Income and expenses of a person. How to spend money correctly? Family budget: example. Home accounting. Maintaining home accounting in the "Housekeeper" program

Income and expenses of money accompany the life of every person, but not everyone pays enough attention to them. If you don’t monitor your income and expenses, you are unlikely to achieve financial independence. What is the main rule for achieving wealth?

Income must exceed expenses several times.

That is why, first of all, when allocating your budget, you must take into account all cash expenses and income, including probable ones. By preparing for upcoming expenses, you can reduce the risk of major problems. No problems in turn will affect your wealth.

Income

Each person has his own level of income, which, as practice shows, not everyone achieves. Unfortunately, working in an office at a boring job, people simply do not want to change anything and continue to work for a fixed price.

The level of income must be increased, even if it seems to you that you cannot achieve a higher salary. In some cases, wages cannot really be increased, but they can be supplemented by other sources of profit. Create as many assets as possible, and let them bring not a large profit, but a stable one.

Having created many sources of profit, the total income will be impressive, but do not forget about the need to develop your success. Put the resulting profit into circulation, thereby increasing the amount of income and its volume.

Expenses

Many of the expenses we incur are completely unnecessary. We are used to buying expensive cell phones without using more than half of their functions, buying fashionable clothes that don’t really suit our taste, etc. All expenses of money must be taken into account and try to reduce them as much as possible.

Numerous wastes of money appear precisely when money appears in our hands, because while it is not there, we do not spend it senselessly. The expenses you incur should be accompanied by specific goals, in other words, money should be spent wisely.

Plan your budget, allowing for every expense and income. Not all people plan the distribution of money, thereby limiting their prospects of becoming much richer. Until your financial matters are in order, you will never achieve the desired result.

You might also be interested in:

—

—

—

Today we have to figure out how to spend money correctly. This topic interests citizens of all countries. And all the time. After all, money is a means of subsistence. And they must provide citizens as much as possible. Not everyone knows how to manage them correctly. And even more so how to postpone it. When you have your own family and children, issues related to finances become seriously aggravated. To prevent this from happening, you just need to know how to spend money. How to learn this? What will help you save and manage your family budget? The best tips and tricks will be presented below. All of the above is not a panacea, but it will help you avoid wasting money. In some cases, this will allow you to spend less and save more, without compromising yourself on your purchases.

Family budget - an eternal dispute

Managing a family budget is a real art that not everyone can master. But it is recommended for every person to master it, or at least try to do it. If done correctly, problems are not terrible. They simply won't exist. Except in cases where wages are delayed. And then the scale of the problems will be minimal.

A very good way to save and create savings. Many, as already mentioned, are recommended to open a bank account and transfer money there. This will help you not to touch the funds and preserve them. In any case, it must be difficult to access. Only in emergency situations is it allowed to spend these savings.

Plan and facts

How to spend money correctly in a family? For those who have already mastered the previously listed methods, you can slightly expand the table of income and expenses. And add to it such components as “plan” and “in fact”.

In the first column, you must indicate in advance what expenses are planned and for what amount. The second contains information about real expenses. Quite an interesting way of planning “free money”. It is recommended to reduce the “actual” column monthly. Exactly the same as the "plan" section. Of course, taking into account the fact that a decrease in these indicators does not harm the life and well-being of the family.

"No" to loans

How to spend less money? Some people believe that loans are a good way to save money. In fact, most citizens who have learned to live within their means and also save well say the opposite.

Taking out loans when planning a budget is not recommended. But there is no need to exclude them from the pivot table if they exist. Lack of loans is a positive prospect. If a person has no debts, then the previously paid amount can be put aside for a rainy day.

Personal needs

How to spend money correctly? Some people don't understand this. If we are talking about one person, then there are no special problems with budget planning. But as soon as a family appears, as already mentioned, certain difficulties arise.

The point is that everyone has personal needs. What every person wants for himself personally. While learning to plan and maintain home accounting, you need to put your desires into the background.

By the way, it is recommended to distribute all “free” money at the end of the month among family members for personal needs. Or enter separate columns in the expense and income accounting table for this purpose. Allocate a fixed amount of money to everyone for their wishes.

Example

This is how to properly manage a family budget. The table example below is not the most advanced method. Rather, it is suitable for beginners. Through it, you can easily learn how to distribute finances so as not to fall into a financial hole.

An approximate table of expenses and income looks like this.

| Article | Plan | Fact | Difference |

| Income | 50 000 | 50 000 | 0 |

| Products | 10 000 | 11 500 | -1 500 |

| Communal payments | 5 000 | 4 500 | 500 |

| Household chemicals | 1 000 | 0 | 1 000 |

| Personal needs | 5 000 | 8 000 | -3 000 |

| Directions | 10 000 | 7 000 | 3 000 |

| Bottom line | 31 000 | 31 000 | 0 |

| Postponed | 5 000 | 5 000 | 0 |

This, as already mentioned, is far from the most common option for cost accounting. But it helps at first. In general, planning a home budget is a crucial moment. And it is recommended to entrust this activity to those who are best at it. With a little patience and strength, you can easily learn how to distribute money and save well.

A family is a state in miniature: it has a head, an adviser, “ subsidized population", income and expense items. Planning, distribution and sequestration ( familiar words?) family budget is an important task. How to save and save without going on a starvation diet? — Create a table for recording funds received by the family and review the structure of payments.

- Money– one of the greatest instruments created by man. They can buy freedom, experience, entertainment and everything that makes life more comfortable. But they can be squandered, spent in an unknown direction and senselessly squandered.

Legendary American actor of the early twentieth century Will Rogers said:

“Too many people spend money on things they don’t need to impress people they don’t like.”

Has your income been less than your expenses over the past few months? Yes? Then you are not alone, but in a big company. The problem is that this is not a very good company. Debts, loans, penalties and late payments are growing like a snowball... it's time to jump out of the sinking boat!

Why do you need to keep a family budget?

“Money is just a tool. They will take you where you want, but will not replace you as a driver,” Russian-born writer who emigrated to the States, Ayn Rand learned from her own experience the need to plan and budget her own finances.

Unconvincing? Here three good reasons start planning your family budget:

- Calculating a family budget will help you figure out long-term goals and work in a given direction. If you drift aimlessly, throwing money at every attractive item, how will you be able to save and go on a long-awaited vacation, buy a car or make a down payment on a mortgage?

- Family budget expenses table sheds light on spontaneous spending and forces you to reconsider your purchasing habits. Do you really need 50 pairs of black high heels? Planning a family budget forces you to set priorities and refocus on achieving your goals.

- Illness, divorce or job loss can lead to a serious financial crisis. Emergencies happen at the most inopportune times. This is why everyone needs an emergency fund. The structure of the family budget necessarily includes the column “ saving“- a financial cushion that will help you stay afloat for three to six months.

How to properly distribute the family budget

A few rules of thumb for family budget planning that we will present here can serve as a rough guide for making decisions. Everyone's situation is different and constantly changing, but the basic principles are a good starting point.

Rule 50/20/30

Elizabeth and Amelia Warren, authors of the book " All Your Worth: The Ultimate Lifetime Money Plan" (in translation " Your Whole Wealth: A Master Money Plan for Life") describe a simple but effective way to create a budget.

Instead of breaking down a family's expenses into 20 different categories, they recommend dividing the budget structure into three main components:

- 50% of income should cover basic expenses, such as paying housing, taxes and buying groceries;

- 30% – optional expenses: entertainment, going to a cafe, cinema, etc.;

- 20% goes to pay off loans and debts, and is also set aside as a reserve.

80/20 rule

Step 2: determine the income and expenses of the family budget

It's time to look at the structure of the family budget. Start by making a list of all sources of income: wages, alimony, pensions, part-time jobs and other options for bringing money into the family.

Expenses include everything you spend money on.

Divide your expenses into fixed and variable payments. Fill in the fields for variable and fixed expenses in the table for maintaining a family budget, based on your own experience. Detailed instructions for working with the excel file are in the next chapter.

When distributing the budget, it is necessary to take into account the size of the family, living conditions and the desires of all members of the “unit of society”. A short list of categories is already included in the example table. Consider the categories of expenses that will be needed to further detail the structure.

Income structure

As a rule, the income column includes:

- salary of the head of the family (indicated “husband”);

- salary of the general adviser (“wife”);

- interest on deposits;

- pension;

- social benefits;

- part-time jobs (private lessons, for example).

Expense column

Expenses are divided into constant, that is, unchangeable: fixed tax payments; home, car and health insurance; constant amounts for Internet and TV. This also includes those 10–20% that need to be set aside for unforeseen cases and “rainy days.”

Expenses are divided into constant, that is, unchangeable: fixed tax payments; home, car and health insurance; constant amounts for Internet and TV. This also includes those 10–20% that need to be set aside for unforeseen cases and “rainy days.”

Variable expenses column:

- products;

- medical service;

- spending on a car;

- cloth;

- payment for gas, electricity, water;

- personal expenses of spouses (entered and planned separately);

- seasonal spending on gifts;

- contributions to school and kindergarten;

- entertainment;

- expenses for children.

Depending on your desire, you can supplement, specify the list or shorten it by enlarging and combining expense items.

Step 3: Track your spending throughout the month

It is unlikely that you will be able to draw up a family budget table right away; you need to find out where the money goes and in what proportions. This will take one to two months. In a ready-made excel spreadsheet that you can download for free, start adding expenses, gradually adjusting the categories " for yourself».

Below you will find detailed explanations for this document, since this Excel includes several interrelated tables.

- The purpose of this step is to get a clear picture of your financial situation, clearly see the cost structure and, at the next stage, adjust the budget.

Step 4: Separate Needs from Wants

When people start recording their spending, they discover that a lot of money " flies away"for completely unnecessary things. Impulse, unplanned expenses seriously hit your pocket if your income level is not so high that a couple or two thousand go unnoticed.

Refuse to purchase until you are sure that the item is absolutely necessary for you. Wait a few weeks. If it turns out that you really cannot live without the desired item, then it is indeed a necessary expenditure.

A little advice: Put your credit and debit cards aside. Use cash to learn how to save. It is psychologically easier to part with virtual amounts than to count out pieces of paper.

How to properly plan a family budget in a table

Now you know what is really happening with your money.

Look at the categories of expenses you want to cut and make your own plan using a free excel spreadsheet.

Look at the categories of expenses you want to cut and make your own plan using a free excel spreadsheet.

Many people don't like the word " budget”, because they believe that these are restrictions, deprivations and lack of entertainment. Relax, a personalized spending plan will allow you to live within your means, avoid stress and sleep better rather than worrying about how to get out of debt.

“An annual income of £20 and an annual expenditure of £19.06 leads to happiness. An income of 20 pounds and an expense of 20.6 leads to suffering,” Charles Dickens’ brilliant note reveals the basic law of planning.

Enter your prepared family budget into the table

You have set goals, determined income and expenses, decided how much you will save monthly for emergencies andlearned the difference between needs and wants. Take another look at the budget sheet in the spreadsheet and fill in the blank columns.

A budget is not a static figure fixed once and for all. If necessary, you can always adjust it. For example, you planned to spend 15 thousand monthly on groceries, but after a couple of months you noticed that you only spend 14 thousand. Make additions to the table - redirect the saved amount to the “savings” column.

How to plan a budget with irregular income

Not everyone has a permanent job with regular paychecks. This doesn't mean you can't create a budget; but this means you have to plan in more detail.

- One strategy is to calculate the average income over the past few years and focus on this figure.

- Second way- determine a stable salary from your own income - what you will live on, and save the excess into an insurance account. In lean months, the account balance will decrease by exactly the missing amount. But your “salary” will remain the same.

- Third planning option– maintain two budget tables in parallel: for “ good" And " bad» months. It's a little more complicated, but nothing is impossible. The danger that awaits you along this path: people spend and take out loans, waiting for income from the best months. If the “black streak” drags on a little, the credit funnel will eat up both current and future income.

Below you will find solutions on how to distribute the family budget according to the table.

After we have decided on the main goals, let's try to distribute the family budget for the month, indicate current income and expenses in the table, in order to manage funds wisely, to be able to save for main goals, without missing out on current and everyday needs.

Open the second sheet " Budget"and fill in the fields of monthly income, annual income, and the program will calculate the results itself, example:

In columns " variable expenses" And " fixed costs» Enter estimated numbers. Add new items where " other", in place of unnecessary names, enter your own:

Now go to the tab of the month from which you decided to start saving and planning family expenses. On the left you will find columns in which you need to record the date of purchase, select a category from the drop-down list and make a note.

- Additional notes are very convenient to refresh your memory if necessary and clarify exactly what the money was spent on.

Simply delete the data entered in the table as an example and enter your own:

To account for expenses and income by month, we suggest looking at the table on the third sheet in our Excel " This year", this table is filled in automatically based on your expenses and income, sums up and gives an idea of your progress:

And on the right there will be a separate table that will automatically summarize all expenses for the year:

Nothing complicated. Even if you have never tried to master working with Excel tables, selecting the desired cell and entering the numbers is all that is required.

Poll: How old are you?

The problem of lack of money is relevant for most modern families. Many people literally dream of getting out of debt and starting a new financial life. In times of crisis, the burden of low wages, loans and debts affects almost all families without exception. This is why people strive to control their expenses. The point of saving expenses is not that people are greedy, but to gain financial stability and look at your budget soberly and impartially.

The benefit of controlling financial flow is obvious - it is cost reduction. The more you save, the more confidence you have in the future. The money you save can be used to create a financial cushion that will allow you to feel comfortable for a while, for example, if you are unemployed.

The main enemy on the path of financial control is laziness. People first get excited about the idea of controlling the family budget, but then quickly cool down and lose interest in their finances. To avoid this effect, you need to acquire a new habit - constantly control your expenses. The most difficult period is the first month. Then control becomes a habit, and you continue to act automatically. In addition, you will see the fruits of your “labor” immediately - your expenses will be amazingly reduced. You will personally see that some expenses were unnecessary and can be abandoned without harm to the family.

Poll: Is an Excel spreadsheet enough to control the family budget?

Accounting for family expenses and income in an Excel spreadsheet

If you are new to creating a family budget, then before using powerful and paid tools for home accounting, try maintaining your family budget in a simple Excel spreadsheet. The benefits of such a solution are obvious - you do not spend money on programs, and try your hand at controlling finances. On the other hand, if you bought the program, then this will stimulate you - since you spent money, then you need to keep records.

It is better to start drawing up a family budget in a simple table in which everything is clear to you. Over time, you can complicate and supplement it.

Read also:

Here we see three sections: income, expenses and report. In the expenses section we have introduced the above categories. Next to each category there is a cell containing the total expense for the month (the sum of all days on the right). In the “days of the month” area, daily expenses are entered. In fact, this is a complete report for the month on the expenses of your family budget. This table provides the following information: expenses for each day, for each week, for the month, as well as the total expenses for each category.

As for the formulas used in this table, they are very simple. For example, the total consumption for the “car” category is calculated using the formula =SUM(F14:AJ14). That is, this is the amount for all days on line number 14. The amount of expenses per day is calculated as follows: =SUM(F14:F25)– all numbers in column F from the 14th to the 25th line are summed up.

The “income” section is structured in a similar way. This table has categories of budget income and the amount that corresponds to it. In the “total” cell the sum of all categories ( =SUM(E5:E8)) in column E from the 5th to the 8th line. The “report” section is even simpler. The information from cells E9 and F28 is duplicated here. Balance (income minus expenses) is the difference between these cells.

Now let's make our expense table more complex. Let's introduce new columns “expense plan” and “deviation” (download the table of expenses and income). This is necessary for more accurate family budget planning. For example, you know that car costs are usually 5,000 rubles/month, and rent is 3,000 rubles/month. If we know the expenses in advance, then we can create a budget for a month or even a year.

Knowing your monthly expenses and income, you can plan large purchases. For example, family income is 70,000 rubles/month, and expenses are 50,000 rubles/month. This means that every month you can save 20,000 rubles. And in a year you will be the owner of a large sum - 240,000 rubles.

Thus, the “expense plan” and “deviation” columns are needed for long-term budget planning. If the value in the deviation column is negative (highlighted in red), then you have deviated from the plan. The deviation is calculated using the formula =F14-E14(that is, the difference between the plan and actual expenses for the category).

What if you deviate from the plan in some month? If the deviation is insignificant, then next month you should try to save on this category. For example, in our table in the category “clothing and cosmetics” there is a deviation of -3950 rubles. This means that next month it is advisable to spend 2050 rubles (6000 minus 3950) on this group of goods. Then, on average, over two months you will not have any deviation from the plan: (2050 + 9950) / 2 = 12000 / 2 = 6000.

Using our data from the expense table, we will build a cost report in the form of a chart.

We construct a report on family budget income in the same way.

The benefits of these reports are obvious. Firstly, we get a visual representation of the budget, and secondly, we can track the share of each category as a percentage. In our case, the most expensive items are “clothing and cosmetics” (19%), “food” (15%) and “credit” (15%).

Excel has ready-made templates that allow you to create the necessary tables in two clicks. If you go to the “File” menu and select “Create”, the program will offer you to create a finished project based on the existing templates. Our theme includes the following templates: “Typical Family Budget”, “Family Budget (Monthly)”, “Simple Expense Budget”, “Personal Budget”, “Semi-Monthly Home Budget”, “Monthly Student Budget”, “Personal Expenses Calculator” .

A selection of free Excel templates for budgeting

You can download ready-made Excel tables for free using these links:

The first two tables are discussed in this article. The third table is described in detail in the article about home accounting. The fourth selection is an archive containing standard templates from the Excel spreadsheet.

Try downloading and working with each table. After reviewing all the templates, you will surely find a table that is suitable specifically for your family budget.

Excel Spreadsheets vs. Home Accounting Software: What to Choose?

Each method of doing home accounting has its own advantages and disadvantages. If you have never done home accounting and have poor computer skills, then it is better to start accounting for your finances using a regular notebook. Enter all expenses and income into it in any form, and at the end of the month take a calculator and combine debits and credits.

If your level of knowledge allows you to use an Excel spreadsheet processor or a similar program, then feel free to download home budget spreadsheet templates and start accounting electronically.

When the functionality of the tables no longer suits you, you can use specialized programs. Start with the simplest software for personal accounting, and only then, when you get real experience, you can purchase a full-fledged program for a PC or smartphone. More detailed information about financial accounting programs can be found in the following articles:

The advantages of using Excel tables are obvious. This is a simple, straightforward and free solution. There is also the opportunity to gain additional skills in working with a table processor. The disadvantages include low performance, poor visibility, and limited functionality.

Specialized programs for managing a family budget have only one drawback - almost all normal software is paid. There is only one relevant question here - which program is the highest quality and cheapest? The advantages of the programs are: high performance, visual presentation of data, many reports, technical support from the developer, free updates.

If you want to try your hand at planning a family budget, but are not ready to pay money, then download for free and get down to business. If you already have experience in home accounting and want to use more advanced tools, we recommend installing a simple and inexpensive program called Housekeeper. Let's look at the basics of personal accounting using the Housekeeper.

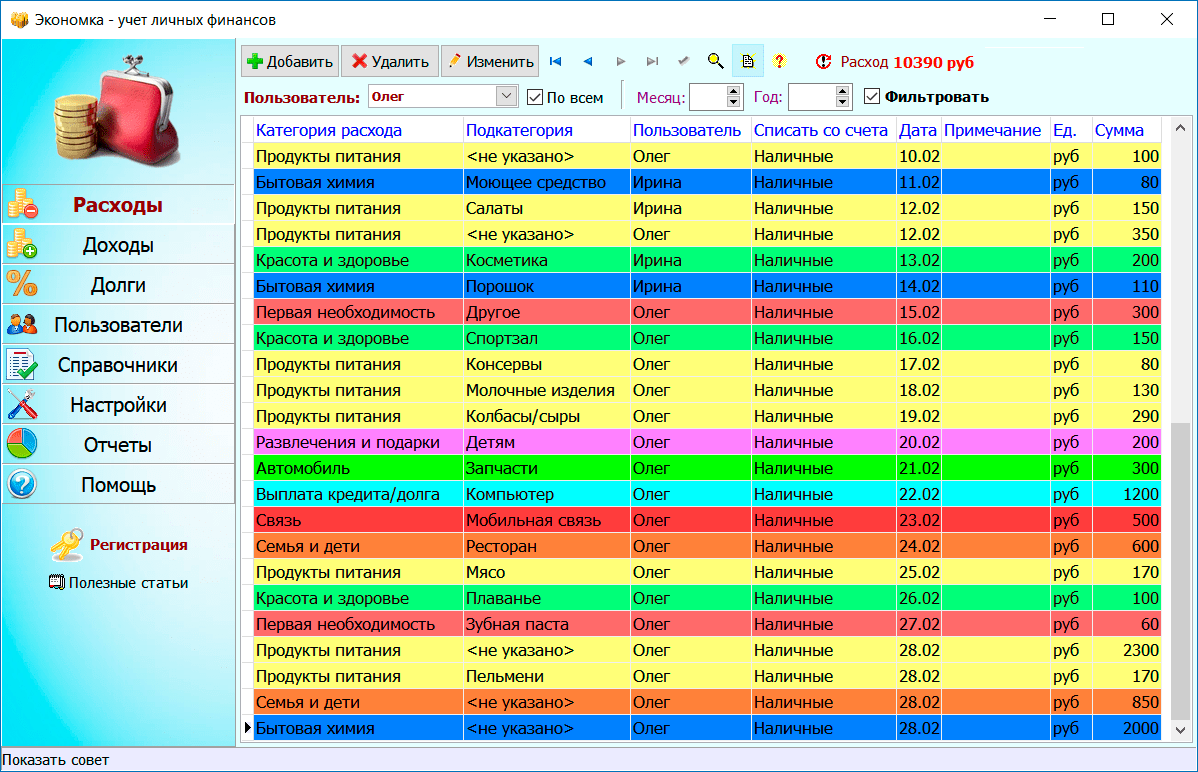

Maintaining home accounting in the "Housekeeper" program

A detailed description of the program can be found on this page. The functionality of the "Housekeeper" is simple: there are two main sections: income and expenses.

The “Income” section is arranged in a similar way. User accounts are configured in the “Users” section. You can add any number of accounts in different currencies. For example, one account can be in rubles, the second in dollars, the third in Euros, etc. The principle of operation of the program is simple - when you add an expense transaction, the money is debited from the selected account, and when it is an income transaction, the money, on the contrary, is credited to the account.

To build a report, you need to select the report type in the “Reports” section, specify the time interval (if necessary) and click the “Build” button.

As you can see, everything is simple! The program will independently generate reports and point you to the most expensive expense items. Using reports and an expense table, you can manage your family budget more effectively.

Video on family budgeting in Excel

There are many videos on the Internet dedicated to family budget issues. The main thing is that you not only watch, read and listen, but also apply the acquired knowledge in practice. By controlling your budget, you reduce unnecessary expenses and increase savings.

It is common to find families wondering where their money is being spent. After transferring wages, they can spend more than half of their income in a week, and then borrow money from friends or, even worse, take out countless bank loans. In addition, lack of money often becomes the cause of domestic quarrels and divorces in families. So what is it, what are the advantages and disadvantages of doing it?

Be sure to read my review on the topic and how I came to this only at 37 years old, exactly 1.5 years ago.

Family budget – balance of family income and expenses for a specified period of time.

Advantages of maintaining a family budget:

- General picture of family income for the period - main and additional earnings. This is the basis from which you should build on your capabilities for planned costs.

- Full control of family expenses. To avoid disputes, the spending picture will always show who spent the money on what. In the future, the dynamics of costs for each item will allow them to be adjusted depending on preferences and informed choice.

- Accumulation of funds and minimization of debts.

- major purchases and travel. The dynamics of the main cost items allows you to plan major events in a certain period using previously accumulated funds.

- Discipline. increases discipline in the life of every person.

Disadvantages of maintaining a family budget:

- Full transparency of the income and expenses of all family members, which not everyone may like.

- The ability to get hung up on the idea of saving, go beyond boundaries and infringe on yourself and other family members in any needs.

Principles of maintaining a family budget:

Income and expenses must be divided into items. Their number can be any at the discretion and convenience of everyone. For example, at first, expense items may be more detailed: food, household goods, rent payments, telephone payments, other payments for children's sections and school lunches, etc. Later, it would be better to combine some of the expenses. For example, all mandatory monthly payments are included in one article.

For the first two months, it’s enough to simply record your income and expenses by item. In the future, the budget must be planned for the future, at least for one period in advance.

It is more convenient to record expenses every day, reconcile cash balances (cash, bank cards, accounts, electronic money, etc.).

If distributed correctly, the family's expenditure budget should not exceed the income budget. In this way, a reserve portion will be formed, which can be accumulated or spent on necessary needs. It is recommended that the monthly reserve be at least 10% of income.

It is advisable to divide the reserve part into at least two components - the acquisition of useful purchases and an emergency reserve. The latter is necessary as a “spare cushion” in the event of a sudden loss of permanent income (dismissal, layoff), a deep financial crisis, or unforeseen circumstances.

Methods of maintaining a family budget:

- “the old fashioned way” - a thick notebook with manual notes and calculations on a calculator: a time-consuming and inconvenient option in terms of analysis and dynamics;

- maintaining a detailed, convenient table in Microsoft Office Excel on any computer, using an individual approach;

- services for budgeting (online websites and mobile applications) with the ability to choose the most convenient and appropriate one.

- Duplication is possible, for example, maintaining an express budget in a mobile application to quickly record costs and a more detailed budget with analysis and dynamics in Microsoft Excel.

An example of maintaining a family budget in Excel in our family.

how to make a family budget

how to make a family budget In addition to maintaining a table in Excel, I recommend daily accounting of expenses and income in special applications for maintaining a family budget, for example, Home Accounting, which, among other things, can be installed as an individual or family application, i.e. on 2 devices on Android, Windows or iOS.

I can recommend the free AbilityCash program, which I use myself, you can download it from this link

Home accounting allows you to quickly understand where the money is going and where there are reserves for saving.

Explore different programs and choose the one that is convenient for you. It is important that the program has the ability to divide expenses into different items, obtain spending statistics for each item, and use various data filters.

Many families do not take into account the nuances of properly managing the family budget, which is why many financial issues arise in the family.

To avoid this, it is worth learning the three most important accounting rules.

No. 1. Determine the exact total amount of income for the month. You will have to take all the income for the month and, by adding, find out the total amount.

No. 2. Calculate all monthly necessary expenses and payment of bills. In other words, find out the inevitable waste of money per month.

No. 3. Subtract the amount of unavoidable expenses from the principal amount of income. And only distribute the remaining amount to other side expenses.

So, there is a certain amount of money left. How to competently manage it further? Family is a big responsibility and everyone has their own personal needs. In order to satisfy the major needs of each family member, for example, buying seasonal outerwear or shoes, you should set aside approximately 10% of the income amount from each monthly income. When the time comes to buy one of the family members an important new thing, or an unexpected spending situation suddenly arises, the family will already be ready for it. The accumulated amount will be able to cover such expenses.

Why do you dream about ripe red strawberries: interpretation of the dream according to various dream books

Why do you dream about ripe red strawberries: interpretation of the dream according to various dream books What does the dream book say: I’m dancing with a man - why do I dream?

What does the dream book say: I’m dancing with a man - why do I dream? What does a dream portend if you dream that your loved one has left you?

What does a dream portend if you dream that your loved one has left you? Dream Interpretation - deceased relatives: why see a dead father, mother, wife, husband, grandmother, grandfather, children in a dream as if they were alive and that they are dying?

Dream Interpretation - deceased relatives: why see a dead father, mother, wife, husband, grandmother, grandfather, children in a dream as if they were alive and that they are dying? “Dream book dead cat dreamed of why a dead cat dreams in a dream

“Dream book dead cat dreamed of why a dead cat dreams in a dream If in a dream they give red boots

If in a dream they give red boots What could red boots mean in a dream?

What could red boots mean in a dream?