PCO erroneously allocated VAT when receiving a loan. Consultations with specialists. Payment is confirmed by a cash receipt

Question: A retail trade organization sells goods subject to value added tax (VAT) at a rate of 20%. Only total records of goods sold are kept. In this case, can the organization calculate VAT at the estimated rate?

Answer: Yes, it can, subject to certain conditions.

According to paragraph 2 of Art. 103 of the Tax Code of the Republic of Belarus (hereinafter referred to as the Tax Code), the amount of VAT is calculated as the product of the tax base and the tax rate.

At the same time, Part 1, Clause 9, Art. 103 of the Tax Code determines that payers engaged in retail trade and public catering can calculate VAT on goods based on the tax base and the share of the amount of VAT on goods available in the reporting period in the cost of these goods (including all taxes, fees (duties) ) and other obligatory payments to the budget or state extra-budgetary funds levied upon the sale of goods), including goods exempt from VAT.

The form for calculating VAT based on the tax base and the share of the VAT amount when selling goods at retail prices is given in Appendix 34 to the Resolution of the Ministry of Taxes and Duties of the Republic of Belarus dated December 24, 2014 N 42 “On some issues related to the calculation and payment of taxes and fees ( duties), other payments, the calculation and payment of which are controlled by the tax authorities.”

Organizations engaged in retail trade can evaluate purchased goods at acquisition cost or at retail prices (clause 8 of the Instructions for Accounting for Inventory, approved by Resolution of the Ministry of Finance of the Republic of Belarus dated November 12, 2010 N 133).

When accounting for goods at retail prices, information on trade margins (discounts, surcharges) on goods, as well as taxes included in the price of goods, is summarized using account 42 “Trade margin”. When goods are accepted for accounting, the amounts of trade margins (discounts, surcharges), taxes included in the price of goods are reflected in the debit of account 41 “Goods” and the credit of account 42 “Trade margin” (parts 1 and 3 of clause 33 of the Instructions on the procedure application of a standard chart of accounts for accounting, approved by Resolution of the Ministry of Finance of the Republic of Belarus dated June 29, 2011 N 50).

Columns 2 and 3 of VAT calculation based on the tax base and the share of the VAT amount when selling goods at retail prices are filled in based on accounting data for account 42 “Trade margin”.

In the absence of separate accounting of VAT amounts included in the price of goods, calculation of this tax when selling goods at retail prices is carried out at a rate of 20% (Part 3, Clause 9, Article 103 of the Tax Code).

Thus, a retail trade organization selling goods subject to VAT at a rate of 20% can calculate this tax on goods based on the tax base and the share of the amount of VAT on goods available in the reporting period in the cost of these goods, provided that the accounting for goods sold at retail prices and separate accounting for VAT included in the retail price of goods.

I.G.KORZHOVNIK,

center specialist

accounting analytics

LLC "YurSpektr"

24.08.2015

Copyright: (C) LLC "YurSpektr", 2015

Exclusive property rights to this

copyright material belongs to LLC "YurSpektr"

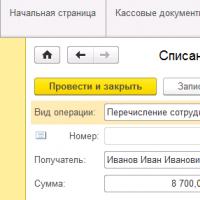

You can download the cash receipt order (CRO) form on our website:

We offer you to download the PQS form for free in the 2 most common file formats - Word and Excel. In this case, the already completed form is presented in Excel, located below.

However, downloading a cash receipt order is not all; you should make sure that this is the current form of the document.

NOTE! As of August 19, 2017, new rules for conducting cash transactions are in effect, which you can familiarize yourself with.

What requirements must the cash receipt order form meet?

On our website you can download the PKO form using Form KO-1 (corresponding to OKUD number 0310001), approved by Decree of the State Statistics Committee of the Russian Federation dated 08/18/1998 No. 88. Russian organizations are prescribed to use only this form by Bank of Russia Directive No. 3210-U dated 03/11/2011 .

For more information about what standards primary documents must meet, read the article “Primary document: requirements for the form and the consequences of its violation” .

NOTE! Individual entrepreneurs who, in accordance with the legislation of the Russian Federation on taxes and fees, keep records of income or income and expenses and (or) other objects of taxation or physical indicators characterizing a certain type of business activity, may not draw up cash documents and a cash book (clauses 4.1, 4.6 of instruction No. 3210-U).

How to fill out the PKO form

Downloading the cash receipt order form is the first stage of the task, and the next step will be to correctly fill out this document. A completed PQS sample may look like this:

A cash receipt order can be issued on paper or using technical means - the data is entered on a computer, then the PKO is printed and signed. In addition, the receipt can be issued in electronic form, provided that it is protected from unauthorized access, distortion and loss of information. In this case, the PKO is signed with an electronic signature (clause 4.7 of instruction No. 3210-U).

You can print out the completed sample cash receipt order and place it on the cashier’s desk along with instructions for filling it out, which we will provide below.

Filling out the PKO form: nuances

There are a number of nuances that characterize the procedure for filling out a cash receipt order form. Let's look at them.

The “Structural unit” column should be filled out only if cash is accepted from an employee of the organization. If they are transferred by another legal entity or individual, then a dash should be placed in the corresponding paragraph of the form.

The “Debit” and “Credit” items contain the accounts of the Chart of Accounts (approved by Order of the Ministry of Finance dated October 31, 2000 No. 94n) in accordance with the essence of the business operation.

The column “Purpose code” is filled in by organizations that use the appropriate coding system.

The column “Amount of rubles, kopecks” of the KO-1 form is filled in only with numbers, rubles and kopecks are separated by a comma (for example, “200.75”). In the “Amount in words” column, rubles are indicated in words (the first word is capitalized), and kopecks are indicated in numbers. You should also put a dash (if the document is filled out on a computer, then a continuous sequence of consecutive dashes) in the empty spaces of the corresponding column after indicating the amount in words.

If the company does not work with VAT, then in the “Including” column you should enter “Without VAT”. Otherwise - the corresponding VAT amount.

In the “Appendix” paragraph, you should record the primary documents that are the basis for entering figures into the PKO (for example, a cashier’s report).

In addition to the main part of the KO-1 form, you will also need to fill out a receipt, which is included in the structure of the PKO. The receipt will appear in the document on the same page as the main part of the form. As for affixing the seal, based on business customs, the seal is often affixed so that part of it is on the receipt, and the other part is on the PKO. Please note that in this case, claims from the tax authorities are possible. However, you can try to challenge them (see, for example, the decision of the Seventh Arbitration Court of Appeal dated 04/06/2010 No. 07AP-1517/10). In addition, today such disputes seem to us to be of little relevance, since in connection with the entry into force of the law of April 6, 2015 No. 82-FZ, the seal for organizations has ceased to be a mandatory requisite.

See also material Printing is not a mandatory attribute of the primary » .

The order must be signed by the cashier or other authorized person. The cashier checks the signatures of authorized persons on the PCO with the samples (except for the situation when the receipt is issued in electronic form).

If the document is filled out by an individual entrepreneur and does not hire a cashier, then the appropriate authority to sign the document is assigned to him. A receipt is issued to the person who deposited funds into the cash register.

NOTE! If you fill out the PKO electronically and sign with an electronic signature, then you can send a receipt to the depositor of funds at his request by email (clause 5.1 of instruction No. 3210-U).

From 08/19/2017, the cashier can issue a general cash receipt order at the end of the day for the entire amount of cash receipts, confirmed by fiscal documents - cash receipts and BSO online cash register (clause 4.1 of instruction No. 3210-U).

Results

A cash receipt order is a primary document drawn up on the unified form KO-1. The PQO is filled out when funds are received at the cash desk and can be in either paper or electronic form. In the latter case, the PCP is signed using electronic signatures.

Registration of a cash receipt order is an important element of cash discipline. It is filled out when cash arrives at the company's cash desk and always goes in conjunction with a receipt.

A cash receipt order can be issued in absolutely any situation: when money comes from the founder, when compensating for damage caused by employees of the enterprise, from the sale of company property, as payment for goods from the buyer, etc.

Since 2014, the execution of cash receipt orders, due to the simplification of the procedure for maintaining cash in organizations, has ceased to be mandatory; however, this document is still widely used there.

FILES

Rules for registering a cash receipt order

There is no unified sample of a cash receipt order, so each enterprise can develop its form at its own discretion or use a template. In recent years, it has become common for an enterprise to independently develop a PKO form, print it in a printing house, and accountants then fill it out manually. No less often there are situations when the form is filled out directly on the computer and then printed on a printer. Thus, an order can be drawn up either by hand or printed on a computer, but in any case, it must contain “live” signatures.

The document is signed by a specialist from the accounting department or an authorized employee, as well as by the cashier. It is not necessary to certify the form with a seal, since since 2016, legal entities, as previously and individual entrepreneurs, have the right not to use seals and stamps in their work.

The document is drawn up in a single copy and stored in the accounting department.

It should be noted that filling in pencil, just like blots, errors and corrections in the cash receipt order is unacceptable - this should be avoided, or, as a last resort, it is better to re-issue the document.

After filling out the cash receipt order, it is necessary to register it in the internal register of receipt and expenditure orders, and the receipt must be torn off along the dotted cut line and given to the person who deposited the money into the cash register.

Instructions for filling out a cash receipt order

The standard cash receipt order form can be divided into two parts.

Part one

The first includes name of company indicating its organizational and legal status (IP, LLC, CJSC, OJSC), as well as structural subdivision, which writes it out (to be filled in if necessary, you can put a dash). Also here you need to indicate OKPO organization code(all-Russian classifier of enterprises and organizations) - you can find it in the constituent documents of the organization.

Next, just below, opposite the name of the document in the appropriate cell, you should write it number for internal document flow, namely, the register of receipts and consumables (the numbering of receipt orders must be continuous), as well as the date of its completion.

Part two

The second part of the cash receipt order is the main one and includes information directly related to financial receipts.

- In column "Debit" you should enter the number of the accounting account, the debit of which includes the received cash (most often the number 50 is put here, i.e. “Cash”). This cell is optional, so you can leave it blank.

- Next in the column "Credit" you need to enter the code of the department or division to which the finances are allocated (you can also put a dash) and the number of the corresponding account, which reflects the receipt to the cash desk. Also, if necessary, you need to fill out the column "analytical accounting code"(but if such codes are not used in the organization, the cell does not need to be filled in).

- Then to the column "Sum" The amount of money (in numbers) received at the cash desk is entered.

- To cell "Destination Code" You must enter the destination code for the money received, but only if such codes are used in the organization.

- Below you need to indicate from whom exactly the money came (last name, first name, patronymic of the person), as well as the basis (here you need to enter the name of the business transaction, for example, “loan of funds”, “return of advance payment”, “payment under agreement”, etc. .)

- In line " Sum", again enter the amount of incoming funds, but in words. After making an entry, you must put a dash in the remaining empty field (to avoid falsification of the document). Here you need to highlight VAT, and if VAT is not used, then this should also be noted.

- In line "Application" details of attached primary documents (if any) are indicated.

In conclusion, under the document you need to put signatures of the chief accountant and cashier who accepted the money. The receipt is filled out in exactly the same way and then torn off along the cut line and handed over to the person who transferred the money.

Entrepreneurs who are required to maintain cash documents are regularly checked by the Federal Tax Service for completeness of revenue accounting. It is drawn up by the PKO, so we will consider several examples of filling out a receipt order, and penalties for their absence.

Standard forms of accounting documents were approved by Resolution of the State Statistics Committee No. 88 of August 18, 1998. According to the Maintenance Procedure, they are used for all cash payments. When funds arrive at the organization's cash desk, a cash receipt order is drawn up; we will explain with examples how to fill it out correctly so that there are no questions during verification.

PKO (Form No. KO-1) confirms the entry into the cash register, in other words, the posting of cash received:

- as a result of the provision of services, sale of goods, performance of work (revenue, including from separate divisions);

- return of the balance of money given to employees as compensation for damage caused;

- payment of a share in the authorized capital by a new participant in a limited liability company;

- as payment for sold property, equipment;

- withdrawn from the organization's current account for specific needs.

Thus, this document documents any money received at the cash desk, regardless of the source. Companies operating as payment agents fill out separate orders using clients' money and their own revenue.

PKO form and filling procedure

Cash orders are drawn up in a single copy. Marks or corrections are not allowed in it; if it is damaged, you just need to fill out a new one. Usually it is written out by the chief accountant, but such a duty can be assigned by the job description to any employee. In their absence, the manager does this. A sample of filling out a cash receipt order is shown in Figure 1.

The form is divided by a tear line into two parts, the left one remains in the organization, and the receipt is returned to the depositor. Filling features:

- The full name of the organization and structural unit is entered if it has its own cash desk that accepts money.

- The OKPO and OKUD codes assigned during registration are indicated.

- The number corresponds to the serial number in the registration log (form No. KO-3). They are filled out sequentially, from the beginning of the calendar year.

- The date of compilation coincides with the day of transfer of money, written in the format 00.00.0000 in Arabic numerals, for example: 03/01/2015.

- Structural unit code, indicated if available; destination code - when funds are received from the account for a specific purpose.

- In the columns “Debit” and “Credit” the corresponding accounts are entered to reflect the transaction being carried out.

- In the “Accepted” line, indicate your full name in the genitive case. If the money came from an account - the name of the bank and the details of the cashier or another company.

- The foundation is a business transaction. Document details (name, number, etc.) must be indicated in this line. If they are attached to the receipt and stored with it, then the data is entered in the “Attachment” line. They must be canceled with a “Received” stamp indicating the date.

- The amount is written in words, but do not forget about cash discipline: it cannot exceed 100,000 rubles. Accepting several receipt orders for a total amount greater than permitted will also be a violation.

- “Including” - the VAT amount is indicated in numbers, except in cases of depositing money from a current account or from a sub-report. Organizations that are not payers of this tax, as well as if a service or product is not subject to it, make the entry: “Without VAT.”

All empty spaces in the lines are supplemented with a dash. When accepting money, the cashier checks the signatures with the available samples, the presence of supporting documents, and the correspondence of the indicated amount with the actual amount. The receipt is signed and certified by a seal, which is usually affixed so that part of it remains on the form of the cash receipt order. If errors are found, the receipt crosses them out and returns them to the accounting department. It is allowed to issue one PKO for the total amount of daily revenue at the end of the working day on the basis of strict reporting forms, cash register tape, if the organization works using cash register systems.

The following reasons may be given for the receipt of cash:

- payment for shipped products according to the invoice;

- payment for work performed according to the act;

- compensation for material damage by court decision (order);

- making an advance payment under the contract;

- return of unused funds issued for reporting;

- compensation for identified shortages based on an audit or order.

How to fill out a cash receipt order in this case? Let's give a sample.

If there is no PQR or it is filled in with errors

Compliance with the requirements for processing cash transactions is verified by the tax authorities, including: completeness of receipt of revenue. For violation of the order, administrative fines are provided: for individual entrepreneurs up to 5,000, for organizations - up to 50,000 rubles (Articles 14.1, 15.1 of the Administrative Code).

Be careful! Shortcomings in the document flow procedure do not relate to financial violations. They are considered according to the rules of Article 120 of the Tax Code of the Russian Federation, and punishment may follow for gross neglect of the rules for accounting for income and expenses (fine up to 30,000 rubles).

The following are considered rude: absence of primary documents, including orders, invoices, invoices; incorrect reflection of business transactions on accounts. Errors in filling out, if they did not result in, for example, incomplete posting or accumulation of an excess balance in the cash register, do not apply to them.

An example from judicial practice. (case No. A52-2365/2010, Resolution of the FAS SVO dated 02/07/2011).

During an inspection by the Federal Tax Service, incorrectly executed receipt orders were discovered: without the signature of the chief accountant, cashier, and with receipts. A fine of 40,000 rubles was imposed on the organization, based on Article 15.1 of the Administrative Code. When challenged in the Arbitration Court, it was found that the incorrect execution of the PKO, in this case, did not lead to violations of financial accounting. The decision was made in favor of the legal entity.

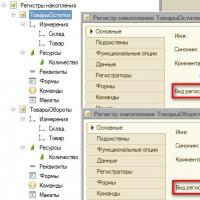

List of values of accumulation registers 1s

List of values of accumulation registers 1s Advance calculation in 1s 8

Advance calculation in 1s 8 GPC agreements Reception for GPC in 1s

GPC agreements Reception for GPC in 1s Month closing settings How to close a period in UP

Month closing settings How to close a period in UP Specialist consultations

Specialist consultations Accounting for fuel and lubricants in 1C: instructions for accountants Write-off of fuel and lubricants 1s 8

Accounting for fuel and lubricants in 1C: instructions for accountants Write-off of fuel and lubricants 1s 8 Issue an invoice in the 1s 8 program

Issue an invoice in the 1s 8 program