1s 8.3 accounting recalculation of lack of water. How to recalculate for shortfalls with a change in tariff. Recalculation of insurance premiums

Adjustment of charges with the type of operation “Underdelivery” is intended for recalculation of charges for services in case of short delivery for a certain period. This type of operation can also be used in a situation where the tariff has changed in the period, but charges have already been made.

Let's consider adjusting accruals with this type of operation in the 1C program: Accounting in housing and communal services management companies, homeowners' associations and housing cooperatives, ed. 3.0 using the example of the “Heating” service.

1. Let’s assume that in January the “Heating” service was charged in the amount of 900 rubles according to l/s No. 2011067001:

Note: in the example, the “Heating” service is calculated based on the total area. Room area 50 m2, tariff 18 rubles.

2. In February it becomes known that in January the payment should have taken place at a rate of 13 rubles. To carry out recalculation

create a document “Adjustment of accruals” with the type of operation “Underdelivery”.

Fill out the document:

- indicate the date of the document and the recalculation period - January 2015;

- indicate the number of days that need to be recalculated, in the example - 31 days;

- We indicate the object of recalculation, in this case l/s No. 2011067001;

- We indicate the service for which recalculation will be made, in this case “Heating”;

- check the “Partial recalculation” checkbox, select the recalculation option “with a reduction in tariff by” and enter the number by which you want to increase or decrease the tariff, in this case 18 – 13 = 5;

- fill out the table section using the “Fill” button;

- Click the “Calculate” button to perform the recalculation:

The recalculation was carried out at a rate of 13 rubles: (18-5)*50 = 650 rubles. Hence the recalculation amount is 250 rubles.

Recalculations form an integral part of payroll calculation. Information about sick leave, vacations or absenteeism of employees received by the accounting department with some delay leads to recalculation of salaries and, accordingly, insurance premiums. 1C experts talk about how calculations and recalculations of insurance premiums are reflected in accounting and regulated reporting in the 1C: Salaries and Personnel Management 8 program, edition 3.

When recalculating wages, it becomes necessary to recalculate insurance premiums. In addition, the reason for recalculation of contributions may be a change in the tariff during the year or the discovery of errors, for example, non-inclusion of the calculation in the base for insurance premiums.

In these cases, the accountant has questions about the need, obligation and right to submit updated information to the Federal Tax Service.

According to clause 1.2 of the Procedure for filling out the calculation of insurance premiums, given in Appendix No. 2 to the order of the Federal Tax Service of Russia dated 10.10.2016 No. ММВ-7-11/551@, the payer is obliged to make the necessary changes to the Calculation and submit an updated report to the tax authority if any unrecorded or incomplete information, as well as errors leading to an underestimation of the amount of insurance premiums payable.

When deciding whether to submit an updated calculation, the accountant must answer the following questions:

- whether all information was reflected;

- whether errors were made and whether they led to an underestimation of the amount of insurance premiums payable.

Submission of an updated Calculation may be an obligation, a right or a forced necessity.

Updated calculation of insurance premiums

The obligation to submit an updated calculation arises if, after submitting the report to the Federal Tax Service, it turns out that incomplete or incorrect information about employees was submitted, or errors were discovered that led to an underestimation of the amount of insurance premiums payable.

Types of common errors that require mandatory submission of an updated Calculation:

1. The employee did not promptly report changes in his personal data, and the Federal Tax Service provided false information about him in Section 3 of the Calculation.

2. The employee worked in a department that has the right to apply a preferential rate of insurance premiums. Then he was transferred to a unit where the basic insurance premium rate is applied. Information about the employee's transfer was received late by the accounting department. The calculation of contributions was made incorrectly at a reduced rate.

3. At the initial setup stage of the 1C: Salaries and Personnel Management 8 program, a mistake was made by excluding the premium from the calculation base for insurance premiums. Correcting the error will result in additional fees being charged.

4. A department with a preferential tariff loses the right to use it, but the information reaches the payroll manager with a delay. Recalculation according to the basic tariff leads to an increase in the amount of insurance premiums payable.

5. When calculating insurance premiums, the program did not indicate that the position was listed in the list of hazardous professions subject to additional tariffs. After the error was discovered and corrected, the recalculation resulted in an underpayment of insurance premiums at additional rates.

Let's look at the features of recalculating insurance premiums in “1C: Salaries and Personnel Management 8” edition 3 using examples.

Example 1

When calculating insurance premiums for a unit Stock a preferential rate of insurance premiums was applied Residents of the technology-innovation special economic zone(fare code “05”). This tariff provides for contributions to the Pension Fund in the amount of 13% in 2018; in the Social Insurance Fund 2.9%; in the Federal Compulsory Medical Insurance Fund 5.1%. This is exactly how contributions were calculated for employee V.S. Ivy. With monthly earnings of 10,000 rubles. The amount of insurance deductions for the month was:

- in the Pension Fund - 1,300 rubles;

- in FFOMS - 510 rubles;

- in the Social Insurance Fund - 290 rubles.

The indicated amounts were reflected in the calculation of insurance premiums for the first quarter of 2018.

When it turned out that the division had lost the right to apply a preferential rate of insurance premiums, then in accordance with letters of the Federal Tax Service of Russia dated October 25, 2017 No. GD-4-11/21611@ and the Ministry of Finance of Russia dated December 18, 2017 No.? 03-15-06/ 84443 there was a need to submit a clarifying Calculation. To form it, it is necessary to recalculate insurance premiums with new rates.

In the card Divisions the field should be cleared Preferential tariff fear. contributions. Now the division is subject to the tariff used for the organization and specified in the card Organizations on the bookmark Accounting policies and other settings link Accounting policy in field Tariff type.

In Example 1, the organization is set to Basic insurance premium rate(tariff code “01”), providing for contribution rates in 2018: to the Pension Fund of the Russian Federation in the amount of 22%; Social Insurance Fund 2.9%; FFOMS 5.1%. It is obvious that the Pension Fund has “underpaid” 9% of contributions (22% - 13%), and the tariff code has changed.

In Example 1 under consideration, in order to recalculate contributions, the income accounting procedure should be revised. The document is intended to register the procedure for recording income and recalculating insurance premiums of the previous period. (menu Taxes and fees). On the bookmark Income information it is necessary to manually clarify all employee incomes. At the same time, on the bookmark Estimated contributions Insurance premiums will be recalculated automatically.

As a result of recalculation of insurance premiums of employee V.S. Ivy with monthly earnings of 10,000 rubles. The amount of insurance deductions for the month was:

- in the Pension Fund of Russia - 2,200 rubles;

- in the Federal Compulsory Medical Insurance Fund and the Social Insurance Fund - the amount did not change and amounted to 510 rubles, respectively. and 290 rub.

After recalculating insurance premiums for the first quarter, clarifying Calculations should be prepared. Using the service 1C-Reporting, it is necessary to create new reports for the periods being corrected and for Title page indicate Correction number(Fig. 2). The clarifications affected all employees of the department, since everyone’s tariff code had changed. Therefore, Sections 3 in the updated Calculation are formed for all employees of the department. In other cases, when the formation of an updated Calculation is caused by changes in the data or accruals of individual employees, Section 3 displays data only for these employees. In any case, the remaining sections of the clarifying Calculation are filled in with completely new data.

Rice. 2. Title page of the clarifying calculation of insurance premiums for the first quarter of 2018

The right to submit an updated Calculation of insurance premiums

Policyholders can submit an updated Calculation to the inspection if they find errors that lead to an overestimation of the amount of insurance premiums. In fact, during the next calculation of contributions in the current period, a recalculation is made, and the result is reflected in the report for the next period. Situation options that allow you to present an updated Calculation:

1. The employee was paid a salary for the full month worked. The calculation of insurance premiums was submitted to the Federal Tax Service, but it later turned out that the employee was on sick leave or on vacation at his own expense. An accrual not included in the base for calculating premiums replaced an accrual subject to insurance premiums, which led to overpayment of premiums.

2. Any recalculation of employee accruals, leading to a recalculation of insurance premiums towards their reduction.

Example 2

When calculating wages for June to employee S.S. Gorbunkov was awarded:

- salary payment - 7,500 rubles;

- business trip payment (based on average earnings) for June - 2,500 rubles.

Insurance premiums have been calculated at the basic rate. In June, contributions from S.S.’s salary. Gorbunkov were:

- in the Pension Fund of Russia - 2,200 rubles;

- in FFOMS - 510 rubles;

- in the Social Insurance Fund - 290 rubles.

These contributions have been paid and included in the 2018 Half Year Account. The sick leave submitted to the accounting department for the period 06/25/2018-06/30/2018 does not create a reason for the formation of an updated Calculation. Document registered in the program Sick leave reverses the previously accrued amount of travel allowances (Fig. 3).

Rice. 3. Recalculation of travel allowances in the “Sick Leave” document

The sick leave was received by the organization in July. This is not an error situation and does not result in underpayment of insurance premiums. Since the amount accrued on sick leave is not subject to insurance contributions, there was an overpayment of contributions in the amount of:

- in the Pension Fund of the Russian Federation - 550 rubles;

- in FFOMS - 127.50 rubles;

- in the Social Insurance Fund - 72.50 rubles.

In a programme Sick leave, registered July 2018, affects the calculation of insurance premiums in the current month, reducing the calculation base.

There are no legal requirements for the submission of an updated Calculation in such a situation. All recalculations occur in the next period and are reflected in the next reports. But at the same time, the organization has the right to clarify the report for the half-year and notify the Federal Tax Service about the overpayment that has occurred by submitting a clarification.

However, before the end of the month, you should not make hasty clarifications of the Calculation. After all, various documents are registered throughout the month. At some point the document Sick leave can indeed reverse the income of the previous month, and based on the results of calculating wages for the month, another document, for example, Calculation of salaries and contributions, will make additional accruals that exceed the reversal income of the previous period. As a result, the current month’s income will decrease by the amount of the business trip reversal, no minuses for the previous month will remain, and the adjusting report will not show any changes.

The need to submit an updated Calculation of insurance premiums

In a number of cases, despite the absence of an obligation to submit an updated Calculation, the policyholder has no other opportunity to report his overpayment of premiums, except for submitting an update:

1. As a result of the recalculation of contributions in the current period, the employee receives a negative amount. A report with a negative amount cannot be submitted to the Federal Tax Service. Therefore, there is only one way out - to generate an updated report for the previous period.

2. The employee worked in hazardous work. Insurance premiums were calculated at an additional rate. Information about the employee's transfer to work under normal working conditions was received late by the accounting department. As a result of recalculation, it is impossible to reduce the calculated contributions at the additional rate, because the employee’s accruals in the current period are no longer subject to contributions at the additional rate.

Example 3

In this case, unlike the previous Example 2, the negative amount of insurance premiums resulting from the cancellation of a business trip will not be compensated by accruals. Despite the fact that due to the accruals of other employees, the total amount of insurance premiums will be positive, in Section 3 the employee will remain negative values, and this is unacceptable. And therefore the accountant will have to create a document Recalculation of insurance premiums, recalculate contributions for June, generate and submit an updated Calculation to the Federal Tax Service.

The 1C: Salary and Personnel Management 8 program automates the process of recalculating insurance premiums. Using the service 1C-Reporting initial and clarifying calculations for insurance premiums are generated automatically. However, the decision to prepare a clarifying Calculation remains with the accountant. Having analyzed the consequences of registering a document that changes calculations in the period for which a report has already been submitted, the accountant either recalculates insurance premiums for the previous period, or the calculation automatically occurs in the current month.

From the editor. In the article, read about the mechanism implemented in 1C:Enterprise 8 for checking control ratios for the calculation of insurance premiums, which takes into account the data of adjustment calculations.

The Recalculation object is used to store information about for which calculation register records the calculation results (resources) need to be recalculated. It is a configuration object subordinate to the calculation register. The need to recalculate resources may arise due to an incorrect sequence of document input by the user (retroactive entry of documents), which leads to the need to recalculate the calculation results of those records that depend on the calculation results of other records entered into the system later.

Recalculation object settings

Information about records requiring recalculation can be stored in varying detail.

Allocation records contain predefined fields:

- Recalculation object – a link to the registrar whose calculation results need to be revised;

- Calculation type – a link to the calculation type from the plan of calculation types that is assigned to the register that owns the Recalculation object.

To more accurately identify out-of-date settlement register entries, you can enter allocation measurements. This will allow you to narrow down the list of records that require recalculation.

Let's look at an example.

If the calculation register stores data on the accrued basic salary of the organization's employees and, thus, the calculation register has the "Employee" dimension, then the recalculation can also have the "Employee" dimension. This will lead to the fact that recalculation records will mean the need to recalculate those register entries that belong to a specific registrar, have a certain type of calculation and contain a link to a specific employee.

The conversion table can be filled in automatically by the system based on the settings made during configuration. Automatic tracking of records for which a revision of the result is required is the main purpose of the recalculation object.

Allocation dimensions are one of the tools that allow you to configure this automatic allocation filling.

This is done using the properties of the allocation dimension:

- Register dimension – a link to the dimension of the “parent” calculation register to which the recalculation is subordinated.

- Leading register data – links to measurements and details of leading calculation registers.

- The main register is the calculation register to which recalculation is subordinated and which it “monitors” the relevance of the results.

- Leading registers are calculation registers whose entries affect the result of the calculation of the main register entries.

In order to describe exactly what changes in leading register entries will lead to the appearance of recalculations, recalculation measurements are used. To specify the need to recalculate records for the same employee for whom the leading register records were entered (changed), do the following. A link to the "Employee" dimension of the main register is entered into the "Register Dimension" property, and links to the "Employee" dimension of all leading registers are entered into the "Leading Register Data" property. With this setup, in the event of any change in the composition of the leading register records (i.e. when writing the corresponding set of records), the following will happen:

- A set of leading register records has been analyzed (let’s say the set of records contains records for employee Ivanov that have a certain validity period (for example, March)

- The main register will be automatically requested

- If it already contains records, according to Ivanov, and their result potentially depends on the records of the leading register (what “potentially depends…” means will be discussed below), then lines with the following data will be entered into the recalculation:

In this case, rows will be entered only if such rows are not already in the conversion table.

It should be noted that the appearance of recalculation entries does not mean any changes directly in the main register. Recalculation records are nothing more than a signal that the system gives. And how exactly to react to this signal about the need to recalculate register entries depends on the developer of a particular solution. We will discuss examples of processing recalculation records in other publications.

Calculation type plan settings related to allocations

The dependence of some register entries on others is built through the settings of plans for calculation types. The following concepts are used for this:

- Variant of dependence on the base – property of the plan of calculation types;

- Basic plans of calculation types – property of the plan of calculation types;

- Leading types of calculation - property of the type of calculation;

- Base period – details of the calculation register entry;

- Validity period – details of the calculation register entry;

- Registration period – details of the calculation register entry.

Dependence on the base – “by validity period” or “by registration period”;

Basic plans for calculation types – plan for calculation types “Auxiliary”.

This will mean that the main calculation register, which behaves according to the “Main” calculation type plan, depends on those registers to which the “Auxiliary” calculation type plan is assigned (i.e. in our case, the leading calculation register) and at the same time the entries The main register depends on the master records by validity period or by registration period.

When setting up a plan for calculation types “Main”, its calculation types (for example, the calculation type “Additional allowance”) must be set in the list of leading calculation types for the “Auxiliary” plan calculation types (for example, the calculation types “Personal surcharge” and “Monthly surcharge”). This will mean that the results of calculating the main register entries with the calculation type "Additional allowance" depend on the results of the leading register entries with the calculation types "Personal surcharge" and "Monthly surcharge" and must be recalculated in the event of any change (appearance or deletion).

At the same time, in order to find out which records need to be recalculated, the system will compare the records of the leading and main calculation registers:

- by type of calculation,

- when the validity period (or registration period) of the leading register records falls within the base period of the main register records

- and by the Employee dimension, which was described above.

“Recalculation rules” are auxiliary metadata objects designed to automatically track the relevance of the results of calculations when entering new calculation journal entries, deleting existing ones, or manually correcting the calculation result.

When creating a recalculation rule, the types of calculations are determined, when editing which the recalculation rule is “triggered”, and the types of calculations that must be recalculated when this rule is triggered.

The list of calculation types on the basis of which a specific recalculation rule is triggered is conventionally called leading calculation types. The list of calculation types that must be recalculated when a specific rule is triggered is conventionally called dependent calculation types.

For example, to organize the correct recalculation of additional payments to the main charges, you should indicate as leading types of calculation those on the basis of which additional payments are calculated (salary, tariff, piecework), and as dependent types of calculation you should indicate the actual recalculated additional payments.

After entering such a recalculation rule into the system, the calculation journal will behave as described below. In this case, first we will consider the case for the relationship of calculation types in one billing period.

So, if a new entry appears in the settlement journal (as a result of posting a document), disappears (when posting is cancelled) or an existing entry with one of the “leading” types of calculation (in our example - salary, tariff, piece payment) is corrected, then it will be removed the sign “Calculated” from all entries corresponding to additional payments, if any, with the same validity period as the entered, deleted or corrected entry.

If at the same time an entry is entered with a validity period not in the current billing period, but in one of the past ones (for example, retroactive calculation of salary for the last month), then the system will enter recalculation entries for all additional payments of the corresponding previous period.

The recalculation rule can be of three types: recalculation of records of the current period, recalculation of records of the same period, or recalculation of records of future periods.

In the first case, specified types of calculations are recalculated from only the current period, regardless of the validity period of the changed calculation journal entries.

In the second case, the specified settlement types are recalculated with the same validity period as the new entry entered.

In the third, records of one or more future billing periods are recalculated.

For example, if you build a rule for recalculating sick leave, then the types of beginning calculations will be assigned as leading calculations.

Calculation registers- these are application configuration objects. They are used in the mechanism of complex periodic calculations and serve to store records about certain types of calculations that need to be performed, as well as to store intermediate data and the results of the calculations themselves.

Structure

Information in the calculation register is stored in the form of records, each of which contains measurement values and corresponding resource values.

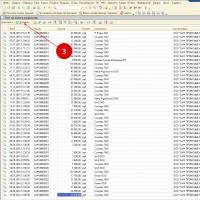

Measurements registers describe the sections in which information is stored, and resources registers directly contain the stored information. For example, for a calculation register Accruals, which has the following structure:

The records stored in the database will look like this:

Relationship to calculation types plan

The calculation register is associated with one of the calculation type plans that exist in the application solution. This relationship causes each register entry to have a field Type of calculation, thanks to which register mechanisms can track the mutual influence of calculation records on each other.

Periodicity

The calculation register stores data not only in the context of created measurements, but also in the context of time. This is the reason for the existence of one more required field for each calculation register entry - Validity. When creating a calculation register, the developer can specify the minimum frequency with which entries will be entered into the register:

Subordination to the registrar

A change in the state of the calculation register usually occurs when a document is posted. Therefore, each register entry is associated with a specific document - a registrar and the line number of this document. Adding entries to the register, changing them and deleting them is only possible simultaneously for all entries related to one document.

Relationship to Timeline

The calculation register can be linked to a time schedule. A timeline is a register of information that contains a time diagram of the source data involved in the calculations. The dimensions of this schedule can be, for example, the work schedule and date, and the resource can be the number of working hours on this date. Then it will be possible to associate a calculation register entry with a specific work schedule and in the future, using the built-in language, obtain information about the number of working hours necessary to perform calculations.

For example, a timeline with the following structure:

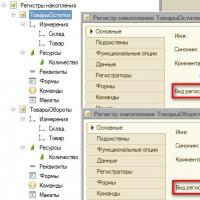

Recalculations

The calculation register may include special objects - Recalculations:

In these objects, the system will store information about which entries in the calculation register have lost their relevance and are subject to recalculation as a result of the operation of the dependency mechanisms for the base period and eviction for the validity period.

Uniqueness of records

The system provides control over the uniqueness of records stored in the calculation register. Therefore, the calculation register cannot contain two entries relating to the same line of the same document.

Mechanisms implemented by the calculation register

Preemption by validity period

The validity period preemption mechanism allows you to calculate the actual validity period of a settlement register entry based on an analysis of other entries contained in the register.

In general, a settlement register entry contains two dates that define the period over which the entry is valid. This period is called the entry validity period. However, if the calculation type to which a given entry relates can be superseded by another calculation type, then the validity period of the given entry is only a “requested” period, that is, “we want the entry to be valid in this period.” In reality, the actual period of validity of this record can be determined only after analyzing all records of calculation types that supersede this type of calculation by validity period. The actual validity period will be a set of periods that are a subset of the original validity period of the entry. If no record is found that displaces the given one in terms of validity period, then the actual validity period of this record will be equal to its validity period. Another extreme case of lifetime eviction is when a given record is completely ousted by other records. In this case, there will be no actual validity period for the entry.

Each settlement register entry contains the settlement type to which it relates. To determine which entries should supersede a given entry by validity period, the payroll register uses a link to the payroll types plan, which describes the mutual influence of payroll types on each other. Using this relationship allows the payroll register to determine the actual validity period of each entry.

Dependency by base period

The base period dependence mechanism allows you to obtain the base value for a calculation register entry based on the analysis of other entries contained in the register.

The base is the numeric value that must be used to calculate the result of a given record. The base is calculated by analyzing the calculation results of other entries on which this entry depends for the base period. Thus, in the general case, a calculation register record contains two dates that determine the period in which it is necessary to analyze records of calculation types on which this type of calculation depends on the base - the base period. Using the link to the calculation type plan allows the calculation register to determine the calculation types on which a given calculation type depends for the base period.

The calculation register supports two types of dependence on the base period:

- dependence on the period of validity;

- dependence on the registration period.

In the case of a dependence on the validity period, to obtain the base, those records will be selected for which the intersection of their actual validity period with the base period of this record is found. The value of the base that will be obtained from a particular influencing record is generally not equal to the result that this record contains. The base will be calculated in proportion to the portion of the actual period of the influencing record that overlaps with the specified base period. This will use the chart data associated with this record.

In case of dependence on the registration period, to obtain the base, the results of calculation of those records that fall into the base period of this record by the value of their “Registration Period” field will be selected.

The most complex version of the dependence on the base period is the case when the “Validity period is the base period” property is set for the calculation type of this record. This property means that the base period of this record will be used not the base period, which is specified in the corresponding fields of the record, but the actual validity period of the record, obtained as a result of the operation of the eviction mechanism for the validity period and which, in the general case, is a set of some periods.

Generating recalculation records

The mechanism for generating recalculation records monitors the fact that records appear in the register that affect the calculation result of existing records. The possibility of new records influencing existing ones is determined as a result of an analysis of the mutual influence of calculation types and based on the operation of the displacement mechanisms for the validity period and the dependence for the base period.

The result of the mechanism for generating recalculation records is a set of recalculation records containing information about which register entries should be recalculated (recalculated).

Calculation register functionality

The main functionality that the calculation register provides to the developer is:

- selecting records in a given interval according to specified criteria;

- selection of records by registrar;

- obtaining the base value for register entries that satisfy the specified selection;

- obtaining schedule data for register entries that satisfy a given selection;

- obtaining data on records subject to recalculation;

- reading, modifying, and writing a set of records to a register.

List of values of accumulation registers 1s

List of values of accumulation registers 1s Advance calculation in 1s 8

Advance calculation in 1s 8 GPC agreements Reception for GPC in 1s

GPC agreements Reception for GPC in 1s Month closing settings How to close a period in UP

Month closing settings How to close a period in UP Specialist consultations

Specialist consultations Accounting for fuel and lubricants in 1C: instructions for accountants Write-off of fuel and lubricants 1s 8

Accounting for fuel and lubricants in 1C: instructions for accountants Write-off of fuel and lubricants 1s 8 Issue an invoice in the 1s 8 program

Issue an invoice in the 1s 8 program