Accounting for fuel and lubricants in 1C. Accounting for fuels and lubricants in 1C: instructions for accountants Write-off of fuels and lubricants 1s 8.3 accounting

If the institution operates vehicles or units that consume fuel and lubricants during operation, write-off of fuel and lubricants should be carried out on the basis of waybills, accounting sheets of units, taking into account standards. In the presence of a large transport economy, various types of activities, and sources of financing, the tasks of automating the issuance of waybills and the correct write-off of fuel and lubricants according to expense items are urgent. Experts from the 1C company talk about the opportunities provided for solving these problems by edition 2 of the 1C: Public Institution Accounting 8 program.

General operating procedure

The article briefly describes the general procedure for working with the subsystem Fuel and lubricants accounting and the capabilities of the subsystem to improve the efficiency of fuel and lubricants accounting in an institution by reducing the time of registration and processing of fuel and lubricants accounting documents and minimizing errors in routine data entry operations. Complete information about the subsystem Fuel and lubricants accounting, the methodology for accounting for fuels and lubricants, is given in the section “Accounting for fuels and lubricants” of methodological support for edition 2 of “1C: Public Institution Accounting 8” in the ITS-BUDGET resources.

According to paragraph 2 of Article 6 of the Federal Law of November 8, 2007 No. 259-FZ “Charter of Automobile Transport and Urban Ground Electric Transport”, it is prohibited to transport passengers, luggage, cargo by buses, trams, trolleybuses, cars, trucks without issuing a waybill for the corresponding vehicle (vehicle).

The program “1C: Public Institution Accounting 8” (rev. 2) provides for the issuance of waybills for various types of vehicles.

In addition to vehicles, institutions can also use various units that consume fuel and lubricants - gasoline scythes and mowers, chain saws, motor pumps, gas generators and other equipment. Therefore, the program also provides for the preparation of accounting sheets for units that consume fuel and lubricants.

The program processes waybills and accounting sheets for units and writes off fuel and lubricants in accordance with standards.

Calculation of standard and actual costs according to the waybill (unit accounting sheet) can be made for several types of fuels and lubricants, for example for gas-diesel equipment, along several routes or operating modes with different operating conditions of the vehicle or unit that affect the consumption of fuels and lubricants.

For each vehicle or unit, you can create settings that correspond to typical operating conditions, which will be used during taxation and, if necessary, can be adjusted if the route or operating mode differs from the standard one.

You can analyze data on the calculated values of standard and actual expenses, savings, overexpenditure by type of fuel and lubricants, fixed assets - vehicles/units, employees - drivers/operators operating fixed assets, in various reports.

This work is carried out in the subsystem Fuel and lubricants accounting.

What problems does the “Fuel and Lubricants Accounting” subsystem solve?

Subsystem Fuel and lubricants accounting solves the following problems:

- formation of waybills (forms 3, 3 spec, 4-P, 4-S, 6, 6 spec, ESM-2, APK-412);

- generation of accounting sheets for units (forms 17 and APK-411);

- calculation for various routes and operating conditions of vehicles of the standard and actual consumption of several types of fuel, lubricants and special liquids in accordance with methodological recommendations approved by the order of the Ministry of Transport of Russia dated March 14, 2008 No. AM-23-r;

- calculation for various operating modes and operating conditions of units of standard and actual consumption of several types of fuel, lubricants and special liquids;

- generation of a calculation certificate for documenting the decoding of the calculation of standard and actual consumption of fuels and lubricants;

- write-off of fuel and lubricants for one flight according to various accounting accounts, sources of financing, areas of expenditure, centers of financial responsibility and departments;

- consolidated write-off of fuel and lubricants for several waybills (for example, when refueling using fuel cards);

- formation of the Act on write-off of inventories (f. 0504230);

- formation of the Logbook for the movement of waybills (form No. 8, according to OKUD 0345008);

- control of standard and actual consumption, savings and excess consumption of fuel and lubricants for vehicles and units, as well as for employees;

- reconciliation of data on gas stations using fuel cards with data from the fuel supplier.

The capabilities provided by the subsystem are enabled optionally: in the Administration section, call the Setting up accounting parameters command on the navigation panel and then on the Specialized subsystems tab, set the Accounting for fuels and lubricants flag in the drop-down group of the same name. By default, the fuel and lubricants accounting option is disabled.

Operating principles in the “Fuel and lubricants accounting” subsystem

Work in the subsystem is based on the following principles:

- setting up standard filling of waybills and unit registration sheets for each vehicle (the permanent driver, accompanying persons, trailer, etc. are indicated);

- quick selection of addresses in routes and tasks for the driver from the list of frequently visited objects for the vehicle when preparing waybills;

- filling in data on fuel balance and speedometer (odometer) readings according to the data from the previous waybill;

- use of fuel and mileage data from the waybill when calculating standard fuel consumption;

- Calculation of standard fuel consumption in three clicks:

filling in initial data on the settings for typical vehicle use;

calculation of standard consumption of fuel and lubricants according to standards and amendments for several types of fuel and lubricants and routes;

filling out a list of write-off fuel and lubricants according to the settings for reflecting write-offs in accounting; - automatic calculation of fuel and lubricant residues to calculate the actual consumption of fuel and lubricants.

Filling out the settings of the “Fuel and Lubricants Accounting” subsystem

First of all, you should fill out the directory Types of fuels and lubricants(chapter Administration, team group Fuel and lubricants accounting), then enter fuel consumption rates, correction factors and values in the corresponding reference books, and also set up a rounding mode for the results of calculating standard and actual fuel consumption (section Regulatory and reference information, team group Fuel and lubricants accounting).

Consumption rates are set for each type of fuel and lubricants per 100 km and, depending on the type of rate, may have a main calculation parameter (for example, “downtime (h)” or “volume of transport work (t-km)”) and its default value. Consumption rates allow you to specify the seasonality of use (day and month of beginning, day and month of expiration). For the consumption rate of lubricants and special liquids, the type of fuel and the consumption value for the consumption of 100 units of fuel are indicated.

Standards for units have a main calculation parameter, which can be:

- duration of work (hours);

- volume of work (units are customizable);

- meter readings.

Correction factors reflect the adjustment up or down as a percentage (for example, + 5%). Correction values reflect an upward or downward correction in fuel and lubricants units (for example, + 1 l).

Formation of travel and accounting sheets

Before the transport departs (before the unit starts operating), waybills (unit registration sheets) are issued. Registration of waybills and accounting sheets of units is carried out using specialized program documents or manually by filling out a form.

The program “1C: Public Institution Accounting 8” (rev. 2) provides for the formation of waybills according to unified forms No. 3, 3 special, 4-P, 4-S, 6, 6 special, ESM-2, approved by the Decree of the State Statistics Committee of the Russian Federation dated 11/28/1997 No. 78. For each form in the program, a document of the same name is used, hereinafter referred to as the document Waybill.

To prepare primary accounting documents characterizing the operation of the unit, the document Unit Worksheet is used. The form of the primary document was developed on the basis of form No. 17 “Unit Worksheet” (OKUD code 6002210). To prepare primary accounting documents characterizing the mechanized work of tractors, combines and self-propelled machines, the program uses the document Registration sheet for tractor driver (form No. 411-APK). The form of the primary document was developed on the basis of form No. 411-APK “Record sheet for tractor driver-driver”.

To open a list of relevant documents, you can use the commands Journal of waybills and Journal of accounting sheets of units in a group of teams Fuel and lubricants accounting section Material reserves.

It should be noted that the list of unified forms of primary accounting documents, approved by order of the Ministry of Finance of Russia dated March 30, 2015 No. 52n, does not contain forms of waybills approved by Decree of the State Statistics Committee of the Russian Federation dated November 28, 1997 No. 78, as well as forms No. 411-APK, No. 17, therefore, the institution has the right to develop and approve in the Accounting Policy forms of waybills and accounting sheets of units, provided that they contain the mandatory details approved by Order of the Ministry of Transport of Russia dated September 18, 2008 No. 152 “On approval of mandatory details and the procedure for filling out waybills.”

Waybills generated in the program meet these requirements. You can also add an external printed form to any document as part of the standard functionality (in the Administration section, call the command Printed forms, reports and processing, and then make sure the checkbox is enabled Additional reports and processing and follow the link of the same name for detailed settings).

To generate printed forms of waybills, you should fill out:

- Driver data (driver's license details and others) - in the directory Employees;

- vehicle data (state registration plate, garage number, etc.) - on the tab For vehicles bookmarks Individual characteristics directory element Fixed assets, intangible assets, legal acts;

- data on license cards and routes in the corresponding directories - group of commands Fuel and lubricants accounting In chapter Administration.

A special setting is provided for quickly filling out documents. The setting is “tied” to the main tool and type of accounting document (available for adding and filling out the directory item form in the navigation panel Fixed assets, intangible assets, legal acts). This setting makes it easier to fill out:

- most of the details of waybills (for example, assign a specific driver to the car);

- speedometer (odometer) readings according to the previous waybill or its taxation;

- fuel residues according to the previous waybill or its taxation;

- addresses of routes and tasks - by selecting from the list of frequent addresses in the route sheet;

- types of fuel - will be automatically filled in in the new waybill, if the filling mode has not been defined according to previous documents.

Calculation of standard and actual consumption of fuel and lubricants

To calculate the consumption and write-off of fuel and lubricants in the program “1C: Public Institution Accounting 8” edition 2, taxation documents are used Taxation of waybill And Taxation of the unit record sheet(a list of documents is available in the command group Fuel and lubricants accounting section Material reserves).

After the vehicle returns from a trip or the unit’s operation is completed, a tax document is created. It enters data on the primary document, the operation of the vehicle (unit) from the route (record) sheet, calculates the standard and actual consumption of fuel and lubricants, and generates Act on write-off of inventories (f. 0504230) And Help calculating fuel consumption. When carrying out the document, fuel and lubricants are written off - accounting records are generated for accounting and tax accounting. Each waybill (unit registration sheet) must correspond to one taxation document, taking into account all operating and operating conditions of the vehicle (unit).

Taxation documents can be filled out automatically - based on the relevant document Waybill, Unit Worksheet, Tractor Driver's Record Sheet (Form No. 411-APK). You can also enter data into them manually, using primary documents.

If the write-off of fuel and lubricants must be carried out at the end of the billing period established by the contract after receiving documents from the fuel supplier, you do not have to fill out the table in the waybill taxation documents Write-off materials on the bookmark Write-off of fuel and lubricants, but create a summary taxation document and fill it out for the period. The taxation summary document will combine the calculation results for all waybills (account sheets) for the period.

If waybills are issued on printed forms, then the waybill data is indicated in the taxation documents manually on the tab Waybill details.

On the bookmark Initial data all routes should be entered (step 1 in Fig. 1) with different conditions for the application of norms and amendments (for example, the first route was in the mountains, and the second route was on improved roads). In the table on the left, routes and types of fuel and lubricants are specified, and on the right, standards and amendments are specified, reflecting the features for each route.

To simplify filling out consumption norms and adjustments for a vehicle, you should enter the setting in the register Consumption rate settings for vehicles and units.

This setting also allows you to set control parameters for the mileage and service life of the vehicle for the timely start or termination of amendments that take into account the running-in of vehicles or wear associated with high mileage and service life, in accordance with the methodological recommendations approved by the order of the Ministry of Transport of Russia dated March 14, 2008 No. AM-23-r. Using this setting will allow you to quickly fill in any complex combinations of standards and amendments that characterize typical operating conditions for each vehicle.

After executing command Z Fill in the calculation parameters according to the settings for the vehicle(step 2 in Fig. 1) you can edit the values of the main parameters for calculating standards and add/remove standards and amendments to standards in accordance with operating conditions on a given flight.

On the bookmark Calculation of fuel consumption fuel consumption is calculated.

The general user procedure is as follows:

2. Enter data on the amount of fuel issued (refilled) and the remaining fuel upon return; the actual fuel consumption will be calculated automatically.

On the bookmark Write-off of fuel and lubricants a list of items and the direction of consumption of fuel and lubricants for write-off is determined.

To reduce the time required to fill out the list of materials being written off, you can set up an information register Settings for reflecting costs for fuel and lubricants and on command Fill As a result of comparing the type of fuel and lubricants and the nomenclature, the table of written-off materials will be filled in automatically. In more complex cases of writing off expenses, you should use the command Selection. The document allows you to flexibly write off fuel and lubricants according to various values of details Nomenclature, IFO, Division, KFO, Accounting account, KPS, Additional analytics, MOL/Storage location, Cost account and subconto cost account.

After specifying the composition and conclusion of the commission, as well as submitting the document, you can generate printed forms “Certificate-calculation of fuel consumption” and “Certificate of write-off of Ministry of Health (f.0504230)”.

The Help Calculation of Fuel and Lubricant Consumption presents the initial data, formulas and calculation of standard and actual fuel and lubricant consumption.

Generating reports to monitor the correct consumption of fuels and lubricants

The subsystem allows you to generate the following reports:

- Movement of fuel and lubricants in units and machines - reflects for each unit the balances of fuel and lubricants at the beginning and end of the period, as well as the receipt and disposal of fuel and lubricants for the period;

- Movement of fuel and lubricants in vehicles - reflects for each vehicle the mileage and remaining fuel and lubricants at the beginning and end of the period, as well as the mileage, receipt and disposal of fuel and lubricants for the period;

- Logbook for recording the movement of waybills (form No. 8) - a logbook is formed according to form 0345008, approved by Resolution of the State Statistics Committee of the Russian Federation dated November 28, 1997 No. 78;

- Logbook for recording the movement of work sheets of units - an accounting log for units and machines is formed in a form similar to form 0345008;

- Fuel card report - provides information on fuel card refills for comparison with the data of the fuel and lubricants supplier;

- Consumption of fuel and lubricants by fixed assets and employees - provides information on the standard and actual consumption of fuel and lubricants, as well as savings or overconsumption of fuel and lubricants, grouped by fixed assets and employees.

Reports are available in the group Fuel and lubricants accounting report panels Inventory reports section Material reserves.

Accounting for fuel and lubricants according to waybills - 2018-2019 (hereinafter - PL) must be properly organized in any organization. It will allow you to restore order and control the consumption of material resources. The most relevant use of PL is for accounting for gasoline and diesel fuel. Let's consider the algorithm for accounting and tax accounting of fuel and lubricants using waybills in more detail.

The concept of fuel and lubricants

Fuel and lubricants include fuel (gasoline, diesel fuel, liquefied petroleum gas, compressed natural gas), lubricants (motor, transmission and special oils, grease) and special fluids (brake and coolant).

What is a waybill

A waybill is a primary document that records the vehicle’s mileage. Based on this document, gasoline consumption can be determined.

Organizations for which the use of vehicles is the main activity must use the PL form with the details specified in Section II of Order No. 152 of the Ministry of Transport dated September 18, 2008.

Do you have any doubts about the correctness of capitalization or write-off of material assets? On our forum you can get an answer to any question that raises your doubts. For example, you can clarify what the basic fuel consumption rate is recommended by the Ministry of Transport.

Read about the latest requirements of the Ministry of Transport for mandatory details in waybills in the materials:

- “The list of mandatory details of the waybill has been expanded”;

- “From December 15, 2017, the waybill will be issued using a new form”;

- Waybills: from March 1, 2019, the procedure for issuing changes.

For organizations that use a car for production or management needs, it is possible to develop a PL taking into account the requirements of the Law “On Accounting” dated December 6, 2011 No. 402-FZ.

An example of an order for approval of a submarine can be found.

In practice, organizations often use PLs that were approved by Decree of the State Statistics Committee of the Russian Federation dated November 28, 1997 No. 78. This resolution has PL forms depending on the type of vehicle (for example, Form 3 for a passenger car, Form 4-P for a truck) .

Mandatory details and the procedure for filling out waybills are presented .

You can find out about recent changes in the form of the waybill from our discussions in the VK group .

Waybills must be recorded in the waybill register. Accounting for waybills and fuels and lubricants is interconnected. In organizations that are not motor transport by nature of activity, PLs can be drawn up with such regularity that it is possible to confirm the validity of the expense. Thus, an organization can issue a DP once every few days or even a month. The main thing is to confirm the expenses. Such conclusions are contained, for example, in the letter of the Ministry of Finance of Russia dated 04/07/2006 No. 03-03-04/1/327, the resolution of the Federal Antimonopoly Service of the Volga-Vyatka District dated 04/27/2009 No. A38-4082/2008-17-282-17-282.

Accounting for fuel consumption in the waybill

If we analyze the PL forms contained in Resolution No. 78, we will see that they contain special columns designed to reflect the turnover of fuel and lubricants. This indicates how much fuel is in the tank, how much has been dispensed and how much is left. Using simple calculations, the amount of fuel used is determined.

If we turn to Order No. 152 of the Ministry of Transport, then among the mandatory details of the submarine there will not be a requirement to reflect the movement of fuel. In this case, the document must contain speedometer readings at the beginning and end of the journey, which will allow determining the number of kilometers traveled by the vehicle.

When the PL is developed by the organization independently and it does not contain information on the use of fuels and lubricants, but contains only data on the number of kilometers, the standard volume of used fuels and lubricants can be calculated using the order of the Ministry of Transport of Russia dated March 14, 2008 No. AM-23-r. It contains fuel consumption standards for different brands of vehicles and formulas for calculating consumption.

Thus, on the basis of the PL, either the actual or standard write-off of fuel and lubricants is calculated. The data calculated in this way is used for reflection in accounting.

However, the use of PL to account for fuel consumption is impossible in some cases. For example, when chainsaws, walk-behind tractors, and other similar special equipment are refueled with gasoline. In these cases, a fuel and lubricants write-off act is applied.

A sample act for writing off fuel and lubricants can be viewed on our website.

Accounting for fuel and lubricants

Like all inventories, fuel and lubricants are accounted for in the accounting department at actual cost. Expenses that are included in the actual cost are indicated in section II of PBU 5/01.

Acceptance of fuel and lubricants for accounting can be carried out on the basis of gas station receipts attached to the advance report (if the driver purchased the fuel in cash) or on the basis of coupon stubs (if gasoline was purchased using coupons). If the driver purchases gasoline using a fuel card, then accounting for fuel and lubricants on fuel cards is carried out on the basis of a report from the company issuing the card. The write-off of fuel and lubricants can be carried out using the following methods (section III):

- at average cost;

- at the cost of the 1st time of acquisition of inventory (FIFO).

PBU 5/01 has another write-off method - at the cost of each unit. But in practice, it is not applicable for writing off fuel and lubricants.

The most common way to write off fuel and lubricants is at average cost, when the cost of the remaining material is added to the cost of its receipt and divided by the total amount of the remainder and receipt in kind.

Write-off of fuel and lubricants using waybills (accounting)

To account for fuel and lubricants, the enterprise uses account 10, a separate subaccount (in the chart of accounts - 10-3). The debit of this account is used for the receipt of fuel and lubricants, and the credit for the write-off.

How is fuel and lubricants written off? Using the algorithms described above, the used amount of fuel and lubricants is calculated (actual or standard). This quantity is multiplied by the cost of the unit, and the resulting amount is written off by posting: Dt 20, 23, 25, 26, 44 Kt 10-3.

Write-off of gasoline using waybills (tax accounting)

If everything is quite simple with the write-off of fuel and lubricants in accounting, then the recognition of these expenses in tax accounting raises questions.

1st question: in what expenses should fuel and lubricants be taken into account? There are 2 options here: material or other expenses. According to sub. 5 p. 1 art. 254 of the Tax Code of the Russian Federation, fuels and lubricants are included in material costs if they are used for technological needs. Fuel and lubricants are included in other expenses if they are used to maintain official vehicles (subclause 11, clause 1, article 264 of the Tax Code of the Russian Federation).

IMPORTANT! If the main activity of an organization is related to the transportation of goods or people, then fuel and lubricants are material costs. If vehicles are used as service vehicles, then fuel and lubricants are other expenses.

The second question: should we normalize the costs of writing off fuel and lubricants within the framework of tax accounting? The answer to this can be found by linking the details of the waybill and legislative norms:

- The PL calculates the actual use of fuel and lubricants. The Tax Code of the Russian Federation does not contain direct indications that expenses for fuel and lubricants should be taken into tax accounting only according to actual standards.

- The PL contains information only about the actual mileage. However, fuels and lubricants can be calculated according to order No. AM-23-r, paragraph 3 of which contains an indication that the standards established by it are intended, among other things, for tax calculations. The Ministry of Finance of Russia in its letters (for example, dated 06/03/2013 No. 03-03-06/1/20097) confirms that Order No. AM-23-r can be used to establish the validity of costs and determine the costs of fuel and lubricants in tax accounting according to the standards multiplied by mileage.

IMPORTANT! In tax fuel and lubricants accounting can be taken both according to actual use and according to the quantity calculated based on the standards.

In practice, a situation is possible when an organization uses transport for which fuel consumption standards are not approved in Order No. AM-23-r. But in paragraph 6 of this document there is an explanation that an organization or individual entrepreneur can individually (with the help of scientific organizations) develop and approve the necessary standards.

The position of the Ministry of Finance of Russia (see, for example, letter dated June 22, 2010 No. 03-03-06/4/61) is that before developing standards for the write-off of fuel and lubricants in a scientific organization, a legal entity or individual entrepreneur can be guided by technical documentation.

There are no explanations in the Tax Code of the Russian Federation on how to act in such a situation. In cases where an organization independently established standards for writing off fuel and lubricants and, having exceeded them, took into account the amount of excess fuel use in tax accounting, the tax inspectorate may not recognize this as an expense. Accordingly, additional income tax may be charged. In this case, the court may well support the position of the inspectorate (see, for example, the resolution of the Administrative Court of the North Caucasus District dated September 25, 2015 in case No. A53-24671/2014).

Read about the amount of fines for not having a waybill here. article .

An example of writing off fuel and lubricants using waybills

One of the most common types of fuel and lubricants is gasoline. Let's consider the example of purchasing and writing off gasoline.

Pervy LLC (located in the Moscow region) purchased 100 liters of gasoline in September 2018 at a price of 38 rubles. without VAT.

At the same time, at the beginning of the month, the LLC had a stock of gasoline of the same brand in the amount of 50 liters at an average cost of 44 rubles.

Gasoline in the amount of 30 liters was used to refuel a VAZ-11183 Kalina car. The organization uses a car for official transportation of management personnel.

The organization uses average cost estimates for materials.

Fuel and lubricants accountingon admission

|

Amount, rub. |

Operation (document) |

||

|

Gasoline received credit (TORG-12) |

|||

|

VAT reflected (invoice) |

We calculate the average write-off cost for September: (50 l × 44 rubles + 100 l × 38 rubles) / (50 l + 100 l) = 40 rubles.

Option 1.Fuel and lubricants accountingwhen written off in fact

The following marks are made in the submarine: fuel in the tank at the beginning of the voyage - 10 liters, issued - 30 liters, remaining after the voyage - 20 liters.

We calculate the actual use: 10 + 30 - 20 = 20 liters.

Amount to be written off: 20 l × 40 rub. = 800 rub.

Option 2.Fuel and lubricants accountingwhen written off according to standards

Mileage marks are made in the PL: at the beginning of the voyage - 2,500 km, at the end - 2,550 km. This means that 50 km have been covered.

In paragraph 7 of Section II of Order No. AM-23-r there is a formula for calculating gasoline consumption:

Qn = 0.01 × Hs × S × (1 + 0.01 × D),

where: Q n - standard fuel consumption, l;

Hs - basic fuel consumption rate (l/100 km);

S—vehicle mileage, km;

D is the correction factor (its values are given in Appendix 2 to Order No. AM-23-r).

According to the table in sub. 7.1 by car make we find Hs. It is equal to 8 liters.

According to Appendix 2, coefficient D = 10% (for the Moscow region).

We calculate gasoline consumption: 0.01 × 8 × 50 × (1 + 0.01 × 10) = 4.4 l

Amount to be written off: 4.4 l × 40 rub. = 176 rub.

Since the car is used as a company car, the cost of accounting for fuel and lubricants in the tax accounting of fuel and lubricants will be recognized as other expenses. The amount of expenses will be equal to the amounts recorded in the accounting records.

Results

Fuel and lubricants are a significant expense item in many organizations. This means that accountants need to be able to keep records of fuel and lubricants and justify these expenses. Using waybills is one way to determine the amount of fuel and lubricants used.

With the help of PL, you can not only confirm the production necessity of expenses, but also record the distance traveled by a car or other vehicle, as well as determine indicators for calculating the volume of used fuels and lubricants.

After determining the actual or standard volume of use, the amount to be written off can be calculated by multiplying the unit cost by the volume.

Accounting for fuels and lubricants written off as a result of the operation of special equipment that does not have an odometer can be carried out on the basis of a fuel and lubricants write-off act.

Particular attention should be paid to recognizing expenses for fuel and lubricants within the framework of tax accounting.

Waybill is a document on the basis of which the costs of fuels and lubricants are taken into account. The printed form (form according to OKUD No. 0345001) is not mandatory for all organizations except transport companies. In typical 1C 8.3 configurations there is no printed waybill form (you can add it as an external one), but several methods are implemented:

- According to advance reports

- By coupons

- By fuel cards

Let's look at step-by-step instructions and some features of each of them.

The accounting scheme looks like this:

- Issuing cash to an accountant

- Preparation of an advance report

- Cash back to the cashier

- Write-off of costs for fuel and lubricants using fuel cards

Figure 1 shows an advance report, which reflects several operations at once: a report on the advance payment issued, the receipt of gasoline to the warehouse, information on the invoice (if there is one).

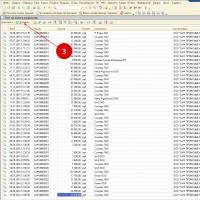

In Fig. 2 you can see the document postings. In order for accounting accounts for the “AI-92 Gasoline” product to be filled out automatically, you need to add a line for the “fuels and lubricants” group in the information register “” (see Fig. 3)

The printed form of the waybill can be connected as an external report or processing to the “Additional reports and processing” directory (see Fig. 4). The report itself will have to be ordered from specialists or purchased from Infostart.

The return of money on the advance report (in our example it is 8 rubles) is drawn up in the document “”, which is filled out automatically in the “Enter based on” mode from the document “”.

Write-off of fuel and lubricants using fuel cards

Unlike coupons, fuel cards are accounted not as, but as strict reporting forms in off-balance sheet account 006.

In general, the accounting scheme consists of the following points:

- Posting a fuel card

- Posting of gasoline received using a fuel card

- Write-off of expenses.

The capitalization of the cost of a fuel card can be recorded as a receipt of service - see Fig. 11 and Fig. 12. And the card itself is accounted for in account 006 by manual operation (Fig. 13)

The receipt of fuel is documented with the document “ ” (see Fig. 14, Fig. 15).

The 1C Accounting 8.3 program is a very convenient tool for maintaining accounting records in an enterprise; it will help both a novice accountant and an experienced accountant not to make mistakes when maintaining records.

Let's consider the issue of recording and writing off fuel and lubricants in an organization and step by step reflect the actions of the accountant in the program.

Firstly, if a working car (or several) is listed on the company’s balance sheet, then a waybill must be filled out daily for each unit (maximum once a month). The driver or mechanic displays information about the car, the route, normal and actual gasoline consumption.

Secondly, gasoline consumption standards are calculated by an accountant for each car based on the standards of the Ministry of Transport and are fixed by order for the enterprise.

Thirdly, the receipt of fuel and lubricants is processed on the basis of primary documents: an invoice from the supplier (if an agreement has been concluded) or an advance report if the driver refuels the car for cash.

Algorithm of actions of an accountant in the 1C Accounting 8.3 program

- Registration of receipt of fuel and lubricants. Follow the path: /Purchases/ - /Receipts (acts, invoices) - button “Receipts” - Goods (invoice)

From the primary document, the invoice, we fill in the data: number and date of the invoice, name of the counterparty, agreement (if any), warehouse, nomenclature. Check the accounting accounts, the accounting account should be 10.03.

At the bottom left, record the invoice from the supplier.

You can view transactions generated based on the posted document using the icon

If an advance was transferred to the supplier, then the entry “Advance offset” is added Dt60.02 Kt 60.01

- Write-off of fuel and lubricants based on a waybill

Write-offs must be made according to the calculated rate

- Reflection of write-off of fuel and lubricants. Follow the path: /Warehouse/ - /Warehouse/ - Requirements-invoices- “Create” button

It is necessary to sum up the consumption for all waybills for a given driver and vehicle and enter the total quantity in the quantity column.

After posting the document, we create a balance sheet for account 10.03 and compare the remaining gasoline with the waybill issued on the last day of the month.

/ "Accounting encyclopedia "Profirosta"

@2017

20.06.2017

Information on the page is searched for by the following queries: Accountant courses in Krasnoyarsk, Accounting courses in Krasnoyarsk, Accountant courses for beginners, 1C: Accounting courses, Distance learning, Accountant training, Training courses Salaries and personnel, Advanced training for accountants, Accounting for beginners

Accounting services, VAT declaration, Profit declaration, Accounting, Tax reporting, Accounting services Krasnoyarsk, Internal audit, OSN reporting, Statistics reporting, Pension Fund reporting, Accounting services, Outsourcing, UTII reporting, Bookkeeping, Accounting support , Providing accounting services, Assistance to an accountant, Reporting via the Internet, Drawing up declarations, Need an accountant, Accounting policy, Registration of individual entrepreneurs and LLCs, Individual entrepreneur taxes, 3-NDFL, Organization of accounting

.JPG)

.JPG)

.JPG)

.JPG)

.JPG)

List of values of accumulation registers 1s

List of values of accumulation registers 1s Advance calculation in 1s 8

Advance calculation in 1s 8 GPC agreements Reception for GPC in 1s

GPC agreements Reception for GPC in 1s Month closing settings How to close a period in UP

Month closing settings How to close a period in UP Specialist consultations

Specialist consultations Accounting for fuel and lubricants in 1C: instructions for accountants Write-off of fuel and lubricants 1s 8

Accounting for fuel and lubricants in 1C: instructions for accountants Write-off of fuel and lubricants 1s 8 Issue an invoice in the 1s 8 program

Issue an invoice in the 1s 8 program