Month closing settings. Month closing settings How to close a period in UP

Most entries for income or expense are made when the corresponding primary documents are entered into 1C. But there are operations that need to be done with a certain regularity, for example, once a month or quarter, and you can set a clear algorithm for such calculations. In this case, we will be helped by the Month Closing processing, which will automatically perform the necessary calculations. This article, using the example of the 1C Enterprise Accounting 8.3 configuration, will provide step-by-step instructions for closing the month*.

It should be noted that many parameters of exactly how the month will be closed are set in the Accounting Policy settings. We will not consider all the features of its configuration; we only recommend that you pay attention to filling it out correctly to obtain correct results.

*Since the article will show different situations, the pictures will not be related to each other by one period and the name of the organization.

Operation Closing the month in BP 8.3

The operation “Closing the month” is located at the “address”: Operations – block Closing the period – Closing the month.

If an organization or accounting policy is not specified, then you can see all the available items that may be available when closing the month. Let us immediately note that such an assembly cannot take place in one organization, because the choice of options depends on the taxation system, accounting policy settings and pre-entered primary documents.

As you can see, processing for closing the month in 1C BP 8.3 contains four blocks that must be “passed” sequentially.

Here you can also preliminarily track the dynamics of document processing over time: if any document was reposted retroactively, before closing the month, the program will offer to reschedule all subsequent ones.

On the bottom panel you can see a hint on the status of completed operations, of which the one carried out without errors will be colored green, the erroneous one red, etc.

Closing the month in 1C 8.3 Accounting must be the last operation for the month. But in the list of allowed operations you can see Payroll calculation and VAT regulations, But usually the salary has already been calculated and consolidated by the end of the month, so you don’t want to touch it by re-posting it. The same goes for creating a book of purchases and sales. What to do?

1C foresaw this turn of events. And if Payroll calculation and creation of purchase and sales books have already been made for the month, they will not be recalculated and reposted. Next to these operations, a pencil symbol will appear next to the checkbox indicating that the operation could be edited manually.

If salary calculation has not been carried out, but employee salaries have been established, when the month is carried out, salaries and contributions will be calculated automatically based on salaries. There are situations when there is really no need to accrue wages for a period. Then either open the generated salary and reset the amounts to zero, or first create an empty payroll document.

It should also be noted that the available points at the end of the month depend on many factors. For example, regulatory documents on VAT appear at the end of each quarter, and balance sheet reformation occurs in December. If the company does not have fixed assets or does not need to write off the cost of workwear, then such operations will not be on the list of available ones. As soon as the situation changes, the number of items processed at the close of the month will increase.

If you need to cancel the month closure, there is a special button for this. In this case, operations marked as manually adjusted will remain completed.

Let's look at a situation where, despite the warning about the need to re-post the documents, they simply canceled the month closure and decided to do it again. An erroneous depreciation item has appeared. By clicking the mouse, you can call up the context menu and view errors.

In this case, they offer to retransmit the documents. Please also note that the operation to close the month is performed on the last day of the period, indicating the time - 23:59:59.

Note that within the first block, operations were carried out independently of each other, but since one of them was erroneous, the further closure of the month was not formed.

If we decide to repost previous periods, then correctly completed transactions will change their status from Done on Needs to be repeated.

All generated certificates and calculations can be viewed by clicking the corresponding button. There is also a button it will not show anything new, there are no detailed calculations for it, only the statuses of operations that are already clearly visible.

Let's consider certain types of calculations when closing the month. We have seen the depreciation entries; they are calculated depending on the residual value and useful life that were indicated for each fixed asset.

Block 1

There is a point here Adjustment of item cost. Before calculating the cost, the cost of the item must first be correctly calculated. This becomes especially relevant if materials are written off for production at average prices, and during the period there were several receipts at different prices. Or, in addition to the cost of materials, there were additional expenses that were not carried out immediately, but the materials had already been written off. Then their cost should be adjusted.

For example, in a month there were two receipts of materials (sewing threads), the quantity in both cases is the same. Price pcs. in one case - 30 rubles, in the second - 40. The average price should be 35, but before the second receipt it is 10 pcs. have already been written off for production. Then, at the end of the month, the cost of written-off materials will be increased.

Sometimes in such a situation, reversing entries are possible.

This block is associated with the calculation of the share of write-off of indirect expenses. The fact is that, according to the Tax Code of the Russian Federation, some expenses may not be taken into account in full, but depending on a certain base. For example, sometimes advertising or entertainment expenses are subject to rationing, etc. In 1C, all such types of expenses are considered indirect. They should not be reflected on account 20; this may lead to errors in tax accounting. In our case, we show an option where advertising costs amounted to 5,000 rubles, but you can only accept a thousand. The calculation certificate will show this situation.

Here we move on to closing costly accounts. At this moment, the cost price is calculated, the actual cost of the finished product is adjusted, and the

level of cost of sales. Perhaps this is the most important and voluminous item of all when closing the month. In this case, the formation of transactions will be affected by the accounting policy settings in the accounting system, as well as the list of direct and indirect expenses for the accounting system.

Note that the largest number of errors usually occurs when closing these particular accounts. Thanks to 1C prompts when closing, you can find the erroneous document and make a correction. Most often, errors are associated with incorrect use of nomenclature groups. For example, costs were reflected in one product group, and production or sales were carried out in another. Or some costs must be distributed, but there is not enough data for automatic distribution. For example, they did not indicate a product group or cost item, or there is no revenue, but it is the base. After making changes, you must close the month again.

The final result of closing the month will be the calculation of income tax. After the month is closed, accounts 25 and 26 should be closed in accounting. The 20th may remain for the amount of work in progress. If there is no incompleteness, the 20th account should also be closed. For accounts 90 and 91 there should be no final balance at the upper level, but the expanded balance for subaccounts is reflected throughout the year.

In tax accounting under account 26, there may be a difference in the amount of indirect expenses, which are calculated in the second block of closing the month.

When reforming the balance, accounts 90, 91, 99 are closed, transferring the financial result to account 84. If the balance on the account. 84 credit, a profit is made, if debit, a loss.

When there is a loss at the end of the year, you will have to manually enter an additional operation before reforming the balance sheet. For example, at the end of the year a loss of 200,000 rubles was received. Since in NU this amount can be written off in the future when making a profit, IT arises and the need to take these amounts into account somewhere for NU. In accounting, account 09 will reflect 20% of the loss amount with the “Current period loss” analytics, and 80% of the amount (160,000) will be seen in DT 84 as a loss. Moreover, next year on account. 09 the amount should be designated as “Deferred expenses”. If you do not enter additional manual entries in December, you will receive an error when closing January of the next year.

Create a manual operation. According to the hint from 1C, we transfer analytics from account 09 to BU Current period loss on Future expenses(analytics are selected from reference books).

For account 97 in the accounting system (we do not change the accounting system), we record the amount of the loss. Different sources mention different subaccounts of account 97 for this operation, in our case the most suitable one is 97.21. One of the types of subconto according to Article 97 may be subdivisions; they should not be indicated in this operation.

We create a new type of expenses, the name is arbitrary, Type for NU from the directory - Recognition of expenses is in a special order. We set the write-off period, in our case – 10 years, starting from the next year. You can specify the amount and comment as a hint.

As noted above, according to account 97 we do not enter the amounts in the accounting book; we indicate the amount of the loss in the accounting book. To comply with the rule BU = NU + differences, according to the type of BP we set the amount of loss with a minus.

After this we carry out a balance sheet reformation.

In January of next year there will be no errors in tax calculation, and in Block 4 At the end of the month, a clause will appear about writing off losses from previous years. If they make a profit, they will begin to be written off.

We looked at the main points when using Month Closing processing in 1C Accounting 8.3. It should be noted that on our information resource you can find more detailed articles on accounting for those operations that are involved in closing the month, for example, accounting for fixed assets or work clothes, calculating property or profit tax, calculating cost, etc.

This article will discuss the main features of performing routine operations of the month, taking into account the settings of accounting parameters, as well as a description and practical elimination of the main errors that arise at the end of the period.

Let's start with a detailed look at the month-end closing business process.

All business transactions have already been entered into the information base, and a number of regulatory procedures must be completed. Regulatory operations can be divided into corrective, settlement and ensuring the correct maintenance of accounting and tax records.

The first include, for example, procedures for restoring chronological sequence. During the month, when business transactions were entered into the information base, the correct sequence of recording accounting documents could be disrupted, which could distort the financial result. To prevent this from happening, there is a special regulatory procedure for restoring the correct sequence of recording transactions.

Calculation procedures ensure the correct calculation of indicators in accounting and management accounting, for example, cost calculation.

Other procedures are responsible for complying with accounting and tax rules, such as creating ledger entries for purchases and sales. All operations are carried out separately according to regulatory documents and strictly in a certain sequence.

Setting up a month-end closing procedure

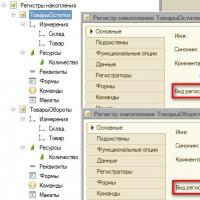

Let's consider the period closing scheme. It is presented in the form of a business process. The month-end closing mechanism is available from the “Accounting and Tax Accounting” and “Accounting Manager” interfaces.

Before starting the procedure, you need to make a setup. Settings for the month closing procedure can be found in the Month Closing Settings reference book. We indicate the period and select the tax system option. All settings are specified regardless of organization.

On the first tab, checkboxes indicate the operations that will be performed (). For example, if no organization makes payments in foreign currency, then there is no point in carrying out a currency revaluation operation.

Rice. 1

Having marked the necessary operations with the checkboxes, let's go to the second tab Scheme. It shows the business process diagram, the sequence of operations performed, as well as active and inactive users responsible for these procedures. You can assign a responsible person on the Responsible tab or by right-clicking on the operation block in the diagram and selecting a user.

The VAT calculation scheme is indicated separately.

On the Cost Allocation tab, you can specify the cost allocation methods for calculating costs. For correct distribution, the correspondence of the Divisions to the Divisions of the Organization in the “Divisions” directory is also indicated.

Running a procedure

The monthly closing setting has been created, now you can start launching the procedure itself. Let’s go to the menu item “Routine Operations” and select the item “Month Closing Procedure”. Here we indicate “Organization” and “Settings”. The characteristics to be reflected in accounting, tax and management accounting will be set themselves depending on the month-end closing settings if you click on the “Load settings” button.

So, everything is ready to launch. We press the “Start procedure” button and click on the “Routine operations” button, we will see that the user has automatically received a task, according to which he must draw up the regulatory documents necessary at this stage.

After completing a stage, the program automatically moves on to the next one. Some steps can be performed in parallel.

After all tasks are completed, the procedure is considered completed.

Stages of performing routine operations

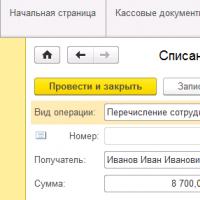

After starting the month-end closing procedure, the system will assign the first task to the person responsible. He will be able to see it from the Regular menu item by switching to the “Accounting and Tax Accounting” interface.

To complete it, the user needs to create and post the documents that the program will offer him at this stage ().

Rice. 2

After the documents are generated and verified, you can mark the operation as completed so that the system moves on to the next task. All necessary documents at the end of the period can be created manually separately from the business process, but it is more expedient and more convenient to generate and check directly from the form of regulatory operations, because it is very easy to get lost in the sequence, which can subsequently lead to a distortion of the result.

Let's consider the main operations included in the month-end closing procedure.

Additional documentation

If the program uses a deferred posting mechanism, then at the end of the month the “Additional posting of documents” processing will be launched so that the documents are posted to all registers. If there is a large document flow, this processing runs regularly.

In the “Delayed Posting of Documents” journal, you can see those documents that are subject to the follow-up mechanism. Using the operation “Actions -> Post completely,” the document is posted to all registers.

Restoring the state of calculations

If the accounting policy of the enterprise indicates that advances are offset by the “Restoring the sequence of calculations” processing, then at the end of the period this processing is launched. It can be found by switching to the “Accounting Manager” interface and the menu item “Routine operations -> Restoring the sequence of calculations.” Processing restores the correct sequence of documents for offsetting advances. After using it, the receipt and sale documents will not be reposted, otherwise the entry for offsetting the advance will disappear.

Restore batch accounting sequence

If the program uses batch accounting, then when writing off batches, you can facilitate the work of the application solution by postponing the write-off in management and regulated accounting and launching special processing at the end of the month, which will process documents through the batch accounting registers. To do this, uncheck the boxes in “Accounting parameters settings -> Write off batches when reflecting documents” and start the “Post by batch” processing. Even if documents were entered retroactively, running this processing is also useful, because it restores the batch accounting sequence.

Adjust the cost of writing off inventories

Used for batch accounting. When posting the document, an adjustment is made to the cost movements according to batch accounting for the month. The adjustment is necessary for: calculating the weighted average cost of writing off batches when using the “By average” method of assessing inventories, as well as taking into account additional costs for the purchase of goods capitalized after writing off the goods.

Calculate depreciation of fixed assets

From the form of a regulatory operation, by clicking on the “Create documents” button on the last day of the month, the document “Depreciation of fixed assets” is automatically created. Next, you should carry out and see the result.

If for some fixed assets the depreciation method is used in proportion to the volume of production or according to uniform depreciation rates, then the document “Development of fixed assets” is first filled out.

Calculate depreciation of intangible assets

The amounts of depreciation and write-off of R&D expenses are calculated when posting the document “Depreciation of intangible assets”. Similarly, if depreciation is calculated in proportion to the volume of products produced, then the volume of products produced in that month should be indicated.

Pay off the cost of workwear

At this stage, the document “Repayment of cost (working clothes, special equipment, inventory)” will be created; during this process, part of the cost of work clothes and special equipment that was not fully repaid during commissioning will be written off.

Write off RBP

When posting the document “Write-off of deferred expenses”, part of the expenses of future expenses is transferred to current ones. The amounts and accounts to which this part will be written off are indicated in the RBP directory.

Calculate insurance costs

The document is intended for writing off future expenses for voluntary insurance of employees in accounting (76.01.2 “Payments (contributions) for voluntary insurance of employees”) and tax accounting (97.02 “Future expenses for voluntary insurance of employees”).

Revalue currency funds

Using the document “Revaluation of Currency Funds”, amounts in the management accounting currency are revalued according to the cash registers and mutual settlements with counterparties and accountable persons.

There is a separate scheme for calculating VAT. On the “VAT calculation scheme” tab, the operations that should be performed are noted. The program itself will create the necessary documents, offer to fill them out and post them. The application solution automatically generates reporting forms: purchase book, sales book, VAT declaration. All regulatory transactions are stored in a journal (the “Accounting and Tax Accounting” interface, menu “VAT -> VAT Regulatory Documents”).

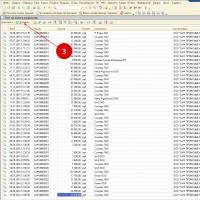

The document “Calculation of cost” is generated for each type of accounting separately; if it is necessary to calculate the cost for all types of accounting, then we carry out several documents (for management accounting and accounting and tax accounting). This document calculates the actual cost of writing off inventories as expenses, writes off materials from work in progress, distributes general production and general business expenses for production () Used only for advanced cost accounting analytics.

Rice. 3

Cost calculation consists of the following operations:

- If the accounting of goods and materials is maintained on a separate account, then “Distribution of goods and materials” is performed.

- A list of services is determined according to the documents “Sales of goods and services”, the cost of which will be calculated.

- Calculation of the cost distribution base - distribution methods are specified in the information register “Methods of distribution of cost items” or from the directory “Cost Items” for each item separately. The calculation of all bases over which expenses will be distributed is performed. The calculated bases are recorded in the information registers “Cost distribution base” and “Cost distribution base (accounting)”

- Distribution of expenses by base - after calculating the base, expenses are distributed among the cost of finished products and services.

- Calculation of actual cost - a total estimate of the cost of inventories is performed.

- Formation of movements in accounting registers (for regulated accounting) and the cost of fixed assets (for management accounting).

Generate financial results

The document “Determination of Financial Results” makes entries to close accounts 90 and 91. The document can be reflected in accounting and tax accounting. When reflecting a document in tax accounting, the operation of writing off losses of previous years can be performed.

When closing the 90th account, a posting will be generated reflecting the profit or loss. When closing the 91 account, the financial result for other types of activities will be calculated.

Calculate income tax

Using the document “Calculations for income tax”, you can calculate permanent and deferred tax assets and liabilities in accordance with the norms of PBU 18/02 “Accounting for calculations for income tax” and calculate income tax. You can use this document to enter balances for deferred tax assets and liabilities.

Close the year

The “Year Closing” document is carried out only in December of each year. As a result, all balances of subaccounts of accounts 90 and 91 of accounting are written off to the corresponding subaccounts with code 99. All balances of subaccounts of account 99 “Other income and expenses” are written off to account 99.01.1 (2), and the balance of this account is written off to account 84 " Retained earnings (uncovered loss)."

With the operation Closing tax accounting accounts, all balances of tax accounting accounts that are not intended to reflect the value of assets are written off.

Every month, accountants need to establish what the results of the organization’s activities are (Profit, loss). To do this, in 1C you need to close the month. Also, the correctness of report generation depends on the correctness of his work.

As a result, those accounts that should not have a balance at the end of the month are closed, for example, account 26. Expenses for the current month are transferred to subaccounts 90 and 91.

Processing “Closing the month” in 1C 8.3 allows you to step-by-step automate routine operations that need to be performed at the end of the month. These include calculations for, formation of a book of purchases and sales, calculation of shares of write-off of indirect expenses and much more.

This processing is located in the “Operations” - “Month Closing” menu.

The figure below shows all the operations performed by this processing.

Depending on the taxation system used by the enterprise, accounting policies, etc., only some of these operations will be available to you. Also, the set of operations depends on what period needs to be closed - month, quarter, year.

It is very important to follow the sequence of operations performed when closing the month. Otherwise, mistakes are inevitable. Let's look at step-by-step instructions for closing a month in 1C 8.3.

First of all, before you start closing the month in 1C 8.3, you need to. You can find it by following the hyperlink of the same name in the “Organizations” directory element card.

In this article, we will not consider this functionality in detail. You can read more about setting up your accounting policy in the article.

Processing "Month Closing"

In this example, we will look at an example of closing a month for an organization with a general taxation system. The list of actions performed when closing a month is shown in the figure below. In this case, a book of purchases and sales will be additionally formed, since the second quarter is closing at the same time.

Step 1

This operation is formed by the accountant monthly using the “Payroll” document. You can view transactions by left-clicking on the corresponding line in the “Month Closing” processing.

In our example, the following movements were formed:

The next step is to calculate depreciation and create the corresponding entries.

If the organization makes any payments in foreign currency, the currency will be revalued at the current rate.

Step 2

The next step will be to calculate the share of write-off of indirect costs. In this case, the program makes intermediate calculations to close cost accounts (20, 23, 25, 26, 44).

Step 3

In this step, cost accounts are closed: 20, 23, 25, 26, 44. Be careful when performing these operations. They influence. In our case, the posting is made on account 90.

Step 4

At the end, accounts 90 and 91 are closed, as well as income tax is calculated.

If the year is closing, then in 1C there will also be a balance reformation operation.

Conclusion

It is very important to follow the established sequence of documents and routine operations. Most errors occur when closing accounts. To find the reasons, you need to check whether analytics is installed everywhere and whether the sequence of document processing is followed. In more complex situations, it is necessary to carry out an in-depth analysis of the relevant account cards.

Preparation for Month Closing and Cost Calculation itself is the most difficult process, for which there are still not enough methodological materials. It is difficult to remember all the subtleties, especially when the period is closed not every month, but once a quarter.

What is useful to remember when closing the month with the method of allocating general and production expenses on account 20 to the actual cost of production.

If you use RAUZ and not batch accounting. If you do not calculate the salaries of the main workers on a piece-rate basis, but you want it to be adequately distributed among the products produced. If you decide to distribute accounts 25 and 26 in proportion to the planned cost of manufactured products by product groups. If you understand what a product group is and have filled out the directory so that a product group is a specific product manufactured by the company. Then check the following:

- In accounting, remove the method of distributing general business expenses using the direct costing method.

- You should understand which costs should go to which accounts.

As of 01/20/1 The account should include direct production costs: materials and components from which the products are made, salaries of the main workers (mechanic, installer, etc.), costs of third-party modification and external production services (painting, cutting, engraving, etc.) . It is also allowed to write off travel and excess daily allowances to account 20, if you can attribute them to a specific nomenclature group and division. All costs should go only to those divisions that will produce something (these are divisions with the attribute “Main production” or “Auxiliary production”. There should be no planning dispatch departments or accounting departments here, these are all others). Otherwise, the unfinished piece will hang there forever.

As of 25.01 the account should include direct general production costs and only those divisions for which there is or will be production (Main and Auxiliary). Only then will these costs be transferred to the 20th account for specific issues or will they fall into the work in progress when closing the month. This could be depreciation of machines, write-off of tools (soldering irons for installers, files for mechanics, cutters for turners), write-off of workers' clothing or lubricants, equipment repairs, salaries of craftsmen assigned to specific production departments, etc. All these expenses will be transferred to account 20 by department as it is. Unless they are spread across the released item groups depending on the cost distribution method selected in the month closing setting.

As of 25.03 the account should include indirect general production costs, which will be proportionally distributed across all divisions, no. groups, releases. Costs for other departments should be collected here. Depreciation of industrial buildings, depreciation of computers of production services, salaries of production management personnel, repair of elevators, etc.

On 26.01 and 26.03 Cost invoices should come in the same way as invoices 25. That is, everything that is on January 26th is transferred to production departments. For example, removal of mechanical production chips, water and electricity for the foundry. Such costs should be charged to the 20th account in specific departments and then spread out only among product groups. And on March 26, we drop all general business expenses, which we will spread across all products produced and across all departments. Depreciation of a garage, warehouse and other buildings, depreciation of computers for planning and economic services, water, electricity, Internet, elevator repairs, garbage removal, etc.

If overhead costs are accrued methodically incorrectly, you can transfer them manually using the “Adjustment of other costs” document.

- Set up a directory of departments. There should be no divisions of organizations that do not belong to any division. As well as to several at once. If you have one company, then the directories should be configured one to one. If there are several, then understand it this way: divisions are what you understand as a division for the entire organization. For example, in one of your company there is a Division of the organization “Garage No. 1” and “Garage No. 2”, and in another of your company there is a Division of the organization “Transport Shop”. Doc, everyone is used to thinking that everything is “Transportation Service”. Create such a division and indicate that it includes both garages and a transport workshop.

- Document production releases with the documents “Production Report for a Shift”. The document indicates what products are released into the warehouse and what materials they consist of. You can also indicate other costs there. These materials, like other costs, must be listed in the department at the time of release. You can write off materials to a department using the “Request-invoice”. use the “Cost Accounting Sheet” report to track negative balances in the department and control the work in progress for materials:

- Use the “Inventory Accounting Sheet” and the “Cost Accounting Sheet” to track and eliminate negative balances in warehouses and production. To do this, in the opened ones, remove all selections and set the selection: Props - “Final balance quantity”, Comparison type: - “Less”, Value - “0”. You will see which documents registered the negative balances.

- All release documents must be carried out according to tax accounting, even if it is not provided (for example, in cases of manufacturing products from customer-supplied raw materials).

- All released items must have planned prices. Those that have the “Planned” attribute in the price type. Moreover, the date of planned prices must be no later than the beginning of the quarter being closed. If the Issue was on March 1, and the price was set on March 2, then nothing will happen. Prices are set in the documents “Setting Item Prices” and are stored in the information register “Item Prices”.

- To see the plan/fact and generally analyze the cost, you should keep records of production. Otherwise, it will just be a cauldron of costs by item groups.

- In all receipts of services, enter item groups, cost items, and the department receiving the costs. If these are production costs, for example, third-party modification, then you should remember that the costs must fall into the division for which the releases will be issued, otherwise these costs will never leave the 20th account.

To check whether the necessary details are filled out everywhere and whether they are filled out correctly, you can use the “Universal report (on documents, directories, registers)”. Open this report, select the object of analysis “Document”, indicate the type of document and the tabular part on which we will conduct the check. For example, we need to track which documents did not indicate item groups. Let's use the following setting. In line groupings we will display a link to the document, and in selections we will set restrictions by date, organization and empty item group:

- In all implementations, enter nomenclature groups corresponding to the products of the enterprise.

- Enter nomenclature groups in requirements and releases.

- Check that all production documents (receipts of services, requirements, production reports) indicate divisions belonging to the organization and having the attribute “Main production” or “Auxiliary production”. And these should be the divisions for which production is issued.

- Make sure that the costs from third-party modifications go to the departments in which the releases of these products are issued. Otherwise, these costs will remain hanging on account 20 and will not be written off anywhere.

Let us again turn to the report “Universal report (on documents, directories, registers)”. Let's select the document and the tabular part, and in the settings we will set the row groupings: first "Organizational unit", then "Link". In selections, we will set restrictions on date, organization and cost item. Also, in order to filter out documents whose tabular part “Services” is empty, you can set the selection “Line number” is not equal to zero, which will mean that there must be at least one row in the tabular part.

- It is necessary that there are no expenses not linked to departments (this happens due to advance reports where the necessary details were not filled out).

- If in the month-end closing setup in the cost distribution table, at least one line indicates an item group, or there are distribution methods that are considered simple (this method has the Use Simple Distribution attribute), or methods of distribution of cost items with Distribution Base Type = Tabular or SKD are used, then the information register It is useless to fill out methods for distributing Cost Items; the program will not even look at it. In other words, if you distribute costs in proportion to the planned cost of production, then the program will not look at the information register.

- If you reflect production activities with “Shift Production Reports” ( Using “invoice requirements” you write off materials for production from warehouses, and then in “Shift Production Reports” you indicate what materials the products were made from), then in the month-end closing setup in the cost distribution table for the cost item “Materials and semi-finished products”, specify the “Do not distribute” method. Otherwise, at the end of each month you will not have unfinished materials. Everything that you put into production over the course of a month, even if the products have not yet been released, will be spread across the products that you did manage to release.

- After each cost price, it is necessary to repost the documents of the next closed period. Otherwise, those adjustments and prices and transactions that appeared, which were made by the cost calculation, will not take part in subsequent documents. Thus, if you are closing a quarter, first do a cost calculation for January. Then post the February documents and make a cost calculation for February. Etc.

List of values of accumulation registers 1s

List of values of accumulation registers 1s Advance calculation in 1s 8

Advance calculation in 1s 8 GPC agreements Reception for GPC in 1s

GPC agreements Reception for GPC in 1s Month closing settings How to close a period in UP

Month closing settings How to close a period in UP Specialist consultations

Specialist consultations Accounting for fuel and lubricants in 1C: instructions for accountants Write-off of fuel and lubricants 1s 8

Accounting for fuel and lubricants in 1C: instructions for accountants Write-off of fuel and lubricants 1s 8 Issue an invoice in the 1s 8 program

Issue an invoice in the 1s 8 program