Creation of a separate division. Filling procedure. Directory Divisions How to make divisions in 1c

Program 1C: Manufacturing Enterprise Management 8 (1C: UPP 8) has the functionality to create the structure of a full-fledged enterprise with a branched structure, which includes various organizations and their divisions. In the article Inform Active about how to edit the structure and relationship of enterprise divisions in the program

Editing the structure of an enterprise and the structures of its constituent organizations, as well as establishing the relationship of all objects, is conveniently performed using the special processing “Divisions”, which is in the 1C: UPP 8 program. It is located in the “Directories” menu, section “Enterprises”.

The “Enterprise Structure” window opens before us, which is divided into two parts. The structure of the enterprise is displayed on the right, on the left? structure of organizations. All divisions of the enterprise and those included in the organization are interconnected. In this case, the type of connection is defined as “from one to many,” but the program allows you to establish connections of the type “from many to many.” However, the second case is interpreted by the system as a non-critical error, about which the user receives a corresponding warning.

Setting up the interaction of objects within an enterprise using the same processing in 1C: UPP 8

By left-clicking on a department of an enterprise or organization, you can quickly gain access to editing its parameters. For example, for a division of an enterprise, you can assign a manager by entering his personal data in the appropriate fields, the type of financial responsibility center, etc.

In the window for editing the data of organizational units, you can also assign a manager, as well as set up codes for statistics and tax reporting. If a division of the organization is a separate division, then also set up accounting for employee salaries.

But in order to replenish the enterprise structure with a new division, you need to right-click in the “Enterprise Structure” window and select “New Structural Division” in the pop-up context menu. Then enter all the necessary information about it, as well as establish connections in the overall structure.

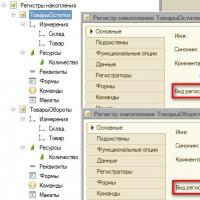

Help from the directories "Divisions" and "Divisions of Organizations" in ZUP 2.5:

The directory is intended for storing lists of departments for management accounting. Division is one of the main aspects of cost accounting in management accounting.

Directory "Divisions of Organizations"

The directory “Divisions of Organizations” is used to maintain personnel records by division, as well as to account for costs at work sites (workshop No. 1, workshop No. 2) and at places where economic functions are concentrated (directorate, accounting department).

Data on the “Separate divisions” tab is entered in the case when the division is separate, i.e. registered with the Federal Tax Service as separate with the assignment of a code according to OKATO and KPP, but does not have a dedicated balance sheet.

The “Salary Accounting” tab shows the current setting of the method for reflecting accruals and amounts of temporary disability benefits at the expense of the employer of all employees of this department. By clicking the link “Set salary accounting for department employees,” you can go to the form for setting up the reflection of salaries in accounting for employees of this department, where you can additionally indicate that all accruals will relate to types of activities subject to UTII, i.e. the percentage of UTII activity for accruals of all employees of this division is taken equal to 100%, with the exception of those employees for whom the “own” percentage of UTII was entered in the document “Entering the percentage of UTII activity”.

It should be remembered that the method of reflecting accruals in accounting, specified for the department, is used only if the employee and the accrual do not have their own “own” methods of reflection in accounting. For more information about the methods of reflection, see the reference book “Methods of reflecting wages in regulated accounting.”

Legal entities have the right to create separate divisions for various purposes. The legislation regulates in detail the conditions and procedure for their creation. Separate divisions simultaneously have two main characteristics:

- The address of a separate division differs from the address of the organization indicated in the Unified State Register of Legal Entities;

- At the location of the separate unit, at least one stationary workplace is equipped for a period of more than a month.

In the 1C:Accounting 3.0 program, created on the 1C:Enterprise 8.3 platform, registration of a separate division is carried out in the menu “Directories - Enterprises - Divisions”.

Fig.1

You need to create a new division in 1C: check the “Separate division” box, fill in all the details, indicate the head division. The division will have its own checkpoint, and the TIN will be common for all divisions and the parent company.

Fig.2

After filling out, the document must be recorded, and then it will be reflected in accounting.

Fig.3

In the 1C program, you can create, configure and maintain records of several organizations and departments at the same time. At the same time, it is possible to separately calculate wages with the submission of tax reports to different Federal Tax Service Inspectors. Let's look at an example of how to keep records for separate divisions in terms of wages.

In the main menu, select “Administration – Program settings – Accounting parameters”.

Fig.4

In the accounting parameters, select “Salary settings”.

Fig.5

In the “Payroll calculation” section, check the “Payroll calculation by separate departments” checkbox.

Fig.6

In the department card you can enter the details of the tax office to which the reports will be submitted.

Fig.7

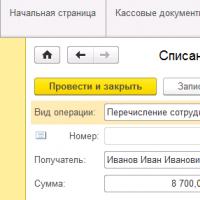

Payroll

First we need to hire employees for our division. To do this, go from the main menu to “Salaries and personnel – Personnel records – Hiring”.

Fig.8

Through “Create” we go to the employment document. We fill in the following information:

- The organization is our organization;

- Division – a separate subdivision;

- Position – position of an employee of a separate unit;

- Employee – an employee of a separate unit;

- Reception date – fill in the required date;

- Probation period – fill in if one is provided;

- Type of employment – in our case it is internal part-time work.

Fig.9

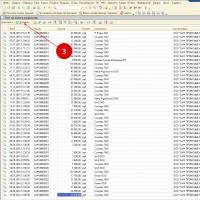

Now let’s calculate the salary of the employee of the main and separate division. Salaries in 1C 8.3 are calculated in the section “Salaries and Personnel - Salaries - All Accruals”.

Fig.10

Using the “Create” button, we calculate wages for employees of the main department. For example, let's take data for one employee. We will fill out and post the “Payroll” document.

Fig.12

Generation of 2-NDFL certificates

So, we have calculated wages for two employees of the main and separate departments. Next, we will generate 2-NDFL certificates for these employees. To do this, from the main menu go to “Salaries and personnel – personal income tax – 2-NDFL for transfer to the Federal Tax Service”.

Fig.13

We create a certificate for an employee of the main department. The 1C 8.3 program offers the opportunity to select a tax office according to OKTMO and KPP. We select the one we need and fill in the remaining data. The employee data should be filled in automatically. The help displays the following information:

- The tax rate is in our case 13%;

- Income – accrued salary to an employee;

- Taxable income - if there were no deductions, then the amounts are the same;

- Tax – the amount of accrued personal income tax;

- Withheld – personal income tax is withheld at the time of salary payment, our salary has only been accrued, so in our case the value in this cell is “0”;

- Listed – this field will be filled in after the tax is paid to the budget, so for now it is also “0”.

Fig.15

Next, fill out a certificate for an employee of a separate unit. We generate the certificate in a similar way, changing the data in the OKTMO/KPP field when paying income. Data from the Federal Tax Service at the address of the separate division. Similar to the previous certificate, the employee’s data, his income, tax rate and tax amount are filled in automatically.

Fig.16

Just like for the previous certificate, you can display a printed form in which we see the Federal Tax Service code different from the first one.

Fig.17

In this article, we looked at how to create a separate division, as well as the possibilities offered by the 1C 8.3 program for payroll, tax calculation, as well as submitting reports for employees of the main and separate divisions to different tax inspectorates. Thanks to them, maintaining a separate unit in the program will not be difficult for users.

We bring to your attention an article about reflecting enterprise divisions in the 1C: Trade Management 8 program (rev. 11.3). As an example, a demo base in the standard delivery was used.

Settings

The use of departments in the program can be enabled or disabled using a flag in the enterprise settings:

Master data and administration – Setting up master data and sections – Enterprise

If the use of departments is disabled, the corresponding directory will not be available. There will be no “Division” field in documents and directories.

Where are units used?

Direct maintenance of separate accounting is included in the form of the unit itself.

Directory "Enterprise structure"

Filling out the directory

Divisions are entered into a directory called “Enterprise Structure”:

Master data and administration – Master data – Enterprise structure

This reference book implements a hierarchy of elements. This means that one division can be created directly "inside" another, without the use of groups. For example, in the image below you can see that the trade sales department includes other departments:

When creating a department, you must enter its name. If this unit is included in a higher one, it is also indicated in the corresponding field. It is possible to specify the head of the department (optional parameter):

Important. In the 1C: Trade Management program, divisions are not tied to an organization (individual entrepreneur or legal entity), but relate to the entire enterprise.

Separate accounting of goods

To do this, the appropriate setting must be installed in the program (see paragraph 2 of this article).

Features of reflecting holding divisions

If an enterprise is a holding company that includes several organizations, the question arises: how to enter the divisions of these organizations into the information database?

The holding includes two legal entities, each of which has an administration, a sales department and a purchasing department.

The reflection of such divisions in the directory depends on the situation at the enterprise. There are two options:

14.09.2018

How to enable the ability to maintain records for Separate divisions in the standard configuration "1C: Enterprise Accounting KOPR"

General information

The standard configuration of 1C: Enterprise Accounting, version 8 of KORP, allows you to organize end-to-end accounting in the context of organizational units, both allocated and not allocated to a separate balance sheet.

The CORP version allows you to set up accounting for separate divisions for the receipt and transfer of fixed assets, finished products, materials, cash, as well as the transfer of employees between the parent organization and separate divisions.

The KORP version of the "1C: Enterprise Accounting" configuration allows you to keep track of income, expenses, and profits for each separate division. When preparing an income tax return, distribution shares according to the Federal Tax Service are calculated, which greatly facilitates the work of an accountant.

For each separate division, you can indicate the addresses, telephone numbers, and names of the responsible persons of the division. This data is displayed in printed forms of all documents issued by a separate division. Separate numbering of documents by separate divisions is supported.

Buy 1C: Accounting CORP for 33,600 rubles. right now!

Also, the KORP version of the "1C: Enterprise Accounting" configuration allows you to organize the accounting of payments for state defense orders in accordance with the requirements of Federal Law No. 275-FZ dated December 29, 2012 (taking into account amendments to Federal Law No. 159-FZ dated June 29, 2015).

How to enable accounting by separate divisions

To enable the ability to create Separate divisions in the standard configuration of "1C: Enterprise Accounting KORP" version 3.0, you need to check the "Accounting for several organizations" and "Separate divisions" flags in the functionality settings window on the "Organization" tab (see figure).

We agree with the warning “Enabling functionality may take a long time.”

After this, the “Organizations” item will appear in the “Main” section.

A directory of organizations and separate divisions will open.

Click the "Create" button.

A window will open in which you can select which organization we are adding: individual entrepreneur, new legal entity or separate division.

In the next window, you can specify the details of the Separate Division: Name, checkpoint, Prefix (if separate continuous numbering of documents in the separate division is required) and Digital code for invoices, OGRN, registration date, address, telephone, bank details, full names of the responsible persons of the separate division divisions (which must be indicated in documents issued on behalf of the OP), data from the Federal Tax Service, Pension Fund of the Russian Federation, Social Insurance Fund and statistics codes.

The TIN of a separate division and the taxation system are the same as those of the Parent organization and cannot be changed.

After specifying all the details of the Separate Unit, click on “Record” or “Record and Close”.

The separate division will appear in the "Organizations" directory. Now you can select a Separate Division in any document.

To increase the convenience and speed of work, each user can be assigned a Separate Department by default, which will be immediately automatically inserted into documents when they are created, and if necessary, you can set up an access restriction system so that users of a separate department can write out and see only documents of their separate department and not saw the documents of the Parent Organization and/or other divisions.

Please note that full support for working with Separate divisions is implemented only in the standard configuration "1C: Enterprise Accounting" rev. 3.0 version of CORP. There are no plans to include these functionalities in the Basic and Professional versions!

Cost of "1C: Accounting 8 KORP"

You can purchase 1C: Accounting KORP from our company, even if you are in another region of the Russian Federation. The price includes remote installation of electronic delivery and sending boxed versions by courier throughout the Russian Federation.

There are several options for delivering the software product "1C: Accounting 8 CORP":

| Name | Price | Description |

|---|---|---|

| 1C:Accounting 8 CORP | Boxed delivery of "1C: Accounting" version of KORP with a software protection system with a license for 1 workplace | |

| 1C: Accounting 8 CORP. Electronic delivery | Electronic delivery of "1C: Accounting" version of KORP with a software security system with a license for 1 workplace | |

| 1C:Accounting 8 KORP (USB) | Boxed delivery of "1C: Accounting" version of CORP with a USB hardware dongle for 1 workstation |

Advantages of electronic delivery of "1C:Accounting 8 KORP"

- Purchasing an electronic delivery allows the user to receive installation distributions and activation codes for 1C software products as quickly as possible.

- The electronic delivery is generated at the time of purchase, so the user receives the current version of the program at the time of purchase.

- Documentation and accompanying materials are supplied in a convenient electronic format, which allows you to immediately see the contents of the book and quickly move to the desired chapter.

- The software product is registered in your personal account on the official 1C technical support portal immediately at the time of purchase and the user gets access to all updates to the technology platform and standard configuration immediately, without the need for additional registration.

Discount when upgrading from 1C:Accounting 8 PROF and previous versions

You can get a discount when upgrading 1C: Accounting from the PROF version to KORP in our company, even if you purchased 1C: Accounting PROF elsewhere and are in another region of the Russian Federation. The main condition is that the 1C: Accounting PROF set to be handed over must be licensed and officially purchased.

If you have previously used 1C: Accounting 8 PROF, then this gives you the right to purchase 1C: Accounting 8 CORP at a significant discount. When upgrading, you will only need to pay the difference in price between PROF and KOPR versions of 1C:Accounting 8 according to the current price list + 150 rubles. For example, if you previously purchased 1C: Accounting 8 PROF (at the time of writing, the price list price is 13,000 rubles), then when upgrading to 1C: Accounting 8 CORP, the cost of the additional payment will be 33,600 - 13,000 + 150 = 20,750 rubles.

When upgrading, the price of the purchased 1C: Accounting 8 CORP set includes 3 months of a preferential subscription to information technology support for ITS. Also, when upgrading, it is possible to extend the preferential ITS subscription period from 3 to 12 months at a special price of 19,776 rubles, which makes it possible to make the transition to the CORP version even more profitable. For example, a regular ITS PROF subscription for 1C:Accounting PROF for 12 months at the price list costs 35,992 rubles, and the cost of an upgrade from PROF to CORP version is 20,750 rubles. + extension of the preferential ITS subscription when purchasing the program from 3 to 12 months. - 19776 rub. The total cost of the upgrade + ITS for 12 months will cost 40,529 rubles, i.e. the amount of additional payment for the transition from PROF to CORP version will be 4934 rubles! The rest of the amount will go towards payment for the ITS subscription, which you would already have to pay for the maintenance of 1C: Accounting PROF.

Online version of "1C:Accounting CORP" in the cloud service 1C:Fresh

Cost from 495 rub./month. per user*

Today, “1C: Accounting KORP” can not only be purchased and installed on your computer, but also used remotely via the Internet in cloud service mode. In this case, the 1C: Accounting KORP database is located on secure servers in the 1C data center, and users can work in the program remotely via the Internet using a regular web browser (Chrome, IE, Edge, Mozilla, Safari) or 1C thin client (provided free of charge).

Access to the online version of "1C: Accounting KORP" is provided on the principles of SaaS (software as a service - program as a service).

Our company is an official partner of the 1C company with the status "1C: Network Competence Center", which gives us the right to connect users to the cloud service "1C: Fresh" on the same conditions for the entire Russian Federation and at the price established by the 1C company.

The 1C website has a page for auto-registration https://online.1cfresh.com, which allows our users to independently register in the cloud service.Upon initial registration, our users are provided with free access for the first 30 days of connection, then the cost of access will cost from 495 rubles* per month per user, depending on the number of users, number and size of information databases.

Cost of access to the online version of 1C:Accounting 8 KORP in the cloud service 1C:Fresh

Tariff plan 1 month 3 months 6 months 12 months 1C: Accounting CORP

Access for up to 10 simultaneous users

594.00 rub. per month

for 1 user

535.40 rub. per month

for 1 user

516.60 rub. per month

for 1 user

494.40 rub. per month

for 1 userAdditional workplace (over 10 users)

The indicated price includes access to up to 10 simultaneous users (sessions) to two 1C: Accounting CORP information databases up to 8GB in size + connection to electronic reporting for 1 legal entity + connection to the 1C: Counterparty service for auto-filling the details of counterparties by TIN and checking them against the database Federal Tax Service + the ability to use other configurations available in the service (1C: Enterprise Accounting PROF/Basic, 1C: Salaries and Personnel Management, 1C: Managing Our Company) without limiting the number and size of information databases.

* Cost 495 rub./month. per user is calculated when connecting 10 users and paying for 12 months.

If everything worked out as it should, then like the article on social networks and share the link on your favorite forums))).Online Company, 2018

Separate division in 1C, How to set up a separate division in 1C: Accounting KORP, 1C 8.3 separate division, 1C Accounting separate division, How to create a separate division in 1C 8.3 accounting, How to create a separate division in 1C Accounting KORP rev.3.0, Accounting for separate divisions in 1C: Accounting KORP, changing the address of a separate division in 1C Accounting, Opening a separate division in 1C Accounting KORP, Where to indicate tax data for a separate division of 1C Accounting KORP, How to add a separate division in 1C Accounting KORP, 1C Accounting Personal Income Tax separate division, How to create a separate division in 1C separate division, 1C 8 separate division, changing the head of a separate division in 1C Accounting, how to open a separate division of LLC in 1C Accounting, paying taxes by separate divisions, how to register a separate division in 1C Accounting, How to create a separate division in 1C Accounting CORP, Separate division in 1C Accounting KORP, A separate division in a standard configuration Enterprise Accounting 1s 8.3, Accounting for separate divisions in 1s 8.3, 1s corp separate divisions, How to create a separate division in 1C Accounting 8.3 version KORP, How to maintain a separate division in 1C Accounting KORP, Separate division 1s 8.3 in the directory of organizations, Create a separate division in 1C 8.3, FSS separate division in 1C Accounting, separate division profit calculation in 1C Accounting, Dedicated balance sheet of a separate division in 1C Accounting KORP, How to create separate divisions in 1C, separate division allocated to a separate balance sheet in 1C Accounting KORP, Separate accounting of a separate division in 1C Accounting, How to enter a separate division in 1C, Order to create a separate division in 1C Accounting, 1C 8.2 separate division, cash book of a separate division, parent organization and separate division in 1C Accounting KORP, personal income tax on separate divisions in 1C Accounting, How to set up accounting for separate divisions in 1C Accounting CORP 8.3, How to add a separate division in 1C, How to add a separate division in 1C Accounting CORP, Separate divisions in 1C 8 3, How to create a separate division in 1C Accounting in another region, Property tax of separate divisions in 1C Accounting, Documents for a separate division in 1C Accounting, Separate division step-by-step instructions, taxation of a separate division in 1C Accounting, Create a separate division in 1C Accounting 8. 3 versions of KORP, How to add a checkpoint of a separate division in 1C Accounting KORP, 1C KPP of a separate division, How to create a balance sheet for a separate division in 1C Accounting KORP, 6-NDFL separate division in 1C Accounting KORP, 1C Accounting KORP NDFL separate division, accountant of a separate division, Calculation of contributions to funds for a separate division in 1C Accounting, How to create a separate division in another city in 1C Accounting, How to maintain a separate division in 1C, How to create a separate division in 1C 8.3, Tax accounting for a separate division in 1C Accounting, cash desk of a separate division 1C , organization of activities of a separate division in 1C Accounting, Separate division of a legal entity in 1C Accounting, Separate account of a separate division in 1C: Accounting, How to enter a separate division into 1C, How to indicate information about a separate division in 1C Accounting, Calculation of contributions to the Social Insurance Fund for a separate division in 1C Accounting, Separate accounting of the profit of a separate division in 1C Accounting, Balance sheet of a separate division in 1C Accounting, 1C Accounting how to create a separate division, Income tax of a separate division in 1C Accounting, How to add a separate division in 1C 8.3, Location of a separate division in documents 1C Accounting, 1C 8.3 corp separate division, Accounting of a separate division in 1C Accounting, Reporting of a separate division in 1C Accounting, How to make a separate division in 1C, checkpoint of a separate division invoice 1C Accounting, Calculation of contributions to the Pension Fund of the Russian Federation for a separate division in 1C Accounting , Declaration of a separate division in 1C Accounting, Head of a separate division in 1C Accounting, Create a separate division in another city in 1C Accounting, invoices of separate divisions 1C, Work of separate divisions in 1C Accounting, How to fill out a separate division in 1C, legal address of a separate division in 1C Accounting, Where to indicate the current account of a separate division in 1C Accounting, 1C income tax separate division, Calculation of contributions for a separate division in 1C Accounting, Representative office (separate division) in 1C Accounting, create a separate division in 1C 8.3 accounting, Director of a separate division in 1C Accounting, accounting for a separate division + in 1C 8. 3 accounting, Separate division reports in 1C Accounting, How to create a separate division of your organization in 1C, 1C accounting accounting for separate divisions, separate division of a company in 1C Accounting, implementation for a separate division in 1C, Calculation of taxes for a separate division in 1C Accounting, accounting for separate divisions, 2-NDFL of a separate division in 1C Accounting, Contributions for a separate division in 1C Accounting, 1C Accounting 3.0 separate division, 1C 8.3 separate division, Tax accounting of a separate division in 1C Accounting, Profit for separate divisions in 1C, insurance contributions of a separate division in 1C Accounting, 1C cash book of a separate division, Income tax for separate divisions in 1C, How to enter a separate division in 1C 8.3, a separate division located outside the location of the parent organization in 1C Accounting, Invoice of a separate division in 1C Accounting, separate division in 1C 8.3 corporate accounting, Numbering of invoices of a separate division in 1C Accounting, 1C accounting 3.0 separate divisions, Profit declaration of a separate division in 1C, Separate accounting of the property of a separate division in 1C Accounting, setting up a separate division in 1C 8.3, Head and separate division in 1C Accounting, 1C reporting of separate divisions, Calculation for a separate division in 1C Accounting, 1C 8.3 checkpoint of a separate division, organization of accounting for a separate division in 1C Accounting, Cash desk of a separate division in 1C 8.3, Income tax declaration of a separate division in 1C Accounting, Separate division of a branch organizations in 1C Accounting, VAT of a separate division in 1C Accounting, branches and other separate divisions in 1C Accounting, How to create a branch in another city in 1C Accounting, accounting policy of a separate division in 1C Accounting, Registration with the tax authorities of a separate division, details of a separate division in 1C Accounting, how to reflect the formation of a separate division in 1C Accounting, a separate division taxes and reporting in 1C Accounting, a separate division of a limited liability company in 1C Accounting, Accounting for income and expenses, as well as actual profit for each separate division in 1C Accounting KORP

Tags: How to add a separate division in 1C Accounting KORP, 1C Accounting Personal Income Tax separate division, How to create a separate division in 1C, 1C 8 separate division, changing the head of a separate division in 1C Accounting

List of values of accumulation registers 1s

List of values of accumulation registers 1s Advance calculation in 1s 8

Advance calculation in 1s 8 GPC agreements Reception for GPC in 1s

GPC agreements Reception for GPC in 1s Month closing settings How to close a period in UP

Month closing settings How to close a period in UP Specialist consultations

Specialist consultations Accounting for fuel and lubricants in 1C: instructions for accountants Write-off of fuel and lubricants 1s 8

Accounting for fuel and lubricants in 1C: instructions for accountants Write-off of fuel and lubricants 1s 8 Issue an invoice in the 1s 8 program

Issue an invoice in the 1s 8 program