Accounting info. Accounting info 1s 8 return from buyer

If the quality is unsatisfactory or for other reasons, the buyer can use the service of exchanging the unsuitable product to the seller. The client initiates an exchange for another product or a refund. He can transfer information to prepare a return over the phone or during a personal meeting, depending on the seller’s desire to cooperate. To process the return of goods in 1C 8.3 Trade Management, programmers created functionality to reflect data on such business transactions.

Creating a request to return a product

The rights of buyers to exchange or return goods are regulated in two laws of the Russian Federation: Article No. 25 “On the Protection of Consumer Rights” and Article No. 502 in the Civil Code. But not everyone understands that these documents are not aimed at returning, but at exchanging goods they don’t like. If at the time of circulation of a similar product for which the buyer would agree to exchange the purchased item, then by agreement with the company management, he can wait until it appears.

If a defect or other damage is detected, the client also has the right to request a replacement or refund from the seller. The only exception is the situation in which he was aware of the presence of a defect. Basically, there is a special discount on such products. In any case, to make a claim, an application is written addressed to the head of the company for a return or exchange, indicating the buyer’s passport details and providing a receipt.

Returns of goods happen all the time, so it is worth studying the issue of carrying out this operation in the 1C program. To create a file for returning a product, you need to go to the “Sales” section and find the “Return Documents” item in the “Returns and Adjustments” section.

Depending on the purpose, you can create one of the following documents:

- Returns from customers, if this file is selected, the amounts for returned goods can be included in mutual settlements with the buyer, as payment for his other purchases;

- Returns from commission agents, this document can be issued on any date. It does not matter when the return occurs before the commission agent provides data on the products sold or after the fact of sale has been registered;

- Returns from retail customers, it is used in cases where the client returned a purchased product that was sold at retail after the cash book was closed.

The details of this document will vary when choosing one of the proposed options.

Important! When choosing the last type of documents “Returns from retail customers”, the seller must have a receipt provided by the client as a basis for the return.

In addition, you can use “Requests for returning goods from customers.” In order to create such a request, you need to go to “Sales” - “Returns and Adjustments” in the same way as in the first case and select the first item.

Exchange requests can be submitted in two ways: based on information about sold products or manually entered according to the data provided by the buyer.

In the file that opens, you can see several commands with which you can quickly select applications:

- The current condition in which the returned product is;

- Deadline;

- A priority;

- Manager responsible for the return process.

The application, in turn, can be divided into three types, depending on who the refund is issued:

- Client;

- Commissioner;

- Retail buyer.

When creating an application, the 1C program offers you to select one of the types of statuses. This paragraph can be changed in the document depending on the actual change in the situation. Setting this or that status will determine which actions the client will be able to use and which will become unavailable.

To return a product, the status field must be set to “To be returned” or “To be completed.” If the application is “Under approval”, processing a return on it will not be possible.

In the first tab “Basic” the document number will be assigned automatically when saving the document, and the date will be set to today. But they can be changed manually to the necessary ones. Below you will find information about the client, the counterparty, the agreement reached and the payment procedure. The other part of the table contains information about the company to which the product will be returned, the warehouse and the required field – “Method of compensation”. There are two such methods:

- “Replacement of goods”, instead of the product that the client refused, he is provided with another product. It may be completely different from the previous one. When choosing this method, you will need to fill out the “Returnable Items” and “Replacement Items” tabs;

- “Return funds” is a simpler method, which involves returning money to the client by filling out an expense cash order or by non-cash debiting from the organization’s current account. It is convenient for both the seller and the buyer. But with this method, the organization loses part of the money earned, so the first option with replacement is preferable. In some cases, the replacement product costs more than the previously provided product. And then the buyer has to pay the difference between the prices for his purchase.

By going to the second tab, you need to fill out the nomenclature of the returned goods. In it, you should pay close attention to the extreme field “Sales document”. It has the ability to select goods based on sales documents that were created during shipment. To manually fill out the product range, you can use two commands. The first is “Fill out sales documents and prices,” which provides information about sales documents and the prices specified in these documents.

The selection is set up according to LIFO principles, which assume that the goods shipped are presented in the latest documents.

You can also load information using the Add Products from Sales Documents command. In this case, you need to select one of the sales documents and find the necessary goods in it.

By going to the next tab “Replacement Products” you need to indicate which product will be replaced with the returned one, as well as the price at which this compensation is provided.

The last tab is “Advanced”, the following lines are filled in:

- Operation – select from the drop-down list from whom the refund is issued;

- Deal;

- Subdivision;

- Manager involved in the transaction;

- Currency;

- When working with VAT, check the box next to the currency;

- Taxation.

In addition, applications for the return of goods can be issued based on the sales document. By going to the sales journal, you can select the required document and create a statement based on it. In this case, you do not have to fill out every item in the document; the 1C program will do everything automatically. After this, all that remains is to adjust the “Returnable Goods” tab if the sale included several types of goods, but only one needs to be returned. You just need to delete unnecessary lines.

Registration of a return invoice in the 1C Trade Management program (UT 11) 11.2

The application has been created and it’s time to start processing the return itself. You need to go to the “Returns of goods from customers” section and switch to the “Orders for registration” tab, there is an assistant for creating returns based on orders.  It will already contain the previously created application. You need to select it and click on the “Return goods” button.

It will already contain the previously created application. You need to select it and click on the “Return goods” button.

The program automatically filled in all the basic information necessary to generate the document using existing data. The basis will indicate the number and date of the application on the basis of which it was created.

By going to the “Products” tab, you can see the product that is subject to return, as well as all the necessary information about the quantity and price of the selected air conditioner.

The “Additional” tab is filled with data about the manager conducting the transaction for which the return operation is being carried out. In addition, information about the division, currency, return transactions from the client and everything about taxation is indicated.

After checking the completed lines, this document must be posted and closed.

The main actions have been completed and you need to return to the order log to return the goods to the client. Since the client has already returned an unsuitable air conditioner, it is necessary to replace it with a new product specified in the terms of exchange. To do this, in the “Substitute Goods” tab, click on the “Collateral” button and select “Fill out the collateral”, then a window will appear in which the “For shipment” checkbox will appear. Afterwards, the document can be posted and an invoice can be created based on it.

In addition, after all the actions in the “Return of Goods” document, it is possible to generate reports such as:

- Customer debt. After completion, the debt will be changed only if the prices for the goods to be exchanged were different;

- Card of settlements with clients;

- Payment card for containers;

- Places of use;

- Related documents.

If you know exactly which document the sale was based on, you can create a request from the “Sales Documents” journal. You need to find the required file, select it and create an “Application for Return of Goods” based on it.

Important! If the program gives an error and does not allow you to generate a document, you need to open the implementation and change the status from “For prepayment” to “Implemented”. In this case, all the basic data will already be indicated and all that remains is to edit them a little.

To create an invoice, you need to go to the “Sales” - “Sales Documents” section. Among the orders for registration, you need to find the request that was created earlier to return the product from the client. It is necessary to isolate it and form an implementation based on it. After this, check the correctness of the filled in data and post the invoice.

Payment of the buyer's debt in cash

After the operation to return and provide the buyer with new, more expensive equipment, a debt will be formed in favor of the seller. Therefore, the client must pay the resulting difference. This also needs to be reflected in the 1C: Trade Management program.

In most cases, additional payments are made in cash, so we will consider this option. To do this, go to the “Treasury” menu and select the “Cash receipts” item. In the presented journal, you need to switch to the “For receipt” tab.

In the line “Base of payment”, select the item “Settlements with clients”. The list presented will include the previously created application to return the product.

The amount of surcharge that the buyer is obliged to pay to the seller is calculated from the difference between the goods: those returned to the organization and those provided to the client for compensation as a replacement.

After selecting the required application, you need to use the “Submit for receipt” button, which will open a window with the creation of a cash receipt order. In the document, the 1C program will already fill in all the necessary credentials, such as cash register and payer.

By going to the “Payment Decoding” tab, you can see that the lines have already been filled in: the basis document, the cash flow item. In the “Print” tab, you can check information on printing a cash receipt order. After this, the document is posted and closed.

Important! Otherwise, if the replaced product turns out to be cheaper than the original one, a cash receipt order is issued in the same way.

It is located in the “Treasury” menu. After this, you need to go to the “Cash vouchers” tab and go to “For payment”. Its basis will also be the previously created application for the return of goods and click the “Pay” button.

This instruction contains a description of the work on creating documents “Return of goods from the client” in the 1C: Trade Management system created on the 1C: Enterprise platform and is intended for users of the standard system. After familiarizing yourself with it, you will be able to independently create and post the required documents, that is, process the return of goods in 1C. System configuration in which the examples were created: “Trade Management”, edition 11 (11.4.3.126).

Document details

If for some reason the product is not suitable for the buyer, it can and should be returned to the seller. The client initiates this return in any way convenient for him - by phone, by email. by mail, in person. In the standard functionality of the 1C UT system, it is possible to reflect this business transaction.

In the Trade Management configuration, there are 3 types of operations within which you can process a product return:

- Return of goods from the buyer (retail)

- Return of goods from the commission agent

Creating a document

The journal of customer return documents is located in the “Sales” – “Returns and Adjustments” – “Return Documents” workplace. A document can be created in the following ways:

- Manually from the workplace;

- Based on the basis document (“Sales of goods and services”, “Return application”).

The filling also depends on the method.

Creation from workspace

The first method of creation is carried out through “Returns and adjustments” – “Return documents” – “Create”:

When you click on the highlighted button “Create” – “Return from the client”, a new window for creating the document “Return of goods from the client” opens. All tabular parts except the date and compensation option are not filled in, so you need to fill in all the details of the document and its tabular part (may differ depending on the type of operation).

Requisites:

Organization– the name will be automatically entered into this field if the system maintains records for one organization at a time. If the system keeps records of several organizations, you need to select the desired one from the directory of organizations, that is, the one to which the goods will be returned from the client. Keeping records in the system on behalf of one or more organizations is configured in the section: “Master data and administration” – “Set up master data and sections” – “Enterprise” – “Several organizations (checked)”.

Client– you need to select a client from the directory of partners (clients).

Counterparty– the field will be automatically filled in after selecting a client. If “Partner (Client)” has been created in the system, but “Counterparty” has not been created, then a counterparty must be created in the directory of partners (clients).

Stock– you must select a warehouse from the “Warehouses and Stores” directory.

Agreement– you need to choose an agreement when using them. When you select an organization and a client, a list of agreements will be available for selection in the drop-down list by clicking the button:

Compensation– settlement option regarding the excess of the refund amount over the repaid debt. The field is not available for selection until the tabular part of the “Products” document is filled out. After filling out the tabular part, this field becomes available for change.

Possible filling options:

- Return the funds (after registering the return of goods, a document “Write-off of non-cash DS” is drawn up, with the help of which the return of funds to the client is recorded);

- Leave as an advance (the funds are not returned to the client, but after the goods are returned to the client, the funds can be offset as an advance on any other transaction, for example, as an advance on a customer order or as payment for a shipping invoice). The refund amount reduces the client's current debt. The debt to be repaid is indicated in the list of mutual settlements (opened using the hyperlink “Customer debt reduced”).

![]()

In the window that opens, you can add a settlement document (customer order, contract, return of goods from the client), according to which the client’s debt will be reduced. The document is filled out from the list of available settlement objects.

The table part can be filled in:

- Manually line by line: you need to click the “Add” button, select the required products from the “Nomenclature” directory and fill in the quantity and cost. To automatically fill in information about sales documents, you can use the “Fill” – “Fill in sales documents and prices” command. The program will automatically fill in information about the sales documents and the prices at which the returned goods were sold;

- Using the selection dialog“Fill” – “Select products” add products from sales documents.

A new dialog box opens, listing all sales documents for the selected period. Select the required goods* for return by checking the boxes and clicking the “Move to document” button to fill out the tabular part of the document “Return of goods from the client”.

*For convenience, you can use selection (Ctrl, Ctrl + A, Shift), transfer or exclude a large number of items. In the selection of goods, the quantity does not change; you can adjust the quantity of returned goods in the tabular part of the return from the client. The cost is filled in automatically from the sales document.

- From an external file. To do this, you need to copy the columns into the table from an external file (Excel, Word) via the clipboard. One of the columns must be filled in: “Barcode”, “Code”, “Article” or “Nomenclature”.

The product is returned to the warehouse in accordance with the cost settings specified in the product line. Using the “Fill” – “Fill Cost” dialog box, you can specify the determination method for the selected lines:

*With the manual version of the cost determination method, if prices for the selected price type are not registered on the specified date, then the amounts will not be recalculated, which will be indicated by the corresponding information line.

Setting up the currency of management accounting is located: “Master data and administration” – “Setting up master data and sections” – “Enterprise” – “Currencies” – “Currency of management accounting”. This setting is not configurable for the system as a whole or for organizations.

Important to remember! Indicating the sales document in the tabular section is not a prerequisite for posting the document, but it is recommended to indicate it for correct reflection, accounting and automatic filling of the fields in the tabular section.

Additional fields:

Manager– is automatically filled in. If necessary, you can change the user.

Deal– filled in when using transactions.

Subdivision– filled in automatically by the manager, or selected manually.

The contact person– filled in from the list of contact persons of the counterparty.

Group of fin. accounting for settlements– filled in from the list of previously entered financial groups. accounting. The field is optional, used for analytics of financial accounting of settlements with partners. If necessary, you can create a new settings group from the dialog box that appears. Can be automatically filled in from the details of the selected agreement between the organization and the counterparty.

Incoming document number– manually fill in the number of the paper document according to which the goods were returned.

Currency– select the document currency. Automatically filled in from the contract/agreement between the counterparty and the organization.

Payment– select payment (in rubles, in foreign currency). Automatically filled in from the agreement between the counterparty and the organization.

Operation– is automatically specified when selecting the operation type when creating a document.

Taxation– select from the options: “Sale is subject to VAT”, “Sale is not subject to VAT”, “Sale is subject to UTII”.

Price includes VAT– when the flag is turned on, prices are indicated including VAT; when turned off, prices are calculated in addition to the price of goods.

Return of transferred reusable packaging– when accounting for goods and having items in the system with the “Containers” type, the document can be supplemented with containers and reflect their arrival at the warehouse.

There is a deposit for packaging– this flag is turned on manually, and if the conditions for working with containers are specified in the agreement between the organization and the counterparty, then the flag will be set automatically when selecting an agreement in the return document.

Save the document by clicking “Burn” (if you need to continue working with the document). Perform a refund by clicking “Post” (if you need to continue working with the document). If you do not plan to work further with the document, click “Post and close”.

Additional functionality

If necessary attach one or more files to the document, you need to select the “Files” tab and click the “Add” button on the toolbar:

You can attach a file (for example, a scan of a document) by loading the finished file from disk. The file is selected using a standard dialog.

Later, after downloading, the file can be edited. File versions are saved (fields “Date modified”, “Modified”). Also, attached files can be distributed into folders, viewed, edited, sent to a printer and via email (when setting up an email client in the system).

Functionality available for working with electronic signatures(according to the icon, as in the figure below), but this requires additional configuration:

If the need arises create a task According to this document, any user of the system must enter the task based on the return document:

- Exercise– a required text field to be filled in (for example, “Check product quality”).

- Executor– a required field to fill in, where you need to select an executor from the “Users” directory or from the “Executor Roles” directory (in this case, the task will be sent to those users who have a specific role configured).

- Term– you need to fill in the date and time manually, or fill it in from the calendar.

- Check progress flag– after the task is completed by the executor, the author of the task will receive a reminder to check the completion (on the user’s desktop when opening the system).

Previously created tasks for a document can be viewed by opening the “Tasks” tab. They can be changed - mark completion, cancel the task, redirect the task, accept for execution, create an additional task based on it, you can also set a reminder about this task on the system desktop for the current user.

If necessary, you can create a note the current user of the system to the desktop. You can create a note in the “My Notes” document tab by clicking the “Create” button. Notes are reflected on the user's desktop and help not to forget about planned activities.

So, the document “Return of goods from the client” is completed and posted. If you specify several sales documents in the return, they will be reflected in the reporting structure.

From the base document

Let's consider the second, simpler method of creating a document, which at the same time helps to avoid errors when filling out, and also speeds up the process of creating and posting the document.

In any convenient way, you need to find and open the basis document (for example, “Sales of goods and services”) from the document journal, or by going to it according to the subordination structure.

Having opened the base document, you need to click the “Enter based on” button:

With this method of creating a document, all tabs and the tabular part will be filled in automatically. The document can be adjusted if necessary.

Additional features

Using return requests is a system option, included in “Master data and administration” – “Set up master data and sections” – “Sales” – “Wholesale sales” – “Return applications (checked)”. Applications can be used when working with “Order from warehouse” and “To order”. The created application is controlled by statuses. It can be created as a separate document, or based on a sales document. The application can be the basis for filling out the return of goods from the client (along with such supporting documents as “Sales of goods and services”, etc.).

When using the “Quality” block in the system, the product returned from the client can be registered as a product of a different quality (“Good”, “Limited Good”) and entered into the warehouse. To do this, you need to use the button in the “Goods” tab of the “Return of goods from the client” document – “Return of goods of different quality.” Afterwards, additional columns appear in the document: “The product was previously shipped” and “The product is being returned of a different quality.”

For lines with defective goods, you need to check the box in the “Item” field (in the “Product of a different quality is returned” group) and select an item of a different quality. To select a product of a different quality, the “Select a product of a different quality” form will be opened, in which you must select a product of a different quality (if it was previously created in the system), or create and select it.

Return to a warehouse other than the shipping warehouse can be carried out if the company does not work with quality, but wants to reflect the return of goods directly to a separately allocated scrap warehouse. Here you need to change the warehouse in the header, and then post the document. Thus, it will be convenient to track all defective goods in the defective warehouse.

Return of imported goods is necessary when the system carries out shipments of imported goods with the obligatory indication of the customs declaration number and country of origin. The return document must indicate the document that recorded the sale of the returned product. Information about which products were returned by the client can be viewed after posting the return document by clicking on the “Open inventory types” button from the “More” command group.

Return of goods to the warehouse where the order document flow scheme is maintained. Registration of the actual receipt of returned goods at the warehouse depends on the warehouse to which the goods are returned:

- If the warehouse does not use an order scheme for the receipt of goods, then the actual receipt of goods at the warehouse will be issued when posting the document “Return of goods from the client”;

- If the warehouse uses an order scheme for the receipt of goods, then the actual receipt of goods at the warehouse is formalized using the document “Receipt order for goods”. In this case, the document “Return of goods from the client to the order warehouse” is an order for acceptance of goods.

After posting the document, in the section “Warehouse and delivery” – “Order warehouse” – “Acceptance” information will be displayed for which returns you need to issue a receipt order:

To create a receipt order for goods, you need to click the “Create order” button. The document “Receipt order for goods” will be filled out automatically, but you will need to fill in the actual quantity (command “Fill” - “Quantity only”) and then post the document.

If the “Incoming order statuses” flag is set in the order warehouse settings, then the goods will appear in the warehouse after posting the “Incoming order for goods” document in the “Accepted” status (previous statuses: “For receipt”, “In progress”, “Processing required” ). In previous statuses, the product will not appear in the warehouse balances. If incoming order statuses are not used, the goods will be available in the warehouse immediately after posting the “Goods incoming order” document.

Thus, we looked at how to return goods in 1C, Trade Management configuration, in two ways: manually and using a base document.

3.0 is produced in the following typical cases:

the buyer returns unsuitable/defective goods;

the buyer returns the equipment;

the buyer returns the container;

the commission agent/agent returns the goods.

To reflect these operations in the enterprise database, a document “Return of goods from the buyer” is provided. It can be entered in two ways: based on a sales document or retail sales report, or manually.

Creating a return of goods from a buyer in 1C based on sales or a retail sales report is the easiest and fastest way to process it. In this case, details, cost and other data are filled in automatically from the sales document.

Let's consider the manual method of filling out the return of goods from the buyer. In the list of operations on the “Sales” tab, you need to select the appropriate type of operation “Returns of goods from customers”. In the list of return documents that opens, you need to create a new return. To do this, select the desired type of document from the drop-down list of the “Return” button:

If the product is returned to us, then select the “Sale, commission” option. In the form that opens, fill in the fields indicating the warehouse where the returned goods will be posted, price types (this data is in the sales agreement, settings for the counterparty, if required, they can be changed directly through the document), the currency in which payments were made under the agreement.

Regardless of the type of return, the header of the document is filled out in the same way.

Further filling depends on the type of return. Let's consider all the options separately.

Returning unsuitable/defective goods to 1C: Accounting

It can be performed in two ways: with or without indication of the sales document. First, let's look at filling out the document when the sales document is not specified. Create a new return, select the type “Sales, commission”, fill out the header. Let's move on to the tabular part.

Here it is important to pay attention to the price indication (this is the price at which we return the product); when setting the quantity, the program will automatically calculate the amount. The counterparty's debt to our organization will be reduced by this amount (since the goods have been returned to us). Next, you need to indicate the cost price - according to this data, the goods will be reflected in accounting on 41 accounts and returned to the warehouse. The cost price in the absence of a sales document is indicated manually.

Please note that for enterprises that are on the simplified tax system, when returning, you must indicate whether the returned product will be included in the accepted expenses at the time of sale. To do this, data is entered in the “Expenses (OU)” field.

When filling out the fields, the 1C program itself will substitute accounting accounts, income and expenses, and a VAT account from the characteristics of the items accepted for return to 1C. The completed document is posted, after which you can see the following transactions:

Now let’s consider the case of indicating a sales document (a special field “Shipment Document” is provided for this). Let’s enter data on sales or retail sales¸ after which, when you click the “Fill” button, the program will automatically fill out the tabular part, including the cost of the goods:

The tabular part will be filled in completely according to the shipment document. If necessary, you can adjust the quantity of goods being returned and delete any item if it is not actually returned.

If the shipment document is a retail sales report, 1C a PKO will appear in the structure of the document, according to which the funds will be returned to the buyer.

Return of equipment to 1C:Accounting

The buyer can return the equipment to the organization. You can also issue such a return in 1C using a document of the same name, but when creating it, select the “Equipment” type:

The tabular part is filled out in the same way as when returning goods. This can be done by manually adding new lines and selecting items from the directory, or filling them out automatically based on shipment. As in the previous case, when returning equipment without indicating the shipment document, you will have to independently indicate the cost and cost.

Return of packaging from the buyer in 1C: Accounting

From the point of view of accounting in 1C, containers will be considered the same product. Therefore, when processing a return, the actions will be similar: if the container is accepted separately, then the registration takes place through “Sale, commission”. If equipment and containers are returned together, then “Equipment” is correct.

Return of goods from a commission agent/agent in 1C: Accounting

The return of goods or products in the case of a commission agent is carried out through the “Sale, commission” item. Here you need to pay attention to the type of contract: with a commission agent (agent). After specifying the shipment document, you can fill out the tabular part automatically, and the program itself will insert accounting accounts and other data.

What documents can be entered based on a return in 1C: Accounting 8.3

Based on the return document, you can enter issued and received invoices, documents for the expenditure of funds, and calculate and deduct VAT. You can also configure printing of the return invoice and other documents from the return.

Return of goods from customers is documented using a document of the same name. Let's look at the step-by-step instructions for returning goods from the buyer in 1C 8.3 and what transactions this document generates.

In the configuration, it is possible to enter this document based on two other documents: and .

If we go to the transaction log Return of goods from customers, we will see a button with a Return drop-down list. There are two points: Sales, commission and Equipment.

In fact, there are more types of customer returns:

- Return indicating the implementation document.

- Return without specifying the sales document.

- Return from .

- Return of equipment.

- Return of packaging.

When entering a document in the header of each type of return, you must indicate the following details:

- Stock— storage location where the return is made. Returns can only be made to warehouses of the “Wholesale” or “Retail” type.

- Price type– it is necessary to establish the type of price at which the return is made. It is taken from the buyer’s agreement or from the user settings, or can be changed with the Edit button.

- Currency– the currency in which the document amount will be expressed. It is taken automatically from the contract.

The required header details for all types of returns are the same, and we will not consider them further.

Let's consider each type of return separately.

To process this return of goods to the buyer in 1C 8.3, you need to click the Return button in the document log and select the Sale, commission item.

In the header of the newly created document, you need to fill in the details Shipment Document, indicating the sales document against which the return is made. After you have selected the desired operation, fill out the bookmarks: Products and Calculations.

Get 267 video lessons on 1C for free:

- The Products table can be filled out automatically by clicking the Fill button and selecting Fill in according to the shipment document, or manually using the Pick button. After installation, accordingly, you must indicate the Quantity, Price, and VAT Rate. On the Calculations tab, the accounts for which the Item will be accounted for are indicated.

- Price—filled in from the Item Price register.

- Accounting account, VAT account, Income account and Expense account - are filled in from the Item Accounting register.

- Subconto – represents the current product.

If the Goods table is filled in according to the Shipment Document, then the system itself will determine the accounting value of the goods to be returned at the time of sale.

Also, if the return occurs on the basis of the Retail Sales Report document, the details according to which the money was returned to the retail Counterparty are entered.

How to make a return from a buyer without specifying a sales document

Similar to what was described above, to issue this return, you need to click the Return button in the document log and select the Sale, commission item.

Further actions are similar to the formation of a document indicating the implementation document, with some exceptions, which we will now consider.

Since the Shipping Document is not selected, we do not know the batch of goods and, therefore, its Cost. To indicate the Cost, a special field is provided in each line; it must be filled in manually.

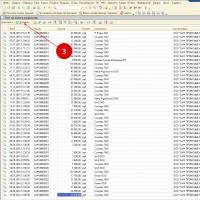

An example of transactions for returning goods from a buyer can be seen in this screenshot:

Our video on returning goods in the 1C program:

Return of goods from the commission agent

To record the operation of returning goods or GP (finished products) to the commission agent, you need to click on the Return button and select the item Sales, commission.

In the created document, the Agreement should have the form “With a commission agent (agent)”.

The program substitutes Accounting Account and Transferred Accounting Accounts based on the settings of the Item Accounting Account register.

Return of equipment

To record the operation of returning equipment from a buyer, you need to click the Return button and select the Equipment item.

On the Equipment tab, the item, quantity, price, VAT rate, as well as item accounting accounts are indicated.

- The tabular part “Products” can also be filled out either manually by adding rows, or through the Fill button based on the shipping document.

- If the Shipment Document field is not filled in, you must additionally indicate the accounting value of the equipment being returned.

- As in the case of Return of goods from the buyer without specifying the sales document, the field Cost must be filled in manually.

- Price—set by the program based on the Item Price register. The accounting account, VAT account, income account and expense account are entered by the program based on the register of the Item Accounting Account.

Return of packaging

Let's consider the situation with returns. These operations always raise many questions. Return is the transfer of goods from the buyer to the seller if facts of improper fulfillment by the seller of their obligations under the purchase and sale agreement listed in the Civil Code of the Russian Federation are revealed.

These are the following cases:

- approval of the order, the seller’s obligation to transfer the goods free from the rights of third parties was violated (Article 460 of the Civil Code of the Russian Federation);

- the seller’s obligation to transfer accessories or documents related to the goods within the period established by the contract has been violated (Article 464 of the Civil Code of the Russian Federation);

- the conditions regarding the quantity of goods were violated (Article 466 of the Civil Code of the Russian Federation);

- the conditions regarding the assortment of goods were violated (clauses 1 and 2 of Article 468 of the Civil Code of the Russian Federation);

- goods of inadequate quality were transferred (clause 2 of Article 475 of the Civil Code of the Russian Federation);

- the packaging of the goods has been violated (clause 2 of Article 480 of the Civil Code of the Russian Federation);

- the terms of container and/or packaging of the goods were violated ( Art. 482 Civil Code of the Russian Federation).

In this article we will focus on returns to the supplier and the reflection of various options in the 1C: Accounting 8 program, edition 2.0.

When accepting goods for accounting, the buyer registers an invoice in the purchase book and VAT is fully deductible (clause 1 of Article 172 of the Tax Code of the Russian Federation), and when returning goods, he issues an invoice to the supplier for the return, which is registered in the sales book.

In the buyer’s accounting, the return of goods is recorded by postings to the debit of account 76.02 “Calculations for claims” and the credit of account 41.01 “Goods in warehouses”.

Sometimes, due to the large turnover, it is inconvenient to allocate calculations for returns to a separate accounting account 76.02, since it will be constantly necessary to make offsets with account 60. Therefore, this article will tell you how you can reflect returns through 60 accounts.

Returns occur in different situations: before or after payment for the goods received. Therefore, we will consider various options.

1. Goods purchased - paid to supplier - returned to supplier. (Settlements for claims are made on account 76.02)

When considering examples, we will not dwell in detail on the creation of standard documents in the 1C: Accounting 8 program.We will reflect the acceptance of goods for accounting in the program using the standard document “Receipt of goods and services.” The goods arrive with VAT. (We will reflect the receipt of the invoice). Accounts payable arise on account 60.01 in the amount of 2,000 rubles.

Document postings:

Document postings:

Thus, accounts payable under account 60.01 are fully repaid. This can be seen in the report “Account balance sheet”

The field “Receipt document” in the document header is not required to be filled out, but the indication of this document makes it possible to make mutual settlements in the context of the third subconto of settlement accounts more clear, and also to eliminate unnecessary offsets.

All examples presented will be considered with an indication of the receipt document.

Let's consider this option now.

Document postings:

Since the debt under 60.01 is closed, all transactions are generated using the auxiliary account 76.02 “Settlements for claims”.

The supplier's advance resulting from the return is formed on account 76.02.

If the supplier returns the money, a document “Receipt to the current account” is drawn up with the transaction type “Return from the supplier”.

Document postings:

The advance is returned.

2. Goods purchased - not paid to supplier - returned to supplier. (Settlements for claims are made on account 76.02)

Document postings:

We will reflect the return to the supplier using the “Return of goods to supplier” document, which is located in the “Purchase” - “Return of goods to supplier” menu.

On the “Accounts” tab we also use account 76.02 “Calculations for claims”.

Since the goods were not paid for before the return, no debt is created on any account. But mutual settlements are reflected in the turnover on account 76.02:

ATTENTION! If in this situation in the document “Return of goods to the supplier” we do not indicate the receipt document, then the program “will not see” which settlement document needs to be closed for account 60.01.

And accordingly, there will be no posting to account 60.01 in this case.

Then a situation will arise in which it is necessary to make an internal offset between 60.01 and 76.02. This can be seen from two reports:

3. Goods purchased - paid to supplier - returned to supplier. (Settlements for claims are made on account 60.02)

We will reflect the acceptance of goods for accounting in the program using the standard document “Receipt of goods and services.” The goods arrive with VAT. (We will reflect the receipt of the invoice). Accounts payable arise on account 60.01 in the amount of 2,000 rubles.Document postings:

We will reflect the payment of accounts payable using the document “Write-off from the current account.”

Document postings:

Thus, accounts payable under account 60.01 are fully repaid. This can be seen in the “Account balance sheet” report.

We will reflect the return to the supplier using the “Return of goods to supplier” document, which is located in the “Purchase” - “Return of goods to supplier” menu.

On the “Accounts” tab, by default the claims account is filled in with 76.02.

In the settings you can set the account to 60.01 or 60.02.

Let us now consider the option when the claims settlement account is 60.02.

The advance resulting from the return will be debited to account 60.02.

This debt will be reflected in the report as follows.

In the case of a supplier returning money, a document “Receipt to current account” is also drawn up with the transaction type “Return from supplier”

Document postings:

The advance is returned.

4. Goods purchased - not paid to supplier - returned to supplier. (Settlements for claims are made on account 60.02)

We will reflect the acceptance of goods for accounting in the program using the standard document “Receipt of goods and services.” The goods arrive with VAT. (We will reflect the receipt of the invoice). Accounts payable arise on account 60.01 in the amount of 2,000 rubles.Document postings:

We will not reflect the payment, we will return the goods immediately.

We will reflect the return to the supplier using the “Return of goods to supplier” document, which is located in the “Purchase” - “Return of goods to supplier” menu.

On the “Accounts” tab we also use account 60.02.

Document “Return of goods to supplier”

Document postings:

There is no debt on any account, since the goods were not paid for before the return, but mutual settlements were reflected in the turnover on account 60.02:

Note: You can indicate in the return document the account for settlement of claims - 60.01.

But then, if payment has already been made for the goods, then upon return the advance payment will be reflected on account 60.01.

And accordingly, the advance amounts in the “Account balance sheet” report for account 60.01 will be displayed with a minus credit, since this is a passive account.

If the enterprise does not work on prepayment with the supplier, and there is always a debt, then:

1) If in the document “Return of goods to the supplier” we we won't indicate receipt document, then according to the third subconto the program “will not understand” from which document the debt should be “removed”.

Accordingly, the advance will again remain on account 60.01 according to the return document:

2) If in the document “Return of goods to the supplier” we let's indicate receipt document, then, as a result of mutual settlements, the turnover on account 60.01 will still be reflected, since the program needs to close settlements on the third subaccount.

Document postings:

Accordingly, in the report “Account balance sheet” the turnover for account 60.01 will be “increased”.

List of values of accumulation registers 1s

List of values of accumulation registers 1s Advance calculation in 1s 8

Advance calculation in 1s 8 GPC agreements Reception for GPC in 1s

GPC agreements Reception for GPC in 1s Month closing settings How to close a period in UP

Month closing settings How to close a period in UP Specialist consultations

Specialist consultations Accounting for fuel and lubricants in 1C: instructions for accountants Write-off of fuel and lubricants 1s 8

Accounting for fuel and lubricants in 1C: instructions for accountants Write-off of fuel and lubricants 1s 8 Issue an invoice in the 1s 8 program

Issue an invoice in the 1s 8 program