Payroll in 7.7

ZiK 7.7 is gradually fading away. But perhaps some of us will still have to deal with this configuration more than once again. Since there is less and less work on it, knowledge about it and experience are gradually fading away. I don’t want to lose my 14-year-long experience with the ZiK 7.7 just like that.

In this article, so as not to forget, I will write down important points about this configuration, so as not to forget myself, and suddenly someone will inherit this for maintenance and will be forced (there is no other way to say it) to maintain it.

Or, you can also consider this article as the now fashionable “Letter to yourself in the past.”

- ZiK is still alive and regular configuration updates are released. This is good. However, there are not always rules for exchanging with other configurations.

- Briefly about the essence of wages. I'll be as brief as possible. Everything is done in the end to obtain a “payslip” report - this is a report showing how much has been accrued and withheld for each employee, and the “Accruals Settlement” report is an analogue of a payslip, but summarized for all employees. There are generally two types of settlement movements - accruals and deductions. Accrual - this can be “salary”, “bonus”, various allowances. Deductions are professional contributions, income tax, etc. Also, deductions can conditionally include payment of wages. As a result, simple arithmetic: initial debt + accruals - deductions = final debt (balance). Salaries are usually calculated monthly.

- From a technical point of view, there are two periods in wages - the “settlement period” and the “action period”. Just remember this.

- In ZiK, for normal calculation it is necessary to “open a period”, or “make a transition to a new period”. In this case, all movements in old periods become available only for viewing, and it is no longer possible to correct the calculation results in the usual way. That is, before the start of a new billing period, for example, when we want to calculate the salary “for January”, we need to make sure that “January of this year” is “open”.

- If you suddenly need to adjust the records of an old period, you need to remember this. There are two types of edits: a) retroactive edits, when we simply correct the records of an old period because they differ from our paper records. This is the only reason why the calculation is corrected retroactively. b) corrections for the current period, when it is discovered that the calculation of the previous period was incorrect, but everything agrees with the papers, and the reporting has already been submitted and signed. That is, it is impossible to edit retrospectively, therefore, in the current period, corrective records of the previous period are made. For example, in January we make an adjustment “for December of that year.” To correct it “retroactively”, check whether the old period is still open, or whether a “change to a new month” has already been made. If the old period is open, everything is clear, we adjusted it, and moved on. If the period is “closed”, then you can open it in the standard way, but this is fraught with serious consequences - the records of the old period being opened will be marked as “not calculated”, and they will have to be recalculated. This is very bad, since the accountant often and haphazardly makes adjustments to calculations (and then does not remember this), as a result of which recalculation cannot be done just like that - manual adjustments will be lost. Use the “Soft Rollback” treatment to go to the old period, and then “roll back” to the current period. For example this http://infostart.ru/public/14760/

- You cannot correct the base of calculation types and accruals if they have already been used (this applies to secondary calculation types such as “Bonus”, etc.). This is important for calculations “on average” - all sorts of sick leave, vacation pay, “downtime”, etc. After this, all this will begin to be considered incorrectly, taking into account adjustments. If it turns out that the database was configured incorrectly, it is better to create a new type of calculation, and “close” employees’ accruals for the old type of calculation and add them a new created type, which is already configured “correctly in a new way.”

- Directory "Employees". If an employee was fired and is hired again, you cannot create a new directory element, you must use an existing one (this is a feature of ZiK 7.7, in 8 versions everything is the other way around), otherwise there will be errors when the only acceptable and correct option when duplication is needed is to accept the same the employee himself, already working, for a position as a part-time worker. Then two elements should appear in the directory. If you look at it from a technical point of view, the main employee will have the “Main Element” field filled in - a link to himself, and the part-time employee will have the “Main Element” field filled in - a link to the main employee. Use the employee input assistant. If an employee is duplicated, it will not be possible to submit reports for the year. We'll have to write the processing.

- ZiK uses a lot of details that change over time - periodic details. Often an accountant experiences difficulties with his work because of them. You should use the "History" button.

- The global module is huge. It's very easy to get confused. Follows OpenConf for ease of working with the configuration. http://infostart.ru/public/15540/ Due to the large number of global lines, debugging modes can also slow down. To debug the globalizer, you should not use breakpoints, but set stubs of the “Warning” type, and then proceed to debugging.

- Do not debug long-running modules on the production base when users are working via RDP, since all users will also experience a code stop (they will feel stuck).

- To calculate transactions, a dynamic scheme is used, that is, transactions are calculated anew each time the “Report on transactions” or “Upload transactions” is launched. In the global book, the “Glav Transactions for the Period” procedure is responsible for calculating transactions. It is large and only a professional can make changes to it.

- On large databases, the “Period Postings” can work for hours, which irritates accountants. There is a simple optimization method; only a few lines are changed, which allows you to speed up the work several times. This is described in one of the articles. Additional technical specifications are used. A typical algorithm does this: Salary Accounting TableNNP.Unload(Salary Accounting TableNNP); You need to add the required number of lines to the statement of work, and only then copy the lines to the statement of work, without completely unloading and loading. It’s described here, although the article has been undeservedly forgotten and abandoned. http://infostart.ru/public/16250/

- Tax calculation. The “personal income tax” tax is calculated immediately when calculating wages, but there is also the “social tax”, which is calculated separately.

- To store records of calculations, there is a “Calculation Journal”. There are two main ones - “Salary” and “Insurance Contributions”. There is also “Additional”, where management salaries are sometimes considered.

- To set up accounting entries, use the “Accounting template” attribute for the employee. You can also not specify it; in this case, set up a “posting template” for the department in which the employees work. Or if the posting is standard for all employees, we use the “Default posting” constant

- Sometimes it is not clear whether personal income tax has been calculated correctly or not. It is important that personal income tax is calculated on an accrual basis throughout the year, so you need to look at the period from January to December. There are also complex cases - for example, the previous period may be included in the calculation, for example, “in December of last year, vacation was accrued for January of the current year.” For ease of control, you can use useful reports on accruals on an accrual basis, or reports such as “pay slip from the beginning of the year,” etc.

- Also for contributions, control can be done using summary special reports. To control insurance premiums, it is important to remember that there is a percentage scale, and you can check whether the tax has been calculated correctly by simply multiplying the base by the percentage. However, you need to keep track of “from what base the accrual came from.” You can also find out the database by running special reports that are not included in the standard ZiK and are written by independent developers. For example, this report: http://infostart.ru/public/21180/

- Sometimes the payroll journal becomes so tangled for an employee that automatic calculation cannot be done, and he cannot correct entries (sometimes the system blocks manual adjustments). To solve this problem, download the “Calculation Journal Editor” processing. For example this one: http://infostart.ru/public/18776/. Of course, you need to make a copy before using it. A beginner or even an average developer will not be able to write an analogue of this processing, since a clear understanding of working with the calculation log programmatically is important. This processing allows you to do whatever you want with the calculation log.

- When making changes to Zik, remember that this is a “Calculation” component; you do not need to add a chart of accounts and operational accounting registers there, since the customer may not have licenses for them. For those working with 8.x versions, this may not be trivial, and I have seen such solutions.

- In the service parameters, enter the date representation in 4-digit form “11/19/2014”, not “11/19/14”. Then avoid confusion with different grandparents born in the 40s, 50s.

Elena SHLIFER

The most complete accounting and calculation of wages is automated in the 1C: Salary and Personnel program. It is in it that various types of accruals and deductions from wages are implemented. This program is suitable for organizations with a complex remuneration system.

However, there is another option. Often, small organizations already use the 1C: Accounting program to maintain accounting and tax records. If the company has a small staff and a simple remuneration system, it is quite possible to keep track of wages in the standard version of the 1C: Accounting 7.7 program.

Our task is to help the reader understand how suitable this program is for the purposes of maintaining payroll records in his or her organization.

Let us list the main features when accounting for wages in the standard configuration of “1C: Accounting 7.7 edition 4.5”.

Personnel records with maintenance of basic documents:

- The order of acceptance to work;

- order on personnel changes;

- order to change salaries;

- dismissal order.

Payroll by type:

- basic salary;

- additional types of income.

- according to writs of execution;

- Personal income tax.

Charges to the wage fund (accounting for unified social tax)

Reporting:

- tax card 1-NDFL;

- certificate of income of an individual 2-NDFL;

- individual UST registration card;

- declaration of insurance contributions to the Pension Fund;

- declaration on the unified social tax;

- report on the use of insurance premiums for compulsory social insurance against accidents at work;

- payroll statement for funds of the Federal Social Insurance Fund of the Russian Federation (form 4-FSS of the Russian Federation);

- FSS insurance premiums for temporary disability (Form 4a-FSS of the Russian Federation).

Tax accounting:

- formation of tax accounting registers.

The following indicators and values need to be configured.

Regional coefficient (not to be confused with the northern surcharge!). The filling format is as follows: for example, with a value of 15% (increase), 1.15 is filled.

The deduction limit for calculating personal income tax is 20,000 rubles. (only done through Constants).

Payroll accounting is carried out in an external program - “no” (i.e., do not check the box) (in General settings).

Use a regressive scale of UST rates (“yes” or “no”) - through Constants.

Is the organization provided with a benefit for paying the unified social tax in accordance with clause 1.2 of Art. 239NK - through Constants.

We remind you that according to this clause, public organizations of disabled people are exempt from paying taxes; institutions created to achieve educational, cultural, medical and recreational, physical education, sports, scientific, information and other social goals (for more details, see the Tax Code of the Russian Federation).

Use regressive rates of insurance contributions to the Pension Fund - values “yes” or “no” - through Constants.

Let's consider the basic provisions for accounting for wages in a configuration in accordance with the listed capabilities.

Personnel accounting

Personnel data is filled out in detail for each employee in the “Employees” directory or in the “Employment Order” document. When hiring a new employee, it is enough to enter data only in the “Hiring Order” document, and it will be automatically copied into the “Employees” directory.

The “Employee is a tax resident” checkbox determines the rate and procedure for calculating personal income tax. The income of residents is taxed at a rate of 13%, non-residents - at a rate of 30%. Individuals - tax residents of the Russian Federation include individuals who are actually on its territory for at least 183 days in a calendar year.

The detail “Deduction for one child” indicates the amount of the standard tax deduction for one child provided when calculating personal income tax (300 rubles if the child is raised by two parents, and 600 rubles if the child is raised by a single parent and the employee’s annual income on an accrual basis has not reached 20,000 rubles. ).

Let us remind you that when entering data, you must fill in all fields for the correctness of further calculations and filling out reports. Particular attention must be paid to periodic details, setting the required date when entering new details or changing existing ones. It should be noted that the document “Order on Personnel Changes” allows the accountant to more clearly see and timely reflect changes in personnel in the relevant operations. Previously, such changes to an employee could only be made manually and seen through the history of the details. The “Dismissal Order” document has a fairly simplified form: the program prompts you to select an employee and the date when he was fired. In the document form window there is a line “Comment” - this is a comment for the accountant; such data does not appear in the order. The reason for dismissal will have to be entered manually on the screen directly in the document form before printing it (but the data will not be saved in memory) or directly in the printed document.

Printed forms of orders T-1, T-5, T-8, starting with the release of program 459, are given in accordance with the new unified forms approved by Resolution of the State Statistics Committee of Russia dated January 5, 2004 No. 1.

Payroll

Edition 4.5 makes it possible to calculate wages by type of accrual, which significantly increases the analyticalness of calculations. The “Types of Accruals” directory allows you to independently enter the types of accruals used, indicating the income code in accordance with the list approved by order of the Ministry of Taxes of Russia dated November 1, 2000 No. BG-3-08/379, as well as determine the taxes levied for each type of accrual.

In order to reflect income not subject to personal income tax, you must indicate the type of accrual corresponding to income with code 0000 “Income exempt from taxation in accordance with Art. 217 of the Tax Code of the Russian Federation.”

For the correct calculation of personal income tax, the chronological sequence of entering regulatory documents into the information base is important. In particular, the “Payroll” document should be entered before the “Month Closing” document.

The sequence of entering regulatory documents is described in more detail in the Configuration Guide, in the section “Generating financial results” (menu Tools® Guide).

For each type of accrual, a separate “Payroll” document must be generated. Accounting entries are generated in accordance with the data specified in the “Employees” directory (for the basic salary) or entered independently into the statements.

Thus, the accountant can enter sick leave, bonuses, vacation pay and other types of accruals with the corresponding accounting correspondence. However, calculations for these and other types of accruals will have to be done manually.

Payment of wages is made in a separate document “Payment of wages” with the formation of a payroll. In addition, payments can be made through the cash register using cash receipts.

Accounting for deductions from wages

The main type of withholding is personal income tax. The calculation of this tax in the program is implemented quite fully. Personal income tax is calculated at rates of 13%, as well as 6% (dividends) and 35% (material benefits).

When entering data for a new employee or from the moment of starting accounting in the program, the user must correctly set in it the start date of tax calculation - this is the date of hiring.

Example

Employee Petrenko was hired on 08/09/04. He enjoys a discount when calculating personal income tax as an individual - 400 rubles, and also has one child (300 rubles). The employee's salary is 4000 rubles. Income since the beginning of the year (from the previous place of work) amounted to 15,000 rubles.

When entering data into the “Employees” directory, on the Initial data tab, you must enter the start date for tax accounting in the program - 08/09/04.

The date 07/31/04 will lead to benefits in the amount of 1400 rubles (400 + + 300) 5 2, i.e. double benefits), and accordingly the personal income tax amount will be calculated incorrectly. Income at the beginning of the year is also entered to take into account the possibility of applying personal income tax benefits.

To record the income of employees, the DFL program account (“Income of individuals”) is intended, which has sub-accounts: DFL.1 “Income related to activities not subject to UTII” and DFL.2 “Income related to activities subject to UTII.”

You can generate a report on your account using the standard method. The turnover in the personal income tax account determines the basis for calculating personal income tax and payroll taxes. Movement in the account occurs automatically when posting the “Month Closing” document.

Other deductions (for example, deductions based on writs of execution) are made through manual operations or through created standard operations. The calculation is done manually.

Accounting for single social tax

Tax rates for UST and FSS can be viewed and filled out in the “Taxes deductions” directory (menu Directories ® Taxes). In the same directory, you can fill out tax details for filling out payment orders for tax transfers.

The calculation of the Unified Social Tax and the formation of accounting entries is carried out through the document “Month Closing”. Accounting entries are generated for each employee and type of tax.

Let us note once again that if in the “Types of accruals (payments)” directory the accountant did not mark some accrual (for example, sick leave) as the basis for calculating the UST, then the tax on this accrual will not be calculated.

In accounting, the unified social tax and contributions to the Pension Fund are reflected by entries from the credit of accounts 69-2-1, 69-2-2 or 69-2-3 to the debit of accounts accounting for the corresponding costs.

So that when posting the document “Closing the month” the calculation of the unified social tax and contributions to the Pension Fund is carried out in accordance with the described methodology, in the constant “Order of calculation of the unified social tax” indicate “2” (menu Operations ® Constants). It should be noted that the order of the Ministry of Taxes and Duties of the Russian Federation dated 01.02.02 No. BG-3-05/49 “On approval of the form for calculating advance payments for the unified social tax and the procedure for filling it out” (approved by order of the Ministry of Taxes of Russia dated 26.03.03 No. BG- 3-05/134), to which the 1C: Accounting program refers, is not valid.

Reporting

New forms of reporting for personal income tax, approved by order of the Ministry of Taxes of Russia dated October 31, 2003 No. BG-3-04/583, have been implemented in the program since release 454. Personal income tax reporting forms can be viewed through the “Employees” directory. Fields highlighted in yellow are edited manually. Fields highlighted in green cannot be edited. There you can also view an individual card for accounting for unified social tax.

Reporting for submission to the Ministry of Taxes and funds is generated through the menu Reports ® Regulated.

Tax accounting

To implement tax accounting for wages and deductions, two documents have been implemented:

Documents are generated automatically based on accounting data after the end of the month through the menu Tax accounting ® Regular operations.

The Fill button automatically fills in the fields in the document data. The “Tax Accrual” document automatically fills in taxes according to the Unified Social Tax, Social Insurance Fund and Pension Fund. The remaining taxes (property, profit, etc.) are filled in manually.

The tax accounting registers themselves are created through the menu Tax accounting ® Register of business transactions. This is a register for accounting for labor costs and a register for accounting for taxes included in expenses. Labor costs can also be included in some other registers, for example, a register for recording direct production costs.

In conclusion, I would like to note what opportunities for accounting for wages are not provided in the 1C: Accounting program.

You cannot maintain a staffing table. Calculation of vacation pay, sick leave, overtime, and alimony must be done manually. Finally, standard transactions are not configured to calculate accruals and deductions from wages.

How to make corrections to the insert on insurance premiums in 1C Salary and Personnel 7.7?

Service - settings - insurance premium rates.

Payment of insurance premiums is not included in personalized accounting.

You need to make a document “Calculation of insurance premiums”. Menu documents - taxes - calculation of insurance premiums. In the field "Month of calculation of premiums" the month for which insurance premiums are transferred is indicated. The date of the document determines the month in which the insurance premiums were transferred.

When filling out the Personalized Account, the amounts of paid contributions are not filled in.

In the menu Documents-Taxes-Calculations for insurance premiums, fill out this document for each billing month.

How to enter payments under License Agreements? Shouldn't they be subject to insurance premiums?

In the menu Directories - Salary calculation - Types of calculations - Withholding - Personal income tax - remove Payments under license agreements from the taxable base; - Insurance premiums - Taxes - remove payments under license agreements from the taxable base. Enter into a License Agreement; it will not be subject to any taxes.

How to start a car rental with a driver, so that the car rental does not fall under insurance premiums, and the driver’s work does not fall only under the Social Insurance Fund?

It is necessary to enter new charges and state that rent is not subject to taxes, and the work service is subject to all taxes, and after calculating taxes, delete the Social Insurance Fund amount in the Journal for calculating insurance premiums.

I need to change the data in Personalized Accounting based on an employee’s length of service, how do I do this?

In the menu Directories - Employees - Employee - Data entry - Personalized accounting of the Pension Fund of Russia (entering information about the length of service) - fill in the data on the length of service or change existing data.

How to enter a b/l for the illness of a 3-year-old child in a hospital?

In the Documents menu - Sick leave - enter in this document the Reason for disability: Caring for a sick child; and in the case of child care: Up to 7 years in a hospital, but because Average earnings are not filled in automatically; they must be filled in with the amount of your last earnings.

Is the GPC agreement not subject to the FSS?

Remuneration under a contract is subject to insurance contributions to the Pension Fund, FFOMS and TFOMS and is not subject to insurance contributions to the Federal Social Insurance Fund of the Russian Federation (Clause 2, Part 3, Article 9 of Law No. 212-FZ).

The average salary on sick leave is not filled in.

In the settings, set the default posting to “Proportional to the calculation base”.

Where to register for benefits for pregnant women registered in the early stages of pregnancy?

Directory - salary calculation - types of calculations - one-time benefits from social insurance. On the accounting tab, check the box for expenses at the expense of the Social Insurance Fund and register the posting Dt 69.01 Kt 70.

In the time sheet, May 3 and May 10 are listed as working days. I entered holidays as 3-00, 10-00.

It is necessary to refill the five-day calendar for May with the “Take into account holidays” checkbox and re-generate the working time sheet.

Where to enter the FSS NS and PZ rate?

Directories - salary accounting - additional postings.

How to enter a Disability Certificate?

You need to select the employee who received a disability certificate in the Employee Directory. In the Tax Accounting tab, in the Data for calculating insurance premiums line, click the Change button to select the document Certificate of Determination of Disability.

In the Leave of up to 1.5 years, the date of payment of benefits up to 1.5 years was entered incorrectly, how can I change it?

It is necessary to make a return during the period of creation of this document, correct the data and re-post all documents.

How can you indicate that ZiK is organizing according to the simplified tax system?

Change in the Organization Settings - simplified tax system - in Constants - Organization using the simplified tax system and make a salary calculation.

How to hire an external part-time worker at your main place of work?

You can fire a part-time employee and hire a full-time employee.

All insurance premiums are considered in ZiK, and the organization is on the simplified tax system.

In operations in constants, in the constant the basic tariff of insurance premiums, enter the history button of the value of the organization that uses the simplified tax system, and indicate from what date this constant is valid.

There is no upload button in the Unified Social Tax declaration...

In the service - in the settings in the program and accounting tab, install the program (instead of another program in a self-supporting organization) accounting 7.7, edition 4.5 and re-open the UST declaration.

How can I view data on the Salary Journal only for 2009?

In the Salary Journal, set the Archive View Depth at the beginning of the year.

Installation of unified social tax in ZIK.

Through the "Start Assistant".

The average salary is not included in the sick leave certificate.

In the service settings on the salary and accounting tab, in the default posting field, enter the default posting. Refill the sick leave, the average salary will be filled.

How to register employee absenteeism?

Menu Documents - Other deviations - Absenteeism.

Compensation for the use of a personal car within the limits is subject to personal income tax.

Find this accrual as part of the personal income tax taxable base and transfer it to the left list.

How do I add the standard deduction for a child?

In the menu Directories - Employees - Employee - on the Main tab - Data entry - Personal income tax deductions - standard deduction 1000 rubles.

How to enter calculations for employees registered in the early stages of pregnancy?

It is necessary to enter a predefined calculation: Menu Directories - Salary calculation - Types of calculations - One-time benefits from social insurance and enter a posting in it.

The new employee is not entered in the "Employees" directory.

You need to press the button “Set (disable) display of list by groups.

Postings for benefits for pregnant women registered in the early stages of pregnancy are not generated.

In the directory - salary calculation - types of calculations, click on the "Assistant" button to describe the predefined calculation, pull out a one-time benefit from social insurance, leave the checkbox accrual is one-time in nature, the benefit is at the expense of the Social Insurance Fund in the posting template Dt 69.01 "Insurance expenses" Kt 70 account, write down the type of calculation . Enter it in the document Entering the calculation for the employee, select the type of accrual of benefits for pregnant women registered in the early stages of pregnancy and make its calculation.

An employee who is on maternity leave does not appear on the time sheet.

When creating a timesheet, fill it out not only with full-time employees, but also check the Temporarily not working box.

The employee returned from maternity leave early. What to do?

Change the terms in the “Parental Leave” document.

There is no "Download" button in the UST reporting.

Open: service - settings - payroll and accounting, change the accounting program, instead of "Another accounting program in a self-supporting organization."

You need to download the chart of accounts from the accounting department.

Data exchange service uploads data to salaries and personnel, check the boxes which accounts need to be uploaded and copy the path. In ZiK service-data exchange - data download, insert the path, 2 checkboxes debug mode, remember links and click on the "Download" button. A surcharge was introduced. The start date is given, the end date is not. An order was issued to cancel the bonus from August 1st. How can I cancel it?

To correct the end date of the document “Entering a calculation for a list of employees,” you must create a correction document using the “Correct” button. After creating reversal entries, you need to fill out (as the program suggests) the document “Salary Accrual” with the “Recalculation for Past Periods” method and indicate the entire period while the type of calculation executed by the document being corrected was in effect.

You can also use the document “Temporary termination of allowances (withholdings)”. The document allows you to temporarily and permanently suspend accruals and deductions for one employee at a time. The employee has been working since May 4th, but she made a mistake and put the date of employment on May 14th in the employment order. I discovered in August that my salary for May was calculated incorrectly. In the order, I corrected the hiring date. The salary for May is incorrect. At the end of August, the employee quits.

In the salary calculation document, indicate the method of re-calculating salaries for the previous period from May 1 to May 31. After that, re-calculate taxes and recalculate. Recalculation data for May will be reflected in the payroll journal in the period August.

Postings for payroll taxes are not generated, but for wages and salaries they are generated.

In the reference book - payroll calculation - types of calculations for each tax on the accounting tab, put a point to distribute among accounts and indicate the posting of the DT account is empty, that is, it will be selected automatically or from the default posting. Either from the employee directory, or from the department, depending on where the postings for payroll and CT account 69 of the subaccount of the corresponding tax are registered.

When adding an employee, the date of birth becomes 2046, and the year of birth is 1946, how can I change it?

In the menu Service-Options-Year of the beginning of the working century, change to 1945.

When providing benefits for up to 1.5 years, it is not carried out. Swears at incorrect wiring.

In this case, it is necessary to enter the entry in the menu Directories-Payroll calculation-Types of calculations-Allowances up to 1.5 years and up to 3 years and re-post the created document.

An employee was sent on a business trip for 3 days from 05/30/09, but returned earlier. How can I change the data on a business trip if the billing period when the document was created is closed?

While in the June billing period, in the created document Payment based on average earnings, click the Edit button to open editing the business trip period and edit the To date and post the document.

When generating reports under the Unified Social Tax and the Pension Fund of the Russian Federation, the amounts of advance payments are incorrectly formed, and there is a discrepancy in the data of an employee on rolling leave.

You need to fill out an external report form and upload it to the Accounting Department.

How can you find out during what periods an employee was on vacation?

You need to review Form T-2 (personal card), section 8.

An employee fell ill while on vacation. There is no sick leave. When entering sick leave, a message appears: “Deviations have already been entered for the period, should I interrupt?”

In this case, you need to select no. After this, go to the vacation document using the “Correct” button, change the end date of the vacation if the vacation is extended.

How can you take parental leave for up to 1.5 years if an employee gives birth to twins?

It is necessary to enter a separate document-deviation for child care leave for each child.

How to enter a transaction according to the Pension Fund of Russia?

In the menu Directories-Salary Calculation-Types of Payments-Unified Tax and Insurance Contributions, enter the entry in the required tax.

[b]The employee worked part-time, how can 8 hours of work be corrected for the employee’s actual hours worked?

Working hours can be changed in the Working Time Sheet, instead of 8 hours you can enter the actual time worked.

How can I assign employees' work to a 4-day work week in the program?

It is necessary to create a 4-day Shift calendar in the Regulations-Calendars menu, and create a new schedule in the Directories-Work Schedules menu and add a Shift calendar to it. Using the Personnel Transfer document, make changes to employees’ work schedules and calculate salaries.

The management company must show data in 2-NDFL paid for an individual.

In this case, you should fill out 1-NDFL for this person and generate data according to the formation of 2-NDFL data.

How to enter holidays?

In the menu Regulations-Enter holidays, enter holidays.

How to enter the accrual of a one-time benefit at the birth of a child?

In the Directories-Payroll menu, enter this accrual for the Social Insurance Fund and in the Documents-Input of calculations menu, the employee enters this accrual.

Is it correct to hire a previously dismissed employee under the old personnel number?

No, only under a new number.

Withholding of alimony.

Menu documents entering deductions - writ of execution, we indicate to the employee the method of withholding the postal fee, the amount of the postal fee, the method of calculation as a fixed amount, we indicate the amount. After the calculation, go to the writ of execution reports, report type by mail and click “Generate”.

How to make an interest-free loan and calculate the material benefits?

In the Directories menu - Payroll calculation, enter New accrual (interest-free loan), in the Documents menu - Entering calculation for an employee, enter the loan accrual, and in Entering accruals, enter the calculation of Material benefits on deposits.

Holiday to care for the child. I put the date wrong...

It is necessary to correct the date in the document to... and recalculate the salary.

How to calculate travel allowances based on average earnings in the 1C: Salary and Personnel program 7.7. The regressive rate under FFOMS and TFOMS for an employee whose salary exceeded 600,000 rubles is not considered. in 9 months.

You need to enter in the menu Documents-Other deviations-Payment based on average earnings. The regressive rate of FFOMS and TFOMS is not considered after exceeding 600,000 rubles.

Will there be any difficulties when switching from one program to another? These questions concern all accountants. Here is a short list of problems solved using:

- Automation of personnel records and payroll calculations.

- Automatic calculation of insurance premiums.

- Formation of regulated reporting to the Social Insurance Fund and the Pension Fund of the Russian Federation.

- Automatic preparation of personalized accounting data, in accordance with the requirements of the Pension Fund of Russia, taking into account accruals and payments of previous periods.

- Personnel motivation management

- Reflection of accrued salaries, taxes and contributions in the expenses of the organization.

- Management of cash settlements with personnel.

- Personnel analysis.

- Management of competencies, training, certification of employees.

- Personnel employment planning

Accounting for several organizations in one database

After downloading, the data on employees, accruals and deductions in the 1C Salary and Personnel 7.7 and . If there are problems, the program will report them, if there are no problems, then the following window will appear on the screen:

All personnel movements, all accruals and deductions for the selected period, as well as taxes are transferred from the 1C Salary and Personnel 7.7 configuration.

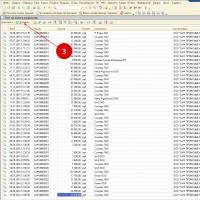

All this data is entered into a special document “Data Transfer”, which can be viewed through the menu “Operations” - “Documents” - “Data Transfer”:

If problems arise, use our services for the transition to 1C salary and HR management 8.2

Phones: +7(815 2) 777 - 666

Or by sending us an email to sales@site

Services are provided with a valid subscription to .

List of values of accumulation registers 1s

List of values of accumulation registers 1s Advance calculation in 1s 8

Advance calculation in 1s 8 GPC agreements Reception for GPC in 1s

GPC agreements Reception for GPC in 1s Month closing settings How to close a period in UP

Month closing settings How to close a period in UP Specialist consultations

Specialist consultations Accounting for fuel and lubricants in 1C: instructions for accountants Write-off of fuel and lubricants 1s 8

Accounting for fuel and lubricants in 1C: instructions for accountants Write-off of fuel and lubricants 1s 8 Issue an invoice in the 1s 8 program

Issue an invoice in the 1s 8 program