Issue an invoice in the 1s 8.3 program. How to issue an invoice for payment: learning how to fill out an important document. We set prices for services

An invoice is a document on the basis of which buyers pay debts to sellers. It indicates the seller’s bank details, the amount of payment and the name of goods, works and services. An invoice for payment in 1C 8.2 is generated in several ways. How to issue an invoice in 1C 8.2, read this article.

An invoice for payment in 1C 8.2 can be created in two ways:

- Manual filling;

- Automatic filling.

In the first method, data on the buyer and the transferred goods (works, services) are entered manually. In the second method, the account is filled out automatically based on:

- Sales of goods and services;

- Sales report to the consignor.

Creating an invoice manually

Step 1. Create an invoice in 1C 8.2 for payment to the buyer

Go to the “Sale” section (1) and click on the “Account” link (2). A window will open to create an invoice for payment in 1C 8.2.

In the window that opens, click the “Add” button (3). A window will open for you to fill out the document.

Step 2. Fill out the account in 1C 8.2 with the necessary data

In the window that opens, fill in the fields:

- "Organization" (4). Please indicate your organization;

- "Counterparty" (5). Specify the buyer to whom you are billing;

- "Treaty" (6). Select an agreement with the buyer;

- "Warehouse" (7). Specify the warehouse from which you are shipping the goods.

In the directory that opens, click on the desired product (11) and click the “Select” button (12). The selected product will appear in the “Item” field.

For the selected item, please indicate:

- Quantity of goods (13);

- His selling price (14);

- VAT rate (15).

To save the document, click the “Save” button (16). To print the document, click “Invoice for payment” (17). A printable form will open.

Step 3. Print the invoice in 1C 8.2

In the printed form that opens, click the “Print” button (18). The document has been sent to the printer.

Creating an invoice from a document

Step 1. Create an invoice in 1C 8.2 for payment from the document “Sales of goods and services”

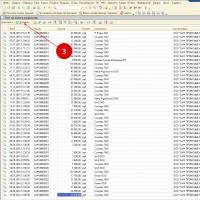

Go to the “Sale” section (1) and click on the “Sale of goods and services” link (2). A window will open with previously created implementations.

In the window that opens, right-click on the implementation (3) from which you want to create a document. Using the “Based on” link (4), go to the “Invoice for payment to the buyer” link (5) and click on it. The completed document form will open.

The document is fully formed. To save it, click the “Record” button (6). To print it, click the “Invoice for payment” button (7).

Step 2. Create an invoice in 1C 8.2 for payment from the document “Report to the Principal”

If you need to issue an invoice to the principal for a commission, then you can generate it from the document “Report to the principal”. To do this, go to the “Purchase” section (8) and click on the link “Report to the principal (principal)” (9). A window with previously created reports will open.

In the window that opens, select the report (10) from which you want to create a document. Click on it with the right mouse button. Using the “Based on” link (11), go to the “Invoice for payment to the buyer” link (12) and click on it. The completed invoice form will open.

The document for the committent is fully formed. To save it, click the “Record” button (13). To print it, click the “Invoice for payment” button (14).

Learning to do batch issuance of acts and invoices (1C: Accounting 8.3, edition 3.0)

2016-12-08T12:54:00+00:00Troika (1C: Accounting 8.3, edition 3.0) has an absolutely wonderful opportunity for batch posting of documents.

This opportunity is suitable for those companies that provide the same services (or groups of services) to the same contractors month after month.

Well, for example, let’s imagine that we are an Internet provider.

We have 200 clients:

- 150 of whom pay 1000 rubles every month at the Economy tariff

- 50 pay 3,500 rubles at the Business tariff.

At the end of every month we generate 200 sets of documents(act of provision of services for communication and invoice).

In this lesson I will tell you how to simplify this process to the point of impossibility in 1C.

Let me remind you that this is a lesson and you can safely repeat my steps in your database (preferably a copy or a training one), the main thing is that the version of the database is 1C: Accounting 8.3, edition 3.0.

So, let's begin

Go to the "Main" section, "Functionality" item:

Go to the "Trade" tab and check (if it is not already there) the "Batch issuance of acts and invoices" checkbox:

Entering clients into the directory

Go to the "Directories" section, "Counterparties" item:

We create two subgroups in the “Buyers” group: “Business” Tariff and “Economy” Tariff:

We have 50 customers on the “Business” tariff; for educational purposes we will include the first two.

We add the first counterparty to the "Business" tariff, here is his card:

We go to the client agreements and create a new agreement there:

Fill in the contract price type"Wholesale", validity until the end of the year and type of payment.

You need to create the calculation type yourself and name it, for example, Communication “Business”. This type does not affect anything, but simply helps us separate clients on the business tariff from clients on the economy tariff.

In the same way, create a second client in the “Business” Tariff group:

Be sure to indicate in his contract the same type of prices and the same type of calculations.

It turns out that all counterparties of the “Business” Tariff group will have an agreement with the same type of prices and the same type of payment. Why this is needed - you will find out below.

And so we fill as many customers on the business tariff as we need...

Let's move on to the "Economy" Tariff group.

We create the first client and his contract:

Here is the contract card:

Please note that the type of settlements for this group of counterparties will be different (but the same for all of them), for example, let’s call it Communication “Economy”.

In the same way, we will create a second buyer on the economy tariff:

And in the same way we will fill as many buyers as we need...

We add services to the directory

Go to the "Directories" section, "Nomenclature" item:

In the "Services" group we create two services, Internet Business and Internet Economy:

We set prices for services

Go to the "Warehouse" section, "Setting item prices":

We create a new document “Setting item prices” from the beginning of the year. Price type "Wholesale", in the table section we add our services and prices:

We carry out the document.

We issue acts and invoices

The preparatory part is finished. Now we can issue acts and invoices to all our customers in batch (group) mode every month (or more often).

It's very easy to do.

Go to the “Sales” section, “Services” item:

If you do not have this item, then you did not enable the “Batch issuance of acts and invoices” checkbox in the functionality (we did this in the very first step of this lesson).

First, we will submit the entire package of documents for all counterparties of the Economy tariff.

To do this, indicate the type of calculation Communication "Economy", the product (service) Internet Economy, and then in the tabular section click the button "Fill in" -> "By type of payment":

1C in this case will analyze the agreements of all counterparties in which the specified type of settlement is filled in and insert these counterparties along with these agreements into the tabular section:

The price in the tabular part was substituted due to the fact that we indicated it in the document “Setting item prices” for the “Internet Economy” service.

If you also need to issue invoices, go to the “Invoices” tab and click the “Mark all” button:

We post the document and see that all the transactions that are usually generated by a deed and an invoice have been generated, only for all counterparties at once:

From the same document we can print acts, invoices or documents for all counterparties at once.

The essence of the activity of any company is the execution of purchase and sale transactions. Goods, services, raw materials, even information - the transfer of all this requires trading operations. Most often, non-cash payment forms are used for payment: firstly, in some cases this is required by law (transferring more than 100 thousand rubles in cash as part of a transaction is prohibited), and secondly, for most legal entities this is more convenient. The basis for making non-cash money transfers is an invoice for payment containing a list of goods/services/other objects of sale, their cost and details of the supplier.

What information does an invoice necessarily contain?

The invoice has no legal force (if it is necessary to return the goods, complete them or exchange them), which, however, does not detract from the importance of this document. In general, there is no unified form for its preparation approved by law, so if a company needs to issue an invoice for payment, it can draw up a document according to its own sample. However, the paper invoice must contain a number of mandatory details:

- name of the organization, its legal and actual address (it is also advisable to indicate telephone and fax numbers);

- TIN or checkpoint;

- bank details (current account number, bank name, BIC and correspondent account);

- invoice number and date;

- buyer's name;

- list of goods and services, their quantity, price, total amount (preferably in tabular form);

- the amount of VAT (if the organization pays it);

- line “Total payable”, in which the sum of the two previous lines is entered;

- invoice amount

- the total cost of work and services in words.

The resulting document must be certified by the signatures of authorized persons.

How to issue an invoice in 1C Enterprise

To issue an invoice in the 1C “Enterprise” program, you must select the “Invoice” item in the “Sales” menu. The “Account number” field must be left empty, since it will be filled in automatically - the document will be assigned the corresponding serial number. The current invoice creation date, which is set by default, can be changed if necessary. If the installed program keeps records of several companies, then in the “Organization” field you should select the one you need, and its details will be entered automatically.

To select a counterparty, you need to use the appropriate menu - the list will appear after clicking on the selection button, which is a square with three dots. To fill out the “Agreement” field, you will need a document on the basis of which the sale is carried out; The “Contract type” item should receive the value “With the buyer”. To make the task easier later, it is advisable to fill out a directory when working with a counterparty - add the details of each new agreement to the “Accounts and Agreements” tab.

You must also fill in the “Warehouse” and “Bank Account” fields with the appropriate information. In the latter case, you need to indicate the account to which the buyer will transfer the funds (by default, the main account of the company is set). After this, the “header” can be considered completed - and proceed to the main part of the task of how to issue an invoice for payment - drawing up a table.

To present the required information in tabular form, you should use the “Selection” menu on the “Products” tab. The algorithm of actions is as follows.

- At the top of the page, select the parameter by which you want to make the selection (field “Selection”, then – “Remaining items”).

- In the middle part of the form, double-click to select the product group from which you need to select a product.

- At the bottom of the form, double-click to set the required nomenclature, after which all product names are selected sequentially. Now “Selection” can be closed.

After these manipulations, you should enter the quantity of goods (for each), the price per unit, VAT (if the company works with it) - and the total amount will be calculated automatically.

In the case of selling services, the algorithm of actions is similar - you just need to work on the “Services” tab. By the way, when filling out the nomenclature directory, you must remember to mark each entered service as a service - otherwise it will be considered a product.

What else can 1C Enterprise do: automatic changes to the tabular part of the invoice and more

In order to make meaningful changes to the table, but not recalculate each position, there is an “Edit” button in the command panel. After clicking it, a window opens where adjustments are made, which will automatically appear in the table after selecting “Run”. This is how you can, for example, round prices or select their type (wholesale/retail/purchase), set the VAT rate and much more - the adjustments made will be applied immediately to all goods from the table.

So, how to make an invoice using an automated system is very clear. But the possibilities of 1C are by no means exhausted. So, based on the invoice, the program can literally create the following documents automatically within a second:

- cash receipt order,

- receipt of funds to the account,

- reflection of VAT for deduction,

- complete set of nomenclature,

- act on the provision of production services.

To take advantage of such program capabilities, you just need to select the “Enter based on” item in the “Actions” menu - and thereby significantly save time on generating a complete package of transaction documents.

Supplier? How to issue an invoice in 1C?

An invoice for payment to a supplier is one of the simplest operations in 1C. This document is issued in cases where it is necessary to record a preliminary agreement on the purchase of a certain item or service from a counterparty.

Let's create such an account in the already familiar 1C Accounting configuration for Ukraine. First, open the account journal. It is located on the “Purchase” tab of the function panel or in the main menu item of the same name. The journal is called “Invoice for payment of supplier”.

We add a new document by pressing the Ins button on the keyboard or “+Add” in the account journal menu. In the created document, fill out the header. We indicate the organization to which the invoice is issued; the counterparty who issues it and the agreement with the counterparty for the supply of goods or provision of services, etc. To select a counterparty or agreement, click the button with the “…” icon. If the required counterparty was not previously entered or there is no required agreement for the entered counterparty, then you can create a new element in the required journal without leaving account editing.

Next, we fill out the nomenclature that will be purchased by our organization. To do this, click the button with the green “+” sign icon in the “Products” tab menu. A new row is formed in the table field, where by clicking the “…” button you can select the desired product.

Next, we fill out the nomenclature that will be purchased by our organization. To do this, click the button with the green “+” sign icon in the “Products” tab menu. A new row is formed in the table field, where by clicking the “…” button you can select the desired product.

We indicate the quantity and price.

To make it easier to fill out the table field, you can use the “Select” button. In this case, a panel opens on the right in which you can add item items without closing the invoice form.

After filling out the tabular part of the document, we write it down and post it. You can print an invoice by clicking the “Invoice for payment” or “Print” button located on the bottom panel.

The remaining bookmarks of the document are filled in in cases where the corresponding categories of material assets or services are supplied. Those. services, returnable packaging or intangible assets.

In fact, this completes the formation of the “Invoice for payment” document, according to which goods are purchased.

If you have any difficulties, we will definitely help.

You can discuss the operation and ask questions about it at.

If you have questions about the article or there are still unresolved problems, you can discuss them at

An invoice for payment to buyers is the primary document on the basis of which the counterparty (your buyer) will be able to pay for goods, work, and services both under an agreement and without it.

You can generate this document from your desktop:

Also, an invoice for payment to the buyer can be issued by following the path: /Sales/- /Sales/- Invoices to customers - book. "Create"

In the document that opens, fill in the fields: counterparty, agreement (if any), VAT (in total or on top), if necessary, add sales prices in the VAT field (if you used the document “Setting item prices”).

The tabular part of the document is filled out using the “Add” button - in this case, you need to fill out each position separately or using the “Selection” button - then the “Selection Window” opens and in it you can check the remaining goods in the warehouse (RECOMMENDED)

After filling out the document, click the “Post” command button.

Then we print out the document “Invoice for payment” in 1 copy, sign it with the manager and chief accountant and transfer it to the counterparty.

Is the counterparty obligated to pay the invoice?

Yes - if this is provided for in the contract.

No - if you have not concluded an agreement with the counterparty. In this case, the invoice for payment does not have legal force, but serves only as a document-the basis for the formation of a “Payment Order”.

In the future, based on the invoice for payment, you will be able to create the entire chain of documents:

Today, the work of an accountant is not possible without knowledge of the 1C Accounting program.

We invite you to undergo training at the ProfiRost training center on working in the 1C Accounting 8.3 program.

/ "Accounting encyclopedia "Profirosta"

02.04.2017

Information on the page is searched for by the following queries: Accountant courses in Krasnoyarsk, Accounting courses in Krasnoyarsk, Accountant courses for beginners, 1C: Accounting courses, Distance learning, Accountant training, Training courses Salaries and personnel, Advanced training for accountants, Accounting for beginners

Accounting services, VAT declaration, Profit declaration, Accounting, Tax reporting, Accounting services Krasnoyarsk, Internal audit, OSN reporting, Statistics reporting, Pension Fund reporting, Accounting services, Outsourcing, UTII reporting, Bookkeeping, Accounting support , Providing accounting services, Assistance to an accountant, Reporting via the Internet, Drawing up declarations, Need an accountant, Accounting policy, Registration of individual entrepreneurs and LLCs, Individual entrepreneur taxes, 3-NDFL, Organization of accounting

List of values of accumulation registers 1s

List of values of accumulation registers 1s Advance calculation in 1s 8

Advance calculation in 1s 8 GPC agreements Reception for GPC in 1s

GPC agreements Reception for GPC in 1s Month closing settings How to close a period in UP

Month closing settings How to close a period in UP Specialist consultations

Specialist consultations Accounting for fuel and lubricants in 1C: instructions for accountants Write-off of fuel and lubricants 1s 8

Accounting for fuel and lubricants in 1C: instructions for accountants Write-off of fuel and lubricants 1s 8 Issue an invoice in the 1s 8 program

Issue an invoice in the 1s 8 program