Advance calculation in 1s 8.2 accounting

In 1C 8.3 ZUP, an advance is understood as a kind of prepayment that is issued in advance towards the upcoming salary. If at the time of payment of the advance the organization did not have a salary debt to its employee, then this amount is the debt of the employee himself. If planned, the advance amount will be deducted from it.

In this article we will look at step by step, for beginners, the calculation and accrual of advances in 1C ZUP 8.3.

The advance can be calculated in various ways:

- a fixed amount,

- % of the employee's wage fund,

- calculation of wages for the first half of the month.

Initially, the type of advance payment in 1C ZUP is set by personnel documents, changes in wages, advance payments, etc. In this article, we will set up an advance payment when hiring.

We created an employee recruitment and went to the “Payment” tab. At the bottom of the window, from the corresponding drop-down list, you can select one of the methods for calculating the advance payment, which were mentioned earlier. In this case, the advance payment to Alexander Matveevich Vankov will be paid in the amount of 35% of the tariff (wage fund). The default value was forty percent.

All this data will be displayed in the employee’s card.

In the figure you can see that the wage fund is 10,000 rubles, therefore, the advance amount will be 3,500 rubles.

Advance calculation

The calculation of the advance in the 1C 8.3 ZUP 3.1 program is made only if in the previous paragraph you indicated that it is paid “Calculation for the first half of the month.”

Just like when calculating wages, before calculating the advance, you must enter into the program all days of absence of the employee.

Let's assume that our employee S.N. Bazhova took leave without pay for the period from August 7 to August 8, 2017 inclusive. We must reflect this data in the program. Moreover, in order for this failure to appear to be taken into account when calculating the advance, as well as when calculating wages, the “Calculation approved” flag must be set in the document itself.

Now you can proceed to calculating the advance payment. Go to the “Salary” section and select “All accruals”.

In the list form that opens, click on the “Create” button and select the appropriate item, as shown in the figure below.

The header of the document is filled out as standard. In this case, we make the accrual until August 15, 2017. After specifying all the data, click on the “Fill” button and all the necessary data will be included in the document automatically.

In the figure below we see that employee S.N. Bazhova only has 9 days worked instead of 11 according to the standard. Thus, the amount of the advance was calculated based on a salary of 70,000 rubles for 9 days.

Please note that, unlike payroll, this document does not produce actual accrual. He only calculates the amount of the advance.

In addition to calculating the advance, this document also reflects deductions, for example, on writs of execution and personal income tax. All this data, as well as accrued amounts, are subject to manual adjustment. An example would be an employee’s personal request to pay a larger or smaller amount as an advance.

Please note that employee A.M. Vankov was not included in the document. This happened because we had previously established an advance payment for him in the amount of 35% of the payroll amount. In this regard, the advance payment can be made without an accrual document.

Advance payment

You can start paying the advance immediately for those employees for whom it is accrued either as a fixed amount or as a percentage of the payroll. Be careful, because in this case, those employees who were absent from the 1st to the 15th (for example, leave without pay, etc.) will not be included in the payroll.

Go to the “Payments” section and select “All statements”.

In the window that opens, you can select the method by which the advance payment will be made.

In the header of the created document, in the “Pay” field, select “Advance” and indicate for which month it needs to be paid. After that, click on the “Fill” button.

For those employees whose advance payment is a percentage of the payroll, or a constant amount, the advance amount will be automatically calculated and will appear in the tabular part of the document. For those whose advance payment is calculated for the first half of the month, the figures will also be displayed in the document if the corresponding accrual was previously made, as described by us earlier.

According to the legislation of the Russian Federation, an employee’s salary must be paid at least once every half month. To do this, in the programs 1C: Salaries and personnel of a government institution 8 (edition 3) and 1C: Salaries and personnel management 8 (edition 3) a mechanism has been implemented for calculating and paying advances, and only then salaries. The software supports three options for calculating an advance: a fixed amount, a percentage of the tariff and calculation for the first half of the month.

The option for calculating the advance payment is set in the “Hiring” document. I would like to draw your attention to the fact that the option is set for an employee, and not for an individual. This means that an individual can hold a main position and work part-time, and he can have different types of advance payments for each activity.

In this article we will cover the entire cycle of setting the necessary settings and charging an advance to an employee by calculation for the first half of the month, and at the end of the article I will also make a reservation about another, simpler, method of paying an advance - a fixed amount.

For any option, you must first set the dates when the advance payment and salary will be paid. To do this, follow the hyperlink “Organization details” from the “Settings” section:

The following window will open:

Let's go to the last tab, there we will use the hyperlink, as shown in the figure:

After setting the advance payment date, we will begin work by creating a new employee in the “Employees” directory:

After clicking the “Create” button in the list of employees:

We fill out the form with the necessary data, then based on it we create a “Hiring” document:

In the form that opens, fill in the required fields:

The software automatically sets the option for calculating the advance payment - “Calculation for the first half of the month”; if necessary, you can select other calculation options provided by the program:

After accepting a new employee, all information about him has been entered and saved, it is necessary to create time and attendance documents. In the article, the option of calculating for the first half of the month is selected; it is required to enter documents for recording working hours in 15-day increments. This can be done using the “Tablet” document:

Click the “Create” button in the list to create a new document:

Change the “Data for” attribute to the “First half of the month” type:

Then, by clicking the “Fill” button, the employees’ working hours will be automatically generated according to the production calendar and work schedule. I would like to draw your attention to the fact that all existing work schedules must be completed and updated in the institution (to be completed once a year).

We proceed directly to calculating the advance payment. In the “Salary” section, create a new document “Accrual for the first half of the month”:

You need to select the month of accrual, then use the “Fill” button and automatically generate the document:

The accrual of the advance is completed, now we will pay the advance to the employees. At the beginning of the article, when setting the dates for payment of wages and advances, the type of payment “Credit to card” was also selected, without indicating the salary project. We will make the advance payment using the document “Statement of Transfers to Accounts”. Accordingly, for payments through the cash register, the document “Statement to the Cashier” is used, and if a transfer is made to personal accounts created in the organization’s payroll project, the document “Statement to the Bank” is used.

Each employee is required to indicate the type of salary payment. You can do this by using the hyperlink from the card, as in the figure below:

Set the switch to the desired position and enter the employee’s bank account:

When the necessary settings are set, create the document “Statement of Transfers to Accounts”:

Click the “Create” button to create a new statement. In the document, in the line “Month of payment”, write down the current month and change the details “Pay” and the assignment “Advance”:

Let's use the "Fill" button again. This is filled in by those employees who have selected the “Payment by transfer to a bank account” option.

Under the “Pay” requisite, it is possible to configure the share of payment of accrued amounts (interests) with which the statement will be filled out. To create a statement for advance payment, you need to set 100 percent:

I would also like to note that if the institution has other accruals in addition to standard ones, then it is necessary to configure these accruals in such a way that they are also included in the advance calculation:

In the form of the list of charges, select the one you need:

In the very bottom line of the accrual form, set the flag in the attribute “Accrued when calculating the first half of the month”:

This article discussed all the necessary settings and documents required for calculating the advance payment using the “Calculation for the first half of the month” option.

And in conclusion, I would like to add that in software, in addition to the considered option for calculating the advance payment, the “Fixed amount” option is quite often used. If this option for calculating the advance is selected, additional documents for entering working hours and accruals are not entered, and a payment document is immediately generated.

Every accountant is faced with the calculation of a planned advance, but not everyone knows how to formalize this correctly in ZUP 2.5.

Below are some instructions for calculating a planned advance in ZUP:

ZUP has developed two methods for calculating the advance:

Advance in a fixed amount;

Advance for the first half of the month in proportion to hours worked

Calculation settings

Open Tools - Accounting Options and set the value settings for your organization:

Fixed advance

It is necessary in the list of the directory “Employees of organizations” in the “Advance” field to indicate the amount that will be a fixed advance for each employee.

After that, how do you fill in all the fixed amounts for employees to pay the advance. Open the document " Salary payable».

“Payroll calculation - Cashier and Bank - Salaries payable to organizations”

Create a new document

We indicate in it the month of accrual (the advance for which month is paid), the method of payment (through the cash register or through the bank). The most important field is the “Pay” field. In it, you must select the “Planned advance” option. After this, click the “Fill” button and the tabular part of the document will be filled in by the employees for whom we indicated the amount of the advance in the “Employees of Organizations” directory.

Let’s complete the document, then each employee who received an advance forms a debt to the organization, i.e. they find themselves indebted to the enterprise. This happens because at the time of payment of the advance, the main part of the salary has not yet been accrued using the “Payroll” document. This can be seen in the report “Organization payroll” and “Accrued salary summary”.

Advance for the first half of the month in proportion to hours worked

When you need to pay an advance for half a month in proportion to the time worked, then for this in the 1C Salary and Personnel Management program there is a special functionality - the Document “Payroll” and of course “Salaries payable”.

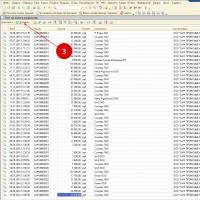

Open the “Payroll” document. In it, you must indicate the month of accrual and in the “Accrual mode” field, be sure to select “First half of the current month.” After that, click the “Fill” button to get a list of employees with their accruals in the tabular section

and click on the “Calculate - Full payment” button - the advance payment for the first half of the month is calculated. Please note that employees have not only basic planned accruals as accruals, but also all additional planned accruals due to employees.

Posting the document “Payroll” with the accrual mode “First half of the current month” does not actually make any accruals, but only calculates the advance amounts. Therefore, when we use this document to calculate salaries at the end of the month, it will again count all employees from the first day of the month, and not from the middle.

After calculating the advance in the “Payroll” document, you need to post it and refer to the “Salaries payable” document. In it we indicate the month of accrual and in the “pay” field we select “Advance payment for the first half of the month.” Click the “fill” button. As a result, the tabular part will be filled in by employees for whom the advance payment for half the month is calculated, minus personal income tax.

As in the first case, after posting the “Salary Payable” document, the employee’s debt to the organization will form.

Frequently asked questions regarding advance payment:

It is necessary that 40% of the monthly salary be accrued as an advance payment. How to calculate?

In the list of employees or in the register of information Advances to employees of organizations (menu Payroll calculation by organizations - Cash desk and bank - Advances to employees of organizations) indicate the amount of the planned advance of 40 from your employee’s salary.

Please clarify what should be paid for the first half of the month: the actual advance or the salary for the 1st half of the month?

1. If there is an advance, but this is NOT AN ACCRUAL! This is a PAYOUT!

We immediately create the Salary to be paid document, fill it out from the fixed advance amount specified in the Advances to Employees information register.

WE DO NOT PAY NDFL!

Yes, an inconveniently fixed amount.

It is possible, yes, to fill these fixed amounts with some kind of processing.

Or fill in the processing not the register of information Advances to employees, but the document Salaries payable itself.

2. If this is the salary for the 1st half of the month, then it is actually calculated by the document. The accrual of the salary for the 1st half of the month is taken and paid by personal income tax, etc. But we do not charge an advance as such, but a part of the salary, tariff, allowances for part of the month.

This should be stated in the official documents of the organization, and not “as it is convenient for the accountant”

And, let me emphasize, an advance is NOT an accrual. Accrued - salary, tariff, allowances.

We DO NOT assign such an advance payment. And we cannot create a formula for it using standard means.

Please tell me, I’m trying to calculate an advance for people, I chose the “planned advance” of 50% of the salary, and entered it for each employee. Then I make “payment”, select “bank”, since I want to transfer it to the cards, and then only one employee is displayed... what’s the catch? although if you select “through the cash register” everything is displayed.. Personal accounts are all filled out.

In the program, you can set a “planned advance” as the type of selected operation in the “Salaries payable” document. Then the amounts assigned to each employee will be automatically entered into the statement. Moreover, those employees to whom you did not assign a planned advance will not be included in such a statement.

Further, if you choose the payment method “through the cash register,” then this version of the statement subsequently only provides the opportunity to “enter on the basis of” the cash register document (cash document). This is implemented in Salary and Personnel Management 8, ed. 2.5.

And if you choose the payment method - “through a bank”, then a field opens on the right for the counterparty bank, to which you submit a statement to write off the amount from your personal account to the salary card accounts of your employees under the Salary Project.

In this case, you can transfer the usual planned advance to the bank.

But if you have a simplified version of accounting for mutual settlements with employees installed, then you will not be able to enter a payment order (as a document) or configure anything in the bank statement.

In addition, there is another option for a certain advance to be included in the statement for transfer from a bank account (or according to cash flow). To do this, you need to make a separate calculation (doc-volume Accrual of salary) for the first half of the month. Such a calculation should take into account actual absenteeism (time sheet), that is, payment is not just the planned amount, but in a smaller amount if the first half of the month is not fully worked by the employee.

Advance payment is one of the simplest operations carried out monthly by payroll accountants. But, like any operation performed regularly, you want to make it as less labor-intensive as possible, and, naturally, in such a way that the calculations are fully consistent with current legislation. In this article, A.V. talks about how the 1C: Salary and Personnel Management 8 program helps its users solve this problem. Yarvelyan (C Data company, St. Petersburg).

Article 136 of the Labor Code of the Russian Federation

Labor Code of the Russian Federation 09/08/2006 No. 1557-6

Execution of Article 136 of the Labor Code of the Russian Federation

Advance calculation procedure

Article 136 of the Labor Code of the Russian Federation regulates the payment of wages no less than every half month. This point is often understood by the employer as “twice a month,” which is generally incorrect. According to the Labor Code of the Russian Federation, wages must be paid at least every 15 days.

It should also be noted that the concept of “advance” is not defined by the Labor Code of the Russian Federation, as well as the procedure for calculating the amount of the advance. However, the Federal Service for Labor and Employment in its letter dated 09/08/2006 No. 1557-6, citing Resolution of the Council of Ministers of the USSR dated 05/23/1957 No. 566 “On the procedure for paying wages to workers for the first half of the month”, gave an explanation according to which the amount The advance payment is determined by the internal labor regulations, collective agreement, and employment contract, but when determining the amount of the advance payment, the time actually worked by the employee (the work actually performed) should be taken into account.

Compliance with Article 136 of the Labor Code of the Russian Federation is mandatory. Wages must be paid to the employee exactly twice a month; the employer has no right not to pay an advance even if there is a corresponding written application from the employee or a corresponding article in the labor and collective agreement.

Typically, enterprises use one of three options for calculating the amount of the advance: a fixed amount determined for each employee; percentage of the employee’s earnings (30-50%); based on the results of calculating earnings for the first half of the month.

In the program "1C: Salary and Personnel Management 8" two of the above options are implemented: a fixed amount and based on the results of salary calculation for the first half of the month.

Advance - fixed amount

In the 1C: Salary and Personnel Management 8 program, each employee is given a fixed amount of advance payment due to him. Typically, the advance amount is set at approximately 40% of the employee's monthly earnings.

You can compare the amount of the planned advance to an employee directly in the form of a directory list Employees. In this case, the system will automatically install for all existing employment contracts (elements of the directory Employees) of a given individual in a given organization the same advance amount (Fig. 1).

Rice. 1

Information about the amount of the advance payment is stored in the information register (Fig. 2). The register list form can be opened for viewing and editing from the submenu Cash register and menu bank Salary calculation on command Advances to employees of organizations. The amount of planned advances of a specific individual can be found by opening the button Go/Advances to employees of organizations command panel of an individual's card register form with preset selection.

Rice. 2

It should be noted that the size of the planned advance and the amount of the employee’s earnings from the point of view of the program are not related in any way. This means that we set the amount of the planned advance for the employee ourselves, calculating it using an algorithm known to us, but we do not tell the program this formula. Therefore, if you change the salary, hourly rate or other parameters that affect the amount of earnings, the size of the planned advance will not change until we change it manually.

Note also that the planned advance in terms of the program is not an accrual, but rather a payment, therefore the only document that indicates (calculates) the amount of the advance for the specified billing period is the document .

To automatically fill out a document Salaries payable to organizations for payment of a planned advance is necessary in the field Pay indicate Planned advance. In this case, when filling automatically (button Fill), the tabular part of the document is filled in with a list of employees who meet the conditions specified in the document (organization, division, method of payment of wages, etc.), and the corresponding advance amounts from the register Advances to employees of the organization. If a planned advance is not set for an employee, this employee will not be included in the document.

Accounting for absenteeism when paying a planned advance

The program provides the opportunity to limit the payment of advances for employees who were absent from the workplace in the first half of the month due to vacation, sick leave and some other reasons. This procedure does not contradict the above legislative norms, since an advance is payment for the time actually worked for the first half of the month, and in this case the employee did not work during the specified period.

Payment for this time, if it must be paid, is carried out in the form of intersettlement payments (for example, vacation pay) or in the general manner when paying wages for the month.

To apply such a restriction, it is necessary in the form of setting up accounting parameters on the tab Salary payment In chapter Planned advance set flag Take into account absenteeism and indicate the estimated date of the planned advance (see Fig. 3).

Rice. 3

If the employee has not worked in full from the beginning of the month until the calculated date of the planned advance, when automatically filling out the document Salaries payable to organizations, the system will issue a warning (Fig. 4).

Rice. 4

If the employee has not worked a single working hour from the beginning of the month until the calculated date of the planned advance, this employee will not be included in the document Salaries payable to organizations for payment of an advance upon automatic completion of a document.

As mentioned above, the described mechanism does not take into account any employee absenteeism, but a very specific list of them. For example, the absence of an employee due to a business trip does not affect the advance payment in any way.

In order for absenteeism to have an impact on the calculation of the advance in the program, the type of calculation by which it is described must satisfy the following conditions: switch Type of time on the bookmark Time The calculation type form must be set to Unworked full shifts and business trips(Fig. 5); one of the options given in Table 1 should be selected as the type of time according to the classifier.

Rice. 5

|

Letter code |

Full name |

|

Temporary disability with the assignment of benefits in accordance with the law |

|

|

Absenteeism while performing state or public duties in accordance with the law |

|

|

Additional annual leave without pay |

|

|

Annual additional paid leave |

|

|

Absences for unknown reasons (until the circumstances are clarified) |

|

|

Annual basic paid leave |

|

|

Additional leave in connection with training without pay |

|

|

Additional leave in connection with training while maintaining average earnings for employees combining work with training |

|

|

Leave without pay in cases provided for by law |

|

|

Unpaid leave granted to an employee with the permission of the employer |

|

|

Maternity leave (leave in connection with the adoption of a newborn child) |

|

|

Parental leave until the child reaches the age of three |

|

|

Suspension from work (preclusion from work) for reasons provided for by law, without accrual of wages |

|

|

Suspension from work (preclusion from work) with payment (benefits) in accordance with the law |

|

|

Absenteeism (absence from the workplace without good reason for the time established by law) |

Of course, it is always possible to edit, add or delete payroll lines manually.

Advance for the first half of the month

Another way to determine the amount of the advance is to calculate the employee’s actual earnings for the first half of the month. This is what the accrual mode is designed for. First half of the current month in the document Calculation of salaries for employees of organizations.

The document calculates all planned accruals and deductions, as well as personal income tax amounts from these accruals, as in the usual calculation of salaries for the current month. Unlike the usual calculation, the calculation period is taken from the 1st to the user-specified date of the current month, which is in the range from 11 to 22. By default, the system offers the period from the 1st to the 15th of the current month (see Fig. 6).

Rice. 6

Despite the fact that after the calculation the document is externally very similar to the one calculated at the end of the month, the movements it makes through the registers are different. In other words, the fact of calculation and posting of this document will not be reflected in any way on the payslip. The document makes movements in the service register, the information in which is intended for subsequent filling out the payroll for the payment of the advance. When posting a document Calculation of salaries to employees of organizations for the first half of the month, the amounts of accruals minus personal income tax are taken into account, other deductions and loans are not taken into account.

To pay the advance, a document is created, as in the previous case Salaries payable to organizations, the type of payment is indicated Advance payment for the first half of the month. The document is filled in automatically with the data received when posting the document .

You can create a payroll directly from a document Calculation of salaries for employees of organizations via button Create documents for salary payment on the top command bar.

Advance in management accounting

Within the framework of management accounting, only one mechanism for paying advances has been implemented - planned. You can set the amount of the planned advance for an employee in management accounting in the information register Advances to employees.

You can open the register form through the menu Go directory element forms Individuals or through the command Payment of salaries/advances to employees menu Settlements with personnel.

When an advance is paid, a document is automatically filled in Salary payable with payment type Planned advance. When paying a management advance, the program does not automatically take into account any no-shows. All changes to the advance amount must be made manually.

Simplified accounting of mutual settlements

When talking about the nuances of paying salaries to employees, it is impossible to ignore the new opportunity provided to users in the latest configuration releases.

Now users can simplify the procedure for processing salary payments in the program and do not have to issue payment orders and cash receipts.

In order to “turn on” the simplified mechanism, just go to the accounting settings on the tab Salary payment set flag Simplified accounting of mutual settlements.

Simplified accounting can be applied to either one or several organizations, depending on the need. When simplified accounting of mutual settlements is enabled, the fact of payment of wages in the information system is the posting of a document Salaries payable to organizations.

At the same time, the appearance of the payroll itself changes somewhat - the column disappears Document, and in the column Mark when filled in, the default value is set in all lines Paid.

The date of payment of wages under such a system is considered to be the date of the payroll.

In management accounting, simplified accounting of mutual settlements is not yet provided.

How to calculate an advance in 1C: 8.2? How to pay an advance in 1C: 8.2?

The calculation and payment of advances to employees of an enterprise includes several interrelated stages, and begins with the formation of the “Payroll” document. This article discusses the procedure for filling out the documents “Salaries for issue to organizations” and “Salary calculation” in an abbreviated form, with reference specifically to the advance payment.

First, you need to open the “Payroll” tab, which is located on the functions panel. Next, in the journal of documents of the same name, you should create a new document using the “Add” button. A field will open where you can fill in the required details. Before creating a new accrual, you need to pay attention to filling out the production regulated calendar. As soon as the details in the header are filled in and the selection of an employee is completed, check the “Preliminary calculation” checkbox, which serves as a mandatory item when calculating the advance.

Then you will need to click the “Fill” and “Calculate” buttons in this example for the employee. Information about the selected employee will be filled in, fully meeting the time standards at the time of calculating the advance. Next, the document is recorded and posted:

Now you should go to the “Wages to be paid” journal, create a new document in it and fill out its header with the necessary details. Then you will need to set the “Type of payment” item to “Advance” and draw up a document according to the type of payment.

After filling out the information about the accrued advance in automatic mode, change the data from “Through the bank” to “Through the cash register” in the “Payment method” menu column. This action is necessary to generate an RKO (cash expense order) and to pay an advance to an employee through the cash register.

Next, the document is recorded and posted, and then in the wage document journal on the generated document, by clicking, select the “Based on” item in which “Cash outgoing order” is marked, this is necessary for payment through the cash register.

Now we fill in all the required details in the created “RKO” and execute this order.

After completing all the above operations, the accrual and payment of the advance is completed. If all actions were performed carefully and correctly with the required details correctly filled in, then further processes for paying the remaining amounts until full accrual for the specified period of time will take into account the advance payment transaction.

List of values of accumulation registers 1s

List of values of accumulation registers 1s Advance calculation in 1s 8

Advance calculation in 1s 8 GPC agreements Reception for GPC in 1s

GPC agreements Reception for GPC in 1s Month closing settings How to close a period in UP

Month closing settings How to close a period in UP Specialist consultations

Specialist consultations Accounting for fuel and lubricants in 1C: instructions for accountants Write-off of fuel and lubricants 1s 8

Accounting for fuel and lubricants in 1C: instructions for accountants Write-off of fuel and lubricants 1s 8 Issue an invoice in the 1s 8 program

Issue an invoice in the 1s 8 program