Receipt cash order. Incoming cash order 1c incoming cash order

Receipt cash order- this is a document of primary accounting documentation of cash transactions, according to which cash is received at the organization's cash desk.

When a cash receipt order is issued

Since the cash receipt order is the primary accounting document, therefore, it must be drawn up when committing a fact of economic life (Part 3 of Article 9 of the Federal Law of December 6, 2011 N 402-FZ “On Accounting”), that is, according to the fact of receipt of cash at the cash desk of an organization or individual entrepreneur.

Thus, it is necessary to issue a cash receipt order at the time of depositing cash at the cash desk of a business entity.

In what cases is the cash receipt order form filled out?

A cash receipt order is filled out when cash is received at the organization's cash desk in the following cases:

posting of received revenue. When selling goods (work, services) for cash, when the buyer is issued a cash register receipt or BSO, at the end of the work shift, only one PKO is drawn up for the entire amount of cash proceeds;

return of unused accountable money;

receiving money from a current account;

return of borrowed funds;

Cash receipt form

For a cash receipt order, a special form has been established (form N KO-1), which is approved by Resolution of the State Statistics Committee of Russia dated August 18, 1998 N 88 “On approval of unified forms of accounting documentation for recording cash transactions and recording inventory results.”

In accordance with form N KO-1, a cash receipt order has two parts: the receipt order itself and a receipt for the cash receipt order. A receipt for a cash receipt order is issued to the person who deposited cash at the organization's cash desk. The receipt for the incoming cash order must be certified by the seal of the organization, signed in the same way as the incoming order itself, and in addition, the receipt for the incoming cash order must be signed by the cashier who receives the money. In this case, the cash receipt order itself must remain in the cash register.

Registration of cash receipt order

A cash receipt order is issued:

chief accountant;

an accountant or other employee (including a cashier), determined by the manager in agreement with the chief accountant (if any) by issuing an administrative document of the organization, individual entrepreneur (hereinafter referred to as the accountant);

manager (in the absence of a chief accountant and accountant).

In this case, the cash receipt order is signed either by the accountant, or, in their absence, by the manager or cashier.

In the case of conducting cash transactions and drawing up cash documents by the manager, cash documents are signed by the manager.

A cash receipt order can be issued on paper or using technical means designed for processing information, including a personal computer and software.

If a cash receipt order is issued using technical means, then it must be printed on paper.

Corrections in the cash receipt order are not allowed.

The procedure for filling out a cash receipt order

The cash receipt form is issued in one copy by an accounting employee and signed by the chief accountant or a person authorized to do so.

In this case, the receipt for the cash receipt order is signed by the chief accountant or a person authorized to do so, and by the cashier, certified by the seal (stamp) of the cashier.

Filling out the cash receipt form

The cash receipt form is filled out as follows:

The line “Organization” indicates the full name of the organization and its OKPO code assigned by the statistics department.

The next line is filled in only if the funds come from a structural unit of this organization (for example, revenue from a retail outlet), otherwise a dash is placed there.

PKOs are numbered, as a rule, starting from January 1 of the current year - the serial number is placed in the “Document number” column.

Due to the fact that primary documents must be completed on the day of the operation, the current date is indicated in the “Date of Compilation” column.

In the columns “Debit” and “Credit” the numbers of the corresponding accounts and codes are entered if the organization uses coding:

So in the “Debit” column the account number is entered, the debit of which is used to receive funds. The enterprises that issued the order enter account 50 “Cash” in this column. The subaccount number can also be indicated here in accordance with the organization’s working chart of accounts.

In the column “Credit, corresponding account, subaccount” the number of the account and, if necessary, the subaccount, the credit of which reflects the receipt of funds at the organization’s cash desk, is indicated. These can be accounts such as 90.1 “Sales revenue”, 51 “Settlements accounts”, 62 “Settlements with buyers and customers”, 71 “Settlements with accountable persons”, 73 “Settlements with personnel for other operations”, 75 “ Settlements with founders."

In the “Amount” column the amount of funds received at the cash desk is entered in numbers.

A dash is placed in the “Purpose Code” column if the organization has not adopted a coding system.

In the “Accepted from” line, write the full name of the organization’s employee, or when making payments between organizations - the name of the organization and the full name of the employee through whom the funds were transferred. In this case, the word “through” is entered, for example “Accepted from “Name of organization” through “Full name of the employee through whom the funds were transferred.”

In the “Base” field, you must enter the content of the transaction, for example, “retail revenue” or “payment under the agreement.”

In the “Amount” line, the rules require you to indicate the entire amount of incoming funds in words from the beginning of the line with a capital letter (kopecks are indicated in numbers). If after writing the amount in rubles there is still free space on the line, then it is crossed out.

Here you should pay attention to this feature. If in the “Amount” column the amount received was indicated with kopecks, then in this line the amount is also indicated with kopecks. If the amount was indicated without kopecks, then the line about kopecks is not mentioned.

In the line “Including” the amount of VAT is indicated, which is recorded in numbers, or the entry “excluding tax (VAT)” is made.

The attached documents, indicating their numbers and dates of completion, are located in the “Attachment” field. These documents themselves, immediately after receiving the money, are canceled with the “Received” stamp indicating the current date.

Filling out a receipt for a cash receipt order

The receipt for the cash receipt order must contain all the same information as the order itself.

In the tear-off receipt attached to the cash receipt order, the following information is filled in:

Name of company

Number and date of document preparation

Taken from

Base

Including

Chief accountant (signature)

Cashier (signature)

Actions of the cashier after receiving funds

After this, the cashier accepts the money and, after receiving it, puts his signature, surname and initials on the receipt order and receipt.

On the receipt, the cashier also indicates the date the money was received and certifies his signature with a seal. The receipt is stamped so that the edge overlaps the receipt order itself

After the money arrives at the cash register, the cashier tears off the receipt for the PKO along the cut line and hands it to the person who handed over the money, and leaves the cash order at the cash register.

In this case, an entry is made about the accepted money in the cash book (Form N KO-4).

Journal of registration of incoming and outgoing cash documents

Before an incoming cash order reaches the cash desk, it must be registered in the register of incoming and outgoing cash documents (Form No. KO-3).

Journal of registration of cash documents KO-3 - is intended for registration of cash documents in the course of conducting cash transactions and is used for registration by the accounting department of incoming and outgoing cash orders.

Form No. KO-3 consists of a cover and a loose leaf, according to which all pages of the magazine are designed, filled out and printed.

The insert sheet is divided into two parts: one is intended for registering incoming cash documents (columns 1-4), the other for expenses (columns 5-8).

Penalties for lack of PCO

The absence or improper execution of primary cash documents, which, in particular, include a cash receipt order, may result in penalties for the taxpayer in accordance with Art. 120 of the Tax Code of the Russian Federation.

So, according to this article, a gross violation of the rules for accounting for income and (or) expenses and (or) objects of taxation, if these acts were committed during one tax period, in the absence of signs of a tax offense, entails a fine of ten thousand rubles.

At the same time, a gross violation of the rules for accounting for income and expenses and taxable items means the absence of primary documents, including primary cash documents.

Also, the absence of primary cash documents from the purchasing organization may become the basis for the refusal of the tax authority to recognize the specified expenses of the organization for the purpose of taxation of profits or a single tax in accordance with the simplified taxation system ( - income reduced by the amount of expenses incurred).

Storage periods for cash receipt orders

The storage period for cash receipt orders is, as for all primary documents, five years after the reporting year.

Still have questions about accounting and taxes? Ask them on the accounting forum.

Receipt cash order: details for an accountant

- Organization of cash payments in an autonomous institution

Cash is accepted according to cash receipt orders. Upon receipt of such an order... there is a signature of the manager), when issuing a cash receipt order on paper - check... the supporting documents listed in the cash receipt order. Cash must be accepted one-by-one... the amount reflected in the cash receipt order, the cashier invites the depositor to add... In this case, the cashier must cross out the cash receipt order (if this is issued...

- Changes have been made to the procedure for conducting cash transactions

Cash is accepted according to cash receipt orders. Upon receipt of such an order... the presence of the manager’s signature), when issuing a cash receipt order on paper - its compliance... the presence of supporting documents listed in the cash receipt order. Cash must be accepted one-by-one... the cashier checks the amount specified in the cash receipt order with the amount actually accepted... the cashier asks the depositor to add the amount to the amount indicated in the cash receipt order...

- New procedure for cash transactions and issuing money on account

Cash transactions are formalized by cash documents: cash receipts, cash receipts. With the introduction of... other documents provided for by law. Only the general... will need to be entered into the cash receipt order. The innovations also affected the rules for re-issuing cash receipt orders. In the event of a discrepancy between the deposited amount... indicated in the cash receipt order drawn up on paper, the cashier crosses out the cash receipt order and sends it to the person in charge...

- The procedure for processing cash transactions and issuing funds for reporting has been changed

F. 0310004) are carried out for each incoming cash order (f. 0310001), outgoing cash order... electronic form. So, when receiving a cash receipt order (f. 0310001), the cashier checks... does not correspond to the amount specified in the cash receipt order (f. 0310001), the cashier offers... cash. The cashier crosses out the cash receipt order (f. 0310001) (in the case of... - makes a note about the need to re-register the cash receipt order) and transfers (sends) to the main...

Accounting for cash transactions is regulated by the directive of the Central Bank of the Russian Federation dated March 11, 2014 N 3210-U “On the procedure for conducting cash transactions by legal entities and the simplified procedure for conducting cash transactions by individual entrepreneurs and small businesses.” We recommend that chief accountants, cashiers and other employees of the financial service of the enterprise who work with cash documents familiarize themselves with it. It is also worth reading the instruction of the Central Bank of the Russian Federation dated October 7, 2013 N 3073-U “On cash payments.”

Recipients of budget funds additionally take into account regulations relating to the regulation of cash transactions in budget financing.

Individual entrepreneurs may not keep records of cash transactions in 1C and should not set a cash limit. At the same time, documents such as KUDR must be maintained, because does not apply to cash registers.

Small enterprises (numbers up to 100 people and ready revenue up to 800 million rubles, including microenterprises - organizations with up to 15 people and revenue up to 150 million rubles) are not required to set a cash limit. Other enterprises set a cash limit, above which the cash must be deposited with the bank. An exception is made for funds whose purpose is to pay wages and similar payments. On salary payment days for up to 5 working days (the exact payment deadline is set by the head of the enterprise and indicated on the payroll), it is allowed to exceed the limit of money in the cash register by amounts intended to pay payroll for wages, benefits and similar payments.

Receipt of funds to the cash desk is registered Parish cash order(abbreviated PKO), payments – Expenditure cash order(abbreviated RKO). For payment of wages, etc. should be pre-formed payroll or payroll, even if payments are made to one person. Document flow can be carried out in paper or electronic form. In the latter case, documents must be signed with an electronic digital signature. At the end of the day a cash book is formed on the basis of PKO and RKO. If there was no movement of funds through the cash register during the day, there is no need to create a cash book for that day.

Limit limit cash settlements between counterparties under one agreement is 100,000 rubles. Settlements with individuals are carried out without restrictions on the amount.

Funds received by the enterprise's cash desk through the sale of goods, provision of services, or as insurance premiums can only be spent for the following purposes:

- Payment of wages and benefits;

- Insurance compensation payments physical persons who have paid insurance premiums cash;

- Payment for goods, works, services;

- Cash issuance on account;

- Refund of funds for goods, works, services previously paid for in cash.

For other purposes, cash should be withdrawn from a bank account.

Violation of the procedure for conducting cash transactions can lead to a fine (Article 15.1 of the Code of Administrative Offenses of the Russian Federation):

- For an official – from 4,000 to 5,000 rubles;

- For a legal entity – from 40,000 to 50,000 rubles.

The tax authorities of the Russian Federation are responsible for checking the correctness of cash transactions (Article 23.5 of the Code of Administrative Offenses of the Russian Federation).

Cash documents in 1C

The above methodology for accounting for cash transactions is not exhaustive and contains the basic rules for working with cash.

Selecting menu items Bank and cash desk => Cash desk => Cash documents

Figure 1. Selecting cash documents

Depending on the version of the program, the menu settings may differ slightly, but in any case in the section Bank and cash desk you will be able to access the main cash documents - PKO and RKO.

Figure 2. Buttons for entering PKO and RKO

Receipt cash order

1C offers ten types of PKO depending on the operation being entered. They are as follows:

- Payment from the buyer;

- Retail revenue;

- Return from an accountable person;

- Return from supplier;

- Receiving cash from the bank;

- Receiving a loan from a counterparty;

- Obtaining a loan from a bank;

- Repayment of the loan by the counterparty;

- Repayment of a loan by an employee;

- Other arrival.

Figure 3. Options for the PQR document

The names of the documents reflect their essence and have corresponding settings, for example Return from an accountable person by default will have correspondence with score 71.

PKO option Other income seems universal, because allows you to select any account from the chart of accounts and carry out any operation. But methodologists from 1C advise using it only as a last resort, for non-standard operations, trying, if possible, to carry out documents with types of operations No. 1-9.

Below are three options for the PKO entry form. General rules – mandatory fields are highlighted with a red line.

Figure 4. PKO - Return from an accountable person

Chapter Details of the printed form can be expanded or collapsed when pressed.

Figure 5. PKO - cash from the bank. Printable form details shown

If the document involves choosing a counterparty who is not an individual, it is mandatory to fill out the field Agreement.

Figure 6. PKO - Payment from the buyer

If you need to specify more than one contract, use the function Split the payment which allows you to fill out data for several contracts. In this case, after selecting the counterparty, you should open the Payment Breakdown tabular section, select contracts and indicate the amounts for each. The overall result will be reflected in the PQR.

Figure 7. PKO settings - payment by agreement

Field value DDS article filled in from the directory. This guide allows you to add Name DDS articles, but here is the meaning Type of movement not available for editing. If there are too many items and you want to group them into folders, you should use the “Create group” button. The completed field values will be taken into account in the future when generating reporting form No. 4 “Cash Flow Statement”.

Figure 8. Directory - cash flow items

Let's fill out the PQR for cash receipt from the bank.

Figure 9. Example of a completed PQR

Figure 10. Postings through PKO

It should be noted that in this case the movement of money is reflected not only through the cash register, but also through the current account. To avoid double debiting of money from a bank account, transactions of the type Dt 50.01 - Kt 51 are generated by cash and not bank documents.

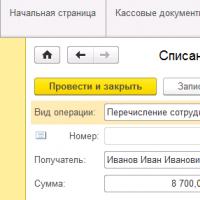

Account cash warrant

An expense cash order, or RKO, is largely formed according to the same rules as the PKO. In 1C there are the following types of cash registers:

- Payment to the supplier

- Return to buyer

- Issuance to an accountable person

- Payment of wages according to statements

- Payment of wages to an employee

- Payment to an employee under a contract

- Cash deposit to the bank

- Repayment of the loan to the counterparty

- Repayment of loan to the bank

- Issuing a loan to a counterparty

- Collection

- Payment of deposited wages

- Issuing a loan to an employee

- Other expenses

For payments No. 4-5, pay slips should be prepared in advance, even if the payment is made to one employee.

Figure 11. RKO document options

We will issue a settlement settlement for the issuance of funds to an accountable person.

Figure 12. Completed cash register document

After posting the document, you can view the postings.

Figure 13. Postings by cash register

Let's consider the procedure for making wage payments in 1C. We will create a payroll. If all employees received a salary according to it, you can use the “Pay Statement” button (at the bottom of the form), and a settlement settlement will be automatically generated.

Figure 14. Options for cash documents based on payroll

Let’s simulate a situation where one employee’s salary is deposited and the rest are paid. In the paper version of the statement, the corresponding mark is placed on the deposited amounts. In 1C, when accounting for cash transactions, you should open the statement and use the button Create based on then Salary deposit. For the deposition document, we leave the names we need.

Figure 15. Document Salary Deposit

After completing the document, we look at the postings.

Figure 16. Postings when depositing salaries

We return to the list and click on the button Create based on we create a document Cash withdrawal. The amount will be recalculated automatically and will be reduced by the deposited amounts.

Figure 17. Document Cash issuance based on payroll

Postings for issuing salaries were generated for two employees, and that’s how it should be.

Figure 18. Postings for the document Cash withdrawal

Deposited amounts can only be kept in the cash desk if they do not exceed the cash storage limit. Otherwise, they should be handed over to the bank. Forming RKO Cash deposit to the bank.

Figure 19. Filling out the document Cash deposit to the bank

The result of the document.

Figure 20. Postings according to the document Cash deposit to the bank

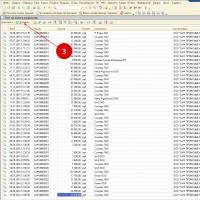

Cash book in 1C 8.3

Based on PKO and RKO carried out during the day, we will create a cash book (Figure 21), which is a report on cash transactions performed.

A small note: sometimes when automating, programmers ask users in what form to implement this or that form - as a document or as a report. This question often confuses people. Let me explain the difference using the example of cash documents. PKO or RKO are separate documents for which there is an input form. The amounts in them, as a rule, are entered by the user himself; he can change them if desired. The cash book is a report; there is no input form for it; it is filled out automatically based on the data entered in the PKO and RKO documents. If changes are made to these documents, the report will automatically give the already changed amounts when generated.

Figure 21. Button for generating a cash book

Using this report, you can set the necessary settings.

Figure 22. Cash book settings

Ready report.

Figure 23. Cash Book report

Advance report

Another document included in the block Cash register in the 1C program - Advance report

Figure 24. Menu path to documents Advance report

Let's look at an example of filling out an advance report.

Figure 25. Creating an expense report

The table part contains several tabs. We fill out the Advances tab based on the issued cash settlement.

Figure 26. Filling out the Advances tab

Tab Goods fill in the information about purchased goods or materials. If VAT is highlighted in the documents, we indicate this data in the advance report.

Figure 27. Filling out the Products tab

Figure 28. Products tab, account details.

On the tab Payment We show payment for previously purchased goods.

Figure 29. Filling out the Payment tab

Learn more about using tabs Goods And Payment.

If you purchase a single product in a retail store, reflect such a purchase in the section Goods. But let’s say you have a situation where you pay with the same supplier either in cash or by bank transfer. And you want to have correct data for calculations, for example, to generate a reconciliation report. Then invoices and invoices received from this supplier on the day of purchase for cash can be posted separately from the advance payment document Receipts (acts, invoices), and in the advance report reflect the details of the PKO, i.e. payment document on the Payment tab.

After posting the document, you can view the postings. The amount of the advance report was 10,180 rubles, i.e. the overexpenditure of 180 rubles will have to be issued from the cash desk after approval of the advance report.

Figure 30. Postings according to the advance report of accounting and accounting records

Figure 31. JSC - VAT deductible

Payment by payment cards

Payment by payment cards, or in another way acquiring– a currently widespread method of payment for goods or services. Let's consider the procedure for carrying out such an operation in 1C.

Menu path: Bank and cash desk => Cash desk => Payment card transactions.

Figure 32. Menu path - Payment card transactions

By button Create There are three possible document options. Choose Payment from the buyer, because this document is configured to reflect payments from legal entities and individual entrepreneurs. Retail payment card transactions are beyond the scope of this article.

Figure 33. Selecting a document option

We fill out the document, everything is quite simple here.

Figure 34. Completed Payment Card Transactions document

Let's look at the wiring. Cash is reflected in account 57.03.

Figure 35. Postings according to the Transactions on payment card document

To reflect the receipt of funds into the current account, you can create a document based on the transaction performed Receipt to the current account.

Figure 36. Creating a document Receipt to current account

Without a bank commission, payments are unlikely to be made, so we break the payment into the payment amount and the bank commission, and indicate the cost account for this commission.

Figure 37. Completed document Receipt to current account

Let's look at the wiring.

Figure 38. Postings according to the document Receipt to the current account

Operations with the fiscal registrar

The fiscal registrar is a technical device for printing checks, has a fiscal memory, connects to a computer and is capable of working over a network. Menu path for connection Administration => Connected equipment.

Figure 39. Menu Connected equipment

In chapter Fiscal registrars the device driver must be specified.

Figure 40. Selecting a fiscal registrar driver

If a real recorder is not available, you can use an emulator from 1C for testing purposes. An example of filling in the data is shown below in Figure 41.

Figure 41. Example of a completed fiscal registrar settings card

After connecting the fiscal registrar, it becomes possible to print checks, for example, from documents PKO or Payment card transaction.

Figure 42. Printing a receipt in the 1C program

This concludes our discussion of the topic of reflecting incoming and outgoing cash orders in the 1C 8.3 program.

Greetings readers. Let's continue to understand the work of the 1C Enterprise Accounting program 8.2.

We have entered, we will take care of the receipt of cash at the cash desk.

Cash is kept in the accounting account “50-Kassa”. Receipt cash orders are registered in the debit of the account in correspondence with the credit of the account, depending on the type of transaction and the source of cash receipt:

50/62 - payment from the buyer;

50/90 – retail revenue;

50/71 – return from an accountable person;

50/51 – receiving cash at the bank;

50/60 – return from the supplier;

50/66 – settlements for short-term loans and borrowings;

50/76 – settlements with other debtors and creditors;

50/75 – settlements for contributions to the authorized capital or entrepreneur’s contribution.

The rules for accounting for funds at an enterprise instruct the accountant to write out a cash receipt order for the amount received, write it down, print it, but not post it.

After depositing funds into the cash register, the cashier formalizes the transaction and enters a cash receipt order. The transaction is included in the cash transactions journal and the cash book.

Open the 1C Enterprise Accounting 8.2 program, main menu.

Cash desk – Receipt cash order – Add. We select the transaction type of the document, we have revenue, OK.

The number will be filled in automatically, the date of the document will appear on the current day. We select an analytical accounting account and enter the amount of cash receipts.

We fill in the details, select the cash flow item, the operating cash account, the correspondence of the loan account, in this case – 90.01.1 Revenue under the general taxation system.

Go to the menu item – Print. We fill in the name of the cashier handing over the trade proceeds, the basis for the payment, and the attached documents. Bottom menu - Print - Cash receipt order.

A cash receipt order is opened, warning that you must first record it. We confirm. We check the cash receipt order, if everything is fine, print it out and give it to the cashier.

After depositing cash into the cash register, a cash receipt order must be posted; this is done by the cashier.

The posting goes into the business transactions journal. In this case, it is 50/90.01.1 – Revenue.

Cash documents in 1C 8.3 are drawn up, as a rule, in two documents: Receipt Cash Order (hereinafter referred to as PKO) and Outgoing Cash Order (hereinafter referred to as RKO). Designed for registration in the program for accepting and issuing cash to the cash desk (from the cash desk) of the enterprise.

I'll start the review with PKO. As the name implies, this document formalizes the receipt of money at the cash desk.

In 1C Accounting 3.0, the following types of transactions can be executed using the PKO document:

- Receiving payment from the buyer.

- Refund of funds from the accountable person.

- Receiving a return from the supplier.

- Receiving funds from the bank.

- Repayment of loans and borrowings.

- Repayment of a loan by an employee.

- Other transactions for the receipt of funds.

This separation is necessary for the correct formation of accounting entries and the book of Income and Expenses.

First of all I want to consider Payment from the buyer, Return from buyer And Payments for loans and borrowings, since they are similar in structure and have tabular parts.

All these three types of software in 1C have the same set of fields in the header. This Number And date(further for all documents), Counterparty, Check accounting And Sum.

Get 267 video lessons on 1C for free:

- Number– is generated automatically and it is better not to change it.

- date- The current date. Here it should be taken into account that if you change the date to a smaller one (for example, the previous day) than the current one, when printing, the program will issue a warning that the numbering of sheets in the cash book is incorrect and will offer to recalculate them. It is desirable that the numbering of documents throughout the day is also consistent. To do this, you can change the time of the document.

- Counterparty– An individual or legal entity who deposits funds into the cash register. Let me immediately note that this field indicates exactly Counterparty, according to which mutual settlements will be carried out. In fact, money can be deposited into the cash register, for example, by an employee Organizations - Counterparty. It is selected from the directory Individuals in field Taken from. In this case, the printed form of the PKO will indicate the full name from whom the money was received.

- Account– in 1C postings, as a rule, account 50.1 is used (more details about the settings in the article -). The corresponding account depends on the type of transaction and is taken from the tabular part of the PKO.

Now I want to draw your attention to the formalization of the amount of money deposited. Payment from the buyer, Return from buyer And Payments for loans and borrowings cannot be executed without specifying the contract. Moreover, funds can be accepted simultaneously under several contracts. This is what the tabular section is for. Amount of payment is formed from the amounts in the rows of the tabular section. It is also indicated there Settlement account And Advances account(corresponding accounts). These accounts are configured in the information register .

Other types of operations should not present any difficulties. They do not have a tabular part, and the entire filling out of the PQS comes down mainly to the choice of the Counterparty. This could be an accountable person, a bank or an employee.

Other cash receipt transactions reflect any other receipts to the enterprise's cash desk and generate its own postings. An arbitrary corresponding account is selected manually.

Account cash warrant

Registration of cash settlements at the cash desk is practically no different from registration of cash settlements. In 1C Accounting, there are the following types of cash withdrawals:

- Issuing payment to the supplier.

- Issuing a refund to the buyer.

- Issuance of funds to an accountable person.

- Issuance of wages on a payroll or separately to an employee.

- Cash to the bank.

- Issuance of credits and loans.

- Carrying out collection.

- Issuance of deposited salary.

- Issuing a loan to an employee.

- Other operations for issuing funds.

Separately, I would like to focus only on the payment of wages. This type of operation has a tabular part in which it is necessary to indicate one or more pay slips. The total cash settlement amount will be the sum of the statements. Without specifying at least one statement, it will not be possible to carry out cash settlement.

To register cash register operations in 1C Accounting 8.3, the following documents are used: cash receipt and expenditure order. The journal for registering outgoing and incoming cash orders in 1C is located in the “Cash documents” item of the “Bank and cash desk” menu.

In order to create a new document, click on the “Receipt” button in the list form that opens.

The set of fields and transactions displayed directly depends on the value specified in the “Type of Operation” field.

Let's look at each type in more detail:

By default, the debit account is 50.01 everywhere – “Cash of the organization”.

Account cash warrant

To create cash settlements in the list of cash documents 1C 8.3, you must click on the “Issue” button.

The execution of this document is practically no different from receipt at the cash desk. The set of details also depends on the selected type of operation.

The only thing worth noting is that when choosing the type of salary payment transactions (except for work contracts), in the document you must select a statement for paying salaries through the cash register. The repayment documents also indicate the type of payment: repayment of debt or interest.

Cash balance limit

To set a cash register limit, go to the section of the same name in the “Organizations” directory card. We have it in the “More” subsection.

This guide indicates the limit amount and validity period. This functionality has made life much easier for accountants to comply with the law.

Cash book

The 1C:Accounting program implements the functionality of creating a cash book (form KO-4). is in the journal PKO and RKO. To open it, click on the “Cash Book” button.

In the report header, indicate the period (the default is the current day). If your program maintains records for more than one organization, it must also be indicated. In addition, if necessary, you can select a specific division for which the cash book will be generated.

For more detailed report settings, click on the “Show settings” button.

Here you can specify how the cash book will be generated and some of the settings for its design in 1C.

After you have made any changes to the settings of this report, click “Generate”.

As a result, you will receive a report with all cash movements at the cash desk, as well as balances at the beginning / end of the day and balances.

Cash inventory in 1C 8.3 Accounting

The procedure for conducting a cash register inventory is described in the order of the Ministry of Finance of the Russian Federation No. 49 dated June 13, 1995.

Unfortunately, in the 1C 8.3 program there is no cash inventory report in the INV-15 form. This request has already been proposed to the 1C company. Perhaps someday they will finalize the program, but for now accountants have to take inventory of the cash register manually.

You can download the form and sample of filling out INV-15 at.

The fastest and most effective way to solve this problem is to order processing for the formation of INV-15 from a specialist. This processing will not only save a lot of time, but will also reduce the influence of the human factor, which will avoid errors.

Training video

See also video instructions for recording cash transactions in 1C 8.3:

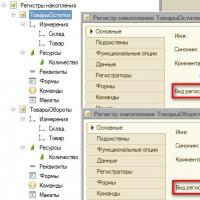

List of values of accumulation registers 1s

List of values of accumulation registers 1s Advance calculation in 1s 8

Advance calculation in 1s 8 GPC agreements Reception for GPC in 1s

GPC agreements Reception for GPC in 1s Month closing settings How to close a period in UP

Month closing settings How to close a period in UP Specialist consultations

Specialist consultations Accounting for fuel and lubricants in 1C: instructions for accountants Write-off of fuel and lubricants 1s 8

Accounting for fuel and lubricants in 1C: instructions for accountants Write-off of fuel and lubricants 1s 8 Issue an invoice in the 1s 8 program

Issue an invoice in the 1s 8 program