1s accounting 8.3 fixed assets and depreciation. How to change the parameters for calculating depreciation of fixed assets. Receipt, acceptance and commissioning of the OS

In this article I want to talk about the accrual, additional accrual and changes in the parameters of depreciation of fixed assets in the 1C program: Accounting of a public institution 8 edition 1.0. Depreciation is the gradual decrease in the value of property due to wear and tear. At the same time, there are several ways to calculate depreciation: this is a 100% accrual upon commissioning of a fixed asset costing 3,000 rubles or more. up to 40,000 rub. and the linear method - for fixed assets worth over 40,000 rubles.

I would like to once again draw your attention to the fact that in order to correctly calculate depreciation, you must correctly indicate the OKOF code in the document “Acceptance for accounting of fixed assets and intangible assets.” I talked about this in detail in the article. Purchase and acceptance for accounting of fixed assets in the 1C program: Accounting of a state institution 8 edition 1.0.

To check the parameters for calculating depreciation, go to the fixed asset card on the “Depreciation” tab.

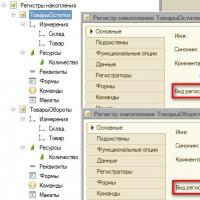

If any of the parameters need to be changed, then for this you need to use the special document “Changing depreciation parameters”, which is located in the menu “OS, intangible assets, legal acts” - “Working with registers of information on OS”.

We create a new document and fill in the fields, while changing the necessary parameters.

After filling out the document, save and post it. Now, from the date specified in the document, depreciation will be calculated according to the new parameters.

To change the cost account when calculating depreciation, there is a special document “Changing the cost account for calculating depreciation of fixed assets”, located in the same menu.

Let's create a new document.

It is possible to automatically fill out the tabular part of the document for the accounting account.

And then you can automatically change the KPI for depreciation.

You can also change the cost account automatically.

After filling out the document, save and post it. Changes will take effect from the date of the document.

The depreciation calculation itself must be done monthly, on the last day of the month. To do this, we use the document “Calculation of depreciation of fixed assets and intangible assets.”

We create a new document, click the “Fill” button, fill it out and post it.

From the document you can print the “Statement of Accrued Depreciation”.

There are cases when it is necessary to suspend or resume depreciation. The document “Suspension of depreciation accrual” is intended for these purposes. It is used to suspend the calculation of depreciation when transferring a fixed asset to conservation for a period of more than three months and to resume the calculation of depreciation after re-preservation.

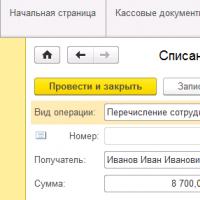

Let's create a new document. The document presents several operations to choose from.

Select the desired operation and fill out the table section. After filling out the document, we submit it.

Sometimes there are still cases when adjustments to accrued depreciation are necessary. For example, the calculated amount of depreciation and the balance of account 104 for the object diverge, or it is necessary to accrue additional depreciation to 100% of the book value for fixed assets (intangible assets), for which the depreciation calculation method is “100% upon commissioning”.

Vladimir Ilyukov

The existing methods of calculating depreciation have been supplemented with one more. This is the so-called lump-sum method of charging depreciation of fixed assets. The basis for its implementation was the order of the Ministry of Finance of the Russian Federation dated May 16, 2016 No. 64n. This legislative act added the method of one-time depreciation of fixed assets, paragraph 10, paragraph 19 of PBU 6/01 “Accounting for fixed assets”. The new depreciation method became available to users starting from version 3.0.43.253.

Legal entities that have the right to use simplified methods of accounting and financial accounting are granted the right to charge depreciation on industrial and business inventory in the amount of 100% of book value at a time, that is, one-time.

The new method has a very important feature. A one-time depreciation charge is carried out at the time of acceptance of the fixed asset for accounting . In addition, it has two limitations.

- Only those persons who legally maintain simplified accounting (financial) records have the right to carry out one-time depreciation.

- These organizations have the right to charge one-time depreciation only for those fixed assets that in the OKOF belong to the section “Industrial and business inventory.”

The right to use simplified methods of accounting and accounting (financial) reporting in accordance with Part 4 of Article 6 of the Federal Law of December 6, 2011 No. 402-FZ was granted

- small businesses;

- non-profit organizations and

- organization that has received the status of a participant in the Skolkovo project.

You cannot limit yourself to this list, because Part 5 of Article 6 of the Federal Law of December 6, 2011 No. 402-FZ clearly lists legal entities that do not have the right to use simplified accounting methods. For example, housing cooperatives do not have this right.

Order No. 64n simplified not only the calculation of depreciation of fixed assets. He expanded the range of simplified accounting methods in other aspects. An extensive commentary on simplified accounting methods is published here http://buh.ru/articles/documents/48157. Essentially, this order is another step towards simplifying accounting.

In order to calculate depreciation on a fixed asset at a time in the 1C Accounting 8.3 program, you need to select the value “One-time upon acceptance for accounting” in the “Acceptance for accounting of fixed assets” registrar, on the “Accounting” tab, in the “Method of calculating depreciation” list. This is the new method of calculating depreciation added in 1C 8.3. Let's consider this method of calculating depreciation of fixed assets in 1C 8.3 for organizations and entrepreneurs using the simplified tax system.

Organization LLC “Simplified commissioning. OS”, using the simplified tax system-15%, purchased an office sofa for the director’s reception area on January 2, 2017 for RUB 70,800, incl. VAT 10,800 rub. Payment for the sofa was also made on the same date. The sofa was put into operation on February 15, 2017. When accepting a sofa for accounting, it is necessary to charge depreciation at a time in 1C 8.3 for the entire amount of its book value.

In the 1C Accounting 3.0 configuration, registration of purchased operating systems is reflected by the “Equipment Receipt” registrar. In accounting, he creates an entry in the debit of account 08.04.1 “Purchase of components of fixed assets” from the credit of account 60.01 “Settlements with suppliers and contractors”.

![]()

Since Simplified Commissioning LLC. OS" applies a special regime of the simplified tax system, then the amount of VAT is written off to increase the initial cost of the sofa. As a result, it became equal to 70,800 rubles.

Acceptance of fixed assets for accounting of fixed assets is reflected by the registrar “Acceptance for accounting of fixed assets.” In it, on the “Accounting” tab, we will assign the “Method of depreciation calculation” variable to the value “One-time upon acceptance for accounting.”

One-time depreciation of fixed assets in 1C 8.3 is applied only to production and business equipment . This is a legal norm. In the information base it is taken into account as follows. When describing fixed assets in the “Fixed Assets” directory, on the “Main” tab in the “Fixed assets accounting group” field, you must assign the value “Industrial and business inventory.”

Go to the “Tax accounting (USN)” tab. Taxpayers using the simplified tax system have the right to include in fixed assets only those that are recognized as depreciable property. This is recognized as property whose book value exceeds 100,000 rubles and whose useful life exceeds 12 months.

In the example considered, the sofa does not fit into the category of depreciable property, because its original cost is less than 100,000 rubles. Because of this, the attribute “Procedure for including costs as expenses” must be assigned the value “Include as expenses.”

In this context, the phrase “Include in expenses” is equivalent to the phrase “Include in material expenses.” The procedure for recognizing material expenses is established in the accounting policy. For the organization of Simplified Commissioning LLC. OS" the following order is established. Material expenses are recognized in the reporting (tax) period in which two conditions are met in the information period: the fact of receipt of the sofa and the fact of its payment are registered.

It is not enough to enter a payment document in the information base. Even if it is entered on the basis of the “Receipt of equipment” registrar, it still It is necessary to indicate the date and amount of payment for the OS on the “Tax Accounting (STS)” tab. This will allow the registrar “Acceptance for accounting of fixed assets” to create an entry in the accumulation register “Registered payments of fixed assets (STS)”. Without this record, the system will not allow you to take into account the costs of purchasing a sofa.

The “Acceptance for accounting of fixed assets” registrar creates records in a variety of fixed assets accounting registers, including the accounting register “Journal of transactions (accounting and tax accounting)”. In it, the registrar created two records.

The first entry reflects the fact of converting a purchased non-current object (office sofa) into an OS object. Entry number 2 reflects the calculation of depreciation in 1C 8.3 for the amount of the book value of the sofa. As a result, the residual value of the sofa becomes zero. At the same time, the sofa remains on the balance sheet and continues to be used.

By standard methods, depreciation is calculated over the useful life of the asset. For example, depreciation is calculated using the straight-line method on a monthly basis, starting from the month following the month in which the fixed asset was accepted for accounting.

The considered example shows that depreciation is accrued on 100% of the book value of the sofa and it is accrued on the date of acceptance of the fixed assets for accounting, on February 15, 2017.

Perhaps someone will have a question, why was depreciation calculated on 02/15/2017, and not on 01/22/2017? The answer is simple - this is a legal requirement, paragraph 10, paragraph 19 of PBU 6/01. It established that one-time depreciation is accrued at the moment the asset is accepted for accounting .

In fact, the registrar “Receipt of equipment” dated January 22, 2017 entered into accounting, in the debit of account 08.04.1 “Purchase of components of fixed assets”, a certain non-current asset was accepted. This is not yet the main tool. In the standard scheme, the initial cost of the operating system is formed on account 08.04.1. After it is formed, the asset is accepted for accounting, but as a fixed asset by the registrar “Acceptance for accounting of fixed assets”.

In general, in the 1C Accounting program, registration of an operating system takes place in three stages: Receipt of an asset - Formation of the initial cost - Acceptance of fixed assets for accounting. If a fixed asset is accepted for accounting at an initial cost equal to the cost of the supplier, then the delivery for accounting takes place in two stages: Receipt of an asset - Acceptance of fixed assets for accounting.

Starting with version 3.0.46.11 in the 1C Accounting 8.3 configuration, an even simpler way to accept OS for accounting has appeared. Now, when capitalizing a fixed asset, you can immediately take it into account. That is, a one-step scheme for registering OS has been implemented. A separate article will be devoted to this issue..

The fact that material expenses are taken into account in tax accounting according to the simplified tax system is clearly demonstrated by the KUDiR report.

Despite the fact that depreciation on the OS in 1C 8.3 was calculated at 100% of the book value of the sofa, it remains on the balance sheet at its original cost. It will remain on the balance sheet until it is removed from the balance sheet. For example, an offended visitor tore up a sofa so much that it cannot be restored. To reflect the disposal of the sofa from the balance sheet, we will create a “Write-off of fixed assets” registrar. It will generate two entries, the second of which the sofa is written off the balance sheet.

Sometimes the question arises: can a given OS object be classified as industrial or business equipment? There's no point in guessing. You just need to turn to the All-Russian Classifier of Fixed Assets (OKOF). It contains a number of sections, among them there is a section “Industrial and household inventory”. It also contains the definitions we need.

- Industrial equipment is objects for technical purposes. They are used in the production process, but do not belong to equipment or structures. For example, special furniture, body armor, training equipment, containers, etc.

- Household equipment is objects for office and household purposes. They are not directly used in the production process. For example, office furniture, watches, carpets, etc.

These definitions do not provide a clear distinction between production equipment and household equipment. For example, one safe is installed in the accounting department for especially valuable documents, and another exactly the same one can be installed in the workshop for storing personal tools. In the first case, the safe is a household item, and in the second case, it is a production item.

Fortunately, there is no particular need to clearly distinguish between these types of equipment. Both production and household equipment are included in one general group called “Industrial and household inventory”.

You can load the OKOF classifier into the 1C Accounting 8.3 program. This allows you to quickly resolve the issue of whether an OS object belongs to production and business equipment.

This article discusses only one element of simplified accounting. In fact, Order No. 64 contains several similar accounting elements. And here I would like to emphasize that even if a legal entity or entrepreneur has the right to use simplified methods of accounting and financial accounting, they must consolidate them in their accounting policies.

The article by methodologists from the 1C company explains the procedure for changing the parameters for calculating depreciation of fixed assets in 1C: Accounting 8. The presence of a mechanism for such a change is due to the very practice of economic relations, because the norms of the current legislation of the Russian Federation allow, for example, changing the useful life of a fixed asset, adjusting the initial cost of property, suspending depreciation, etc. Maintaining accounting records in an automated mode requires an understanding of the mechanism for reflecting these circumstances in program.

Calculate depreciation in information registers And Calculate depreciation located on bookmarks Accounting And Tax accounting Calculate depreciation on bookmarks Accounting And Tax accounting Entering initial balances(menu Enterprise -> Entering initial balances).

Changing the OS state Calculate depreciation

Reflect in tax accounting

New flag meaning Calculate depreciation

How to suspend or resume depreciation

The need to suspend or resume depreciation of fixed assets may arise under circumstances provided for:

- clause 23 of PBU 6/01, approved by order of the Ministry of Finance of Russia dated March 30, 2001 No. 26n (for accounting purposes);

- paragraph 3 of Article 256 of the Tax Code of the Russian Federation (for tax accounting purposes).

For example: in both accounting and tax accounting, depreciation is suspended on fixed assets transferred by decision of the organization’s management to conservation for a period of more than three months.

Depreciation calculation is controlled by the flag Calculate depreciation in information registers Calculation of depreciation of fixed assets (accounting) And Calculation of depreciation of fixed assets (tax accounting). When accepting fixed assets for accounting, flags Calculate depreciation located on bookmarks Accounting And Tax accounting. When entering the initial balances of fixed assets, the depreciation attribute is set using the checkboxes Calculate depreciation on bookmarks Accounting And Tax accounting in the form for entering a fixed asset in a document Entering initial balances(menu Enterprise -> Entering initial balances).

For automatic calculation of depreciation, the state of the flag at the beginning of the period for which depreciation is calculated matters. If this flag is set at the beginning of the period, depreciation on the fixed asset item in this period will be accrued. If the flag is cleared at the beginning of the period, no depreciation will be charged. The flag can be set separately for accounting and tax accounting.

To change the depreciation accrual attribute (suspension or resumption of depreciation accrual), use the document Changing the OS state. In this document you need to set the flag Affects depreciation calculation and set or leave the flag unset Calculate depreciation. This flag state will be written to the information registers when posting the document.

If the document has the flag set Reflect in tax accounting, then the depreciation attribute will be changed for accounting and tax accounting, if this flag is cleared - only for accounting.

New flag meaning Calculate depreciation will be used by the program when calculating depreciation next month.

How to change a cost account to reflect depreciation expense

In accordance with the Instructions to the Chart of Accounts (approved by order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n), the accrued amount of depreciation of fixed assets is reflected in accounting under the credit of account 02 “Depreciation of fixed assets” in correspondence with the accounts of production costs (sales expenses ). The lessor organization reflects the accrued amount of depreciation on leased fixed assets as a credit to account 02 “Depreciation of fixed assets” and a debit to account 91 “Other income and expenses” (if rent forms other income). Thus, the need to change the cost account to reflect depreciation expenses may arise quite often:

- when transferring property for rent;

- when moving fixed assets to another division of the organization (for example: from a retail store to the accounting department of an enterprise);

- when changing the purpose (method of use) of a fixed asset object without moving it.

The cost account and analytics for reflecting depreciation expenses is determined by the details in information registers Methods of reflecting expenses for depreciation of fixed assets (accounting) And Methods of reflecting expenses for depreciation of fixed assets (tax accounting). When calculating depreciation, the program receives from these registers information about the methods of calculating depreciation established at the beginning of the period for which depreciation is calculated.

When accepting a fixed asset for accounting, the method of reflecting depreciation expenses (for accounting and tax accounting) is indicated on the tab General information.

When entering initial balances of fixed assets, the method of reflecting depreciation expenses for accounting and tax accounting is set on the tab Opening Balances forms for entering fixed assets in the document Entering initial balances(menu Enterprise -> Entering initial balances).

Possible ways to reflect depreciation expenses are stored in the directory Methods of reflecting depreciation expenses (repayment of cost).

To change the way depreciation expenses are reflected, use the document Changing the way depreciation expenses are reflected. In the header of this document you must indicate a new way of reflecting expenses, and in the table field Fixed assets list the objects for which the method of recording depreciation expenses needs to be changed.

New attribute value Ways to reflect expenses for depreciation will be used by the program when calculating depreciation on fixed assets next month.

How to change useful life and/or initial cost

According to paragraph 14 of PBU 6/01, changes in the initial cost of fixed assets in accounting are allowed only in cases of completion, additional equipment, reconstruction, modernization, partial liquidation and revaluation of fixed assets. Paragraph 2 of Article 257 of the Tax Code of the Russian Federation establishes a similar rule for tax accounting purposes: “the initial cost of fixed assets changes in cases of completion, additional equipment, reconstruction, modernization, technical re-equipment, partial liquidation of relevant facilities and on other similar grounds”.

The useful life also, as a rule, does not change. For accounting purposes, exceptions to this procedure are cases of improvement (increase) of the initially adopted standard indicators of the functioning of a fixed asset object as a result of reconstruction or modernization (clause 20 of PBU 6/01). In tax accounting, a similar procedure applies, which provides for the possibility of changing the period (within the corresponding depreciation group) also for the case of technical re-equipment.

Typically, the useful life and cost change as a result of the modernization of an item of property, plant and equipment. In addition, these parameters can be changed using the document . In a table field Fixed assets of this document, it is necessary to list the objects for which the useful life and (or) initial cost need to be changed, and indicate for these objects new values for the useful life and (or) initial cost. It is important to note that to calculate depreciation in accounting, the program uses special details Use life to calculate depreciation and Cost to calculate depreciation information register Fixed assets depreciation parameters (accounting). They can also be changed using the document Changing OS depreciation parameters.

Then it is necessary to make the appropriate entries that adjust the initial cost of fixed assets in the accounting and tax accounts. To do this you should use the document Operation (accounting and tax accounting).

The new useful life and/or cost values will be used by the program when calculating depreciation next month.

How to change the special coefficient for calculating depreciation

When accepting a fixed asset for accounting, a special coefficient is indicated on the tab Tax accounting.

When entering initial balances of fixed assets, a special coefficient is indicated on the tab Tax accounting forms for entering fixed assets in the document Entering initial balances.

The use of special depreciation rates is strictly regulated by regulatory legal acts and is allowed only in cases provided for by law. A change in the special coefficient, as a rule, is made precisely in the event of a change in legislation. For example: thanks to amendments to the Tax Code of the Russian Federation, from January 1, 2009, a reduction factor of 0.5 is no longer applied to the basic depreciation rate, previously provided for tax depreciated cars and passenger minibuses, whose original cost exceeded a certain cost limit (before 01/01/2008 - 300,000 rubles and 400,000 rubles, from 01/01/2008 - 600,000 rubles and 800,000 rubles, respectively). In this situation, taxpayers-owners of such fixed assets needed to change the depreciation rate.

The special coefficient is stored only for tax accounting in the details Special coefficient information register Special coefficient for depreciation of fixed assets (tax accounting). When calculating depreciation of a fixed asset object, the program receives from this register a special coefficient set at the beginning of the period for which depreciation is calculated. The special coefficient can only be changed once during the year.

For changed document used for special coefficient Changing the special coefficient for calculating depreciation of fixed assets. In a table field Fixed assets of this document, it is necessary to list the objects for which the special coefficient needs to be changed, and indicate a new special coefficient for each of these objects.

The new value of the Special coefficient attribute will be used by the program when calculating depreciation next month.

How to change the depreciation schedule

In accordance with paragraph 19 of PBU 6/01, for fixed assets used with a seasonal nature of production, the annual amount of depreciation charges is accrued evenly throughout the period of operation of the organization in the reporting year.

The depreciation schedule is a very convenient mechanism for calculating depreciation on fixed assets of seasonal use. For example: if the company owns a snowplow, which is operated only in winter (1st quarter), and it is necessary that depreciation be accrued during this period. In such a situation, using the schedule, the user can indicate in which month and how much will be taken into account as depreciation charges.

The depreciation schedule is stored only for accounting purposes in the details Depreciation schedule information register Depreciation schedules for fixed assets (accounting). When calculating depreciation of a fixed asset object, the program receives from this register a depreciation schedule established at the beginning of the period for which depreciation is calculated. Possible depreciation schedules are stored in the directory Annual fixed asset depreciation schedules.

To change the depreciation schedule (for example: when changing the order of use of a fixed asset) or to set or stop accrual of depreciation according to the schedule, use the document .

In the header of this document you must indicate a new depreciation schedule, and in the table field Fixed assets list the objects for which the schedule needs to be changed.

In the same way, you can set the accrual of depreciation according to the schedule, if previously it was accrued in the general manner.

If you want to stop accruing depreciation of a fixed asset item according to the schedule, then the field Schedule in the document Changing fixed asset depreciation schedules should be left blank.

New attribute value Methods of reflecting depreciation expenses will be used by the program when calculating depreciation on the fixed asset next month.

8.3 (8.2) occurs through a regulatory operation of the same name on the basis of previously created documents for the receipt and acceptance of fixed assets for accounting. Let’s say new equipment has been purchased, we will reflect this in the program with the document “Receipt of equipment” (tab “Fixed assets and intangible assets”, section “Receipt of fixed assets”). Create a new document:

In the header we fill in all the fields in the usual way. Pay attention to the fields:

- Agreement – indicated by the selected counterparty, the type should be “With supplier”:

- Calculations - insertion into the document occurs automatically according to previously established data. To check, you can click on the link itself:

Let's move on to filling out the bottom of the document.

“Equipment” tab - here we add the necessary items by selecting from the nomenclature directory.

“Additional” tab - here there is already data on the consignor and consignee, which can be changed if they differ from the declared ones. When the supplier presents the “Invoice” document, it must be registered in the appropriate field.

When registering an invoice, there is one caveat - the “Operation type code” field should contain the value 01 (Goods, works, services received):

We will put it into operation through the document “Acceptance for accounting of fixed assets” (tab “Assets and intangible assets”, item “Acceptance for accounting of fixed assets”).

Important

Please note that when purchasing several operating systems, each will have its own individual number for correct identification and accounting.

All fields are required:

- MOL - you need to indicate the details of the responsible individual;

- Location - indicates the unit (warehouse, workshop, workshop) in which the equipment will be used;

- OS event - select the type “Acceptance for accounting with commissioning”.

Let's move on to filling out the tabs. “Non-current asset” reflects basic information on equipment. All fields are filled in:

The “Fixed Assets” tab contains a list of equipment that needs to be taken into account. Filled out in any convenient way: “Add” (line by line), “Fill in” (according to the main document) or through “Selection” (comprehensively from the nomenclature directory):

Important

Be sure to go to the fixed asset card and check the completion of the details: “Assets accounting group”, “OKOF code”, “Depreciation group” and “ENAOF code” on the “Main” tab.

Let's return to the document “Acceptance for accounting of fixed assets”. The next tab is “Accounting” - here you set the parameters for calculating depreciation according to accounting records:

Let's look at filling out the fields:

Accounting account - you need to indicate 01.01 (Account for accounting of fixed assets in the organization);

Accounting procedure - indicate “Depreciation”, as this is necessary for this situation;

Depreciation account - indicate the cumulative depreciation account and check the box next to the “Accrue depreciation” field;

Method of calculating depreciation - if the enterprise has no personal preferences, then indicate the “Linear method”;

List of values of accumulation registers 1s

List of values of accumulation registers 1s Advance calculation in 1s 8

Advance calculation in 1s 8 GPC agreements Reception for GPC in 1s

GPC agreements Reception for GPC in 1s Month closing settings How to close a period in UP

Month closing settings How to close a period in UP Specialist consultations

Specialist consultations Accounting for fuel and lubricants in 1C: instructions for accountants Write-off of fuel and lubricants 1s 8

Accounting for fuel and lubricants in 1C: instructions for accountants Write-off of fuel and lubricants 1s 8 Issue an invoice in the 1s 8 program

Issue an invoice in the 1s 8 program