Kbm 0.85 what does it mean. Osago: calculation methods, coefficients, tariffs and payments. How to find out and check your KBM

At the same time, understanding such issues is not only useful, but also profitable. Let’s look at the question from the very beginning, that is, for a car owner who doesn’t even know how KBM stands for, and let’s look at some of the subtleties of its application.

Compulsory insurance

Each car owner, along with other documents, must have MTPL with them. Thanks to the policies, all drivers are thus provided with protection. If a traffic accident occurs, the insurance of the at-fault party in the accident will pay the injured party to restore the vehicle. And if harm was caused to health, then for recovery.

This type of insurance has a system designed to encourage drivers to drive without accidents. Moreover, the measure applies specifically to those responsible for road accidents. It is implemented through KBM classes. Let's study what they mean and how they work.

KBM classes

KBM stands for the coefficient received by the driver who does not get into accidents for which he himself becomes the culprit, and the malus, that is, a reduction in the coefficient, accordingly, is received by the one who initiates the accident.

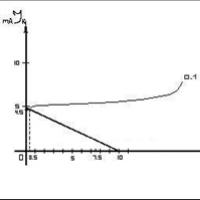

Trouble-free driving can last for many years. But insurers, naturally, are not interested in reducing the cost of the policy to zero. Therefore, they provided a threshold after which the cost of insurance no longer decreases. This is 50%.

There are drivers who drive according to all traffic rules for many years and do not break them. It would be unfair if they had to pay the same as those motorists who hardly respect the rules on the road.

So, the maximum coefficient is 0.50. To achieve this result, you need to avoid getting into an accident for 10 years.

Downgrade or loss of discounts

Even if you receive the maximum discount, you should not think that it is given forever without any conditions. If the driver gets into an accident and becomes the culprit, the discount decreases and reaches one, after which it will take a long time to move again to the coveted 50%. But if the driver got behind the wheel quite recently and his discount is small, then as a result of an accident it will not only be reset to zero, but the cost of insurance will even increase.

From the point of view of conscientious drivers, this is a more than reasonable measure: if you drive in such a way that you pose a danger to others, pay more for your policy!

A lot of accidents happen precisely because of the incompetence or dishonesty of drivers. Only such people will pay more only in cases where they get into an accident due to their fault. Therefore, in the event of minor incidents, it would be much better for them to come to an agreement with the injured party and resolve the issue without calling the traffic police. Then both some will be satisfied (since there will be no need to waste time and nerves interacting with the insurance company), and others (since the discount on the policy will remain the same).

By the way, you need to know that KBM classes under MTPL do not apply to trailers. Also, it will not be taken into account if the policy is issued to a citizen of a foreign country or a vehicle for transit.

KBM class according to OSAGO: table

So, based on the table below, you can calculate your KBM. The horizontal line indicates the driver's class at the beginning of the insurance policy period. Depending on the driving experience during the year (accident-free or with an accident, with subsequent insurance payments), one or another class of KBM according to MTPL is assigned for the next year. The table consists of fifteen classes, where "M", meaning "maximum", is assigned to the penalty box.

What class does a driver receive when driving for the first time?

In the first insurance year, the driver is assigned class 3. Let's use this example to learn how to understand KBM classes. The table, if you look at the first vertical row, contains a class, and if you look at the second - 1. This is its coefficient. It turns out, KBM 1, class 3. What does this mean?

If during this year of driving the driver does not get into traffic accidents (look at the third column), then in the next insurance period he will have a BMR of 0.95, class 4, respectively. Then the discount will be equal to five percent. However, if an accident occurs during this period, then it will be assigned class 2, where the BMC is 1.4. Then you will have to pay 40% more for insurance.

Beginners behind the wheel should be very careful, since in case of two or more accidents, the BMR will reach the maximum and be equal to 2.45. But after the next year of accident-free driving, the third class will return to the driver, and he will again not have to overpay for the insurance policy.

A BMR of 0.5 means a maximum fifty percent discount. But if such a driver gets into an accident, then he is assigned class 7, which corresponds to a coefficient of 0.8.

Several drivers are registered in OSAGO

If it is issued to several drivers, the KBM is considered special. The largest coefficient is taken as the basis. For example, if four drivers are included in the insurance, three of whom have a rating of 0.7 or lower, but only one has a rating of 0.9, the insurance will be calculated based on the latest KBM, that is, taking into account a ten percent discount.

KBM with unlimited insurance

If you plan to buy a compulsory insurance policy that can be used by an unlimited number of people, KBM is considered differently. The data of the car owner is taken as a basis.

It is important to keep in mind that if a policy was previously purchased for a limited number of persons, and then it was decided to reissue it to an unlimited number of persons, then those persons who were included in the policy with a limited number of persons should be included separately in it. Otherwise, the KBM classes of the latter will be lost.

How to check the bonus-malus ratio?

Please note that the KBM is not entered into a single database. It only contains information about previous car insurances. But the coefficient is calculated and checked directly by the insurance company when the driver purchases a policy. Insurance companies are required to apply CBM classes according to compulsory motor liability insurance, and also enter into the database information about accidents in which the driver was a participant in his car.

Therefore, it is the insurance companies that can check your KBM and provide the relevant information.

However, you can find out about this in other ways. For example, by going to the RSA website and accessing the KBM database there. To do this, you will need to write down your VIN code or license plate number of the car and information about the owner.

Rarely (since it is not a requirement) insurance companies indicate the BMR in the insurance policy. Therefore, sometimes it is enough to carefully study the document. The number can be indicated opposite the last name of each driver or in special marks.

Many sites today also have online calculators with which you can easily calculate your KBM. Thus, you can find out it yourself.

KBM database

So, the insurance company takes the data to calculate the coefficient from the database. They are entered directly by the insurance companies that insured the drivers. This feature should be remembered especially by those who decide to change their insurance card to another. It is best for them to take a certificate from the previous insurance company, where the KBM will be indicated. The fact is that some of them may enter information at the wrong time or forget about it, there may also be problems with loading the system, and so on. Therefore, it is better to play it safe and personally bring a document proving that you have a certain coefficient, so that it is not “accidentally” reset to zero.

Features of discounts

The following information should be considered in this matter.

Until recently, a discount for accident-free driving was assigned to a specific car. When selling it and buying a new one, the driver had to start his insurance history again. When the shortcomings of this system were identified, it was decided to abandon it. Now the entire number of how many classes of KBM exist relates directly to the driver. Therefore, it no longer matters what kind of car he drives and from which insurance company he purchased the MTPL policy. The main thing is accident-free driving.

Selected questions that drivers often ask

Let's look at a few individual situations.

What should, for example, one of the drivers who is registered with OSAGO and has changed his driver’s license? In the case of a valid contract, you should immediately contact the insurance company. The policyholder notifies the insurer about this in writing so that the latter makes adjustments to the information base of the Russian Union of Insurers.

Another question of interest to motorists is how the BMR is determined if the insurance contract is not limited to the number of drivers, whereas in the past the contract provided for restrictions on their number. In this case, the insurance company assigns the class specified in the insurance contract. How does the insurance company operate if the situation is the opposite, that is, the previous insurance contract had no restrictions on the number of persons, and the new one was concluded on conditions with restrictions? In this case, the insurance company is obliged to reduce the BMR.

Class 3 - what does this mean for the driver? In addition to the fact that this class is assigned to the one who got behind the wheel for the first time, if the driver has not entered into an MTPL agreement for more than a year, whatever discount he had previously was valid, it expires, and he again receives the class as if he got behind the wheel for the first time. That is, KBM 1, class 3.

What does this mean for the driver if he does not provide complete information about the accident when concluding a contract? An incorrect calculation will be detected by the system immediately. Therefore, the insurance company in this case imposes penalties on the driver. They are expressed in 1.5 KBM. That is, next year the payment will increase by 1.5 factors.

Conclusion

We have looked at what CBM classes mean, how they are calculated, applied and tested. Drivers need to remember that it is important not only to be able to drive a car and follow all existing traffic rules. It would also be useful to understand some related issues, such as, for example, insurance and its subtleties, that is, our topic today. Then he will feel confident behind the wheel, while at the same time saving his money.

KBM or bonus-malus coefficient is an indicator that determines the discount on the cost of an MTPL policy. People call it a discount for accident-free driving. The indicator may increase or decrease the cost of compulsory motor liability insurance depending on how accident-free the car was driven during the previous year of insurance.

How to use the table to calculate KBM?

The table for KBM calculations includes information about the MTPL class, the value of the coefficient that corresponds to a certain class, as well as information on how the number of accidents during the annual insurance period affects the MTPL class.

| Class | KBM | Increase in price | Number of insured events (payments) that occurred during the period of validity of previous MTPL contracts | ||||

| – | 0 | 1 | 2 | 3 | 4 | ||

| Discount | Class to be assigned | ||||||

| M | 2,45 | 145% | 0 | M | M | M | M |

| 0 | 2,3 | 130% | 1 | M | M | M | M |

| 1 | 1,55 | 55% | 2 | M | M | M | M |

| 2 | 1,4 | 40% | 3 | 1 | M | M | M |

| 3 | 1 | No | 4 | 1 | M | M | M |

| 4 | 0,95 | 5% | 5 | 2 | 1 | M | M |

| 5 | 0,9 | 10% | 6 | 3 | 1 | M | M |

| 6 | 0,85 | 15% | 7 | 4 | 2 | M | M |

| 7 | 0,8 | 20% | 8 | 4 | 2 | M | M |

| 8 | 0,75 | 25% | 9 | 5 | 2 | M | M |

| 9 | 0,7 | 30% | 10 | 5 | 2 | 1 | M |

| 10 | 0,65 | 35% | 11 | 6 | 3 | 1 | M |

| 11 | 0,6 | 40% | 12 | 6 | 3 | 1 | M |

| 12 | 0,55 | 45% | 13 | 6 | 3 | 1 | M |

| 13 | 0,5 | 50% | 13 | 7 | 3 | 1 | M |

Using the KBM table is very simple. First you need to know the KBM. This information is available on the website of the Russian Union of Auto Insurers (RUA), you can contact the insurance company or look at the KBM in the current policy (some companies indicate the class directly in the insurance). All other sources are considered unreliable.

If a citizen enters into a MTPL agreement for the first time, he is assigned class 3, for which the BMR is 1.00. Therefore, no discounts or surcharges apply.

Driver classes in the KBM table

The driver's class depends on the number of insurance payments made for the previous year of insurance due to his fault. If the accident was not registered by the State Traffic Safety Inspectorate, this will not affect the driver’s class in the KBM table, since the insurance company is interested in liability, not property.

Each insured event resulting in insurance payments lowers the driver’s class by 2-6 positions. For example, the driver’s initial KBM corresponds to the value 8. If one accident occurs, resulting in an insurance payment, the class will be reduced to 5, two accidents will lower the class to 2, and three or more will drop it to the lowest level. Class M means that the client is especially dangerous for the insurance company. In this case, the cost of the policy increases by 2.45 times.

How does the OSAGO class affect the discount?

The amount of discount on the cost of the policy depends on the MTPL class. Each year of accident-free driving entitles you to a 5% discount.

To determine what discount the driver receives, you need to do some simple calculations. You must subtract one from the coefficient value and multiply the resulting number by 100%.

For example, the driver’s class at the beginning of the annual insurance period is 11. It corresponds to a coefficient of 0.6. Thus,

(0,6-1)*100% = - 40%

Renewing insurance will cost 40% less.

An example of calculating the KBM from the table

We propose to consider an example of calculating the KBM using the table. Initial data: the driver enters into a MTPL contract for the first time and has committed 2 accidents in a year that resulted in insurance payments.

Since the driver has no history, he is assigned class 3, which corresponds to a value of 1. Having committed 2 accidents, the class is downgraded to M. When the contract is extended, the cost of insurance will increase by 2.45 times.

The desire to reduce the cost of insurance pushes some drivers to distort information. However, this is not recommended. If an insured event occurs, the fact of participation in an accident will certainly be revealed, and the insurance company will refuse to pay. You will have to eliminate the consequences of the accident at your own expense.

To encourage car owners to drive carefully on the roads, the Russian Union of Auto Insurers introduced a special bonus-malus coefficient (BMC). This indicator is influenced by the number of emergency situations in which a specific car owner and a specific car have been. We will tell you in our article how this coefficient works and how you can check the KBM using the AIS RSA database for compulsory motor liability insurance.

KBM - what is it?

The cost of an MTPL policy is affected by several facts. The main ones are driving experience and the number of emergency situations in which the driver has been. If you can't influence your driving experience, then you can influence your driving style. This is precisely what an indicator such as KBM is responsible for.

It is taken into account when calculating the cost of the MTPL policy. This is a special measure of reward and punishment. The winners here are those who drive carefully and, as a result, do not get into emergency situations. The losers are those responsible for the accident. Moreover, this incentive is quite tangible: the difference in the cost of the compulsory motor liability insurance policy due to the influence of this coefficient can reach 50%.

It is important to note that until 2008, this indicator was tied to a specific car. So, after its sale or disposal, the coefficient had to be built up from scratch. But now this coefficient is assigned to a specific driver and is not lost either when selling a car or when changing insurer. These changes have weight, but only if the break in insurance is at least 12 months, otherwise you will have to earn CBM from the very beginning.

The most important point is that this data applies only to those car owners who applied for payments to the insurance company. If, after an accident, minor repairs are required, which the driver pays at his own expense, without involving an insurer, then such an accident does not affect the MSC.

Legislative framework

KBM has existed since 2003, since the release of the law “On Compulsory Motor Liability Insurance”. And even then, incentives were provided in the form of discounts on the cost of a compulsory motor liability insurance policy for those drivers who do not get into an accident.

That is, this coefficient has existed for more than 10 years, that is, there are already drivers who have received the maximum discount on OSAGO for careful driving. This is a reality that is available to every motorist: drive carefully and for every year of accident-free driving, receive bonuses in the form of a discount on your MTPL policy.

KBM OSAGO table

As a clear example, below is a table of the OSAGO bonus-malus coefficient, displaying the dependence of the KBM on driving experience and driving accuracy. This table applies to all insurance companies:

| Class at the beginning of the annual insurance | KBM | Class at the end of the annual insurance period, taking into account the presence of insured events and insurance payments | ||||

| 0 | 1 | 2 | 3 | 4 | ||

| M | 2,45 | 0 | M | M | M | M |

| 0 | 2,30 | 1 | M | M | M | M |

| 1 | 1,55 | 2 | M | M | M | M |

| 2 | 1,40 | 3 | 1 | M | M | M |

| 3 | 1,00 | 4 | 1 | M | M | M |

| 4 | 0,95 | 5 | 2 | 1 | M | M |

| 5 | 0,90 | 6 | 3 | 1 | M | M |

| 6 | 0,85 | 7 | 4 | 2 | M | M |

| 7 | 0,80 | 8 | 4 | 2 | M | M |

| 8 | 0,75 | 9 | 5 | 2 | M | M |

| 9 | 0,70 | 10 | 5 | 2 | 1 | M |

| 10 | 0,65 | 11 | 6 | 3 | 1 | M |

| 11 | 0,60 | 12 | 6 | 3 | 1 | M |

| 12 | 0,55 | 13 | 6 | 3 | 1 | M |

| 13 | 0,50 | 13 | 7 | 3 | 1 | M |

To navigate the table and determine the KBM coefficient, you should know your current class as a motorist and the number of accidents in which you are at fault.

Initially, each driver is assigned a 3rd motorist class (this indicator is displayed in the first column of the table). If during the first year of driving not a single insured event occurred, then the next year the driver is assigned class 4 (third column on the 3rd line), and the KBM coefficient will drop to 0.95. If there was one appeal to the insurance company for payments as a result of an accident, then the driver is assigned 1st class (fourth column in the 3rd term), and the BMR will increase to 1.55.

That is, for every year of driving without accidents, the driver receives a 5 percent discount when applying for an MTPL policy. But if you get into an accident, then next year you will have to pay 55% more for the policy.

What if there are several drivers?

If one driver is registered when applying for an MTPL policy, then the KBM is calculated by the analogy given above. But what to do if there are several drivers per car. There are two options:

- A limited number of drivers are included in the policy. In this case, the bonus-malus coefficient is calculated for each driver individually. Moreover, if one warrior has a 45% discount, and another has a 20% discount, then the calculation is based on the lowest indicator, that is, 20%. The rule also applies here: if only one driver is involved in an accident, then the second one is still given a 5 percent discount.

- The policy includes an unlimited number of drivers. In this case, the class is assigned according to the owner of the vehicle. That is, the class is linked to the owner’s passport and a specific car. That is, there is a 40% discount on a specific car; when you sell it and buy a new one, the discount expires.

We check the KBM using the RSA database

Each insurance company maintains its own customer database, where the current driving class is recorded for each car owner. But if the driver decides to change the insurer, then his CBM under OSAGO will have to be checked and found out at the RSA. Here the driver's class, information on the number of accidents in which the car owner gets into, and the amount of the discount that is due to him are recorded. But despite the thoughtfulness of this system, there are often incidents due to which the database may contain erroneous data, as a result of which the driver may not receive the discounts due to him.

Errors may be due to human factors or technical errors. If the data in the database is incorrect and the driver does not have a previous MTPL policy, then the new insurance company will issue him a MTPL contract without discounts. Therefore, to avoid finding yourself in such a situation, collect any documents that can confirm your class as a car owner.

We prove our driving class at RSA

You can check the OSAGO KBM online using the RSA database yourself on the page http://kaskometr.ru/kbm.html to ensure that the entered data is correct. If you find that this database contains incorrect information about you, including a reduced driving class, be sure to prove that you are right. But what you shouldn’t do is prove your case to the insurance agent: this person does not have the right to enter data into the database and acts solely according to instructions.

To achieve justice, you should write a statement to the RSA, in which you should clearly indicate the discrepancy between the real driver's class and the data indicated in the database. To do this, you should attach documents proving your case:

- previous MTPL policies;

- certificates of accident-free driving.

It would also not be amiss to add that if the situation cannot be resolved peacefully, you will be forced to file a complaint with government agencies that perform financial control functions. You can do this if you have not received a response to your letter within 14 calendar days.

But usually, if the evidence base is quite significant, the case does not reach higher authorities. RSA will correct the incorrect information, and you, in turn, will receive your legal discount on the MTPL policy.

KBM OSAGO based on RSA helps to significantly reduce the cost of a car owner's policy. Therefore, drive your car carefully, and then next year your MTPL policy will cost you much less than the previous year.

Video on the topic

daily, from 9:00 to 20:00

How is the MTPL discount calculated? What is KBM?

Tariffs for compulsory motor liability insurance are approved not by insurance companies, as is the case with CASCO, but by the government of the Russian Federation. The price of an MTPL policy is equal to the product of the base tariff and a number of adjustment factors. In this article we will not describe them all, because... This is quite a lot of information. If you want to find out the cost of compulsory motor insurance– use the MTPL calculator on our website.

The focus of this article will be Bonus-Malus Ratio (BMR). The purpose of this parameter is to encourage accident-free drivers in the form of discounts and to punish those whose fault accidents occurred in the form of increasing the cost of the compulsory motor liability insurance policy.

When talking about CBM, Insurers often use the term “Insured Class”. If you are insured for the first time, then your class is 3, and the KBM itself is 1. Then, for each accident-free year of driving, you receive a 5% discount, i.e. in the second year of insurance your BMR becomes 0.95, in the third – 0.9, etc. The maximum threshold is a 50% discount on OSAGO (KBM = 0.5). To achieve this result, it is necessary not to become the culprit of an accident for ten years.

The discount accumulated over the years can easily be lost if you become the culprit of an accident during the next insurance period. If you have been insured not so long ago, and you do not have a discount, or it is insignificant, then careless driving on the road, among other troubles, will result in an increased cost of your MTPL policy for the next year of insurance. It should be noted that sanctions will be applied only if the victim of an accident applies for payment to your insurance company. In theory, he can give up and restore the car at his own expense, for example, if the damage to his vehicle was minor. In such a successful scenario for you, there will be no price increase.

KBM is not taken into account when insuring trailers. Also, it does not play a role when concluding an MTPL agreement for a transit vehicle and for vehicles whose owners are registered in a foreign country.

How to find out your KBM?

To find out your KBM for the next year of insurance, you need to use the appropriate table.

As mentioned earlier, for the first year of insurance the driver is assigned class 3. It is highlighted in yellow in the table. The BMR in this case is equal to 1, i.e. it does not affect the cost of compulsory motor insurance in any way. Let’s say that not a single accident occurred due to the fault of this driver in the first year. We look at the column “0 insurance payments”, the value in the cell is 4. That is. the next year the driver is assigned 4th class (KBM = 0.95). This means that he has the right to count on a 5% discount when renewing the MTPL agreement. If in the second year of insurance this driver becomes the culprit of one accident, then he will be assigned class 2 (KBM = 1.4). Those. The price of the MTPL policy at the next renewal will immediately increase by 40%. Another accident-free year will help him return to 3rd class and not overpay for insurance.

How to determine KBM if several drivers are registered in OSAGO

If the list of insured drivers under compulsory motor liability insurance consists of several people, the largest BMR is taken into account in the calculation. For example, if two drivers have accumulated a 40% discount (KBM = 0.6), and a third has accumulated 10% (KBM = 0.9), then the cost of compulsory motor insurance will be calculated taking into account the 10% discount. If one of the insured drivers is found to be at fault for an accident within a year, only his or her BMR will increase. Others can expect a 5% discount increase.

If the MTPL agreement is drawn up on the condition of an unlimited number of persons allowed to drive, then the vehicle owner’s MSC is taken into account.

How do insurance companies determine drivers' BMR?

Back in 2012, there was confusion in the insurance market regarding the definition of CBM. At the time, there was no single database of drivers' insurance history that insurance companies could access. The drivers who caused the accident understood that their insurance company would ask them to pay significantly more for the MTPL policy next year, and therefore simply applied for a new policy from another insurance company, assuring its representatives that the last year of driving had been accident-free. This hole was also used by insurance agents who wanted to make the most favorable offer for a potential client. It got to the point that drivers immediately received a maximum 50% discount for the first year of insurance.

Almost ten years after the introduction of compulsory civil liability insurance for car owners in 2003, on January 1, 2013, a unified database of the Russian Union of Auto Insurers became operational. From now on, insurance companies are required to provide data on the insurance history of their clients to the RSA. At the same time, Insurers, of course, have access to the database, who are now able to check information on clients rather than take their word for it.

Important to remember

The KBM is not tied to the vehicle. If you sell your old car and decide to buy a new one, your discount will remain. You can count on a discount on compulsory motor liability insurance provided that the new policy comes into force no earlier than the expiration of the previous one, and also if one year has not passed since its expiration. Those. you sold the car in January 2014. His insurance was still valid until June 2014. You will only be able to get a discount on compulsory motor insurance for a new car in June 2014. If the policy is issued before this, for example, in March, the CBM at the beginning of the previous policy will be applied to calculate the compulsory motor liability insurance policy, without an additional discount.

If you have accumulated a discount and then for some reason are not insured under MTPL, then your KBM will be stored in the database for no more than one year from the date of expiration of the last MTPL contract with your participation. After a year, the discount will be canceled and you will be assigned primary 3rd grade (KBM=1).

The price of an MTPL policy depends not only on the power of the vehicle, driving experience, age and place of residence of the driver, but also on how carefully he drives on the road. Car owners who do not get into accidents (at least through their own fault) can count on a MTPL discount of up to 50%. But those who are often at fault for road accidents will pay 2.5 times more for insurance. Exactly how much the discount or premium will be depends on the bonus-malus ratio (BMR). So, what are the rules for calculating KBM?

Discount or penalty?

KBM is otherwise called a discount for accident-free driving. If the driver has never caused an accident over the past year, it means that the insurance company did not have to spend money on For this, the client can be encouraged and sell him insurance at a discount for the next year - provide a bonus.

If the driver got into an accident, the insurer had to fork out payments. And in order to compensate for its costs and at the same time encourage the would-be driver to be more careful on the road, the insurance company, by renewing the policy, will increase the price of compulsory motor liability insurance and provide malus.

What accidents are taken into account?

To begin with, we note that not every accident affects the calculation of the CBM. OSAGO is not property. Therefore, the calculation takes into account only those accidents in which the insurer had to make an insurance payment for its client.

If the driver is not to blame for the accident, or the incident was not registered with the traffic police, or the issue was resolved according to the European protocol, then this does not threaten the car owner with an increase in the cost of compulsory motor liability insurance.

Bonus-malus odds table

To determine the coefficient, the following KBM calculation table is used.

Allowances and discounts | Bonus-malus coefficient | Source class | New class |

||||

0 fear. payments | 1 fear. pay | 2 fear. payments | 3 fear. payments | 4 or more insurance payments |

|||

The first two columns indicate the class at the beginning of insurance and the corresponding coefficient. The remaining columns of the table allow you to determine how the class and BMC will change in the presence or absence of accidents.

The column titles indicate the number of cases in the past period in which compensation was paid. Accordingly, the first column with the number 0 means that there were no accidents, and the fifth, with the number 4+, indicates that the person was involved in an accident more than four times. The numbers and letters in the body of the table show how the OSAGO class changes depending on the number of accidents on the road due to its fault.

The calculation of the KBM is carried out according to the following principle. One is subtracted from the coefficient value and the result is multiplied by 100%. When a person purchases MTPL for the first time, he automatically receives class 3 with KBM 1. Such a driver pays 100% of the cost of insurance - without any discounts or surcharges.

If the BMR is determined at the level of 0.9, then it turns out: (0.9 - 1) * 100% = -10%. This means that the driver is entitled to a 10% discount.

If the coefficient is 2.45, then: (2.45 - 1)* 100% = 145%. The cost of the policy increases by 145%, that is, the car owner pays 2.45 times more for insurance. This is the punishment for creating emergency situations on the road.

How to determine the coefficient from the table?

Before calculating the CBM, or rather, discounts or allowances in accordance with the insurance history, you need to determine the driver’s class in order to know which coefficient to apply.

Let's say a car owner recently received a license, bought a car and came to apply for compulsory motor liability insurance. He is assigned a standard 3rd class. A year passed and he came to renew his insurance. The employee looks at the insurance history and finds out that the client had no accidents in the past year.

The table shows that in the absence of an accident, after the expiration of the annual insurance period, the driver moves to class 4, and his coefficient decreases from 1 to 0.95. When renewing the contract, the car owner can pay for insurance with a 5% discount. Next time, when applying for compulsory motor liability insurance, the insurer will already be guided by the line of the table corresponding to the 4th class.

If it turns out that during this time there was one accident due to the driver’s fault, then his class will change from 3rd to 1st, and the KBM will increase from 1 to 1.55. For insurance for the new year you will have to pay 55% more. Further, the calculation of the KBM will be made on the basis of the line corresponding to the 2nd class. Only after two years a person will be able to return to 3rd class and start earning a discount.

If the driver ends up in class M, it will take him a full five years to reach the standard 3rd class again.

If several people are included in the policy, then the discount or premium is determined by the worst of the coefficients.

How to find out your coefficient?

It is extremely rare that KBM is indicated in an insurance policy. Therefore, in order to determine your MTPL class and, accordingly, the size of the discount or premium, you will have to contact the insurer, calculate the BMR yourself using a table or use the RSA database.

When requesting a driving class, the insurance company is obliged to provide a certificate within five days in Form No. 4 indicating all the necessary information. This document will be useful if the car owner plans to change insurer.

On the RSA website, to find out the coefficient, you need to go to the “OSAGO” section and click on the “Information for policyholders and victims” tab. Among other information services you will find the determination of the coefficient. To obtain information, simply enter your full name and driver’s license number in the form that opens.

So we learned what KBM is, why it is needed, and how to calculate it.

What are ZP, EM, ZPM, MR, NR and SP in the estimate?

What are ZP, EM, ZPM, MR, NR and SP in the estimate? Calculation of HP of plastics during injection molding

Calculation of HP of plastics during injection molding Commissioning works

Commissioning works Subtraction 16. Addition. Subtraction (16 hours). Problem solving. Improving computing

Subtraction 16. Addition. Subtraction (16 hours). Problem solving. Improving computing Logic elements of integral injection logic

Logic elements of integral injection logic Sound in a vacuum Sound wave in a vacuum

Sound in a vacuum Sound wave in a vacuum All about switching power supply Resonant power supplies with high efficiency circuit

All about switching power supply Resonant power supplies with high efficiency circuit