| One meeting at the Contractor’s office for oral consultation for 1 working day. Meeting time during the working day. During the meeting, consultation is carried out and the submitted documents are reviewed. | 8 ocloc'k | 9000 |

| One consultant visit to the Customer’s office for 3 working hours. Consultations with reviewing client documents and issuing oral recommendations. | 3 hours |

5700 Moscow 6000 in the Moscow region. |

| One consultant visit to the Customer’s office for 1 working day. Consultations with review of client documents, issuance of oral recommendations and subsequent provision of the necessary regulatory and legal acts regarding the meeting. | 8 ocloc'k |

11500 Moscow 12000 in the Moscow region. |

| Subscriber consulting service | ||

| |

1 year | 30000 |

| - Unlimited number of telephone consultations on all accounting and taxation issues with links to the regulatory framework; - 5 written answers - 1 meeting on the territory of the Contractor’s company on the most complex issues; |

1 year | 50000 |

| - Unlimited number of telephone consultations on all accounting and taxation issues with links to the regulatory framework; - 5 written answers |

1 year | 60000 |

| - Unlimited number of telephone consultations on all accounting and taxation issues with links to the regulatory framework; - 15 written answers - 3 meetings on the territory of the Contractor’s company on the most complex issues; |

1 year | 70000 |

| - Unlimited number of telephone consultations on all accounting and taxation issues with links to the regulatory framework; - 15 written answers - 3 meetings on the territory of the Contractor’s company on the most complex issues; - 5 trips to the Client’s office (1 trip – up to 7 hours) |

1 year |

100,000 in Moscow 105000 in the Moscow region. |

| Possible additional services | ||

| Receipt of documentation by courier from the Client’s office | 1 trip | 300 in Moscow |

| Departure of a specialist to the Client’s office for a more detailed discussion of the objectives of the consultation or clarification of the consultation | 1 trip (no more than 2 hours) |

1500 Moscow time 2000 in the Moscow region. |

Consultation time is rounded up to 30 minutes. to the greater side.

In accordance with the Tax Code of the Russian Federation, part 2, chapter 26.2, the Contractor is not a payer of value added tax.

Accounting consulting is one of the services of the Business Analytics company. It involves one-time or ongoing consultations with various organizations in matters of financial activity. Our company provides accounting consultations on an outsourcing basis. This means that you do not have to look for and hire a specialist, pay him regular wages, provide vacation and sick leave. You simply order the services of our professionals and receive high-quality accounting advice. In this case, you pay only for those operations that you need.

Cost of accounting consulting services

Consultation with an accountant includes the following steps:

- Specification of the consultation topic

- Preparation of a response by an existing accountant

- Response to consultation in the format of personal communication with the provision of supporting documents

What accounting consulting services can you order from our company?

- Assistance in selecting the organizational and legal form for your company and the optimal taxation system.

- Development and setup of accounting and tax accounting.

- Formation of an accounting register.

- Optimization of the internal document flow system in the company.

- Assistance in reducing the existing tax burden with a focus on civil and tax legislation.

Why should you order financial and accounting consultations from the Business Analytics company?

- You can save your time. Our specialists provide accounting consulting services in the order that is convenient for the client. You can come to our office yourself, where our employee will talk with you in a pleasant, cozy atmosphere and help you resolve important issues. In addition, you can contact our specialist and receive consulting services via telephone, e-mail or Skype.

- Professionals work with you. Accounting consultations are provided by existing specialists who have gained experience in large Russian and foreign companies. Our accountants are well versed in legislation and the nuances of reporting. In addition, they regularly undergo advanced training, gaining new knowledge and experience. We are ready to solve even the most complex problems and find effective solutions to problems.

- You can make your business more profitable. By ordering accounting consulting from our company, you will receive answers to many questions and qualified assistance in organizing the work of your company. Our specialists will help you choose a taxation system and reduce accounting costs, and solve many other issues. This way, you will significantly save your company money and be able to focus on generating additional profits.

40 in a budget institution

40 in a budget institution Chairman of the SNT - duties, rights and powers and their provision

Chairman of the SNT - duties, rights and powers and their provision Tutorial for working in 1s 7

Tutorial for working in 1s 7 Timothy's name day. Timofey. Name day. The meaning of the name Timothy's Name Day

Timothy's name day. Timofey. Name day. The meaning of the name Timothy's Name Day April 19 dates holidays events

April 19 dates holidays events The name Fedor in the Orthodox calendar (Saints)

The name Fedor in the Orthodox calendar (Saints) Boris's name day according to the Orthodox calendar

Boris's name day according to the Orthodox calendar